By Alexandra Wexler

ADDIS ABABA, Ethiopia -- The world's biggest names in

hospitality are battling for a slice of one of the world's

fastest-growing markets for hotels: Africa.

Tourists are pouring into many of the continent's 54 nations in

record numbers, fueling development in traditional tourist hubs and

new investment in frontier markets. The continent boasts the

world's fastest-growing population, some of its most swiftly

expanding economies and a ballooning domestic-travel market driven

by Africa's expanding middle class.

The prospect of bumper growth across dozens of underdeveloped

markets -- some offering the potential to set higher room rates

than in London or New York -- is sparking billions of dollars in

investments from top operators, including Accor SA, Hilton

Worldwide Holdings Inc. and Marriott International Inc. A 2018

survey of 41 international and regional hotel chains by W

Hospitality Group, an advisory firm, shows 298 hotels in the

development pipeline across Sub-Saharan Africa, more than double

the pipeline in 2014.

The most robust growth is taking place beyond the continent's

established tourism hot spots of South Africa and Kenya in the

rising business hubs of Nigeria and Ethiopia.

In Addis Ababa, Ethiopia's highland capital, where gross

domestic product has grown 10% on average annually over the past

decade, the rising skeleton of a 450-room Four Points by Sheraton

is located opposite a swanky, contemporary Hyatt Regency that

opened Jan. 1. The city's vast new airport terminal, which opened

earlier this year, has more than doubled annual capacity to 22

million passengers.

"They have good Wi-Fi and good service," Ibrahim Hamza, a

28-year-old dentist from Addis Ababa, said of the Hyatt while

working on a laptop in its lobby on a recent weekday afternoon. "I

like the design and the interior -- it's unique."

Addis Ababa has become a hub for continental travel via its

state-owned Ethiopian Airlines and hosts the headquarters of the

United Nations Economic Commission for Africa as well as the

African Union.

Investments in hotels in Ethiopia reflect the shifting of

economic centers of gravity across the continent. With 31 hotels in

the pipeline, according to W Hospitality, Ethiopia is second in

Sub-Saharan Africa only to regional economic giant Nigeria.

Revenue in Africa per available room, a performance metric used

in the hotel industry, grew 11% in 2018, faster than in Europe,

where it climbed 5.2%, or Asia, where it rose 1.7%, according to

data and analytics firm STR. The continent trails just South

America, which grew a blistering 29% last year.

To be sure, many African markets are notorious for issues with

land rights, slow construction progress and graft.

"These hotels tend to take so much longer," said Mark

Martinovic, president and CEO of Hotel Spec International Inc., a

South Africa-based hotel-development consulting firm. He also cited

challenges in getting raw materials through customs in the

continent's ports, saying, "I call the [African hotel] pipeline the

'pipe dreams.' "

But many of the world's biggest names in hospitality say that

despite the enduring challenges for investors in Sub-Saharan

Africa, the continent's growth prospects are strong.

In July, Accor, which has over 140 hotels across 22 countries

continent-wide -- over 60 of them in Sub-Saharan Africa -- --

unveiled a $1 billion investment fund with Katara Hospitality, a

global hotel developer and operator owned by Qatar's government, to

help expand its footprint through both acquisitions and organic

growth. Accor plans to open 60 new properties in Africa by 2023.

Accor operates brands that include Fairmont, Sofitel and

Pullman.

"It's all about political and economic stability," said Mike

Collini, Hilton's vice president of development for Sub-Saharan

Africa. "If you look at Africa over the last three decades, it's

become significantly more politically stable."

Hilton, which is opening its first hotels in Botswana, Uganda

and Eswatini, formerly Swaziland, this year, plans to more than

double its footprint on the continent in the next five to seven

years, from more than 40 hotels currently. Last year, the hotel

operator opened a DoubleTree by Hilton in Pointe-Noire, Republic of

Congo, and entered Zambia.

In West Africa, Marriott plans to expand its current footprint

by 75%, or nine hotels, by the end of 2023. Radisson Hospitality AB

is also keen on the region, with plans to expand its nearly 100

hotels in operation and under development across 32 African

countries to 130 hotels by the end of 2022.

"Governments and businesses from all around the world are

rushing to strengthen diplomatic, strategic and commercial ties

with Africa, which has created vast opportunities," said Andrew

McLachlan, Radisson's senior vice president of development for

Sub-Saharan Africa.

Home-sharing company Airbnb Inc. has also expanded significantly

across the continent, notching up listings in every African

country. The continent accounts for three of Airbnb's eight-fastest

growing markets world-wide.

The dominance of Western brands stands out even in economies

that have in recent years built strong trade relationships with

China, Africa's largest investor, as China's vast infrastructure

projects pave the way for many new hotel plans.

But Chinese hospitality giant Jin Jiang International Holdings

Co. Ltd. is gaining ground. The company bought Louvre Hotels Group,

which operates more than two dozen hotels on the continent, in 2015

and led a consortium that acquired Radisson last year.

Hoteliers say there is more than enough room for everyone, with

high nightly rates -- an advantage of being in a frontier market

with few other options -- making up for some of the other

headaches. In Kinshasa, Democratic Republic of Congo, the average

daily rate is $300 a night, compared with an average of $198 a

night in London and $262 a night in New York, according to STR.

"If you drill down into it, there is such a significant

undersupply of quality accommodation," Hilton's Mr. Collini said.

"It's a market that warrants the investment and the focus that

we're applying."

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

May 01, 2019 12:36 ET (16:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

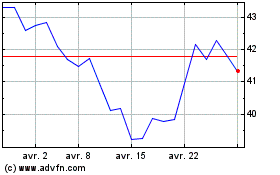

Accor (EU:AC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

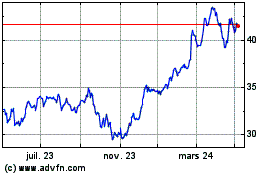

Accor (EU:AC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024