Covid-19 vaccination campaign: 80% of residents

vaccinated

2020: growth in activity and Resilient profitability

- Revenue: €3,922 million (+4.9%)

- EBITDA: €926,5 million (-2.4%)

An expanding growth pipeline: +8,769 beds in 2020

- Pipeline of beds under construction of more

than 25,000 beds

- Network of more than 111,000 beds in 23

countries

Strong increase in real-estate portfolio valuation (+€789

million)

- Portfolio valuation at €6.8

billion

2021 Revenue growth target: at least +6%

Regulatory News:

The ORPEA Group (Paris:ORP), world leader in long-term care

(nursing homes, post-acute and rehabilitation and hospitals and

mental health facilities, and home care services) today announced

its consolidated results for the 2020 financial year1, ended on 31

December, which release has been approved by the Board of Directors

on 16 March 2021.

Management

of Covid-19: major improvement in the sanitary situation across all

Group facilities thanks to the success of the vaccination

campaign

The Covid-19 vaccination campaign, which is scheduled to be

completed across all countries in which the Group operates by the

beginning of April, coupled with the strong commitment of our

teams, has improved the sanitary situation within the ORPEA

network.

At 15 March 2021, 80% of residents and 44% of employees had been

vaccinated. Thanks to the success of these vaccinations, the number

of positive cases has decreased considerably and currently

represents less than 1% of the Group’s residents. More than 90% of

the Group’s nursing homes thus currently have no positive cases of

Covid-19.

Although the teams remain highly cautious and strict barrier

measures remain in place, the social life within each facility,

which is of utmost importance is gradually returning to normal:

meals at the restaurant, family visits, events and entertainment,

authorisations to leave the premises. ORPEA is providing customised

solutions in each region and each facility according to regulatory

requirements and the local public health context.

As has been the case each year for 20 years, ORPEA has carried

out an annual satisfaction survey among the residents of nursing

homes and their families worldwide: 50,000 questionnaires were

issued and the rate of response was 56%, a high level considering

the pandemic. Thanks to the unprecedented commitment of employees

during the past year of this public health crisis, the satisfaction

and recommendation rates have improved: reaching 92.5% (+0.2pt) and

95.1% (+1.2pts) respectively.

2020

results demonstrate the Group’s resilience in an unprecedented

context

Results for 2020 are presented in accordance with IFRS

standards, including IFRS 16.

In €m

(IFRS)

2020

2019

Change

Revenue

3,922.4

3,740.2

+4.9%

EBITDAR (EBITDA before rental

expenses)

963.0

982.5

-2.0%

EBITDA

926.5

949.4

-2.4%

Recurring operating profit

422.9

503.7

-16.0%

Net interest expense

-256.7

-215.0

+19.4%

Profit before tax

210.3

325.7

-35.4%

Net profit attributable to Group’s

shareholders

160.0

233.8

-31.6%

Revenue for 2020 was up +4.9% to €3,922.4 million, driven

by good external growth momentum in Ireland (TLC Group) and France

(Clinipsy, Sinoué). Moreover, the recovery in organic growth during

H2 offset the slight slowdown in growth seen during H1.

EBITDAR (EBITDA before rental expenses) recorded a

limited decline of 2% over the year as a whole, to €963 million

representing a margin of 24.6%, versus 26.3% in 2019, marking a

limited 170 bp decrease against a backdrop of a global

pandemic.

The gross cost of Covid-19 over 2020 was €259 million (loss of

business, additional costs relating to personal protective

equipment and staff bonuses), and the net cost €101 million, taking

into account compensation received. This compensation is recognised

as recurring profit, either mainly under other income for

compensation relating to loss of activity or as a reduction in

expenses for compensation for additional costs.

H2 2020 was characterised by a marked increase in profitability,

with an EBITDAR margin that improved by 150 bp to 25.3% versus

23.8% during H1, thanks to the upturn in business, mainly in

post-acute and rehabilitation hospitals and mental health

facilities. Central Europe and Eastern Europe enjoyed a strong

improvement in profitability during H2, whereas the Iberian

Peninsula and Latam continued to be affected by the scale of the

pandemic in Spain during H1.

