UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of November, 2022

Commission File Number: 001-35936

B2Gold

Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia

V6C 2X8

Canada

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| [ ] Form 20-F |

[X] Form 40-F |

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): [ ]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): [ ]

DOCUMENTS INCLUDED AS PART

OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B2Gold Corp. |

|

| |

|

|

|

| |

|

|

|

| Date: November 1,

2022 |

By: |

/s/ Randall Chatwin |

|

| |

Name: |

Randall Chatwin |

|

| |

Title: |

Senior Vice President, Legal and Corporate Communications |

|

EXHIBIT INDEX

Exhibit 99.1

News Release

B2Gold Reports Q3 2022 Results;

Full-Year 2022 Total Consolidated Gold Production

and Cost Guidance Remains Unchanged;

Year-to-Date Operating Costs and All-In Sustaining Costs In Line with Budget despite Lower than Expected Gold Production

Vancouver, November 1, 2022 - B2Gold Corp.

(TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or the “Company”) announces its operational and financial results

for the third quarter of 2022. The Company previously released its gold production and gold revenue results for the third quarter of 2022.

All dollar figures are in United States dollars unless otherwise indicated.

2022 Third Quarter and Year-to-Date Summary

| • | Total gold production of 227,016 ounces in Q3 2022, expected to increase significantly in Q4 2022:

Lower than expected production at the Fekola and Otjikoto mines in the third quarter of 2022 due to temporary mining sequence changes

(see “Operations” discussion). Strong production anticipated in the fourth quarter of 2022 at both operations. At Fekola,

ore production from Fekola open-pit Phase 6 has commenced and is forecast to average between 3.4 to 3.5 grams per tonne ("g/t")

gold. Over the full fourth quarter of 2022, gold grade mined is anticipated to average over 3.0 g/t gold at Fekola. At Otjikoto, gold

production is anticipated to benefit as mining has reached a higher-grade zone in the Otjikoto pit and with stope ore production from

the Wolfshag Underground mine. |

| • | Total consolidated cash operating costs of $824 per gold ounce sold in Q3 2022, expected to be significantly

lower in Q4 2022: Total consolidated cash operating costs (see “Non-IFRS Measures”) (including estimated attributable

results for Calibre Mining Corp. (“Calibre”), which accounts for approximately 5% of B2Gold’s total gold production

in 2022) of $824 per gold ounce sold and consolidated cash operating costs from the Company’s three operating mines of $810 per

gold ounce sold. Year-to-date total consolidated cash operating costs of $760 per gold ounce sold in line with expectations after a strong

first half of 2022. |

| • | Total consolidated all-in sustaining costs of $1,169 per gold ounce sold in Q3 2022, expected to be

significantly lower in Q4 2022: Total consolidated all-in sustaining costs (see “Non-IFRS Measures”) (including

estimated attributable results for Calibre) of $1,169 per gold ounce sold and consolidated all-in sustaining costs from the Company’s

three operating mines of $1,154 per gold ounce sold. Year-to-date total consolidated all-in sustaining costs of $1,108 per gold ounce

sold is slightly better than expected after a strong first half of 2022. Total consolidated all-in sustaining costs are anticipated to

benefit in Q4 2022 from higher grade ore being processed at Fekola and Otjikoto. |

| • | Maintain full-year 2022 total gold production and total consolidated cost guidance: Based on the

year-to-date cost performance and strong anticipated gold production in Q4 2022, the Company re-affirms full year 2022 total gold production

and total consolidated cost guidance. Total gold production is expected to be between 990,000 and 1,050,000 ounces (including 40,000 and

50,000 attributable ounces projected from Calibre). Total consolidated cash operating costs are expected to be at the upper end of the

Company’s original guidance range of between $620 and $660 per gold ounce and total consolidated all-in sustaining costs are expected

to within the Company's original guidance range of between $1,010 and $1,050 per gold ounce. |

| • | Attributable net loss of $(0.02) per share; adjusted attributable net income of $0.03 per share in

Q3 2022: Net loss attributable to the shareholders of the Company of $(23) million ($(0.02) per share); adjusted net income (see

“Non-IFRS Measures”) attributable to the shareholders of the Company of $32 million ($0.03 per share). |

| • | Operating cash flow before working capital adjustments of $0.13 per share in Q3 2022: Cash flow

provided by operating activities before working capital adjustments was $139 million ($0.13 per share) in the third quarter of 2022. |

| • | Robust financial position: At September 30, 2022, the Company had cash and cash equivalents

of $549 million and working capital (defined as current assets less assets classified as held for sale and current liabilities) of $725

million. |

| • | Q3 2022 dividend of $0.04 per share declared: The Company remains in a strong net positive cash

position and paid a third quarter dividend of $0.04 per common share (annualized rate of $0.16 per common share), representing a 5.0%

yield as of September 30, 2022. |

| • | Completed acquisition of Oklo Resources Limited (“Oklo”): The Company completed the

acquisition of Oklo on September 20, 2022, providing B2Gold with an additional landholding of 1,405 km2 covering highly prospective

greenstone belts in Mali, including Oklo’s flagship Dandoko project (550 km2), located approximately 25 kilometres from

each of the Fekola Mine and the Anaconda area. |

| • | Fekola Complex study underway to deliver low capital intensity production growth: Commencing a

feasibility level engineering study of stand-alone mill and oxide processing facilities at the Anaconda area. The study will be based

on processing at least 4 million tonnes per annum (“Mtpa”) of saprolite and transitional (oxide) resources, with an option

to add fresh rock (sulphide) capabilities in the future. Results of this study are expected in the second quarter of 2023. Conceptual

analysis indicates that the combined Fekola and Anaconda processing facilities could have the potential to produce more than 800,000 ounces

of gold per year commencing as early as 2026. |

| • | Continued investment in near-mine exploration in Mali: The Company is drilling to infill and extend

the saprolite resource area and to follow up on the sulphide mineralization at the Anaconda area, including the Mamba and Adder zones,

and several other targets below the saprolite mineralization. The good grade and width combinations at the Anaconda area continue to provide

a strong indication of the potential for Fekola-style south plunging bodies of sulphide mineralization, which remains open down plunge.

