Battalion Oil Corporation (NYSE American: BATL, “Battalion” or the

“Company”) today announced financial and operating results for the

first quarter of 2023.

Key Highlights

- Substantial progress on acid gas

treating facility as we ramp up gas delivery toward bringing the

facility fully online

- Generated first quarter 2023 sales

volumes of 16,200 barrels of oil equivalent per day (“Boe/d”)

- Continued excellent results from

our most recent wells

- Completed corporate initiative to

reduce general and administrative costs in April

- Generated net income of $22.8

million and Adjusted EBITDA of $26.1 million in the first quarter

of 2023

- Per unit operating cost metrics

down year over year for the first quarter as we continue to more

than offset inflationary forces

Management Comments

The Company has begun testing procedures and

initial processing for its previously announced acid gas injection

(“AGI”) project. The facility has been ramping up its

throughput processing over the last few weeks. When this project is

fully online, the Company will benefit from savings of up to $2.5MM

per month through reduced treating fees and operational

efficiencies at the Monument Draw central production facilities.

These savings not only represent significant bottom line financial

improvement, but also substantiate Monument Draw’s ability to

compete with top tier acreage in the Wolfcamp and Bone

Spring.

Initial work on the second acid gas injection

well has begun; providing significant optionality to the Company

through the ability to expand to as much as 100 MMCFD inlet

treating capacity. Danny Rohling, Chief Operating Officer,

commented, “The Brazos Amine Treatment Facility will be a huge

milestone for Battalion and we’re excited by its progress as our

latest wells continue to outperform expectations. To marry

those production results with a substantially reduced cost

structure paves the way for strong cashflow from our PDP wells, and

a very economic development for our 200+ primary locations.”

The latest two wells are furthest East in the

program – after the first three full calendar months online, the

Fortress well’s cumulative production is over 106,000 BOE, while

the Parnassus well has produced over 125,000 BOE. “Since

coming online, the performance of these wells continue to prove

that the wells in Monument Draw buck the industry perception of the

Eastern side of the Delaware Basin. Because our acreage is

wholly-contiguous and in a few production reporting blocks, public

data aggregated by industry platforms does not accurately represent

our stellar well performance. We and our neighboring operators

continue to put top tier wells online in the Wolfcamp, Bone Spring

and deeper Woodford/Barnett benches,” continued Mr. Rohling, “We

are looking forward to a continuation of development across our

40,000+ net acres in Monument Draw, West Quito Draw and Hackberry

Draw.”

The Company has also substantially completed its

corporate initiative of reducing overhead costs. In April, the

Company executed a 44% reduction of its corporate office workforce.

The Company has also completed a thorough review of all non-staff

general and administrative (“G&A”) expenses and is executing

reductions where appropriate. The combination of these efforts will

reduce overall cash G&A run rate by up to 40% as compared to

2022 actuals.

Matt Steele, Chief Executive Officer, commented,

“Since I arrived at Battalion, the Company has been keenly focused

on operational excellence and reduction of our cost structure. When

the AGI facility is fully online, we will greatly reduce our

operating costs. The corporate cost reductions are immediately

accretive. In short, the actions we have taken continue to position

the Company for success. As we move forward, we are continuing to

prioritize free cash flow generation and the strengthening of our

balance sheet along with meeting our CDC drilling obligations in

our Monument Draw area. I am very proud of our talented team and

thank our Board of Directors for their guidance and support.”

Results of Operations

Average daily net production and total operating

revenue during the first quarter of 2023 were 16,200 Boe/d (50%

oil) and $65.1 million, respectively, as compared to production and

revenue of 14,767 Boe/d (50% oil) and $81.6 million, respectively,

during the first quarter of 2022. The decrease in revenues in the

first quarter of 2023 as compared to the first quarter of 2022 is

primarily attributable to an approximate $17.18 decrease in average

realized prices (excluding the impact of hedges), partially offset

by an increase in average production volumes over the periods.

