false000147172700014717272023-03-282023-03-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

_______________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 21, 2023

_______________________

Better Choice Company Inc.

(Exact name of Registrant as Specified in its Charter)

_______________________

| | | | | | | | |

| Delaware | 001-40477 | 83-4284557 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

12400 Race Track Road

Tampa, Florida 33626

(Address of Principal Executive Offices) (Zip Code)

_______________________________________________

(Registrant's Telephone Number, Including Area Code): (212) 896-1254

N/A

(Former name or former address, if changed since last report.)

_______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading

Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value share | BTTR | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 21, 2023, Better Choice Company Inc., a Delaware corporation (the “Company”), announced its financial results for the second quarter ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

Item 7.01 Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Management's projections and expectations are subject to a number of risks and uncertainties that could cause actual performance to differ materially from that predicted or implied. Forward-looking statements may be identified by the use of words such as "expect," "anticipate," "believe," "estimate," "potential," "should" or similar words intended to identify information that is not historical in nature. Forward-looking statements contained herein include, among others, statements concerning management's expectations about future events and the Company’s operating plans and performance, the effects of the COVID-19 outbreak, including levels of consumer, business and economic confidence generally, the regulatory environment, litigation, sales, and the expected benefits of acquisitions, and such statements are based on the current beliefs and expectations of the Company’s management, as applicable, and are subject to known and unknown risks and uncertainties. There are a number of risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. These statements speak only as of the date they are made, and the Company does not intend to update or otherwise revise the forward-looking information to reflect actual results of operations, changes in financial condition, changes in estimates, expectations or assumptions, changes in general economic or industry conditions or other circumstances arising and/or existing since the preparation of this Current Report on Form 8-K or to reflect the occurrence of any unanticipated events. For further information regarding the risks associated with the Company’s business, please refer to the Company’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the most recent fiscal year end, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Better Choice Company Inc. |

| August 21, 2023 | | | |

| By: | /s/ Carolina Martinez | |

| Name: | Carolina Martinez | |

| Title: | Chief Financial Officer | |

BETTER CHOICE COMPANY INC. ANNOUNCES SECOND QUARTER 2023 RESULTS

Enhanced Operational and Financial Discipline

33% Growth in EPS Year-Over-Year

Gross Margin Growth of 543 Basis Points Year-Over-Year

Increased Operating Margin Growth of 127 Basis Points Year-Over-Year

TAMPA, FL, August 21, 2023 -- Better Choice Company Inc. (NYSE American: BTTR) (the “Company” or “Better Choice”), a pet health and wellness company, announced its results for the second quarter ended June 30, 2023 ("Q2 2023").

SECOND QUARTER 2023 FINANCIAL HIGHLIGHTS

•Net revenue increased 14% from first quarter 2023 to $10.5 million

•Gross margin increased 543 basis points year-over-year (“YOY”) to 34%

•Operating loss improved 39% YOY to $(2.6) million

•Operating margin improved 127 basis points YOY to (-25%)

•Net loss improved 32% to $(3.0) million.

•Earnings (loss) per share (“EPS”) improved 33% YOY to $(0.10)

•Adjusted EBITDA improved 14% YOY to $(1.8) million1

SIX MONTHS 2023 FINANCIAL HIGHLIGHTS

•Gross margin increased 640 basis points YOY to 35%

•Operating loss improved 29% YOY to $(5.9) million

•Net loss improved 23% YOY to $(6.4) million

•EPS improved 28% YOY to $(0.21)

•Adjusted EBITDA improved 13% YOY to $(3.6) million1

SECOND QUARTER 2023 OPERATIONAL UPDATE

•Appointed pet industry executive, Kent Cunningham, as Chief Executive Officer

•Entered into a strategic partnership with Alphia, Inc., (“Alphia”) an industry leader in premium pet food manufacturing

