Barnwell Industries, Inc. (NYSE American: BRN) today reported net

earnings of $1,089,000, $0.11 per share, for the three months ended

December 31, 2022, as compared to net earnings of $1,073,000, $0.11

per share, for the three months ended December 31, 2021.

Mr. Alexander C. Kinzler, Chief Executive

Officer of Barnwell, commented, “We are pleased to report that our

first quarter oil and gas segment revenues increased by over

$1,300,000 (33%) as prices increased for all products with oil,

natural gas, and natural gas liquids increasing 6%, 4%, and 42%,

respectively. Net oil production increased to 48,000 Bbls (barrels)

from 39,000 Bbls (23%) and net natural gas production increased to

300,000 Mcf (1,000 cubic feet) from 205,000 Mcf (46%), in the

current quarter as compared to last year’s quarter, as we continue

to refresh our oil and gas production through new drilling

programs.

“The increases in production were primarily due

to additional working interests acquired and wells drilled in the

Twining area in fiscal 2022 and were partially offset by a decrease

in production from wells in Oklahoma. Barnwell’s oil and natural

gas capital expenditures, including accrued capital expenditures

and excluding additions and revisions to estimated asset retirement

obligations (“Net Capital Expenditures”), totaled $5,928,000 for

the three months ended December 31, 2022, as compared to $2,870,000

for the same period in the prior year. In the three months ended

December 31, 2022, Canadian capital expenditures were primarily for

the completion and equipping of wells and facilities at Twining and

totaled $574,000. During fiscal 2022, Barnwell invested $11,052,000

in Net Capital Expenditures for oil and natural gas

properties.”

In the Twining area, Barnwell’s technical team

has identified 16 high quality, high working interests drilling

locations on our controlled and operated lands. Success with these

wells could translate to numerous additional follow-up locations on

the same lands. Additionally, we have identified approximately 10

additional drilling sites in North Twining Unit where we hold a 29%

interest, four of which are forecasted to be drilled in the next 9

months.

Our Oklahoma operations generated $517,000 (10%)

of our oil and natural gas segment revenues for the three months

ended December 31, 2022 and our oil and natural gas segment

generated $1,986,000 of operating profit before general and

administrative expenses in the three months ended December 31,

2022, an increase in operating results of $418,000 as compared to a

$1,568,000 operating profit during the same period of the prior

year.

Our contract drilling segment sold one drilling

rig and recognized a gain on the sale of $551,000 and operating

results increased $200,000 in the current period as compared to the

prior year period. Our land investment segment saw the Kukio Resort

Development Partnerships in which we own 19.6% sell one lot within

Increment I, resulting in the Company receiving $265,000 in

percentage of sales payments and $478,000 in net cash distributions

in the current period as compared to $600,000 in percentage of

sales payments and $1,075,000 in net cash distributions in the

prior year period.

General and administrative expenses increased

$419,000 primarily due to increases in one-time, non-recurring

professional fees in the current year period as compared to the

same period in the prior year. The Company also incurred a $78,000

foreign currency gain in the current year period due to the effects

of foreign exchange rate changes on intercompany advances as a

result of the weakening of the U.S. dollar against the Canadian

dollar in January.

In January 2023, the Company entered into a

cooperation and support agreement (the “Agreement”) among Mr.

Kinzler, in his capacity as a major shareholder, MRMP-Managers LLC,

the Ned L. Sherwood Revocable Trust, NLS Advisory Group, Inc. and

Ned L. Sherwood (collectively, the “MRMP Stockholders”), which we

believe will be beneficial to the Company and all of our

shareholders. The Agreement extends for two years the

standstill terms of the previous agreement entered into with the

MRMP Stockholders in 2021, ending the potential of a proxy contest

at the 2023 annual meeting of stockholders. The expenses

related to this agreement will be reflected in our results for our

second quarter ending March 31, 2023.

In December 2022, the Company, entered into a

purchase and sale agreement with an independent third party to

acquire a 22.3% non-operated working interest in oil and natural

gas leasehold acreage in the Permian Basin in Texas for cash

consideration of $806,000. In connection with the purchase of such

leasehold interests, Barnwell acquired a 15.4% non-operated working

interest in the planned drilling of two oil wells in the Wolfcamp

Formation in Loving and Ward Counties, Texas and made a prepayment

of $4,293,000 to pay its share of the estimated costs to drill,

complete and equip the wells. In January 2023, the Company executed

agreements to participate in the drilling of two more wells, at a

29% working interest, in our core property, the Twining area of

Alberta, Canada, for approximately $1,500,000.

Barnwell ended the quarter with $6,747,000 in

working capital, including $6,736,000 in cash and cash equivalents.

All 3 of our business segments produced operating profits for the

current quarter and the Board of Directors declared a cash dividend

of $0.015 per share payable on March 13, 2023 to the holders of

record as of the close of business on February 23, 2023.

Mr. Kinzler also stated that “we are pleased to

welcome Messrs. Joshua S. Horowitz and Laurance E. Narbut to our

board. They were appointed to the Board of Directors of the Company

on February 9, 2023. Also, on January 21, 2023, Mr. Kenneth S.

Grossman was appointed Chairman of the Compensation Committee and

Chairman of the Board of Directors and Mr. Douglas N. Woodrum was

appointed Chairman of the Audit Committee and Nominating Committee

of the Board of Directors. We look forward to the contributions of

our new board members and our current board members in their new

roles”.

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

|

COMPARATIVE RESULTS |

|

(Unaudited) |

|

|

Quarter ended December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

Revenues |

$ |

7,511,000 |

|

$ |

5,454,000 |

|

|

|

|

|

|

Net earnings attributable to Barnwell Industries, Inc. |

$ |

1,089,000 |

|

$ |

1,073,000 |

|

|

|

|

|

|

Net earnings per share – basic and diluted |

$ |

0.11 |

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares and equivalent shares

outstanding: |

|

|

|

|

Basic and diluted |

|

9,956,687 |

|

|

9,446,291 |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,736,000 |

|

$ |

12,142,000 |

| CONTACT: |

Alexander C.

Kinzler |

| |

Chief Executive Officer and President |

| |

|

| |

Russell M. Gifford |

| |

Executive Vice President and Chief Financial Officer |

| |

|

| |

Telephone (808) 531-8400 |

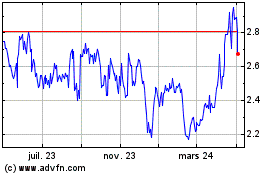

Barnwell Industries (AMEX:BRN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

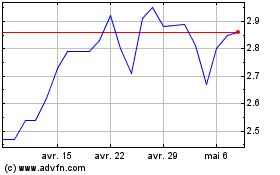

Barnwell Industries (AMEX:BRN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024