UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☒ |

Definitive

Information Statement |

| |

BETTER

CHOICE COMPANY, INC. |

|

| |

(Name

of Registrant As Specified In Its Charter) |

|

Payment

of Filing Fee (Check the appropriate box):

| ☒ | No

fee required |

| | |

| ☐ | Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

NOTICE

OF ACTION BY WRITTEN CONSENT OF HOLDERS OF A MAJORITY OF THE

OUTSTANDING VOTING STOCK OF BETTER CHOICE COMPANY, INC.

This

notice and accompanying Information Statement are furnished to the holders of shares of the common stock, par value $0.001 per share

(“Common Stock”), of Better Choice Company, Inc., a Delaware corporation (“we,” “us,” “our”

or the “Company”), pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and Regulation 14C and Schedule 14C thereunder, and in accordance with the relevant sections of the General Corporation Law of the State

of Delaware (the “DGCL”), each in connection with the approval of the actions described below. This notice is being furnished

to the Company’s stockholders to advise them of the corporate actions described herein, which have been authorized by the Company’s

board of directors (the “Board”) and by the written consent of stockholders owning a majority of the outstanding voting capital

stock of the Company entitled to vote thereon.

On

February 15, 2024, the Company’s board of directors (the “Board”) unanimously adopted resolutions approving, declaring

advisable and recommending to the Company’s stockholders for their approval a proposal to authorize the Board, in its discretion,

to amend the Company’s Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock

at a ratio in the range of 1-for-25 to 1-for-45, such ratio to be determined by the Board (the “Reverse

Stock Split”). Approval of this proposal will grant the Board the authority, without further action by the stockholders of the

Company, to carry out such action any time prior to March 31, 2024, with the exact exchange ratio and timing to be determined at the

discretion of the Board.

Our

stockholders are entitled to notice of this stockholder action by written consent. Since this action has been approved by written consent

by the holders of the required majority of the voting power of our voting capital stock, no proxies are being solicited. The Reverse

Stock Split will not be effective until at least 20 calendar days after the mailing of the Information Statement accompanying this Notice.

We anticipate that the Reverse Stock Split will become effective on or about March 31, 2024.

Attached

hereto for your review is an Information Statement relating to the Reverse Stock Split. Please read this Information Statement carefully.

It describes the essential terms of the actions to be taken. Additional information about the Company is contained in its reports filed

with or furnished to the Securities and Exchange Commission (the “SEC”). These reports, their accompanying exhibits and other

documents filed with the SEC may be inspected without charge at the Public Reference Section of the SEC at 100 F Street, N.E., Washington,

D.C. 20549. Copies of such material may also be obtained from the SEC at prescribed rates. The SEC also maintains a website that contains

reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of

these reports may be obtained on the SEC’s website at www.sec.gov.

WE

ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND YOU ARE REQUESTED NOT

TO SEND US A CONSENT OR PROXY.

This

Information Statement is being mailed to you on or about February 27, 2024.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Kent Cunningham |

| |

Kent

Cunningham |

| |

Chief

Executive Officer |

12400

Race Track Road

Tampa,

Florida 33626

INFORMATION

STATEMENT

February

27, 2024

INTRODUCTION

Pursuant

to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C promulgated

thereunder, the notice and this information statement (this “Information Statement”) will be sent or given on or about February

27, 2024 to the holders of the common stock, par value $0.001 per shares (the “Common Stock”), of Better Choice Company,

Inc., a Delaware corporation (hereinafter referred to as “we,” “us,” “our,” or the “Company”).

This Information Statement is being circulated to advise stockholders of certain actions already approved and taken without a meeting

by written consent of stockholders who hold a majority of the voting power of our voting capital stock.

On

February 15, 2024, the Company’s board of directors (the “Board”) unanimously adopted resolutions approving, declaring

advisable and recommending to the Company’s stockholders for their approval a proposal to authorize the Board, in its discretion,

to amend the Company’s Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock

at a ratio in the range of 1-for-25 to 1-for-45, such ratio to be determined by the Board (the “Reverse Stock Split”). Approval

of this proposal will grant the Board the authority, without further action by the stockholders of the Company, to carry out such action

any time prior to March 31, 2024, with the exact exchange ratio and timing to be determined at the discretion of the Board.