Seven drill rigs are currently drilling in the Anaconda area and one drill rig is currently operating on Bakolobi. On the Mamba zone,

drill results are particularly significant as they confirm the continuity of high grade sulphide mineralization 110 metres below the limit

of the updated Mineral Resource pit boundaries. In the main Anaconda area Mineral Resource pit, drill results demonstrate the potential

to add sulphide Mineral Resources beneath the currently defined saprolite resources, where the mineralization remains open at depth. |

| • | B2Gold and joint venture partner AngloGold Ashanti Limited (“AngloGold”) intend to initiate

a joint sales process for Gramalote: B2Gold and partner AngloGold have completed a comprehensive review of the alternatives relating

to the Gramalote project and consider that the interests of all stakeholders would be best served by finding a buyer for the project.

The partners intend to commence a joint sales process for the Gramalote project in the fourth quarter of 2022. |

Third Quarter and Year-to-Date 2022 Results

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2022 |

2021 |

2022 |

2021 |

| |

|

|

|

|

| Gold revenue ($ in thousands) |

392,554 |

510,859 |

1,140,122 |

1,236,151 |

| Net (loss) income ($ in thousands) |

(21,234) |

134,871 |

110,255 |

307,685 |

| (Loss) earnings per share - basic(1) ($/ share) |

(0.02) |

0.12 |

0.09 |

0.27 |

| (Loss) earnings per share - diluted(1) ($/ share) |

(0.02) |

0.12 |

0.09 |

0.27 |

| Cash provided by operating activities ($ thousands) |

93,118 |

320,283 |

325,307 |

457,821 |

| Average realized gold price ($/ ounce) |

1,711 |

1,782 |

1,810 |

1,794 |

| Adjusted net income(1)(2) ($ in thousands) |

31,996 |

122,750 |

142,340 |

272,646 |

| Adjusted earnings per share(1)(2) - basic ($) |

0.03 |

0.12 |

0.13 |

0.26 |

| Excluding equity investment in Calibre: |

|

|

|

|

| Gold sold (ounces) |

229,400 |

286,650 |

629,800 |

689,051 |

| Gold produced (ounces) |

214,903 |

295,723 |

620,234 |

698,746 |

| Cash operating costs(2) ($/ gold ounce sold) |

810 |

456 |

741 |

544 |

| Cash operating costs(2) ($/ gold ounce produced) |

798 |

418 |

749 |

532 |

| Total cash costs(2) ($/ gold ounce sold) |

926 |

572 |

862 |

666 |

| All-in sustaining costs(2) ($/ gold ounce sold) |

1,154 |

777 |

1,100 |

887 |

| Including equity investment in Calibre: |

|

|

|

|

| Gold sold (ounces) |

241,558 |

301,153 |

669,776 |

732,986 |

| Gold produced (ounces) |

227,016 |

310,261 |

660,004 |

742,517 |

| Cash operating costs(2) ($/ gold ounce sold) |

824 |

482 |

760 |

568 |

| Cash operating costs(2) ($/ gold ounce produced) |

815 |

445 |

767 |

556 |

| Total cash costs(2) ($/ gold ounce sold) |

939 |

596 |

878 |

687 |

| All-in sustaining costs(2) ($/ gold ounce sold) |

1,169 |

795 |

1,108 |

900 |

(1) Attributable to the shareholders of the

Company.

(2) Non-IFRS measure. For a description of how these measures are

calculated and a reconciliation of these measures to the most directly comparable measures specified, defined or determined under IFRS

and presented in the Company’s financial statements, refer to “Non-IFRS Measures”.

Operations

Fekola Mine - Mali

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2022 |

2021 |

2022 |

2021 |

| |

|

|

|

|

| Gold revenue ($ in thousands) |

230,023 |

288,306 |

652,361 |

712,302 |

| Gold sold (ounces) |

135,150 |

161,550 |

361,800 |

396,750 |

| Average realized gold price ($/ ounce) |

1,702 |

1,785 |

1,803 |

1,795 |

| Tonnes of ore milled |

2,285,423 |

2,361,042 |

6,906,172 |

6,730,332 |

| Grade (grams/ tonne) |

1.90 |

2.30 |

1.72 |

1.98 |

| Recovery (%) |

93.1 |

94.8 |

92.9 |

94.2 |

| Gold production (ounces) |

129,933 |

165,557 |

354,647 |

404,256 |

| Cash operating costs(1) ($/ gold ounce sold) |

694 |

424 |

667 |

494 |

| Cash operating costs(1) ($/ gold ounce produced) |

728 |

363 |

667 |

478 |

| Total cash costs(1) ($/ gold ounce sold) |

829 |

563 |

809 |

640 |

| All-in sustaining costs(1) ($/ gold ounce sold) |

978 |

716 |

971 |

772 |

| Capital expenditures ($ in thousands) |

20,353 |

27,961 |

68,779 |

54,078 |

| Exploration ($ in thousands) |

3,392 |

2,096 |

13,848 |

9,323 |

(1) Non-IFRS measure. For a description of

how these measures are calculated and a reconciliation of these measures to the most directly comparable measures specified, defined or

determined under IFRS and presented in the Company’s financial statements, refer to “Non-IFRS Measures”.

The Fekola Mine in Mali (owned 80% by the Company

and 20% by the State of Mali) produced 129,933 ounces in the third quarter of 2022, lower than expected due to a challenging rainy season

in West Mali which temporarily delayed access to higher grade ore from Fekola open-pit Phase 6. In early October 2022, mining commenced

from the higher grade Fekola open-pit Phase 6 as the region exited its rainy season (which typically runs from June to September). Ore

production from Fekola open-pit Phase 6 is forecast to average between 3.4 to 3.5 g/t gold. Over the full fourth quarter of 2022, gold

grade mined is anticipated to average over 3.0 g/t gold.