Excluding the impact of hedges, Battalion realized 95% of the

average NYMEX oil price during the first quarter of 2023. Realized

hedge losses totaled approximately $1.5 million during the first

quarter 2023.

Lease operating and workover expense was $8.94

per Boe in the first quarter of 2023 versus $9.32 per Boe in the

first quarter of 2022. The decrease in lease operating and workover

expense per Boe year-over-year is primarily attributable to an

increase in average daily production as a large portion of our

lease operating expenses are fixed costs. Gathering and other

expense was $11.33 per Boe in the first quarter of 2023 versus

$11.48 per Boe in the first quarter of 2022. The decrease was due

primarily to streamlining the Valkyrie facility and increasing

throughput to our lower cost gas takeaway option. General and

administrative expense was $3.53 per Boe in the first quarter of

2023 and $3.75 per Boe in the first quarter of 2022. After

adjusting for selected items, Adjusted G&A was $3.24 per Boe in

the first quarter of 2023 compared to $3.30 per Boe in the first

quarter of 2022.

The Company reported net income for the first

quarter of 2023 of $22.8 million and a net income per diluted share

available to common stockholders of $1.28. After adjusting for

selected items, the Company reported an adjusted net loss available

to common stockholders for the first quarter of 2023 of $0.7

million, or an adjusted net loss of $0.04 per diluted common share

(see Reconciliation for additional information). Adjusted EBITDA

during the quarter ended March 31, 2023 was $26.1 million as

compared to $11.8 million during the quarter ended March 31, 2022

(see Adjusted EBITDA Reconciliation table for additional

information).

Liquidity and Balance Sheet

As of March 31, 2023, the Company had $230.3

million of indebtedness outstanding and approximately $1.4 million

of letters of credit outstanding. Total liquidity on March 31,

2023, made up of cash and cash equivalents, was $23.2 million.

In March 2023, the Company issued 25,000 shares

of redeemable convertible preferred stock to certain of its

existing equity shareholders and received approximately $24.4

million in net proceeds to improve liquidity and address concerns

around covenant compliance. For further discussion on our liquidity

and balance sheet, refer to Management’s Discussion and Analysis

and Risk Factors in the Company’s Form 10-K.

Forward Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Statements that are not strictly historical statements

constitute forward-looking statements. Forward-looking statements

include, among others, statements about anticipated production,

liquidity, capital spending, drilling and completion plans, and

forward guidance. Forward-looking statements may often, but not

always, be identified by the use of such words such as "expects",

"believes", "intends", "anticipates", "plans", "estimates",

“projects,” "potential", "possible", or "probable" or statements

that certain actions, events or results "may", "will", "should", or

"could" be taken, occur or be achieved. Forward-looking statements

are based on current beliefs and expectations and involve certain

assumptions or estimates that involve various risks and

uncertainties that could cause actual results to differ materially

from those reflected in the statements. These risks include, but

are not limited to, those set forth in the Company's Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, and other

filings submitted by the Company to the U.S. Securities and

Exchange Commission (“SEC”), copies of which may be obtained from

the SEC's website at www.sec.gov or through the Company's website

at www.battalionoil.com. Readers should not place undue reliance on

any such forward-looking statements, which are made only as of the

date hereof. The Company has no duty, and assumes no obligation, to

update forward-looking statements as a result of new information,

future events or changes in the Company's expectations.

About Battalion

Battalion Oil Corporation is an independent

energy company engaged in the acquisition, production, exploration

and development of onshore oil and natural gas properties in the

United States.