Under

the General Corporation Law of the State of Delaware (the “DGCL”), any action required or permitted by the DGCL to be taken

at an annual or special meeting of stockholders of a Delaware corporation may be taken without a meeting, without prior notice and without

a vote, if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than

the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all voting shares entitled

to vote thereon were present and voted. Prompt notice of the approval of any action so taken must be given to those stockholders who

have not consented in writing to the action and who, if the action had been taken at a meeting, would otherwise have been entitled to

notice of the meeting.

Under

the DGCL and the Company’s Certificate of Incorporation, the affirmative vote of the holders of a majority of the Company’s

outstanding voting capital stock is required to approve the Reverse Stock Split. On February 16, 2024, stockholders that, in the

aggregate, are the record owners of 18,300,158 shares of our Common Stock representing, in the aggregate, 50.5% of our

outstanding voting capital stock (together, the “Consenting Stockholders”), executed and delivered to the Company written

consents authorizing and approving the Reverse Stock Split. The Consenting Stockholders include all of the members of our Board and other

significant shareholders.

Accordingly,

the Reverse Stock Split has been approved by stockholders representing the requisite number of shares of our outstanding voting capital

stock. As such, no vote or further action of the stockholders of the Company is required to approve the Reverse Stock Split. You are

hereby being provided with this notice of the approval of the Reverse Stock Split and related charter amendment by less than unanimous

written consent of the stockholders of the Company. The Reverse Stock Split will not be effective until at least 20 calendar days after

this Information Statement has first been sent to stockholders.

We

will provide definitive information in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (the “SEC”)

within four business days upon the effectiveness of the Reverse Stock Split.

ACTIONS

BY BOARD OF DIRECTORS AND CONSENTING STOCKHOLDERS

General

The

Board and the Consenting Stockholders approved the Reverse Stock Split on February 15, 2024 and February 16, 2024, respectively. The

Consenting Stockholders are:

Name

of Consenting Stockholder | |

Number

of Shares Owned | | |

Precent of Beneficial Owner | |

| John M. Word III (Director) | |

| 3,839,560 | | |

| 10.6 | % |

| Michael Young (Director) (1) | |

| 2,132,040 | | |

| 5.9 | % |

| Lionel F. Conacher (Director) | |

| 1,418,166 | | |

| 3.9 | % |

| Gil Fronzaglia (Director) | |

| 597,611 | | |

| 1.6 | % |

| Arlene Dickinson (Director) | |

| 592,611 | | |

| 1.6 | % |

| HH-Halo LP | |

| 2,407,656 | | |

| 6.6 | % |

| Edward J. Brown (2) | |

| 2,336,477 | | |

| 6.4 | % |

| Filipp Chebotarev (3) | |

| 622,867 | | |

| 1.7 | % |

| Dark Horse Capital Ltd. | |

| 1,200,000 | | |

| 3.3 | % |

| Anthony Lyons | |

| 1,350,000 | | |

| 3.7 | % |

| Donald Young | |

| 590,601 | | |

| 1.6 | % |

| Apolo Capital Advisors | |

| 547,552 | | |

| 1.5 | % |

| Damian Dalla-Longa | |

| 299,983 | | |

| 0.8 | % |

| Mena Investment Network Inc | |

| 182,517 | | |

| 0.5 | % |

| Peter Simeon | |

| 182,517 | | |

| 0.5 | % |

| (1) | Includes

2,019,540 shares held personally by Mr. Young and 112,500 shares held by Cottingham Capital

which is controlled by Mr. Young. |

| (2) | As

trustee for the Edward J. Brown Jr. Trust. |

| (3) | Includes

19,900 shares held personally by Mr. Chebotarev and 326,648 shares and 276,319 shares held

by Cambridge SPG IRA Fund LP and Cambridge SPG TP Holdings, respectively, for which Mr. Chebotarev

has signature authority. |

Reasons

for the Reverse Stock Split

The

Board is recommending the Reverse Stock Split for several important reasons. Firstly, the proposed Reverse Stock Split is needed in order

to allow the Company to continue to list our shares of Common Stock on the NYSE American, LLC exchange (“NYSE American”).

