By Tripp Mickle and Joe Flint

CUPERTINO, Calif. -- Apple Inc. unveiled new products for

entertainment, financial services, news and videogames as the

technology giant vies with competitors that are also moving to

expand their disruptive influence outside their core businesses in

search of new growth.

The announcements Monday mark a strategic shift for Apple as it

seeks new momentum amid softening sales in its core iPhone

business. The centerpiece of the star-studded event at Apple's

headquarters, capped by an appearance by Oprah Winfrey, was a new

video-subscription service to carry original programming.

In a first for the company, it plans to make its TV app, which

will carry that content, available on competitors' televisions and

other devices as well as its own -- reflecting Apple's growing

ambition to go beyond selling its own gadgets.

Apple also announced Apple Card, a mainly digital credit card

launched in partnership with Goldman Sachs Group Inc. that aims to

challenge incumbents by offering low interest rates and eliminating

both late fees and annual fees.

It unveiled Apple News+, a $9.99 monthly service that provides

access to 300-plus magazines as well as newspapers, including The

Wall Street Journal through an agreement with parent Dow Jones

& Co. And it showed off Apple Arcade, a gaming subscription

service offering access to 100-plus exclusive games for an

unspecified monthly fee.

Chief Executive Tim Cook portrayed the services as an extension

of Apple's existing mix of products, saying the integration of

hardware, software and services is something Apple does better than

anyone else. "We're excited to extend our services even further,

making them even more entertaining, more useful and more

informative," he said.

The initiatives are part of a broader movement by tech titans to

spread into new industries, betting their combination of loyal

users and troves of data can help unlock revenue opportunities. The

efforts are fueling competition in new arenas between some of the

world's biggest companies, as Amazon.com Inc. pushes beyond

e-commerce into entertainment and finance and Alphabet Inc. goes

past advertising into subscription gaming.

The tech companies are applying their digital expertise to

established industries just as Apple did years ago with the music

business, said Bob O'Donnell, president at Technalysis Research. "A

lot of the markets they're currently in are peaking, so to maintain

growth and satisfy investors they have to extend their reach," he

said.

Apple's success in its new bets isn't guaranteed, and the

company didn't disclose important details Monday that could shed

more light on its odds, including pricing for the video-content and

gaming services. Apple faces stiff competition in areas where it is

expanding, including from existing entertainment and credit-card

players and from companies providing free news and videogames.

Apple shares closed down 1.2% on Monday. They have gained ground

this year despite a sharp drop in iPhone sales at the end of last

year but remain well below their record high from last October.

The new video-content plans thrust Apple into rapidly

intensifying competition among technology companies and traditional

cable operators for pay-TV users.

Growing disillusionment with cable companies and the rise of

streaming-subscription services like Netflix Inc. is leading

millions of Americans to change their pay-TV habits, allowing

companies like Amazon, Sony Corp. and Hulu to elbow into a $100

billion industry long dominated by Comcast Corp., AT&T Inc.'s

DirecTV and others.

Apple's revamped TV app unveiled Monday -- which will house the

new video-content service -- is designed to grab a share of that

splintering TV market. A May software update will turn the app into

a central portal where customers can use a single password to

subscribe to content from AT&T's HBO, CBS Corp.'s Showtime and

others. That will put it most directly in competition with Amazon,

which is spending billions of dollars a year on content to compete

with Netflix while also acting as a distributor for channels like

HBO.

Apple's original-content service, called TV+, will be available

in its TV app starting in the fall. Though the company only showed

brief footage from its original series, it brought out several

stars and directors to discuss their work with Apple, including

Steven Spielberg, J.J. Abrams, Reese Witherspoon and Jennifer

Aniston.

Ms. Winfrey cited the broad audience of people with Apple

devices as one reason she is working with the company. "The Apple

platform allows me to do what I do in a whole new way, to take

everything I've learned about connecting with people to the next

level because they're in a billion pockets, y'all, a billion

pockets," she said.

Still, Apple acknowledged that to truly compete in services, it

needs to do something it hasn't done before and bring its TV app to

non-Apple hardware, including smart TV devices from Samsung

Electronics Co., LG Electronics Inc., Vizio Inc., Roku Inc., Sony

and Amazon.

The broader distribution is designed to help in an already

crowded content marketplace. There were 496 scripted original

series in 2018, according to research from Walt Disney Co.'s FX

Network. Streaming services including Netflix and Amazon are

driving that surge in programming. Since 2014, the number of

streaming shows has grown nearly 40%, according to FX.

The competition has driven the cost of content sky high as

programmers are spending heavily to lock down major producers.

Apple committed $1 billion to create original shows, an amount that

pales in comparison to what Netflix, HBO and others spend

annually.

While streaming services are growing as more consumers cut the

cords to their traditional pay-TV services, it isn't clear whether

the marketplace can sustain the volume of content being

produced.

"There's potential in a future Apple mega-bundle, but today,

their announcement was mostly about creating an offering and

experience largely identical to the one Amazon has had for years,"

said Matthew Ball, an independent consultant and former head of

strategy at Amazon Studios.

The launch of Apple Card, which customers will sign up for on

their iPhones, marks a major expansion of the tech giant's foray

into financial services, begun in 2014 with Apple Pay. The card

uses machine-learning on Apple's devices to organize people's

spending behavior into summaries. Customers can receive a physical,

titanium card to use in locations where Apple Pay isn't yet

accepted.

The news app, called Apple News+, is a premium version of the

existing, free Apple News app. Available immediately in the U.S.,

it provides access to articles from magazines including Vogue, GQ

and Sports Illustrated, as well as newspapers such as the Los

Angeles Times and the Journal. Publishers will split revenue from

the app 50/50 with Apple, according to people familiar with the

agreements.

"We believe in the power of journalism and the impact it can

have on our lives," Mr. Cook said. "We think Apple News+ is going

to be great for customers and great for publishers."

Apple emphasized the privacy of its new services, saying it

won't track articles people read, purchases they make or games they

play. The company recently released a TV advertisement touting its

position on privacy as it looks to differentiate its offerings from

competitors like Google and Facebook Inc.

Write to Tripp Mickle at Tripp.Mickle@wsj.com and Joe Flint at

joe.flint@wsj.com

(END) Dow Jones Newswires

March 25, 2019 19:21 ET (23:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

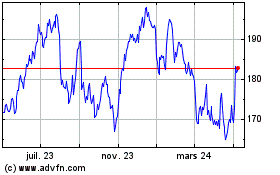

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

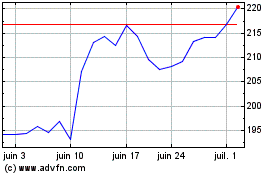

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024