•Paid down and eliminated a $13.5 million Revolving Line of Credit

Better Choice generated $10.5 million in net sales, over Q2 2023, with approximately 70% driven by its Halo Holistic® product line across its E-Commerce and International channels. Point-of-sale (“POS”) growth and strength of digital presence drove a 14% net sales growth from the first quarter of 2023 (“Q1 2023"). In the E-Commerce channel year-to-date, the Halo Holistic® plant based vegan and dry cat products showed a respective 21% and 28% POS growth2 YOY, and are growing dollar share. The Direct-to-Consumer digital segment experienced 28% net sales growth in the second quarter since Q1 2023, driven by a focused customer acquisition and revised promotional strategy. Additionally, the renovated Halo products have resulted in consumer satisfaction growth with an average product rating of 4.6 stars.

1 Adjusted EBITDA is a non-GAAP measure. Reconciliation of Adjusted EBITDA and to net income (loss), the most directly comparable GAAP financial measure, is set forth in the reconciliation table accompanying this release.

2 Point-of-sale growth is a non-GAAP measure.

Net sales softness YOY is attributable to dry kibble supply chain constraints that have impacted the business in the short-term. The Company experienced consistent fulfillment delays from its co-manufacturing partner, which resulted in material out-of-stocks across the Halo Elevate® dog product line and delayed the launch of Halo Elevate® cat products. Despite the topline softness associated with the delays, the largest pet specialty customer realized 55% revenue growth YOY in the second quarter. The Company expects the supply chain constraints to be fully resolved by the end of the third quarter. The Company has started the transition of its dry kibble manufacturing to Alphia, a strategic partnership that will diminish future continuity of supply risk and help improve gross margins. While the move to Alphia will have a positive impact on order fulfillment, the transition has expectedly created delays in foreign market registrations, in turn delaying the Company’s ability to launch in new markets in the short-term. Despite the transition impact, the Company realized a 42% net sales growth from Q1 2023 in its largest International customer, comprising 81% of the segment year-to-date.

“The second quarter was highlighted by our gross margin improvement and step change in operational discipline,” commented newly appointed CEO of Better Choice, Kent Cunningham. “The gross margin improvement of 640 basis points YOY was fueled by strategic pricing initiatives, and a 3% YOY improvement of average equivalized unit conversion and input costs in the first half of 2023. Over the past 90 days, I have seen first-hand the passion of our people and the strength of our Halo brand. The quality of our products is recognized by our consumers and customers, and the visible benefits of feeding our products are real. That said, we recognize the major areas of focus that our Company must immediately address to improve our operations and financial controls, cost structure, and corporate culture to realize synergies across channels and geographies and lay the foundation for sustained profitable growth. Keeping operational improvements at the forefront will continue to fuel our path to profitability and future growth trajectory. Despite the significant and sustained out-of-stocks negatively impacting topline, our focus on operational and financial fundamentals will continue to improve EBITDA and operating margins for the remainder of 2023 and build momentum heading into 2024.”

“In summary, while we experienced significant product supply headwinds in the quarter, we are positioning ourselves to build momentum in the remainder of 2023 as we transition production to Alphia, improve our capabilities firm-wide, and hold our teams accountable for results. We believe our sustained improvement efforts across all levels of the organization will drive growth and accelerate our path to profitability – with the goal of increasing shareholder value over the long term. I look forward to recognizing that goal and unlocking Halo’s full potential.”

Better Choice Company Inc.

