Claranova Management Accompanies the Group’s Growth

08 Novembre 2018 - 6:00PM

Business Wire

Invitation to Claranova SA’s Annual Ordinary

and Extraordinary General Shareholders’ Meeting on November 29,

2018

Regulatory News:

Firmly set on a growth path, the Claranova (Paris:CLA) group

recently announced Q1 2018/2019 revenue of €48.2 million, up

61%. This excellent performance, driven by the consolidation of

the Avanquest’s division Canadian acquisitions and especially

the acceleration of organic growth (+33 %), once

again demonstrated that all the Group’s businesses are on the right

course.

Confident in the Group’s future and outlook, Pierre Cesarini

and Sébastien Martin, Chairman and member of the Management Board,

respectively, wish to accompany this strong momentum. They have

therefore decided, in agreement with the Supervisory Board, to

forego the grant of the 18,185,000 free shares1 reserved for

them.

This decision aims to reduce the accounting impact of these

grants on Claranova’s financial performance. These grants would

have led to the recognition of employer social security

contributions estimated2 at over €5 million, automatically reducing

Claranova’s operating profitability, without any link to the

development of its activities. The Group’s cash position can more

than cover this transaction without worsening its financial

position, however management considers this amount could be better

used to push forward the Group’s growth.

In return, the Supervisory Board approved the payment of an

exceptional bonus of K€1,700 for Pierre Cesarini and K€430 for

Sébastien Martin, as partial compensation for the loss resulting

from this waiver. Payment of these exceptional bonuses remains

contingent on their approval by shareholders at the Annual Ordinary

and Extraordinary General Shareholders’ Meeting on November 29,

20183.

Procedures for providing preparatory

documents

Claranova group shareholders are hereby invited to the Annual

Ordinary and Extraordinary General Shareholders’ Meeting to be held

at 10 a.m. on November 29, 2018, at the Company’s head

office located at 89 boulevard National, Immeuble Vision Défense,

92250 La Garenne-Colombes.

The preliminary notice of meeting with the agenda and

resolutions presented to the General Shareholders’ Meeting was

published in the Bulletin des Annonces Légales Obligatoires (BALO)

(French Journal of Mandatory Legal Announcements) of October 24,

2018. The procedures for participating and voting at this Meeting

are presented in this notice. The notice of meeting will appear in

the coming days in the BALO and a legal notices gazette.

The notice of meeting and all the documents and information

stipulated in Article R.225-73-1 of the French Commercial Code may

be consulted on the company’s website:

http://claranova.fr/investors/shareholder-meeting.php

A Supervisory Board report supplementing the corporate

governance report may be consulted from today at the Company’s head

office and in its website: www.claranova.com.

The other documents and information relating to this Meeting are

also available to shareholders under the applicable legal and

regulatory conditions.

About Claranova:

Claranova is a French technology group operating in three major

business sectors: mobile services through its PlanetArt division,

Internet of Things (IoT) through its myDevices division and

monetizing Internet traffic through its Avanquest division. A truly

global internet and mobile player, Claranova reported annual

revenue in excess of €160 million, generated over 90%

internationally. Its businesses are:

- PlanetArt: A world leader in mobile

printing, specifically via its FreePrints and Photobook

applications – the cheapest and simplest solutions in the world for

printing photos and creating photo albums from a smartphone;

- myDevices: A global platform for IoT

(Internet of Things) management, myDevices allows its partners to

commercialize turnkey solutions (“IoT in a Box”) to their

customers. Ready-to-use solutions are available for roll-out in the

medical, hotel, food and beverage, retail and education sectors

thanks to these offerings;

- Avanquest: A specialist in monetizing

Internet traffic through cross-cutting solutions, Avanquest boosts

its customer impact through cross-selling offerings that maximize

Internet traffic while ensuring the most efficient monetization

possible.

1 14,548,000 shares for Pierre Cesarini and 3,637,000 shares for

Sébastien Martin.

2 Based on the average share price over the 30 trading days

preceding the Board’s decision approving the bonus.

3 Claranova recalls that Pierre Cesarini and Sébastien Martin

respectively hold, directly and indirectly, 24,956,885 and 330,500

Company shares, representing 6.34% and 0.08% of the share capital

and 8.08% and 0.08% of voting rights, respectively.

CODESTicker : CLAISIN :

FR0004026714www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181108005703/en/

ClaranovaANALYSTES - INVESTISSEURS+33 1 41 27 19

74contact@claranova.comorCOMMUNICATION

FINANCIEREAELIUM+33 1 75 77 54 65skennis@aelium.fr

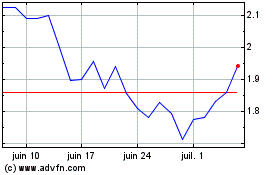

Claranova (EU:CLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Claranova (EU:CLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024