The Fekola Mine’s

cash operating costs (refer to “Non-IFRS Measures”) for the third quarter of 2022 were $728 per gold ounce produced

($694 per gold ounce sold). Operating costs were higher than expected in the third quarter of 2022 largely due to fuel and explosive prices

and increases in mining equipment maintenance costs.

All-in sustaining costs

(refer to “Non-IFRS Measures”) for the third quarter of 2022 for the Fekola Mine were $978 per gold ounce sold. All-in

sustaining costs for the third quarter of 2022 were higher than expected as a result of higher cash operating costs described above and

lower gold ounces sold partially offset by realized gains on the settlement of fuel derivatives.

Capital expenditures in the third quarter of

2022 totalled $20 million primarily consisting of $11 million for mobile equipment purchases and rebuilds, $6 million for tailings storage

facility expansion and equipment, $2 million for process plant and other site maintenance and $1 million for the development of the Cardinal

zone.

On July 3, 2022, ECOWAS removed the economic,

financial and diplomatic sanctions imposed on Mali in January 2022. The sanctions were removed by ECOWAS after the interim Malian Government

announced a two-year transition to presidential elections and promulgated a new electoral law. Mali’s borders with its neighbouring

countries are now open to normal commercial traffic and ordinary supply routes are available. Throughout the period of the sanctions,

the Fekola Mine continued to operate normally and meet its production targets while maintaining a good working relationship with the interim

Government.

Based on an expected strong fourth quarter of

2022 performance, as the region exits its rainy season and with higher grade production forecast from Fekola open-pit Phase 6, the Company

re-affirms the Fekola Mine’s annual production guidance range of between 570,000 to 600,000 ounces of gold. Cash operating costs

for the year are expected to be within Fekola's guidance range of between $510 and $550 per gold ounce produced and all-in sustaining

costs are also expected to be within Fekola's guidance range of between $840 and $880 per gold ounce.

Masbate Mine - The Philippines

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2022 |

2021 |

2022 |

2021 |

| |

|

|

|

|

| Gold revenue ($ in thousands) |

107,936 |

117,795 |

290,704 |

325,627 |

| Gold sold (ounces) |

62,600 |

66,300 |

160,150 |

181,641 |

| Average realized gold price ($/ ounce) |

1,724 |

1,777 |

1,815 |

1,793 |

| Tonnes of ore milled |

1,888,722 |

1,840,379 |

5,885,163 |

5,652,091 |

| Grade (grams/ tonne) |

1.10 |

1.24 |

1.12 |

1.17 |

| Recovery (%) |

74.7 |

81.6 |

77.1 |

82.5 |

| Gold production (ounces) |

49,902 |

61,207 |

164,041 |

175,598 |

| Cash operating costs(1) ($/ gold ounce sold) |

879 |

546 |

815 |

597 |

| Cash operating costs(1) ($/ gold ounce produced) |

867 |

609 |

801 |

611 |

| Total cash costs(1) ($/ gold ounce sold) |

977 |

643 |

922 |

698 |

| All-in sustaining costs(1) ($/ gold ounce sold) |

1,110 |

751 |

1,076 |

820 |

| Capital expenditures ($ in thousands) |

10,158 |

7,023 |

29,908 |

20,365 |

| Exploration ($ in thousands) |

696 |

1,446 |

3,111 |

3,871 |

(1) Non-IFRS measure. For a description of

how these measures are calculated and a reconciliation of these measures to the most directly comparable measures specified, defined or

determined under IFRS and presented in the Company’s financial statements, refer to “Non-IFRS Measures”.

The Masbate Mine in the Philippines produced

49,902 ounces in the third quarter of 2022. Gold production was 4% less than expected as the ratio of sulphide and transitional ore to

oxide ore was higher than forecasted in the third quarter of 2022, which contributed to the lower throughput and gold recovery and higher

gold mill feed grade.

The Masbate Mine's cash operating costs (refer

to “Non-IFRS Measures”) for the third quarter of 2022 were $867 per gold ounce produced ($879 per gold ounce sold).

Cash operating costs per ounce produced for the third quarter of 2022 were higher than expected as a result of slightly lower gold production

and higher mining and processing costs resulting from higher than expected diesel and heavy fuel oil cost.

All-in sustaining costs (refer to “Non-IFRS

Measures”) for the third quarter of 2022 were $1,110 per gold ounce sold. All-in sustaining costs for the third quarter of 2022

were in line with expectations as a result of offsetting factors. Slightly higher cash operating costs as described above and slightly

higher capital expenditures due to timing differences were offset by realized gains on the settlement of fuel derivatives and higher gold

ounces sold.

Capital expenditures in the third quarter of

2022 totalled $10 million, primarily consisting of $5 million for mobile equipment purchases and rebuilds, $2 million for an additional

powerhouse generator and $1 million for tailings storage facility construction.

For the full year 2022 the Masbate Mine is expected

to produce towards the lower end of increased guidance of between 215,000 and 225,000 ounces of gold (original guidance range was between

205,000 and 215,000 ounces of gold). For full-year 2022, with the increases being experienced in fuel prices, Masbate's cash operating

costs are now expected to be at the lower end of Masbate's previously revised 2022 guidance range of between $820 and $860 per gold ounce

(original guidance range was between $740 and $780 per gold ounce). The all-in sustaining cost guidance range remains unchanged and are

expected to be at the upper end of Masbate's guidance range of between $1,070 and $1,110 per gold ounce.