EBITDA declined by a limited 2.4% to €926.5 million,

representing a margin of 23.6% (vs 23.1% during H1 2020).

Recurring operating profit stood at €422.9 million (-16%)

after depreciation, amortisation and charges to provisions of

€503.7 million (+13%) with the level of amortisation and

depreciation reflecting the growth of the real-estate portfolio

held by the Group.

Net non-recurring gains were €44.1 million compared with €37.0

million in 2019 (+19.2%).

The net interest expense reached €256.7 million (+19.4%), with

this increase mainly driven by a non-cash element relating to

provisions for interest rate hedging due to an environment of

sustained negative interest rates during 2020.

Against a backdrop of the global public health crisis that

impacted both levels of activity and operating expenses, net profit

attributable to Group’s shareholders reached €160 million (-31.6%).

Excluding IFRS 16, 2020 net profit stood at €174 million,

representing a decline of 29% compared to 2019.

Proposed

dividend distribution of €0.90 per share

In 2020, faced with an unprecedented situation, ORPEA was one of

the first groups to propose a dividend suspension in solidarity

with all stakeholders. This proposal was almost unanimously

approved (99%) by shareholders during the Annual General

Meeting.

Faced with the prospect of an improvement in the public health

situation, the Board of Directors, will propose, at the 24 June

2021 Annual General Meeting, that shareholders approve the

distribution of a dividend of €0.90 per share, entirely paid in

cash, with respect to the 2020 financial year. This amount implies

a pay-out ratio of 36%, allowing the Group to maintain its

investment capacity to improve and develop its network of

facilities.

Significant

growth in the real-estate portfolio to €6.8 billion

At 31 December 2020, the Group’s real-estate portfolio was

valued at €6,806 million2 and had a total surface area of more than

2.2 million sqm.

This significant improvement of €789 million (+13%) compared to

2019 was driven by:

– the revaluation (+€406 million) of all existing real estate

(as opposed to one third of the portfolio every three years) by

independent experts Cushman & Wakefield and JLL. This

assessment points to a capitalisation rate of 5.3% (vs 5.7% in

2019) that reflects changes to market conditions, but which

nonetheless remain conservative in terms of recent transactions of

assets falling within the same category;

– the continuation of developments associated with the ownership

of new buildings in prime locations, notably with the acquisition

of buildings in Ireland, Germany and the Netherlands (+€615

million);

– the disposal of facilities (-€232 million), in line with the

arbitrage strategy announced by the Group at the end of 2019.

As the public health crisis has demonstrated the resilience of

occupancy rates at healthcare facilities, the Group’s buildings

continue to attract an increasing number of international

real-estate investors, under conditions that remain very attractive

in terms of yield, the indexation of rental income and lease terms.

The Group has thus received commitments of more than €2 billion for

its 2021-2025 disposal programme.

ORPEA therefore now owns 47% of its facilities, which is in line

with the medium-term ownership rate objective of 50%.

Financial

structure strengthened further in 2020

In 2020, ORPEA continued to actively strengthen its financing

capacity, with new bank financing and non-banking transactions

(Schuldschein and Euro PP for almost €500 million), of which part

in long-term maturities (12 and 15 years), as well as a Private

Placement indexed to extra-financial impact criteria.

Net financial debt stood at €6,103 million3 at 31 December 2020,

compared with €5,958 million at 30 June 2020, a very modest

increase considering the level of investments, both in real estate

and operating assets.

The share of real estate debt reached 87%, compared with 85% at

31 December 2019. Debt ratios restated for IFRS 16, used by the

Group’s financial partners, remain well below their covenants, with

financial leverage restated for real estate assets at 3.4 (5.5

authorised) and stable restated gearing compared with 2019 at 1.6

(2.0 authorised). The Group therefore has good financial leeway to

execute its growth strategy.

Borrowing cost (including hedging costs) stood at 2.4%, a 30 bp

decrease compared to 2019. Net debt is still fully hedged against

the risk of an increase in interest rates.

