FINATIS: Rallye, Foncière Euris and Euris announce an agreement with their banks on all their derivatives transactions and t...

25 Novembre 2019 - 8:35PM

FINATIS: Rallye, Foncière Euris and Euris announce an agreement

with their banks on all their derivatives transactions and the

extension of the observation period

FINATIS

Société anonyme au capital de 84 646 545 euros

83, rue du Faubourg Saint-Honoré – 75008 Paris

712 039 163 RCS PARIS

Paris, on 25 November 2019

Rallye, Foncière Euris and Euris announce an

agreement with their banks on all their derivatives transactions

and the extension of the observation period

Following the authorization of the insolvency judge

(juge-commissaire), Euris informed Finatis of the entry into force

today of an agreement entered into with a financial institution

regarding the restructuring of the terms and conditions of the

claim in respect of the settlement amount linked to its sole

derivatives transaction structured in the form of forward sales

combined with equity swaps (the Restructuring Agreement). Rallye

and Foncière Euris also announced today the entry into force of

similar agreements at their level (see press releases of Rallye and

Foncière Euris).

The Restructuring Agreement covers the claim in respect of the

settlement amount linked to a derivatives transaction that amounts

to a total of 15 million euros, secured by pledges over 487,500

Finatis shares, i.e. 8.6% of its share capital.

The principles provided for in the Restructuring Agreement are

as follows:

- the financial institution that has agreed to the

reorganization of the terms and conditions of the claim in respect

of the settlement amount linked to the derivatives transaction (the

Relevant Financial Institution) waives its right under the ongoing

events of default as at the signature date of the Restructuring

Agreement to request immediate mandatory prepayment of any amounts

due by Euris or to exercise its pledges on Finatis shares;

- the claim in respect of the settlement amount linked to the

derivatives transaction will be repaid at the latest on 31 December

2023, it being specified that Euris will be able to exercise an

early repayment option of such settlement amount;

- the claim in respect of the settlement amount linked to the

derivatives transaction will only bear capitalized interests;

- any dividend paid in respect of Finatis shares pledged as part

of the derivatives transaction will be immediately and

automatically allocated to the payment of the claim in respect of

the settlement amount linked to the derivatives transaction;

- Euris acknowledges the application of the derogatory regime of

Articles L. 211-36 to L. 211-40 of the French Monetary and

Financial Code (Code monétaire et financier), which allows the

termination, netting, and exercise of security in spite of the

opening of insolvency proceedings;

- the Relevant Financial Institution may, if applicable, demand

payment of the claim in respect of the settlement amount linked to

the derivatives transaction and exercise the related security

interests in the following main cases of default:

- (i) conversion of the safeguard proceedings opened to the

benefit of Euris into rehabilitation proceedings (redressement

judiciaire) or liquidation proceedings (liquidation judiciaire), or

(ii) cancellation of the safeguard plan that will be adopted to the

benefit of Euris, or (iii) non-compliance with the schedule of the

safeguard proceedings (in particular, the adoption of a safeguard

plan by 31 July 2020);

- loss of the direct or indirect control by Jean-Charles Naouri

and his family of Euris, Finatis, Foncière Euris, Rallye or of

Casino;

- cross default: any default of Rallye and/or Foncière Euris

under the restructuring agreements of their derivatives

transactions which entered into force today (see today’s press

releases of Rallye and Foncière Euris) ;

- in the event of a case of default, exercise by one of the

Relevant Financial Institutions of any of their security interests

relating to the derivatives transactions subject of the

Restructuring Agreements for Rallye, HMB, Cobivia, Foncière Euris

or Euris (see today’s press releases of Rallye and Foncière

Euris)

Finatis and Euris also announce they have obtained an

extension of the observation period of the safeguard proceedings

opened to their benefit for a period of 6 months.

Finatis and Euris confirm their objective to obtain the approval

of their safeguard plans by the Court by the end of the first

quarter of 2020 at the latest.

Contact presse :

Citigate Dewe Rogerson Aliénor MIENS + 33 6 64 32 81 75

Alienor.miens@citigatedewerogerson.com Annelot Huijgen +33 6 22 93

03 19 Annelot.Huijgen@citigatedewerogerson.com

- 2019 11 25 Fi Communiqué accord dérivés et prolongement

sauvegarde anglais

Finatis (EU:FNTS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

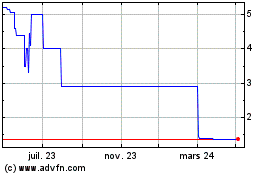

Finatis (EU:FNTS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024