Otjikoto Mine - Namibia

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2022 |

2021 |

2022 |

2021 |

| |

|

|

|

|

| Gold revenue ($ in thousands) |

54,595 |

104,758 |

197,057 |

198,222 |

| Gold sold (ounces) |

31,650 |

58,800 |

107,850 |

110,660 |

| Average realized gold price ($/ ounce) |

1,725 |

1,782 |

1,827 |

1,791 |

| Tonnes of ore milled |

877,249 |

901,216 |

2,573,360 |

2,656,367 |

| Grade (grams/ tonne) |

1.27 |

2.41 |

1.25 |

1.42 |

| Recovery (%) |

98.0 |

98.7 |

98.3 |

98.3 |

| Gold production (ounces) |

35,068 |

68,959 |

101,546 |

118,892 |

| Cash operating costs(1) ($/ gold ounce sold) |

1,165 |

443 |

881 |

635 |

| Cash operating costs(1) ($/ gold ounce produced) |

958 |

382 |

948 |

597 |

| Total cash costs(1) ($/ gold ounce sold) |

1,234 |

515 |

954 |

707 |

| All-in sustaining costs(1) ($/ gold ounce sold) |

1,625 |

781 |

1,247 |

1,137 |

| Capital expenditures ($ in thousands) |

20,292 |

19,371 |

59,575 |

59,337 |

| Exploration ($ in thousands) |

896 |

1,257 |

2,275 |

2,846 |

(1) Non-IFRS measure. For a description of

how these measures are calculated and a reconciliation of these measures to the most directly comparable measures specified, defined or

determined under IFRS and presented in the Company’s financial statements, refer to “Non-IFRS Measures”.

The Otjikoto Mine in Namibia, in which the Company

holds a 90% interest, produced 35,068 ounces in the third quarter of 2022, lower than expected due to delays in bringing the Wolfshag

Underground mine into production. Project delays were due to issues achieving development rates in prior periods, which have been addressed

through the appointment of a new underground development contractor in April 2022. Development rates in the Wolfshag Underground mine

have improved and are in line with budget, with access to initial development ore achieved in the third quarter of 2022 and stope ore

production having commenced in the fourth quarter of 2022. Mined ore tonnage and grade continue to reconcile well with Otjikoto's resource

model, with production anticipated to significantly increase in the fourth quarter of 2022 when mining reaches a higher-grade zone in

the Otjikoto pit and with stope ore production from the Wolfshag Underground mine.

Cash operating costs (refer to “Non-IFRS

Measures”) for the third quarter of 2022 were $958 per gold ounce produced ($1,165 per gold ounce sold). Cash operating costs

per ounce produced for the third quarter of 2022 were higher than expected as a result of lower production due to delays in accessing

Wolfshag Underground production (which has commenced in the fourth quarter of 2022) and higher fuel costs partially offset by a weaker

than expected Namibian dollar.

All-in sustaining costs (refer to “Non-IFRS

Measures”) for the third quarter of 2022 were $1,625 per gold ounce sold. All-in sustaining costs for the third quarter of 2022

were higher than expected as a result of the higher cash operating costs described above and lower gold ounces sold, partially offset

by lower sustaining capital expenditures and realized gains on the settlement of fuel derivatives. The lower sustaining capital expenditures

are mainly a result of delays in underground development resulting in underground development costs being classified as non-sustaining

instead of sustaining as budgeted.

Capital expenditures for the third quarter of

2022 totalled $20 million, primarily consisting of $8 million for Wolfshag underground mine development, $7 million for prestripping in

the Otjikoto pit, $3 million for mobile equipment purchases and rebuilds and $1 million to complete the national power grid connection

line.

The Otjikoto Mine is expected to produce towards

the lower end of its previously revised guidance range of between 165,000 and 175,000 ounces of gold in 2022 (original guidance range

of 175,000 to 185,000 ounces). Overall and after factoring in the operating results for the first nine months of 2022, Otjikoto's costs

guidance ranges for full-year 2022 remain unchanged. For full-year 2022, cash operating costs are expected to be within the Company's

guidance range of between $740 and $780 per gold ounce and all-in sustaining costs are expected to be within its guidance range of between

$1,120 and $1,160 per gold ounce.

Fekola Complex Regional Development and Exploration

Development

Based on the updated Anaconda area Mineral Resource

estimate and B2Gold's preliminary planning, the Company has demonstrated that the Anaconda area (Bantako and Menankoto license areas)

could provide selective higher grade saprolite material (average grade of 2.2 g/t gold) to be trucked approximately 20 kilometers and

fed into the Fekola mill at a rate of up to 1.5 million tonnes per annum. Trucking of selective higher grade saprolite material to the

Fekola mill will increase the ore processed and annual gold production from the Fekola mill, with the potential to add an average of approximately

80,000 to 100,000 ounces of gold per year to the Fekola mill's annual production (Fekola Complex optimization Phase I).

In 2022, the Company budgeted $33 million for

the development of saprolite mining at the Anaconda area including road construction, mine infrastructure, and mining equipment. The construction

mobile equipment fleet is arriving, and the Company expects to break ground on roads and mining infrastructure construction in the fourth

quarter of 2022. Engineering and procurement of the mine workshop and mobile equipment is on schedule for saprolite production from the

Bantako license area as early as the second quarter of 2023 and from the Dandoko license area as early as the fourth quarter of 2023.

Production from Bantako and Dandoko is contingent upon receipt of all necessary permits as well as optimizing long-term project value

from the various oxide and sulphide material sources now available including Fekola Pit, Fekola Underground, Cardinal, Bantako, Menankoto,

Dandoko, and Bakolobi.