Contact

Kristen McWattersExecutive Vice President, Chief Financial

Officer & Treasurer713-210-7517

|

|

|

BATTALION OIL CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except per share amounts) |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

| Operating

revenues: |

|

|

|

|

|

|

|

Oil, natural gas and natural gas liquids sales: |

|

|

|

|

|

|

|

Oil |

|

$ |

54,215 |

|

|

$ |

62,524 |

|

|

Natural gas |

|

|

2,900 |

|

|

|

8,881 |

|

|

Natural gas liquids |

|

|

7,158 |

|

|

|

10,003 |

|

|

Total oil, natural gas and natural gas liquids sales |

|

|

64,273 |

|

|

|

81,408 |

|

|

Other |

|

|

869 |

|

|

|

194 |

|

|

Total operating revenues |

|

|

65,142 |

|

|

|

81,602 |

|

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

Lease operating |

|

|

11,691 |

|

|

|

11,524 |

|

|

Workover and other |

|

|

1,335 |

|

|

|

865 |

|

|

Taxes other than income |

|

|

3,190 |

|

|

|

4,951 |

|

|

Gathering and other |

|

|

16,517 |

|

|

|

15,255 |

|

|

General and administrative |

|

|

5,137 |

|

|

|

4,985 |

|

|

Depletion, depreciation and accretion |

|

|

16,148 |

|

|

|

10,220 |

|

|

Total operating expenses |

|

|

54,018 |

|

|

|

47,800 |

|

| Income (loss) from

operations |

|

|

11,124 |

|

|

|

33,802 |

|

|

|

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

|

Net gain (loss) on derivative contracts |

|

|

19,473 |

|

|

|

(123,858 |

) |

|

Interest expense and other |

|

|

(7,786 |

) |

|

|

(2,688 |

) |

|

Total other income (expenses) |

|

|

11,687 |

|

|

|

(126,546 |

) |

|

Income (loss) before income taxes |

|

|

22,811 |

|

|

|

(92,744 |

) |

|

Income tax benefit (provision) |

|

|

— |

|

|

|

— |

|

| Net income

(loss) |

|

$ |

22,811 |

|

|

$ |

(92,744 |

) |

|

|

|

|

|

|

|

|

| Net income (loss) per

share of common stock: |

|

|

|

|

|

|

|

Basic |

|

$ |

1.29 |

|

|

$ |

(5.69 |

) |

|

Diluted |

|

$ |

1.28 |

|

|

$ |

(5.69 |

) |

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

16,393 |

|

|

|

16,303 |

|

|

Diluted |

|

|

16,535 |

|

|

|

16,303 |

|

|

|

|

BATTALION OIL CORPORATION CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) (In

