GE to Turn Focus to Finance Unit After Fixing Power Business -- WSJ

23 Mai 2019 - 9:02AM

Dow Jones News

By Thomas Gryta

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 23, 2019).

Larry Culp, General Electric Co.'s chief executive, plans to set

his sights on the company's problematic financial-services business

after he cuts overall debt and stabilizes its power-generation

division, he told investors Wednesday.

In a wide-ranging presentation at the Electrical Products Group

conference, Mr. Culp reiterated GE's latest financial forecasts and

discussed the steps he is taking to streamline its operations. "We

are changing the way we run the business," he said. "From a

business that was often run top-down...to a business that's going

to be run from the bottom up."

GE has struggled the past two years -- losing $200 billion in

market value over 2017 and 2018 -- with slumping profits in its

power business and troubles in GE Capital, leading it to change

CEOs, cut its dividend twice and set plans to break itself apart.

Mr. Culp, who took the helm in October after six months on the

board, has projected up to $2 billion in negative cash flow for

2019.

GE Capital has been a key part of the conglomerate's profit

engine for decades, but it has also been the root of some of its

recent problems and continues to be a concern for investors. The

financial-services division ended 2018 with more than $109 billion

in assets and $66 billion in debt.

When asked Wednesday how quickly GE can shrink the size of GE

Capital, Mr. Culp said he expects to be in a better position to

make decisions once GE's debt of more than $100 billion is reduced

and the power division is "back on its feet." He said future cash

contributions to the Capital unit would be "meaningfully less" than

the $4 billion needed this year.

GE Capital brought the conglomerate to its knees during the

financial crisis, and a swift sale of most of the business to get

out from government oversight years later didn't jettison toxic

remnants that have cost billions of dollars more recently. GE

Capital has been shrinking, but it still has attractive parts such

as its airplane-leasing business, Mr. Culp said. "Are they more

valuable outside of GE, than as part of GE?," he said.

Regarding the power business, Mr. Culp said the division has cut

1,000 workers this year and is aiming to further reduce costs. The

division had about 60,000 employees at the end of 2018. GE finance

chief Jamie Miller recently said there would be additional

restructuring in the power business in the second quarter and "in

particular in the second half."

Mr. Culp said GE isn't banking on selling its products in China

to turn around the power business. He also said cost pressures from

tariffs in the continuing U.S.-China trade battle are manageable,

but GE is more concerned about "the more-subtle repercussions" of

relations with China. "Our health-care business in China for

example got off to a very good start," he said, "but it is

something we are watching very carefully."

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

May 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

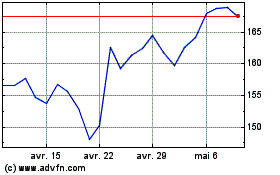

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024