On September 21, 2023, the Company received a written notice (the “NYSE Notice”) from the NYSE American indicating

that the Company is not in compliance with the NYSE American continued listing standard set forth in Section 1003(f)(v) of the NYSE American

Company Guide (“Section 1003(f)(v)”) because shares of the Company’s common stock have been selling for a substantial

period of time at a low price per share. The Notice had no immediate effect on the listing or trading of the Company’s common stock

and the common stock has continued to trade on the NYSE American under the symbol “BTTR.” Pursuant to Section 1003(f)(v),

the NYSE American determined that the Company’s continued listing is predicated on effecting a reverse stock split of its common

stock or demonstrating sustained price improvement within a reasonable period of time, which the NYSE American determined to be no later

than March 21, 2024. A decrease in the number of outstanding shares of our common stock resulting from the Reverse Stock Split should,

absent other factors, increase the per share market price of the Company’s common stock, although there is no assurance that the

selling price for the Common Stock would remain over the selling price requirements of the in order to sustain a continued listing our

Common Stock on the NYSE American if the Company elects to effectuate the Reverse Stock Split.

An

additional reason why the Board is recommending the Reverse Stock Split is to provide the Company with the appropriate flexibility it

requires to issue shares in the event that the Board determines that it is necessary or appropriate to (i) raise additional capital through

the sale of equity securities, (ii) enter into strategic business transactions, (iii) provide equity incentives to directors, officers

and employees pursuant to equity compensation plans or (iv) further other corporate purposes.

Lastly,

the Board believes that the Reverse Stock Split could enhance the appeal of the Company’s common stock to the financial community,

including institutional investors, and the general investing public. The Board believes that a number of institutional investors and

investment funds are reluctant to invest in lower-priced securities and that brokerage firms may be reluctant to recommend lower-priced

stock to their clients, which may be due in part to a perception that lower-priced securities are less promising as investments, are

less liquid in the event that an investor wishes to sell its shares, or are less likely to be followed by institutional securities research

firms and therefore to have less third-party analysis of the Company available to investors. In addition, certain institutional investors

or investment funds may be prohibited from buying stocks whose price is below a certain threshold. The Board believes that the reduction

in the number of issued and outstanding shares of the common stock caused by the Reverse Stock Split, together with the anticipated increased

stock price immediately following and resulting from the Reverse Stock Split, may encourage interest and trading in the Company’s

common stock and thus possibly promote greater liquidity for the Company’s stockholders, thereby resulting in a broader market

for the common stock than that which currently exists. Finally, the Company believes that the intended increase in the stock price could

decrease price volatility, as currently small changes in the price of the common stock result in relatively large percentage changes

in the stock price.

The

Company cannot assure that all or any of the anticipated beneficial effects on the trading market for the Company’s common stock

will occur. The Board cannot predict with certainty what effect the Reverse Stock Split will have on the market price of the common stock,

particularly over the longer term. Some investors may view a reverse stock split negatively, which could result in a decrease in our

market capitalization. Additionally, any improvement in liquidity due to increased institutional or brokerage interest or lower trading

commissions may be offset by the lower number of outstanding shares.

Board

Discretion to Implement the Reverse Stock Split

The

Board believes that stockholder approval of a range of Reverse Stock Split ratios (rather than a single exchange ratio) is in the best

interests of the Company’s stockholders because it provides the Board with the flexibility to achieve the desired results of the

Reverse Stock Split and because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented.