thousands, except share and per share amounts) |

|

|

| |

|

March 31, 2023 |

|

December 31, 2022 |

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,245 |

|

|

$ |

32,726 |

|

|

Accounts receivable, net |

|

|

32,456 |

|

|

|

37,974 |

|

|

Assets from derivative contracts |

|

|

15,103 |

|

|

|

16,244 |

|

|

Restricted cash |

|

|

90 |

|

|

|

90 |

|

|

Prepaids and other |

|

|

1,028 |

|

|

|

1,131 |

|

|

Total current assets |

|

|

71,922 |

|

|

|

88,165 |

|

| Oil and natural gas

properties (full cost method): |

|

|

|

|

|

|

|

Evaluated |

|

|

723,957 |

|

|

|

713,585 |

|

|

Unevaluated |

|

|

62,651 |

|

|

|

62,621 |

|

|

Gross oil and natural gas properties |

|

|

786,608 |

|

|

|

776,206 |

|

|

Less - accumulated depletion |

|

|

(406,603 |

) |

|

|

(390,796 |

) |

|

Net oil and natural gas properties |

|

|

380,005 |

|

|

|

385,410 |

|

| Other operating

property and equipment: |

|

|

|

|

|

|

|

Other operating property and equipment |

|

|

4,659 |

|

|

|

4,434 |

|

|

Less - accumulated depreciation |

|

|

(1,319 |

) |

|

|

(1,209 |

) |

|

Net other operating property and equipment |

|

|

3,340 |

|

|

|

3,225 |

|

| Other noncurrent

assets: |

|

|

|

|

|

|

|

Assets from derivative contracts |

|

|

5,434 |

|

|

|

5,379 |

|

|

Operating lease right of use assets |

|

|

258 |

|

|

|

352 |

|

|

Other assets |

|

|

3,023 |

|

|

|

2,827 |

|

| Total

assets |

|

$ |

463,982 |

|

|

$ |

485,358 |

|

| |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

58,643 |

|

|

$ |

100,095 |

|

|

Liabilities from derivative contracts |

|

|

18,008 |

|

|

|

29,286 |

|

|

Current portion of long-term debt |

|

|

40,106 |

|

|

|

35,067 |

|

|

Operating lease liabilities |

|

|

258 |

|

|

|

352 |

|

|

Asset retirement obligations |

|

|

225 |

|

|

|

225 |

|

|

Total current liabilities |

|

|

117,240 |

|

|

|

165,025 |

|

| Long-term debt,

net |

|

|

174,536 |

|

|

|

182,676 |

|

| Other noncurrent

liabilities: |

|

|

|

|

|

|

|

Liabilities from derivative contracts |

|

|

22,838 |

|

|

|

33,649 |

|

|

Asset retirement obligations |

|

|

15,441 |

|

|

|

15,244 |

|

|

Operating lease liabilities |

|

|

— |

|

|

|

— |

|

|

Deferred income taxes |

|

|

— |

|

|

|

— |

|

|

Other |

|

|

3,074 |

|

|

|

4,136 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Temporary

equity: |

|

|

|

|

|

|

| Series A redeemable

convertible preferred stock: 25,000 shares of $.0001 |

|

|

25,033 |

|

|

|

— |

|

|

par value authorized, issued and outstanding as of March 31,

2023 |

|

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

|

| Common stock: 100,000,000

shares of $0.0001 par value authorized; |

|

|

|

|

|

|

|

16,456,563 and 16,344,815 shares issued and outstanding as of |

|

|

|

|

|

|

|

March 31, 2023 and December 31, 2022, respectively |

|

|

2 |

|

|

|

2 |

|

| Additional paid-in

capital |

|

|

332,952 |

|

|

|

334,571 |

|

| Retained earnings (accumulated

deficit) |

|

|

(227,134 |

) |

|

|

(249,945 |

) |

|

Total stockholders' equity |

|

|

105,820 |

|

|

|

84,628 |

|

| Total liabilities,

temporary equity and stockholders' equity |

|

$ |

463,982 |

|

|

$ |

485,358 |

|

|

|

|

BATTALION OIL CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In thousands) |

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2023 |

|

|

2022 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

22,811 |

|

|

$ |

(92,744 |

) |

| Adjustments to reconcile net

income (loss) to net cash |

|

|

|

|

|

|

| provided by (used in)

operating activities: |

|

|

|

|

|

|

| Depletion, depreciation and

accretion |

|

|

16,148 |

|

|

|

10,220 |

|

| Stock-based compensation,

net |

|

|

227 |

|

|

|

384 |

|

| Unrealized loss (gain) on

derivative contracts |

|

|

(21,004 |

) |

|

|

91,038 |

|

| Amortization/accretion of

financing related costs |

|

|

1,798 |

|

|

|

899 |

|

| Reorganization items |

|

|

— |

|

|

|

(744 |

) |

| Accrued settlements on

derivative contracts |

|

|

(555 |

) |

|

|

12,809 |

|

| Change in fair value of

embedded derivative liability |

|

|

(1,062 |

) |

|

|

(2,032 |

) |

| Other income (expense) |

|

|

11 |

|

|

|

— |

|

| Cash flows from operations

before changes in working capital |

|

|

18,374 |

|

|

|

19,830 |

|

| Changes in working

capital |

|

|

(19,063 |

) |

|

|

(7,783 |

) |

| Net cash provided by (used in)