Further

sustained growth for the network in 2020: +8,769 new beds in just

one year

At 31 December 2020, the ORPEA network extended across 23

countries, with 111,801 beds in 1,114 facilities, thanks to a

sustained pace of growth despite the Covid-19 pandemic.

Indeed, following an already steady increase of almost 8,000

beds in 2019, the Group continued its development policy by

increasing its network by 8,769 new beds (+8%) in 2020:

– +5,808 beds (i.e. 66% of the increase) through the creation of

facilities across all geographical regions, in particular in

France, Germany, Portugal and Mexico;

– +2,961 beds through external growth, via the acquisition of

groups (Sinoué and Clinipsy in France, TLC and Brindley in Ireland)

and independent facilities.

The growth pipeline, consisting exclusively of beds under

construction, posted growth in excess of 20% over 12 months to

reach a record level of 25,403 beds. This marked improvement, for

the third consecutive year, underlines the Group’s long-term growth

momentum, which remains unchanged despite the unprecedented context

of the public health crisis. This growth pipeline will allow the

Group to guarantee secure, sustainable and strong organic growth

for the next five years.

Number ofsites Beds in service Beds

underconstruction Number of beds Change in 12

months France Benelux

572

42,540

5,366

47,906

+3,838 France

372

32,673

3,543

36,216

+2,193 Netherlands

116

1,676

1,168

2,844

+583 Belgium

71

7230

268

7,498

79

Luxembourg

2

0

365

365

+0 Ireland

11

961

22

983

+983

Central Europe

261

22,148

5,828

27,976

+1,485 Germany

191

17,105

3,452

20,557

+974 Italy

30

1,977

1,518

3,495

+266 Switzerland

40

3,066

858

3,924

+245

Eastern Europe

142

11,154

4,101

15,255

+836 Austria

87

7,041

954

7,995

+180 Poland

23

1,190

1,696

2,886

+0 Czech Rep.

20

2,044

784

2,828

+103 Slovenia

9

551

467

1,018

+225 Latvia

1

202

202

+202 Croatia

1

126

126

+126 Russia

1

200

200

+0

Iberia and Latin America

137

10,416

9,723

20,139

+2,225 Spain

66

8,992

2,339

11,331

+254 Portugal

37

728

3,336

4,064

+956 Brazil

22

471

2,487

2,958

+206 Uruguay

3

100

209

309

-17

Colombia

4

0

641

641

+320 Mexico

5

125

711

836

+506

Other country

2

140

385

525

+385 China

2

140

385

525

+385

Total Group

1,114

86,398

25,403

111,801

8,769

Major

developments and investments in training

ORPEA’s employees are key to the Group’s success and a major

stakeholder within the CSR commitments of the Group. Achieving

sustainable growth requires the implementation of an innovative and

differentiating Human Resources strategy that meets three

fundamental challenges - recruitment, training and loyalty.

In terms of recruitment, ORPEA uses all the means available to

increase the visibility and attractiveness of its employer brand,

while diversifying its sources:

– strengthening its social media presence to better promote its

professions and careers,

– the digitalisation of HR processes, which has already achieved

tangible results with, for example, 5,000 unsolicited job

applications received in France and Germany,

– partnerships with non-profit organisations to attract new

profiles: “Nos quartiers ont du talent”, “Rev’elles ton Potentiel”,

“Viens Voir Mon Taf”,

– the development of Open Innovation through partnerships with

start-ups such as Hublo, a digital solution for the management of

replacement care staff which already has more than 9,000 candidates

registered in its database for ORPEA.

ORPEA has always considered training to be a cornerstone of its

HR development policy to enable all employees, regardless of their

position, to advance in their careers with no “glass ceiling”. The

Group has thus introduced major new initiatives in this area:

– the development of internal schools, for example in France

that now has two schools for carers capable of accepting 250

candidates each year;

– the acquisition of EMG Akademie, the leading nursing and care

school in Austria, associated with the construction of a campus

covering all Care-related courses, with a capacity of over 500

students;

– an acceleration in the Validation of Prior Experience (VAE)

programme: more than 600 nursing assistants will be able to become

carers in just two years;

– partnerships with prestigious universities to create

University Degrees specific to ORPEA’s fields of expertise: Degree

in Psychiatric Nursing, Degree in Hygiene, Degree in Troubled

Teens, etc.

