Aegon 1st Half Net Profit +26%

15 Août 2019 - 8:17AM

Dow Jones News

By Ian Walker

Aegon NV (AGN.AE) Thursday reported a 26% rise in net profit for

the first half of the year, driven by realized gains and lower

other charges, although these were partly offset by a higher loss

on fair value items.

The Dutch insurance and asset-management company made a net

profit of 618 million euros ($689.8 million) in the six months

ended June 30 compared with EUR491 million in the year-earlier

period.

Underlying pretax profit--one of the company's preferred

metrics, which strips out exceptional and other one-off items--was

EUR1.01 billion compared with EUR1.06 billion and consensus

forecasts of EUR988 million, taken from the company's website and

based on 20 analysts forecasts.

The company blamed lower fee business outflows in the U.S. and

increased investments to support growth and improve customer

experience for the fall in underlying profit.

Aegon's Solvency II ratio--a measure of its balance-sheet

strength--stood at 197% at June 30 compared with 211% at Dec. 31,

2018, and 215% at June 30, 2018.

The company has declared a dividend of 15 European cents a share

compared with 14 cents a year earlier.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

August 15, 2019 02:02 ET (06:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

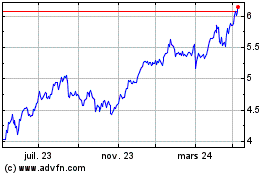

Aegon (EU:AGN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Aegon (EU:AGN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024