Preliminary results of a Fekola Complex optimization

study, coupled with 2022 exploration drilling results, indicate that there is a significant opportunity to increase gold production and

resource utilization with the addition of oxide processing capacity. The Company has therefore commenced a feasibility level engineering

study of stand-alone mill and oxide processing facilities at the Anaconda area (Fekola Complex optimization Phase II). The study will

be based on processing at least 4 Mtpa of saprolite and transitional (oxide) resources, with an option to add fresh rock (sulphide) capabilities

in the future. Results of this study are expected in the second quarter of 2023. Conceptual analysis indicates that the combined Fekola

and Anaconda processing facilities could have the potential to produce more than 800,000 ounces of gold per year commencing as early as

2026, subject to completion of final feasibility studies, and the receipt of all necessary regulatory approvals and permits. Further expansion

of the Mamba and Cobra sulphide zones (see September 15, 2022 press release) could sustain a production profile averaging over 800,000

ounces of gold per year over a 10-year period. Drilling is currently ongoing at the Mamba and Cobra sulphide zones.

Exploration

In 2022, B2Gold is conducting an approximately

161,000 m drill program on the Fekola Complex with a budget of approximately $35 million, including drill programs on the Fekola North

deposit to further test the underground mineralization potential, and on the Anaconda area, including the Mamba, Adder, Anaconda, Cascabel,

Viper, and Cobra zones.

At the Mamba Main Zone in the Anaconda area,

positive exploration drilling results were received, including hole BND_108 with 5.89 grams per tonne (“g/t”) gold over 28.70

meters (“m”) from 455.45 m, hole BND_101 with 3.76 g/t gold over 32.08 m from 299.00 m, and hole BND_104 with 3.33 g/t gold

over 14.30 m from 362.70 m, which collectively confirm and extend the continuity of the high grade sulphide mineralization of the sulphide

shoot to over 700 m down plunge, providing a strong indication of the potential for Fekola-style bodies of sulphide mineralization, which

remain open at depth.

At the Cobra Zone in the Anaconda area, strong

initial drilling results were received, including hole MSD_227 with 2.02 g/t gold over 25.30 m from 201.70 m, and 6.75 g/t gold over 13.80

m from 244.40 m, confirming the potential for economic grade and width combinations in the sulphide mineralization. The Company believes

that the Cobra Zone may extend onto the Bakolobi permit and are currently drilling this extension target.

Gramalote Project

The Gramalote Feasibility Study has been completed

for the Gramalote gold project in Colombia (the “Gramalote Project”), a joint venture between B2Gold and AngloGold, and both

partners have determined that the project does not meet their investment thresholds for development of the project. The Gramalote Project

continues to benefit from government support as well as continuing support from local communities. B2Gold and AngloGold have completed

a comprehensive review of the alternatives relating to the Gramalote Project and consider that the interests of all stakeholders would

be best served by finding a buyer for the Project. The partners intend to commence a joint sales process for the Gramalote Project in

the fourth quarter of 2022.

Outlook

For the full-year 2022, total consolidated production

and cost guidance remains unchanged. Lower than expected production at the Fekola and Otjikoto mines in the third quarter of 2022 were

due to temporary mining sequence changes (see “Operations” discussion). Strong production is anticipated in the fourth quarter

of 2022 at both operations. As a result, the Company re-affirms its total gold production guidance for 2022 of between 990,000 and 1,050,000

ounces of gold (including 40,000 and 50,000 attributable ounces projected from Calibre). Overall and after factoring in the operating

results for the first nine months of 2022, the Company's costs guidance ranges for full-year 2022 remain unchanged. The Company’s

total consolidated cash operating costs are expected to be at the upper end of the original guidance range of between $620 and $660 per

ounce and total consolidated all-in sustaining costs are expected to within the original guidance range of between $1,010 and $1,050 per

ounce.

The Company’s operations continue to be

impacted by global cost inflation with fuel costs reflecting the most significant increases. However, despite these ongoing cost pressures,

draw downs of existing inventories, proactive management and the revised sequencing of certain mining and capital costs, and gains realized

from the Company's fuel hedging program, the Company's consolidated cash operating costs and all-in sustaining costs in the first nine

months of 2022 were in line with budget. For full-year 2022, the Company expects to be at the upper end of its original total consolidated

cash operating cost guidance range and within its original total consolidated all-in sustaining cost guidance range. The Company will

continue to closely monitor the levels of cost inflation over the remainder of 2022. B2Gold’s projects and operations continue to

target long-term cash flow and value at industry leading costs per ounce of gold produced.

The Company's ongoing strategy is to continue

to maximize profitable production from its mines, further advance its pipeline of remaining development and exploration projects, evaluate

new exploration, development and production opportunities and continue to pay an industry leading dividend yield.

Third Quarter 2022 Financial Results - Conference Call Details

B2Gold executives will host a conference call

to discuss the results on Wednesday, November 2, 2022, at 10:00 am PST/1:00 pm EST. You may access the call by dialing the operator at

+1 (778) 383-7413 / +1 (416) 764-8659 (Vancouver/Toronto) or toll free at +1 (888) 664-6392 prior to the scheduled start time or you may

listen to the call via webcast by clicking here. A playback version will be available for two weeks after the call at +1 (416)

764-8677 (local or international) or toll free at +1 (888) 390-0541 (passcode 705653 #).

Qualified Persons

Bill Lytle, Senior Vice President and Chief Operating

Officer, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained

in this news release.

Brian Scott, P. Geo., Vice President, Geology

& Technical Services, a qualified person under NI 43-101, has approved the scientific and technical information related to exploration

and mineral resource matters contained in this news release.

About B2Gold

B2Gold is a Vancouver-based international gold

mining company with three operating gold mines and numerous development and exploration projects in various countries including Mali,

the Philippines, Namibia, Colombia, Finland and Uzbekistan. Since its founding in 2007, B2Gold has created significant shareholder value

by identifying and acquiring companies with assets that benefit from B2Gold’s best-in-class approach to exploration, mine building

and operations. This includes the acquisition of Australian-based Papillon Resources that brought in what is now B2Gold’s flagship

Fekola Gold Project in Mali in 2014, Australian-based CGA Mining with its Masbate Gold Mine in the Philippines in 2013, and Canadian-based

Auryx Gold with its Otjikoto Gold Project in Namibia in 2011. Fekola is now a tier-one gold mine expected to produce between 570,000 and

600,000 ounces of gold in 2022, Masbate is expected to produce between 215,000 and 225,000 ounces in 2022, and Otjikoto is expected to

produce between 165,000 and 175,000 ounces in 2022.