operating activities |

|

|

(689 |

) |

|

|

12,047 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

| Oil and natural gas capital

expenditures |

|

|

(28,611 |

) |

|

|

(15,684 |

) |

| Proceeds received from sale of

oil and natural gas assets |

|

|

1,189 |

|

|

|

— |

|

| Other operating property and

equipment capital expenditures |

|

|

(269 |

) |

|

|

— |

|

| Other |

|

|

(5 |

) |

|

|

(160 |

) |

| Net cash provided by (used in)

investing activities |

|

|

(27,696 |

) |

|

|

(15,844 |

) |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Repayments of borrowings |

|

|

(5,017 |

) |

|

|

(85 |

) |

| Payment of deferred debt

financing costs |

|

|

— |

|

|

|

(379 |

) |

| Proceeds from issuance of

preferred stock |

|

|

24,375 |

|

|

|

— |

|

| Other |

|

|

(454 |

) |

|

|

(461 |

) |

| Net cash provided by (used in)

financing activities |

|

|

18,904 |

|

|

|

(925 |

) |

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash, cash equivalents and restricted

cash |

|

|

(9,481 |

) |

|

|

(4,722 |

) |

|

|

|

|

|

|

|

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

32,816 |

|

|

|

48,359 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

23,335 |

|

|

$ |

43,637 |

|

|

|

|

BATTALION OIL CORPORATION SELECTED

OPERATING DATA (Unaudited) |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