Unaudited Condensed Consolidated Statements of Operations

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 10,536 | | | $ | 16,515 | | | $ | 19,773 | | | $ | 33,529 | |

| Cost of goods sold | 6,948 | | | 11,788 | | | 12,944 | | | 24,095 | |

| Gross profit | 3,588 | | | 4,727 | | | 6,829 | | | 9,434 | |

| Operating expenses: | | | | | | | |

| Selling, general and administrative | 6,173 | | | 8,988 | | | 12,669 | | | 17,656 | |

| Total operating expenses | 6,173 | | | 8,988 | | | 12,669 | | | 17,656 | |

| Loss from operations | (2,585) | | | (4,261) | | | (5,840) | | | (8,222) | |

| Other expenses: | | | | | | | |

| Interest expense, net | (379) | | | (106) | | | (608) | | | (182) | |

| Total other expense, net | (379) | | | (106) | | | (608) | | | (182) | |

| Net loss before income taxes | (2,964) | | | (4,367) | | | (6,448) | | | (8,404) | |

| Income tax expense | — | | | — | | | — | | | 3 | |

| | | | | | | |

| | | | | | | |

| Net loss available to common stockholders | $ | (2,964) | | | $ | (4,367) | | | $ | (6,448) | | | $ | (8,407) | |

| | | | | | | |

| Weighted average number of shares outstanding, basic | 30,551,653 | | | 29,364,712 | | | 30,516,666 | | | 29,327,316 | |

| Weighted average number of shares outstanding, diluted | 30,551,653 | | | 29,364,712 | | | 30,516,666 | | | 29,327,316 | |

| Net loss per share available to common stockholders, basic | $ | (0.10) | | | $ | (0.15) | | | $ | (0.21) | | | $ | (0.29) | |

| Net loss per share available to common stockholders, diluted | $ | (0.10) | | | $ | (0.15) | | | $ | (0.21) | | | $ | (0.29) | |

Better Choice Company Inc.

Unaudited Condensed Consolidated Balance Sheets

(Dollars in thousands, except share amounts)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 3,607 | | | $ | 3,173 | |

| Restricted cash | — | | | 6,300 | |

| Accounts receivable, net | 5,781 | | | 6,744 | |

| Inventories, net | 8,557 | | | 10,257 | |

| Prepaid expenses and other current assets | 1,820 | | | 1,051 | |

| Total Current Assets | 19,765 | | | 27,525 | |

| Fixed assets, net | 292 | | | 375 | |

| Right-of-use assets, operating leases | 147 | | | 173 | |

| Intangible assets, net | 9,296 | | | 10,059 | |

| Other assets | 904 | | | 544 | |

| Total Assets | $ | 30,404 | | | $ | 38,676 | |

| Liabilities & Stockholders’ Equity | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 4,193 | | | $ | 2,932 | |

| Accrued and other liabilities | 2,818 | | | 2,596 | |

| Line of credit | 2,260 | | | — | |

| Warrants liabilities | 2,208 | | | — | |

| Operating lease liability | 54 | | | 52 | |

| Total Current Liabilities | 11,533 | | | 5,580 | |

| Non-current Liabilities | | | |

| Line of credit, net | — | | | 11,444 | |

| Term loan, net | 2,550 | | | — | |

| Operating lease liability | 96 | | | 124 | |

| Total Non-current Liabilities | 2,646 | | | 11,568 | |

| Total Liabilities | 14,179 | | | 17,148 | |

| Stockholders’ Equity | | | |

| Common Stock, $0.001 par value, 200,000,000 shares authorized, 30,577,148 & 29,430,267 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 30 | | | 29 | |

| Additional paid-in capital | 321,215 | | | 320,071 | |

| Accumulated deficit | (305,020) | | | (298,572) | |

| Total Stockholders’ Equity | 16,225 | | | 21,528 | |

| Total Liabilities and Stockholders’ Equity | $ | 30,404 | | | $ | 38,676 | |

Better Choice Company Inc.

Non-GAAP Measures

Adjusted EBITDA

We define Adjusted EBITDA as EBITDA further adjusted to eliminate the impact of certain items that we do not consider indicative of our core operations. Adjusted EBITDA is determined by adding the following items to net (loss) income: interest expense, tax expense, depreciation and amortization, share-based compensation, warrant expense, impairment of goodwill, loss on disposal of assets, change in fair value of warrant liabilities, gain or loss on extinguishment of debt, equity and debt offering expenses and other non-recurring expenses.

