UnitedCorp Releases

Fiscal Year 2018 Financial

Results and Operational Highlights

First year of BlockchainDome

operations yielded

positive earnings;

company plans to grow its hyperscale data

center technology and other strategic areas in

2019

MIAMI, FL -- April 3, 2019 --

InvestorsHub NewsWire -- On March 31, 2019

Miami-based

United American

Corp ("UnitedCorp"

or the

"Company") (OTC:

UAMA) released its financial results

for

year-end

December 31,

2018 and

provided a corporate update from management related to its three

strategic areas; data centers/ BlockchainDome

Heat

Stations, fixed and wireless

telecommunications, and intellectual

property applications and

technology related to social

media,

telecommunications and blockchain

technology.

UnitedCorp reported positive

results for 2018 including revenues of US $1.7 million,

consolidated net earnings of $249,693 and consolidated EBITDA of

$339,842. Revenues accrued exclusively from its Canadian

subsidy, which owns and operates its

BlockchainDome Heat Stations and which yielded $446,506 in net

profit.

BlockchainDome operations

began in May 2018 with 1,000 servers going

online.

The number

was increased to 5,000 in 4 BlockchainDome Heat

Stations progressively

up

to

November

15th for a total of 8.5

megawatts. Revenues therefore represent

a ramp up of operations during that period, with December being the first full month of

operations with 5,000 servers online. In February 2019 the Company

purchased the property where the 4 BlockchainDomes are

located,

which is

not yet reflected as an asset in the current financial

statements.

2018 Annual

Highlights

(all

figures in US

dollars)

- Generated

annual revenue of $1,703,259(1) primarily

through

BlockchainDome Heat Station for hosting, management and power over

an 8 month period of operation with a gross profit of

$791,685(2)

- Annual net

earnings of $446,506 primarily on segregated BlockchainDome

operations and $249,693 for UnitedCorp on a consolidated

basis

- EBITDA for

the period was $339,842(3)

- Increase in

tangible assets to $3,036,430

- 5,000 miners

in service at year end (8.5 megawatts)

(1) Revenue

is based on approximately 8 months of progressive deployment of

5,000 miners as of December

31st

(2) Gross profit consists of total BlockchainDome

billings less direct costs (mainly electricity) and is a non-IFRS

measure. Since the Company bills in advance for services

and pays its

main direct costs in arrears,

gross profit as a percentage of revenue may be higher during the

current growth cycle.

(3)

EBITDA is a

non-IFRS measure

Financial

Review

|

|

Year Ended

|

|

(US$)

|

|

|

Dec 31,

2018

|

Dec 31,

2017

|

|

Total

Revenue

|

$

1,703,259

|

-

|

|

Cost of Revenue

|

911,574

|

-

|

|

Gross Profit

|

791,685

|

-

|

|

General Expenses

|

451,843

|

354,552

|

|

Financial Expenses

|

37,363

|

-

|

|

Depreciation

|

52,786

|

-

|

|

|

|

Net Income

|

249,693

|

(354,552)

|

|

EBITDA

|

339,842

|

(354,552)

|

While the

Company

will continue to develop its BlockchainDome Heat Station business

in 2019 as a primary source of revenue, it will also continue to

develop its business in other strategic areas. The Company also intends to

re-examine the

feasibility of up-listing to the

OTCQB board or other exchanges as to be

determined.

Hyperscale

Data Centers:

The Company has been refining

its proprietary passive cooling ground-coupled

heat-exchanger technology developed for its

BlockchainDomes to be used for hyperscale data

centers.

This is in

response to the increasing demand for cloud

computing, much of which is

to support the

growth in consumer and corporate applications or "apps". Such data

centers have significant cooling requirements for their servers

which are often one of the major cost components of operations.

Hyperscale data centers are often located in cooler climates to

reduce the cost of server cooling. The company has developed

and filed a patent application for an

airtight negative pressure server enclosure which, when used in

conjunction with its passive cooling

ground-coupled heat-exchanger

technology, can reduce costs of operations even in environments

where typically there is little or no cool ambient air

as it does not require mechanical or HVAC-based cooling

systems.