|

Production volumes: |

|

|

|

|

|

|

|

Crude oil (MBbls) |

|

|

730 |

|

|

|

670 |

|

|

Natural gas (MMcf) |

|

|

2,407 |

|

|

|

2,315 |

|

|

Natural gas liquids (MBbls) |

|

|

327 |

|

|

|

273 |

|

|

Total (MBoe) |

|

|

1,458 |

|

|

|

1,329 |

|

|

Average daily production (Boe/d) |

|

|

16,200 |

|

|

|

14,767 |

|

| |

|

|

|

|

|

|

|

Average prices: |

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

74.27 |

|

|

$ |

93.32 |

|

|

Natural gas (per Mcf) |

|

|

1.20 |

|

|

|

3.84 |

|

|

Natural gas liquids (per Bbl) |

|

|

21.89 |

|

|

|

36.64 |

|

|

Total per Boe |

|

|

44.08 |

|

|

|

61.26 |

|

| |

|

|

|

|

|

|

|

Cash effect of derivative contracts: |

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

(5.01 |

) |

|

$ |

(46.64 |

) |

|

Natural gas (per Mcf) |

|

|

0.88 |

|

|

|

(0.68 |

) |

|

Natural gas liquids (per Bbl) |

|

|

— |

|

|

|

— |

|

|

Total per Boe |

|

|

(1.05 |

) |

|

|

(24.70 |

) |

| |

|

|

|

|

|

|

|

Average prices computed after cash effect of settlement of

derivative contracts: |

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

69.26 |

|

|

$ |

46.68 |

|

|

Natural gas (per Mcf) |

|

|

2.08 |

|

|

|

3.16 |

|

|

Natural gas liquids (per Bbl) |

|

|

21.89 |

|

|

|

36.64 |

|

|

Total per Boe |

|

|

43.03 |

|

|

|

36.56 |

|

| |

|

|

|

|

|

|

|

Average cost per Boe: |

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

Lease operating |

|

$ |

8.02 |

|

|

$ |

8.67 |

|

|

Workover and other |

|

|

0.92 |

|

|

|

0.65 |

|

|

Taxes other than income |

|

|

2.19 |

|

|

|

3.73 |

|

|

Gathering and other |

|

|

11.33 |

|

|

|

11.48 |

|

|

General and administrative, as adjusted (1) |

|

|

3.24 |

|

|

|

3.30 |

|

|

Depletion |

|

|

10.84 |

|

|

|

7.57 |

|

| |

|

|

|

|

|

|

| (1) Represents

general and administrative costs per Boe, adjusted for items noted

in the reconciliation below: |

| |

|

|

|

|

|

|

| General and

administrative: |

|

|

|

|

|

|

|

General and administrative, as reported |

|

$ |

3.53 |

|

|

$ |

3.75 |

|

|

Stock-based compensation: |

|

|

|

|

|

|

|

Non-cash |

|

|

(0.16 |

) |

|

|

(0.29 |

) |

|

Non-recurring charges and other: |

|

|

|

|

|

|

|

Cash |

|

|

(0.13 |

) |

|

|

(0.16 |

) |

|

General and administrative, as adjusted(2) |

|

$ |

3.24 |

|

|

$ |

3.30 |

|

| |

|

|

|

|

|

|

| Total operating costs, as

reported |

|

$ |

25.99 |

|

|

$ |

28.28 |

|

|

Total adjusting items |

|

|

(0.29 |

) |

|

|

(0.45 |

) |

| Total operating costs, as

adjusted(3) |

|

$ |

25.70 |

|

|

$ |

27.83 |

|

| ____________________ |

|

(2) |

General and administrative, as adjusted, is a non-GAAP measure that

excludes non-cash stock-based compensation charges relating to

equity awards under our incentive stock plan, as well as other cash

charges associated with non-recurring charges and other. The

Company believes that it is useful to understand the effects that

these charges have on general and administrative expenses and total

operating costs and that exclusion of such charges is useful for

comparison to prior periods. |

|

(3) |

Represents lease operating expense, workover and other expense,

taxes other than income, gathering and other expense and general

and administrative costs per Boe, adjusted for items noted in the

reconciliation above. |

|

|

|

BATTALION OIL CORPORATION RECONCILIATION

(Unaudited) (In thousands, except per share

amounts) |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

| As

Reported: |

|

|

|

|

|

|

|

Net income (loss) available to common stockholders – diluted

(1) |

|

$ |

21,200 |

|

|

$ |

(92,744 |

) |

| |

|

|

|

|

|

|

| Impact of Selected

Items: |

|

|

|

|

|

|

| Unrealized loss (gain) on

derivatives contracts: |

|

|

|

|

|

|

|

Crude oil |

|

$ |

(19,690 |

) |

|

$ |

82,901 |

|

|

Natural gas |

|

|

(1,314 |

) |

|

|

8,137 |

|

| Total mark-to-market non-cash

charge |

|

|

(21,004 |

) |

|

|

91,038 |

|

| Change in fair value of

embedded derivative liability |

|

|

(1,062 |

) |

|

|

(2,032 |

) |

| Non-recurring charges |

|

|

183 |

|

|

|

217 |

|

| Selected items, before income

taxes |

|

|

(21,883 |

) |

|

|

89,223 |

|

| Income tax effect of selected

items |

|

|

— |

|

|

|

— |

|

| Selected items, net of

tax |

|

|

(21,883 |

) |

|

|

89,223 |

|

| |

|

|

|

|

|

|

| Net income (loss) available to

common stockholders, as adjusted (2) |

|

$ |

(683 |

) |

|

$ |

(3,521 |

) |

| |

|

|

|

|

|

|

| Diluted net income (loss) per

common share, as reported |

|

$ |

1.28 |

|

|

$ |

(5.69 |

) |

| Impact of selected items |

|

|

(1.32 |

) |

|

|

5.47 |

|

| Diluted net income (loss) per

common share, excluding selected items (2)(3) |

|

$ |

(0.04 |

) |

|

$ |

(0.22 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Net cash provided by (used in)

