Ahold Delhaize 4Q Net Profit Beats Expectations

27 Février 2019 - 7:45AM

Dow Jones News

By Ian Walker

Koninklijke Ahold Delhaize NV (AD.AE) on Wednesday reported a

31% fall in fourth-quarter net profit due mainly to a tax credit in

the comparable period, with the result beating analysts'

forecasts.

The Netherlands-based grocer made a net profit of 517 million

euros ($588.2 million) for the quarter ended Dec. 30, compared with

EUR744 million a year earlier, on sales that rose to EUR16.55

billion from EUR15.76 billion a year ago.

Net profit for the fourth quarter of 2018 included a tax credit

of EUR235 million.

U.S. sales, including online, rose to $11.17 billion from $10.89

billion a year earlier, it said.

Consensus net income was EUR461 million, taken from the

company's website and based on 16 analysts' estimates. Net sales

were forecast at EUR16.44 billion, also taken from the company's

website and based on 19 analysts' forecast.

The company said it expects underlying income per share from

continuing operations for 2019 to grow by high single digits as a

percentage compared to last year.

Delhaize said it expect to realize EUR540 million of cost

savings this year, allowing it to invest in organic and inorganic

growth while keeping group margins in line with 2018. Underlying

operating margin in the quarter was 4.2%.

The board has declared a final dividend of 70 Euro cents a share

compared with 63 Euro cents in 2017. The company said the board

plans to introduce an interim dividend for the first half of this

year, with a payout of 40% of underlying income.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

February 27, 2019 01:30 ET (06:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

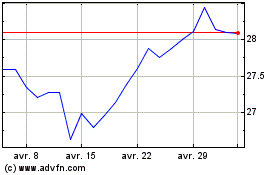

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

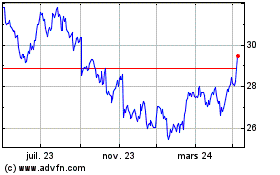

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024