Telecommunications:

TNW Wireless

Inc.

The Company recently

announced that it will complete the acquisition of TNW Wireless

Inc. ("TNW Wireless") from Investel Capital Corporation (Canada)

later this April after Canadian Radio-television and

Telecommunications

Commission ("CRTC") Decision 2019-56 ruled on

February 28, 2019 that Bell Mobility Inc. ("Bell") and TELUS Corporation

(TELUS)

were required to

provide it with national roaming services as

mandated by the CRTC. It has already initiated the

interconnection process with Bell and TELUS as well as with Rogers

Communications Canada Inc. The acquisition is subject to

approval of Industry Science and Economic Development Canada

("ISED") and the Company has already submitted all necessary

information to ISED.

TNW Wireless will focus

initially on the development of connectivity within its licensed

territory along the Alaska Highway, which is currently underserved

by other carriers. TNW Wireless has designed self-contained

transceiver modules for rapid deployment along the

highway.

Immediately after ruling on

TNW's application, the CRTC issued a Notice of Consultation,

2019-57 which will form the basis for

a new competitive framework for the future of the Canadian wireless

industry. TNW intends to submit

interventions and appear in person during the CRTC hearings

and be an active

participant throughout the entire process. The consultation

will focus on the possible use of incumbent national

wireless networks by smaller licensed wireless carriers such as

TNW to

allow them to offer national coverage with the goal of increasing

competition in the Canadian market.

Last Mile

Solutions

The Company is

currently piloting, in partnership with a local

Quebec utility, an innovative last mile

solution developed in-house to provide wireless broadband

connectivity to underserved residential and commercial

subscribers.

This will provide

subscribers with a faster and less

expensive option over their current DSL, cable or point to

multipoint service. Utilizing the partner's

utility poles, the Company installed its own fibre cable along the pilot service

area which services subscribers through wireless access

points, therefore without the need

for a physical connection. Unlike traditional high

speed

Internet

service, this technological

approach is less restrictive with

bandwidth use and will permit high density

connectivity to each subscriber.

Once the pilot is complete

later in the 2nd quarter of 2018, the Company

will finalize its

business plan to

roll out the service as a separate operating division and will

provide updates as these plans develop.

Other

Telecommunications Assets

UnitedCorp will continue to

defend its position with respect to certain third party

telecommunications

assets and

operations to which it has an interest

and which

are currently in dispute in a Vancouver

proceeding. Recently, some of these

assets were released to the third parties.

The

Company is supporting litigation to retrieve the balance of

the assets

and operations

which will be used to support the Company's current

and future telecommunications operations.

Intellectual

Property Technology Applications:

The Company has always

believed strongly in innovation

and the

value of developing a portfolio of high

quality intellectual property.

It currently

maintains the rights, through development or

acquisition, to a number of intellectual

properties and patents pending under its intellectual property

portfolio. It intends

to continue this

strategy and exploit these assets as part of its business plan.

This includes BlochainDomes,

iFramed social media posting

technology, iPCS Smartphone over IP, BlockNum blockchain over PSTN

and

others.

The company will continue its

focus on the development of intellectual

property

and technology

solutions such as its Last Mile initiative. It is

currently developing several applications for

transactions secured on the

blockchain which

have resulted from experience gained

with the

BlockchainDomes.

It will also continue

to pursue

any

infringement of

its intellectual property including current actions

against

Snap Inc.,

Facebook and Instagram for infringement on iFramed

and

will

seek appropriate

remedies.

"2018 was a breakout year for

United American Corp," stated UnitedCorp

CEO

Benoit Laliberte.

"We began

the year with some great ideas and a determined team of

professionals who really wanted to put these ideas to

work, coupled with an ambitious

implementation timeline. The operational result was

even better than we expected. With the BlockchainDomes now proven

to work well in all seasonal conditions

and

with them

now generating steady revenues,

in 2019 we can devote more time to our other strategic areas

and build on our

experience, in addition to growing the

BlockchainDome business."