The Group will continue to invest in its HR development strategy

to reinforce its attractiveness, attract and retain more talent,

and promote the personal and professional development of its

employees which is a key factor in terms of competitiveness for

ORPEA.

Strategy

and outlook

In 2021, the Group will remain extremely cautious in terms of

the public health situation and will continue to implement all of

its resources and know-how to protect its residents, patients and

employees and strengthen its relationship with and the well-being

of all its stakeholders. The Group has set the following

objectives:

– continue to grow in its five geographical areas across all

professions in long-term physical and mental health care, through

targeted acquisitions and new facility construction projects;

– open 4,055 new beds from the growth pipeline;

– revenue growth above 6% (> €4,155 million)

– real-estate disposals of €400-500 million, in line with its

strategy of owning around 50% of its property portfolio;

– roll out its CSR roadmap with 2023 objectives focused on its

five stakeholders: Residents, Patients & Families, Employees,

Partners, Environment, Society & Community.

Yves Le

Masne, Chief Executive Officer of ORPEA, commented:

“2020 was an unprecedented year in the scale and duration of the

global pandemic, but ORPEA, thanks to the commitment of its 68,000

employees, who I would like to once again thank for their

unwavering commitment, was able to demonstrate its ability to adapt

and resist. ORPEA thus posted revenue growth of close to 5%,

EBITDAR in slight decline of 2% compared to 2019 and net profit of

€160 million (€174 million restated for IFRS 16, -29%).

While remaining highly cautious to protect our residents and

patients, we are reasonably confident that the public health

situation will gradually return to normal, thanks in particular to

the success of the vaccination campaign.

In 2021, we will continue to broaden our CSR commitments,

notably by investing in the development, training and well-being of

our employees so that they are happy and proud to work, each day,

in a profession that has never been so useful and essential to our

society.

Lastly, the Group is confident in its ability to continue its

sustained global growth focused, as always, on value creation

through new acquisitions and the construction of new health

facilities."

About ORPEA (www.orpea-corp.com)

Founded in 1989, ORPEA is one of the major world leaders in

long-term care, with a network of 1,114 facilities comprising

111,801 beds (25,403 of which are under construction) across 23

countries, which are divided into five geographical regions:

- France Benelux: 572 facilities/47,906 beds (of which 5,366 are

under construction)

- Central Europe: 261 facilities/27,976 beds (of which 5,828 are

under construction)

- Eastern Europe: 142 facilities/15,255 beds (of which 4,101 are

under construction)

- Iberian Peninsula/Latin America: 137 facilities/20,139 beds

(of which 9,723 are under construction)

- Rest of the world: 2 facilities / 525 beds (of which 285 under

construction)

ORPEA is listed on Euronext Paris (ISIN code: FR0000184798) and

a constituent of the SBF 120, STOXX 600 Europe, MSCI Small Cap

Europe and CAC Mid 60 indices.

Next press release: Q1 2021 revenue 4 May

2021 after market close

Organic growth

Organic growth reflects the following

factors:

- The year-on-year change in the revenue of existing facilities

as a result of changes in their occupancy rates and per diem

rates

- The year-on-year change in the revenue of redeveloped

facilities or those where capacity has been increased in the

current or year-earlier period

- Revenue generated in the current period by facilities created

in the current or year-earlier period, and the change in revenue at

recently acquired facilities by comparison with the previous

equivalent period

EBITDAR

EBITDA before rents, including provisions

related to external charges and staff costs

EBITDA

Recurring operating profit before net

additions to depreciation and amortisation, including provisions

related to external charges and staff costs

Pre-tax profit on ordinary

activities

Recurring operating profit - Net financial

expense

Net debt

Non-current borrowings + current

borrowings - cash and short-term investments

Financial leverage restated for

real-estate assets

(Net debt - Real-estate debt)/(EBITDA -

(6% x Real-estate debt))