ON BEHALF OF B2GOLD CORP.

“Clive T. Johnson”

President and Chief Executive Officer

For more information on B2Gold please visit the

Company website at www.b2gold.com or contact:

| Michael McDonald |

Cherry De Geer |

| VP, Investor Relations & Corporate Development |

Director, Corporate Communications |

| +1 604-681-8371 |

+1 604-681-8371 |

| investor@b2gold.com |

investor@b2gold.com |

The Toronto Stock Exchange and NYSE American

LLC neither approve nor disapprove the information contained in this news release.

Production results and production guidance

presented in this news release reflect total production at the mines B2Gold operates on a 100% project basis. Please see our Annual Information

Form dated March 30, 2022 for a discussion of our ownership interest in the mines B2Gold operates.

This news release includes certain "forward-looking

information" and "forward-looking statements" (collectively forward-looking statements") within the meaning of applicable

Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements

regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs

(sustaining and non-sustaining) and operating costs, including projected cash operating costs and AISC, and budgets on a consolidated

and mine by mine basis; the impact of the COVID-19 pandemic on B2Gold's operations, including any restrictions or suspensions with respect

to our operations and the effect of any such restrictions or suspensions on our financial and operational results; the ability of the

Company to successfully maintain our operations if they are temporarily suspended, and to restart or ramp-up these operations efficiently

and economically, the impact of COVID-19 on the Company's workforce, suppliers and other essential resources and what effect those impacts,

if they occur, would have on our business, our planned capital and exploration expenditures; future or estimated mine life, metal price

assumptions, ore grades or sources, gold recovery rates, stripping ratios, throughput, ore processing; statements regarding anticipated

exploration, drilling, development, construction, permitting and other activities or achievements of B2Gold; and including, without limitation:

projected gold production, cash operating costs and AISC on a consolidated and mine by mine basis in 2022, including production being

weighted heavily to the second half of 2022; total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022 with cash

operating costs of between $620 and $660 per ounce and AISC of between $1,010 and $1,050 per ounce; the potential upside to increase Fekola’s

gold production in 2023 by trucking material from the Anaconda area or the Dandoko project, including the potential to add approximately

80,000 to 100,000 per year to Fekola’s annual production profile, and for the Anaconda area and the Dandoko project to provide saprolite

material to feed the Fekola mill starting in the second quarter of 2023 and the fourth quarter of 2023, respectively; the timing and results

of a feasibility study for the Anaconda area to review the project economics of a stand-alone oxide mill; the potential for the Fekola

complex to produce 800,000 ounces of gold per year over a 10-year period starting in 2026; stope ore production at the Wolfshag underground

mine at Otjikoto commencing in the fourth quarter of 2022; the potential payment of future dividends, including the timing and amount

of any such dividends, and the expectation that quarterly dividends will be maintained at the same level; and B2Gold's attributable share

of Calibre’s production. All statements in this news release that address events or developments that we expect to occur in the

future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although

not always, identified by words such as "expect", "plan", "anticipate", "project", "target",

"potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe"

and similar expressions or their negative connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates

of management as of the date such statements are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the

duration and extent of the COVID-19 pandemic, the effectiveness of preventative measures and contingency plans put in place by the Company

to respond to the COVID-19 pandemic, including, but not limited to, social distancing, a non-essential travel ban, business continuity

plans, and efforts to mitigate supply chain disruptions; escalation of travel restrictions on people or products and reductions in the

ability of the Company to transport and refine doré; the volatility of metal prices and B2Gold's common shares; changes in tax

laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving

production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's

feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining

activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change

and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities

of companies acquired by B2Gold; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential restrictions imposed on B2Gold's operations as a result thereof and the

ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including

those associated with operations in Mali, Namibia, the Philippines and Colombia and including risks related to changes in foreign laws

and changing policies related to mining and local ownership requirements or resource nationalization generally, including in response

to the COVID-19 outbreak; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of

energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory,

political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors,

third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which

owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition

with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations

from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to

maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance

with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having

an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other

factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information

Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities

and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov, respectively (the "Websites").

The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements.

B2Gold's forward-looking statements are based

on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to

management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability

to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development

and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or

reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability

to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including

gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political

conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based

on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's

beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking

statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in,

or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set

forth above, undue reliance should not be placed on forward-looking statements.

Non-IFRS Measures

This news release includes certain terms or

performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards ("IFRS"),

including "cash operating costs" and "all-in sustaining costs" (or "AISC"). Non-IFRS measures do not have

any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies.

The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures

of performance prepared in accordance with IFRS and should be read in conjunction with B2Gold's consolidated financial statements. Readers

should refer to B2Gold's Management Discussion and Analysis, available on the Websites, under the heading "Non-IFRS Measures"

for a more detailed discussion of how B2Gold calculates certain of such measures and a reconciliation of certain measures to IFRS terms.

Cautionary Statement Regarding Mineral

Reserve and Resource Estimates

The disclosure in this news release was prepared

in accordance with Canadian National Instrument 43-101, which differs significantly from the requirements of the United States Securities

and Exchange Commission ("SEC"), and resource and reserve information contained or referenced in this news release may not be

comparable to similar information disclosed by public companies subject to the technical disclosure requirements of the SEC. Historical

results or feasibility models presented herein are not guarantees or expectations of future performance.