operating activities |

|

$ |

(689 |

) |

|

$ |

12,047 |

|

| Changes in working

capital |

|

|

19,063 |

|

|

|

7,783 |

|

| Cash flows from operations

before changes in working capital |

|

|

18,374 |

|

|

|

19,830 |

|

| Cash components of selected

items |

|

|

738 |

|

|

|

(11,848 |

) |

| Income tax effect of selected

items |

|

|

— |

|

|

|

— |

|

| Cash flows from operations

before changes in working capital, adjusted for selected items

(1) |

|

$ |

19,112 |

|

|

$ |

7,982 |

|

| ____________________ |

|

(1) |

Amount reflects net income (loss) available to common stockholders

on a diluted basis for earnings per share purposes as calculated

using the two-class method of computing earnings per share which is

further described in Note 12, Earnings Per Share in our Form 10-Q

for the quarter ended March 31, 2023. |

|

(2) |

Net income (loss) earnings per share excluding selected items and

cash flows from operations before changes in working capital

adjusted for selected items are non-GAAP measures presented based

on management's belief that they will enable a user of the

financial information to understand the impact of these items on

reported results. These financial measures are not measures of

financial performance under GAAP and should not be considered as an

alternative to net income, earnings per share and cash flows from

operations, as defined by GAAP. These financial measures may not be

comparable to similarly named non-GAAP financial measures that

other companies may use and may not be useful in comparing the

performance of those companies to Battalion's performance. |

|

(3) |

The impact of selected items for the three months ended March 31,

2023 and 2022 were calculated based upon weighted average diluted

shares of 16.4 million and 16.3 million shares, respectively, due

to the net income (loss) available to common stockholders,

excluding selected items. |

|

|

|

BATTALION OIL CORPORATION ADJUSTED EBITDA

RECONCILIATION (Unaudited) (In

thousands) |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

Net income (loss), as reported |

|

$ |

22,811 |

|

|

$ |

(92,744 |

) |

| Impact of adjusting

items: |

|

|

|

|

|

|

|

Interest expense |

|

|

9,009 |

|

|

|

4,721 |

|

|

Depletion, depreciation and accretion |

|

|

16,148 |

|

|

|

10,220 |

|

|

Stock-based compensation |

|

|

227 |

|

|

|

384 |

|

|

Interest income |

|

|

(191 |

) |

|

|

- |

|

|

Unrealized loss (gain) on derivatives contracts |

|

|

(21,004 |

) |

|

|

91,038 |

|

|

Change in fair value of embedded derivative liability |

|

|

(1,062 |

) |

|

|

(2,032 |

) |

|

Non-recurring charges and other |

|

|

152 |

|

|

|

217 |

|

| Adjusted EBITDA(1) |

|

$ |

26,090 |

|

|

$ |

11,804 |

|

| ____________________ |

|

(1) |

Adjusted EBITDA is a non-GAAP measure, which is presented based on

management's belief that it will enable a user of the financial

information to understand the impact of these items on reported

results. This financial measure is not a measure of financial

performance under GAAP and should not be considered as an

alternative to GAAP measures, including net income (loss). This

financial measure may not be comparable to similarly named non-GAAP

financial measures that other companies may use and may not be

useful in comparing the performance of those companies to

Battalion's performance. |

|

|

|

|

BATTALION OIL CORPORATION ADJUSTED EBITDA

RECONCILIATION (Unaudited) (In

thousands) |

|

|

|

|

| |

|

Three MonthsEndedMarch

31, 2023 |

|

Three MonthsEndedDecember

31, 2022 |

|

Three

MonthsEndedSeptember 30,

2022 |

|

Three MonthsEndedJune 30,

2022 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

|

$ |

22,811 |

|

|

$ |

(7,652 |

) |

|

|

105,888 |

|

|

|

13,047 |

|

|

| Impact of adjusting

items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

9,009 |

|