Restated gearing

Net debt/(Equity + Deferred taxes

available indefinitely on intangible assets)

Capitalisation rate

The real-estate capitalisation rate or the

rate of return is the ratio between the rental amount and the

building’s value

Consolidated income statement (Audit in progress)

In €m

2020

2019

2020

Restated IFRS 16

2019 Restated IFRS 16

Revenue

3,922.3

3,740.2

3,922.3

3,740.2

Purchases used and other external

expenses

-712.3

-685.6

-718.4

-685.6

Staff costs

-2,210.3

-1,978.1

-2,210.3

-1,978.1

Taxes other than on income

-135.5

-129.2

-135.5

-129.2

Depreciation, amortisation and charges to

provisions

-503.6

-445.7

-233.4

-198.5

Rents

-36.5

-33.1

-354.0

-331.4

Other recurring operating income and

expenses

98.8

35.1

98.8

35.1

Recurring operating profit

422.9

503.7

369.5

452.5

Other non-recurring operating income and

expenses

44.1

37

43.5

36.2

Net interest expense

-256.7

-215.0

-184.0

-147.9

Profit before tax

210.3

325.7

228.9

340.8

Income tax expense

-52.6

-98.6

-56.9

-101.6

Share in profit/(loss) of associates and

joint ventures

2.3

6.7

2.3

6.7

Net profit attributable to ORPEA’s

shareholders

160.0

233.8

174.3

245.9

Consolidated balance sheet (Audit in progress)

In €m

31-dec-20

31-dec-19

Non-current assets

14,398

12,440

Goodwill

1,489

1,299

Intangible assets

2,881

2,469

Property, plant and equipment and

properties under development

6,806

6,017

Right of use assets

2,817

2,334

Other non-current assets

405

321

Current assets

1,944

1,699

Cash and short-term investments

889

839

Assets held for sale

550

400

TOTAL ASSETS

16,892

14,539

Equity attributable to ORPEA’s

shareholders and deferred taxes available indefinitely

3,949

3,513

Equity attributable to ORPEA’s

shareholders

3,374

3,014

Deferred taxes available indefinitely on

operating intangible assets

576

499

Non-controlling interests

-5

-3

Non-current liabilities

9,998

8,849

Other deferred tax liabilities

625

529

Provisions for liabilities and charges

191

199

Non-current liabilities

6,462

5,859

Lease commitments

2,720

2,262

Current liabilities

2,399

1,780

o/w current financial liabilities (bridge

loans and real-estate porting)

530

515

Liabilities associated with assets held

for sale

550

400

TOTAL EQUITY AND LIABILITIES

16,892

14,539

Cash flows (Audit in progress)

In €m

2020

2019

Net cash from operating

activities

440

487

Investments in construction projects

-427

-375

Acquisitions of real-estate

-324

-343

Disposals of real-estate

232

16

Net operating investments and equity

investments

-488

-276

Net cash generated/(used) by investing

activities

-1,007

-978

Net cash generated/(used) by financing

activities

617

562

Change in cash over the period

50

71

Cash at end of period

889

839

1 The 2020 financial statements are currently being audited. 2

Excluding the impact of €490 million of real-estate assets held for

sale as of 31.12.20 3 Excluding €550 million and €400 million in

debt associated with assets held for sale at 31.12.2020 and 31.12.

2019 respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210316005950/en/

Investor Relations ORPEA Steve Grobet EVP

Communication and Investor Relations s.grobet@orpea.net

Benoit Lesieur Investor relations b.lesieur@orpea.net

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 orpea@newcap.eu

Media Relations Rebecca David Tél. : 06 04 74 83 69

rdavid@image7.fr

Charlotte Le Barbier Tel.: 06 78 37 27 60

clebarbier@image7.fr

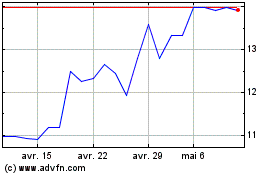

Orpea (EU:ORP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Orpea (EU:ORP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024