B2GOLD CORP. CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30 |

(Expressed in thousands of United States dollars, except per share amounts) (Unaudited) |

| |

|

For the three

months ended

Sept. 30, 2022 |

|

For the three

months ended

Sept. 30, 2021 |

|

For the nine

months ended

Sept. 30, 2022 |

|

For the nine

months ended

Sept. 30, 2021 |

| |

|

|

|

|

|

|

|

|

| Gold revenue |

|

$ 392,554 |

|

$ 510,859 |

|

$ 1,140,122 |

|

$ 1,236,151 |

| |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

|

|

|

|

|

|

| Production costs |

|

(185,704) |

|

(130,770) |

|

(466,967) |

|

(374,695) |

| Depreciation and depletion |

|

(94,207) |

|

(111,768) |

|

(253,344) |

|

(256,304) |

| Royalties and production taxes |

|

(26,644) |

|

(33,154) |

|

(76,235) |

|

(84,351) |

| Total cost of sales |

|

(306,555) |

|

(275,692) |

|

(796,546) |

|

(715,350) |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

85,999 |

|

235,167 |

|

343,576 |

|

520,801 |

| |

|

|

|

|

|

|

|

|

| General and administrative |

|

(10,384) |

|

(10,410) |

|

(33,761) |

|

(31,026) |

| Share-based payments |

|

(5,808) |

|

(5,996) |

|

(18,253) |

|

(15,835) |

| Write-down of mineral property interests |

|

(3,927) |

|

— |

|

(7,085) |

|

(1,040) |

| Reversal of impairment of long-lived assets |

|

— |

|

— |

|

909 |

|

— |

| Loss on sale of mineral property interests |

|

(2,804) |

|

— |

|

(2,804) |

|

— |

| Community relations |

|

(873) |

|

(855) |

|

(1,945) |

|

(2,169) |

| Foreign exchange losses |

|

(7,982) |

|

(2,718) |

|

(16,439) |

|

(3,758) |

| Share of net income of associate |

|

2,080 |

|

3,851 |

|

8,991 |

|

13,198 |

| Other expense |

|

(1,776) |

|

(563) |

|

(2,746) |

|

(3,972) |

| Operating income |

|

54,525 |

|

218,476 |

|

270,443 |

|

476,199 |

| |

|

|

|

|

|

|

|

|

| Interest and financing expense |

|

(2,709) |

|

(3,112) |

|

(7,983) |

|

(9,057) |

| (Losses) gains on derivative instruments |

|

(8,751) |

|

5,484 |

|

18,297 |

|

23,024 |

| Other income |

|

3,621 |

|

43 |

|

14,309 |

|

1,199 |

| Income from operations before taxes |

|

46,686 |

|

220,891 |

|

295,066 |

|

491,365 |

| |

|

|

|

|

|

|

|

|

| Current income tax, withholding and other taxes |

|

(32,520) |

|

(83,024) |

|

(140,315) |

|

(174,620) |

| Deferred income tax expense |

|

(35,400) |

|

(2,996) |

|

(44,496) |

|

(9,060) |

| Net (loss) income for the period |

|

$ (21,234) |

|

$ 134,871 |

|

$ 110,255 |

|

$ 307,685 |

| |

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

| Shareholders of the Company |

|

$ (23,410) |

|

$ 123,110 |

|

$ 95,117 |

|

$ 283,122 |

| Non-controlling interests |

|

2,176 |

|

11,761 |

|

15,138 |

|

24,563 |

| Net (loss) income for the period |

|

$ (21,234) |

|

$ 134,871 |

|

$ 110,255 |

|

$ 307,685 |

| |

|

|

|

|

|

|

|

|

|

(Loss) earnings per share

(attributable to shareholders of the Company) |

|

|

|

|

|

|

|

|

| Basic |

|

$ (0.02) |

|

$ 0.12 |

|

$ 0.09 |

|

$ 0.27 |

| Diluted |

|

$ (0.02) |

|

$ 0.12 |

|

$ 0.09 |

|

$ 0.27 |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding

(in thousands) |

|

|

|

|

|

|

|

|

| Basic |

|

1,064,301 |

|

1,054,747 |

|

1,060,826 |

|

1,053,127 |

| Diluted |

|

1,064,301 |

|

1,060,687 |

|

1,067,753 |

|

1,061,756 |

B2GOLD CORP. CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30 |

(Expressed in thousands of United States dollars) (Unaudited) |

| |

|

For the three

months ended

Sept. 30, 2022 |

|

For the three

months ended

Sept. 30, 2021 |

|

For the nine

months ended

Sept. 30, 2022 |

|

For the nine

months ended

Sept. 30, 2021 |

| Operating activities |

|

|

|

|

|

|

|

|

| Net (loss) income for the period |

|

$ (21,234) |

|

$ 134,871 |

|

$ 110,255 |

|

$ 307,685 |

| Non-cash charges, net |

|

160,355 |

|

122,258 |

|

331,700 |

|

265,304 |

| Changes in non-cash working capital |

|

(34,362) |

|

57,871 |

|

(87,833) |

|

(113,107) |

| Changes in long-term value added tax receivables |

|

(11,641) |

|

5,283 |

|

(28,815) |

|

(2,061) |

| Cash provided by operating activities |

|

93,118 |

|

320,283 |

|

325,307 |

|

457,821 |

| |

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Revolving credit facility transaction costs |

|

— |

|

— |

|

(2,401) |

|

— |

| Repayment of equipment loan facilities |

|

(879) |

|

(7,236) |

|

(12,374) |

|

(21,806) |

| Interest and commitment fees paid |

|

(725) |

|

(3,967) |

|

(3,049) |

|

(5,700) |

| Cash proceeds from stock option exercises |

|

335 |

|

1,943 |

|

12,966 |

|

3,777 |

| Dividends paid |

|

(42,949) |

|

(42,186) |

|

(127,695) |

|

(126,151) |

| Principal payments on lease arrangements |

|

(1,732) |

|

(1,196) |

|

(5,399) |

|

(2,624) |

| Distributions to non-controlling interests |

|

(23,648) |

|

(23,177) |

|

(27,828) |

|

(32,411) |

| Funding from non-controlling interests |

|

1,656 |

|

— |

|

2,386 |

|

— |

| Changes in restricted cash accounts |

|

132 |

|

293 |

|

132 |

|

792 |

| Cash used by financing activities |

|

(67,810) |

|

(75,526) |

|

(163,262) |

|

(184,123) |

| |

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Expenditures on mining interests: |