We present Adjusted EBITDA as it is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. We believe that the disclosure of Adjusted EBITDA is useful to investors as this non-GAAP measure forms the basis of how our management team reviews and considers our operating results. By disclosing this non-GAAP measure, we believe that we create for investors a greater understanding of and an enhanced level of transparency into the means by which our management team operates our company. We also believe this measure can assist investors in comparing our performance to that of other companies on a consistent basis without regard to certain items that do not directly affect our ongoing operating performance or cash flows.

Adjusted EBITDA does not represent cash flows from operations as defined by GAAP. Adjusted EBITDA has limitations as a financial measure and you should not consider it in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net (loss) income, gross margin, and our other GAAP results.

The following table presents a reconciliation of net loss, the closest GAAP financial measure, to EBITDA and Adjusted EBITDA for each of the periods indicated (in thousands):

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss available to common stockholders | $ | (2,964) | | | $ | (4,367) | | | $ | (6,448) | | | $ | (8,407) | |

| Interest expense, net | 379 | | | 106 | | | 608 | | | 182 | |

| Income tax expense | — | | | — | | | — | | | 3 | |

| Depreciation and amortization | 421 | | | 430 | | | 845 | | | 839 | |

| EBITDA | (2,164) | | | (3,831) | | | (4,995) | | | (7,383) | |

| Non-cash share-based compensation and warrant expense (a) | 284 | | | 801 | | | 1,145 | | | 1,892 | |

| Loss on disposal of assets | — | | | 1 | | | 11 | | | 3 | |

| Strategic branding initiatives and product launches (b) | 18 | | | 845 | | | 33 | | | 1,151 | |

| Co-manufacturing partner transition (c) | 6 | | | — | | | 6 | | | — | |

| Other single occurrence expenses (d) | 31 | | | 50 | | | 189 | | | 185 | |

| Adjusted EBITDA | $ | (1,825) | | | $ | (2,134) | | | $ | (3,611) | | | $ | (4,152) | |

| (a) Non-cash expenses related to equity compensation awards. Share-based compensation is an important part of the Company's compensation strategy and without our equity compensation plans, it is probable that salaries and other compensation related costs would be higher. |

| (b) Single occurrence expenses related to marketing agency and design, strategic re-branding initiatives, Elevate® launch, product innovation and reformulations. |

| (c) Single occurrence expenses related to the transition of our largest dry kibble co-manufacturing supplier. |

| (d) Single occurrence expenses related to employee severance, executive recruitment, and other non-recurring professional fees. |

About Better Choice Company Inc.

Better Choice Company Inc. is a pet health and wellness company focused on providing pet products and services that help dogs and cats live healthier, happier and longer lives. We offer a broad portfolio of pet health and wellness products for dogs and cats sold under our Halo brand across multiple forms, including foods, treats, toppers, dental products, chews, and supplements. We have a demonstrated, multi-decade track record of success and are well positioned to benefit from the mainstream trends of growing pet humanization and consumer focus on health and wellness. Our products consist of kibble and canned dog and cat food, freeze-dried raw dog food and treats, vegan dog food and treats, oral care products and supplements. Halo’s core products are made with high-quality, thoughtfully sourced ingredients for natural, science-based nutrition. Each innovative recipe is formulated with leading veterinary and nutrition experts to deliver optimal health. For more information, please visit https://www.betterchoicecompany.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. The Company has based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Some or all of the results anticipated by these forward-looking statements may not be achieved. Further information on the Company’s risk factors is contained in our filings with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Company Contact:

Better Choice Company Inc.

Kent Cunningham, CEO

Investor Contact:

KCSA Strategic Communications

Valter Pinto, Managing Director

T: 212-896-1254

Valter@KCSA.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

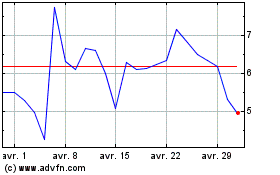

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024