Financial

Statements

The Company's financial

statements are available at www.otcmarkets.com under UnitedCorp's

profile.

About United

American Corp

Established in 1992, United

American Corp is a Florida-based development and management company

focusing on telecommunications and information technologies. The

company currently owns telecommunications assets and holds the

rights to manage a portfolio of patents and proprietary technology

in telecommunications, social media and Blockchain technology, and

owns and operates the BlockchainDomes which are designed to provide

heat for agricultural operations using computer equipment in

naturally cooled data centers where efficiency and low-cost

operations are a priority.

About TNW

Wireless Inc.

TNW Wireless is a licensed

wireless operator for wholesale and retail services in Canada and a

wholly-owned subsidiary of United American Corp pending the acquisition

by UnitedCorp. The company currently holds 25MHz

bandwidth tier-2 850 MHz licences and is a registered wireless

carrier. It is licensed to provide communication services to the

Northwest region of Canada and can provide global communication

services through its proprietary iPCS Smartphone-over-IP

technology.

About

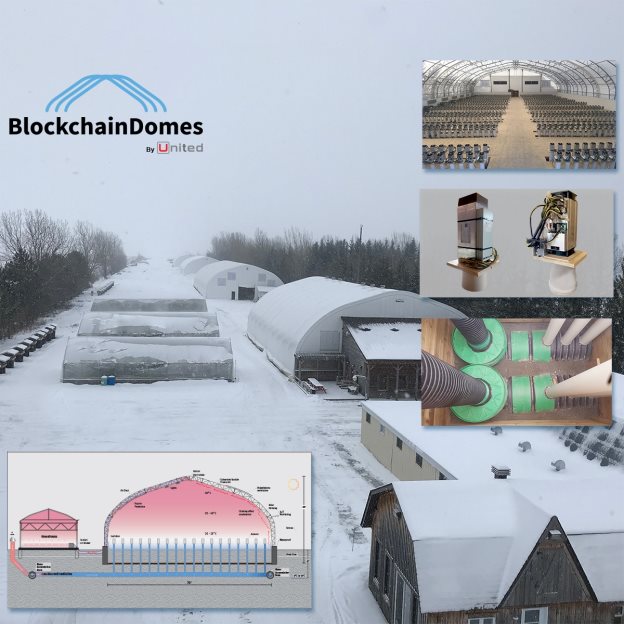

the BlockchainDome

The UnitedCorp

BlockchainDome Heat Station was designed to provide heat

for agricultural operations using ASIC (application-specific

integrated circuit chip) mining operations where efficiency and

low-cost operations are a priority. The BlockchainDomes, which

utilize a proprietary passive cooling ground-coupled heat-exchanger

technology, are particularly suited for situations where rapid

cluster deployment is required as they can be erected and

commissioned in a matter of weeks rather than up to a year using

the traditional "Bricks and Mortar" approach. BlockchainDomes can

be configured in a wide range of sizes to service any type of

greenhouse operation.

How BlockchainDomes work can

be seen at: https://www.youtube.com/watch?v=YDmhhaJKHLg

Campus and

Interior Views of UnitedCorp

BlockchainDomes and

Rendering of Adjacent Greenhouses

This news release

contains forward-looking statements that are subject to various

risks and uncertainties. The Company's actual results could differ

materially from those anticipated in such forward-looking

statements as a result of numerous factors that may be beyond the

Company's control. Forward-looking statements are based on the

expectations and opinions of the Company's management on the date

the statements are made, and the Company assumes no obligation to

update forward-looking statements should circumstances in

management's expectations or opinions change.

Source:

United American Corp

Contact:

Jenna Trevor-Deutsch

Director Investor Relations

investorrelations@unitedcorp.com

604 398 5000 ext: 109

United American (CE) (USOTC:UAMA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

United American (CE) (USOTC:UAMA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025