|

|

|

|

|

|

|

|

| Fekola Mine |

|

(20,353) |

|

(27,961) |

|

(68,779) |

|

(54,078) |

| Masbate Mine |

|

(10,158) |

|

(7,023) |

|

(29,908) |

|

(20,365) |

| Otjikoto Mine |

|

(20,292) |

|

(19,371) |

|

(59,575) |

|

(59,337) |

| Gramalote Project |

|

(4,273) |

|

(9,200) |

|

(12,810) |

|

(16,669) |

| Anaconda Property, pre-development |

|

(5,154) |

|

— |

|

(12,083) |

|

— |

| Other exploration and development |

|

(16,269) |

|

(13,944) |

|

(45,505) |

|

(39,368) |

| Cash paid for acquisition of mineral property |

|

— |

|

— |

|

(48,258) |

|

— |

| Deferred consideration received |

|

45,000 |

|

— |

|

45,000 |

|

— |

| Cash paid for acquisition of Oklo Resources Limited |

|

(21,130) |

|

— |

|

(21,130) |

|

— |

| Cash acquired on acquisition of Oklo Resources Limited |

|

1,415 |

|

— |

|

1,415 |

|

— |

| Loan to associate |

|

(5,000) |

|

— |

|

(5,000) |

|

— |

| Cash paid on exercise of mineral property option |

|

— |

|

— |

|

(7,737) |

|

— |

| Funding of reclamation accounts |

|

(954) |

|

(1,071) |

|

(5,052) |

|

(4,570) |

| Purchase of common shares of associate |

|

— |

|

— |

|

— |

|

(5,945) |

| Other |

|

1,626 |

|

2,071 |

|

1,268 |

|

(1,452) |

| Cash used by investing activities |

|

(55,542) |

|

(76,499) |

|

(268,154) |

|

(201,784) |

| |

|

|

|

|

|

|

|

|

| (Decrease) increase in cash and cash equivalents |

|

(30,234) |

|

168,258 |

|

(106,109) |

|

71,914 |

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

(7,002) |

|

(3,892) |

|

(17,434) |

|

(5,092) |

| Cash and cash equivalents, beginning of period |

|

586,692 |

|

382,141 |

|

672,999 |

|

479,685 |

| Cash and cash equivalents, end of period |

|

$ 549,456 |

|

$ 546,507 |

|

$ 549,456 |

|

$ 546,507 |

| |

|

|

|

|

|

|

|

|

B2GOLD CORP. CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS |

(Expressed in thousands of United States dollars) (Unaudited) |

| |

|

As at September 30,

2022 |

|

As at December 31,

2021 |

| Assets |

|

|

|

|

| Current |

|

|

|

|

| Cash and cash equivalents |

|

$ 549,456 |

|

$ 672,999 |

| Accounts receivable, prepaids and other |

|

38,464 |

|

32,112 |

| Deferred consideration receivable |

|

3,850 |

|

41,559 |

| Value-added and other tax receivables |

|

12,000 |

|

14,393 |

| Inventories |

|

293,793 |

|

272,354 |

| Assets classified as held for sale |

|

— |

|

12,700 |

| |

|

897,563 |

|

1,046,117 |

| |

|

|

|

|

| Long-term investments |

|

24,496 |

|

32,118 |

| Value-added tax receivables |

|

91,924 |

|

63,165 |

| Mining interests |

|

|

|

|

| Owned by subsidiaries and joint operations |

|

2,292,047 |

|

2,231,831 |

| Investments in associates |

|

118,685 |

|

104,236 |

| Other assets |

|

92,885 |

|

82,371 |

| Deferred income taxes |

|

— |

|

1,455 |

| |

|

$ 3,517,600 |

|

$ 3,561,293 |

| Liabilities |

|

|

|

|

| Current |

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ 108,870 |

|

$ 111,716 |

| Current income and other taxes payable |

|

41,817 |

|

92,275 |

| Current portion of long-term debt |

|

19,796 |

|

25,408 |

| Current portion of mine restoration provisions |

|

734 |

|

734 |

| Other current liabilities |

|

1,041 |

|

1,056 |

| |

|

172,258 |

|

231,189 |

| |

|

|

|

|

| Long-term debt |

|

42,732 |

|

49,726 |

| Mine restoration provisions |

|

85,352 |

|

116,547 |

| Deferred income taxes |

|

230,928 |

|

187,887 |

| Employee benefits obligation |

|

7,323 |

|

7,115 |

| Other long-term liabilities |

|

7,269 |

|

7,822 |

| |

|

545,862 |

|

600,286 |

| Equity |

|

|

|

|

| Shareholders’ equity |

|

|

|

|

| Share capital |

|

2,484,468 |

|

2,422,184 |

| Contributed surplus |

|

73,756 |

|

67,028 |

| Accumulated other comprehensive loss |

|

(150,876) |

|

(136,299) |

| Retained earnings |

|

476,721 |

|

507,381 |

| |

|

2,884,069 |

|

2,860,294 |

| Non-controlling interests |

|

87,669 |

|

100,713 |

| |

|

2,971,738 |

|

2,961,007 |

| |

|

$ 3,517,600 |

|

$ 3,561,293 |

| |

|

|

|

|

This regulatory filing also includes additional resources:

ex991.pdf

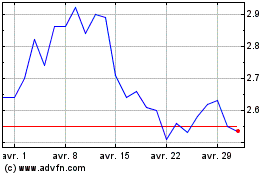

B2Gold (AMEX:BTG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

B2Gold (AMEX:BTG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024