|

|

9,378 |

|

|

|

6,232 |

|

|

|

5,394 |

|

|

|

Depletion, depreciation and accretion |

|

|

16,148 |

|

|

|

15,479 |

|

|

|

13,615 |

|

|

|

12,601 |

|

|

|

Stock-based compensation |

|

|

227 |

|

|

|

670 |

|

|

|

683 |

|

|

|

473 |

|

|

|

Interest income |

|

|

(191 |

) |

|

|

(227 |

) |

|

|

(141 |

) |

|

|

(1 |

) |

|

|

Unrealized loss (gain) on derivatives contracts |

|

|

(21,004 |

) |

|

|

3,655 |

|

|

|

(102,112 |

) |

|

|

(12,837 |

) |

|

|

Change in fair value of embedded derivative liability |

|

|

(1,062 |

) |

|

|

1,224 |

|

|

|

(449 |

) |

|

|

(562 |

) |

|

|

Non-recurring charges (credits) and other |

|

|

152 |

|

|

|

194 |

|

|

|

597 |

|

|

|

53 |

|

|

| Adjusted EBITDA(1) |

|

$ |

26,090 |

|

|

$ |

22,721 |

|

|

$ |

24,313 |

|

|

$ |

18,168 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted LTM EBITDA(1) |

|

$ |

91,292 |

|

|

|

|

|

|

|

|

|

|

|

| ____________________ |

|

(1) |

Adjusted EBITDA is a non-GAAP measure, which is presented based on

management's belief that it will enable a user of the financial

information to understand the impact of these items on reported

results. This financial measure is not a measure of financial

performance under GAAP and should not be considered as an

alternative to GAAP measures, including net income (loss). This

financial measure may not be comparable to similarly named non-GAAP

financial measures that other companies may use and may not be

useful in comparing the performance of those companies to

Battalion's performance. |

|

|

|

|

BATTALION OIL CORPORATION ADJUSTED EBITDA

RECONCILIATION (Unaudited) (In

thousands) |

|

|

|

|

| |

|

Three MonthsEndedMarch

31, 2022 |

|

Three MonthsEndedDecember

31, 2021 |

|

Three

MonthsEndedSeptember 30,

2021 |

|

Three MonthsEndedJune 30,

2021 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

|

$ |

(92,744 |

) |

|

|

25,935 |

|

|

|

13,052 |

|

|

|

(33,929 |

) |

|

| Impact of adjusting

items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

4,721 |

|

|

|

3,215 |

|

|

|

1,904 |

|

|

|

1,838 |

|

|

|

Depletion, depreciation and accretion |

|

|

10,220 |

|

|

|

12,679 |

|

|

|

10,885 |

|

|

|

11,249 |

|

|

|

Stock-based compensation |

|

|

384 |

|

|

|

450 |

|

|

|

481 |

|

|

|

485 |

|

|

|

Interest income |

|

|

— |

|

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(84 |

) |

|

|

Loss (gain) on extinguishment of debt |

|

|

— |

|

|

|

122 |

|

|

|

(2,068 |

) |

|

|

— |

|

|

|

Unrealized loss (gain) on derivatives contracts |

|

|

91,038 |

|

|

|

(21,332 |

) |

|

|

(1,816 |

) |

|

|

34,817 |

|

|

|

Change in fair value of embedded derivative liability |

|

|

(2,032 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Non-recurring charges (credits) and other |

|

|

217 |

|

|

|

(718 |

) |

|

|

559 |

|

|

|

(275 |

) |

|

| Adjusted EBITDA(1) |

|

$ |

11,804 |

|

|

$ |

20,350 |

|

|

$ |

22,994 |

|

|

$ |

14,101 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted LTM EBITDA(1) |

|

$ |

69,249 |

|

|

|

|

|

|

|

|

|

|

|

| ____________________ |

|

(1) |

Adjusted EBITDA is a non-GAAP measure, which is presented based on

management's belief that it will enable a user of the financial

information to understand the impact of these items on reported

results. This financial measure is not a measure of financial

performance under GAAP and should not be considered as an

alternative to GAAP measures, including net income (loss). This

financial measure may not be comparable to similarly named non-GAAP

financial measures that other companies may use and may not be

useful in comparing the performance of those companies to

Battalion's performance. |

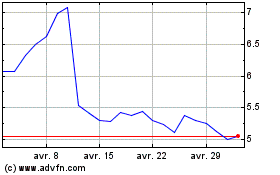

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024