Current Report Filing (8-k)

09 Juin 2022 - 10:53PM

Edgar (US Regulatory)

0000002178FALSE00000021782022-06-092022-06-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 9, 2022

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | |

17 South Briar Hollow Lane, Suite 100, Houston, Texas | 77027 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |

Item 8.01 Other Events.

Risk Factor Update

Adams Resources & Energy, Inc. (the “Company”) is supplementing the risk factors set out under “Item 1A. Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “2021 Form 10-K”) with an additional risk factor set out below. The risk factor should be read in conjunction with the other risk factors set out in the 2021 Form 10-K.

Our largest shareholder has indicated its intent to divest its ownership of our stock.

On May 6, 2022, KSA Industries, Inc. (“KSA”), our largest shareholder, filed an amended beneficial ownership report on Schedule 13D that indicated its decision to pursue a potential sale of the Company common stock that it holds. According to KSA’s amended Schedule 13D, sales may take place in the open market, in privately negotiated transactions, through derivative transactions, through public offerings or otherwise, subject to market conditions, legal and regulatory requirements, any contractual limitations and other factors the shareholder considers relevant from time to time. KSA currently owns approximately 38% of our outstanding common stock, which gives it a significant degree of control over the approval of significant corporate transactions, a sale of our company, decisions about our capital structure, the composition of our board of directors, amendments to our certificate of incorporation and any other matter submitted to stockholders for approval. If KSA were to sell a substantial amount of stock on the open market or otherwise, it could have an adverse effect on our stock price. In the event that KSA were to sell its shares in the Company in a block to a third party, that third party would obtain a similar degree of control of the Company, may be able to influence the strategic direction of the Company, and may have interests that differ from those of our long-term shareholders. Such a sale to a single purchaser may also constitute an event of default under our existing revolving credit facility if it is made without our lender’s consent. Since the filing of the amended Schedule 13D, the Company and KSA have held preliminary discussions through advisors about the degree, if any, to which the Company may be involved in such a sale. As of the date hereof, the Company cannot predict the timing, nature or outcome of a sale of our stock by KSA, if any. We cannot assure you that KSA will not take actions that impair our ability to implement our business plan effectively or that conflict with the best interests of our other shareholders.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of future results or conditions but rather are subject to various factors, risks and uncertainties that could cause actual outcomes to differ materially from those expressed in these forward-looking statements, including, but not limited to, the timing, nature or occurrence of any sale of shares by our largest shareholder, our ability to execute our business plan effectively and those factors identified in our filings with the Securities and Exchange Commission as may be accessed at www.sec.gov. The Company undertakes no obligation to update the disclosure provided in this Current Report on Form 8-K on account of new information, future events, changes in expectations or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | June 9, 2022 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

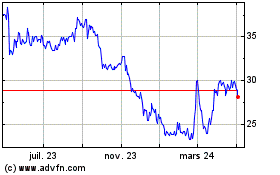

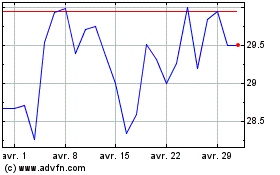

Adams Resources and Energy (AMEX:AE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Adams Resources and Energy (AMEX:AE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024