If stockholders approve this proposal, the Board would carry out the Reverse Stock Split only upon the Board’s determination that

a reverse stock split would be in the best interests of the Company’s stockholders at that time, and only (without further stockholder

approval) up to March 31, 2024. The Board would then set the ratio for the Reverse Stock Split within the range approved by the Company’s

stockholders and in an amount it determines is advisable and in the best interests of the stockholders considering relevant market conditions

at the time the Reverse Stock Split is to be implemented. In determining the Reverse Stock Split ratio, following receipt of stockholder

approval, the Board may consider numerous factors including:

| |

● |

the projected impact of the Reverse Stock Split ratio on trading

liquidity in the Common Stock and the Company’s ability to continue the listing of the Common Stock on the NYSE American; |

| |

● |

the historical and projected performance of the Common Stock; |

| |

● |

general economic and other related conditions prevailing in

the Company’s industry and in the marketplace; |

| |

● |

the Company’s capitalization (including the number of

shares of Common Stock issued and outstanding); |

| |

● |

the then-prevailing trading price for the Common Stock and

the volume level thereof; and |

| |

● |

potential devaluation of our market capitalization as a result

of a Reverse Stock Split. |

The

Board intends to select a reverse stock split ratio that it believes would be most likely to achieve the anticipated benefits of the

reverse stock split described above.

Certain

Risks Associated with the Reverse Stock Split

Before

executing this Action by Written Consent of Stockholders and approving the Reverse Stock Split, the undersigned has considered the following

risks associated with effecting the Reverse Stock Split:

| |

● |

Although the Company expects that the Reverse Stock Split will

result in an increase in the market price of our common stock, the Company cannot assure you that the Reverse Stock Split, if effected,

will increase the market price of the common stock in proportion to the reduction in the number of shares of the common stock outstanding

or result in a permanent increase in the market price. The effect the Reverse Stock Split may have upon the market price of the common

stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in similar circumstances

to the Company’s is varied. The market price of the common stock is dependent on many factors, including the Company’s business

and financial performance, general market conditions, prospects for future success and other factors detailed from time to time in the

reports the Company files with the Securities and Exchange Commission. Accordingly, the total market capitalization of the common stock

after the proposed Reverse Stock Split may be lower than the total market capitalization before the proposed Reverse Stock Split and,

in the future, the market price of the common stock following the Reverse Stock Split may not exceed or remain higher than the market

price prior to the proposed Reverse Stock Split. |

| |

● |

Even if the Reverse Stock Split is approved, the Reverse Stock

Split is effected and the Common Stock continues to be listed on the NYSE American, there can be no assurance that the Company will maintain

the ongoing continued listing requirements for an extended period of time. |

| |

● |

The Reverse Stock Split may result in some stockholders owning

“odd lots” of less than 100 shares of common stock on a post-split basis. These odd lots may be more difficult to sell, or

require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares. |

| |

● |

While the Board believes that a higher stock price may help

generate investor interest, there can be no assurance that the Reverse Stock Split will result in a per share price that will attract

institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors

or investment funds. As a result, the trading liquidity of the common stock may not necessarily improve. |

| |

● |

Although the Board believes that the decrease in the number

of shares of common stock outstanding as a consequence of the Reverse Stock Split and the anticipated increase in the market price of

common stock could encourage interest in our common stock and possibly promote greater liquidity for the Company’s stockholders,

such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split. |

Principal

Effects of the Reverse Stock Split

Effect

on Existing Common Stock

If

the Reverse Stock Split is affected, the number of shares of common stock issued and outstanding will be reduced from 36,240,690

shares (as of February 15, 2024) to between approximately 1,449,628 shares and 805,349 shares, depending on which exchange ratio is ultimately

effected. Except for the change resulting from the adjustment for fractional shares (described below), the change in the number of shares

of common stock outstanding that will result from the Reverse Stock Split will not affect any stockholder’s percentage ownership

in the Company. The relative voting and other rights that accompany the shares of common stock would not be affected by the Reverse Stock

Split.

Although

the Reverse Stock Split will not have any dilutive effect on stockholders (other than de minimis adjustments that may result from the

treatment of fractional shares), the proportion of shares owned by the Company’s stockholders relative to the number of shares

authorized for issuance will decrease because the number of authorized shares of common stock would remain at 200,000,000. As a result,

additional authorized shares of common stock will be available for issuance at such times and for such purposes as the Board may deem

advisable without further action by the Company’s stockholders, except as required by applicable laws and regulations. To the extent

that additional authorized shares are issued in the future, such shares could be dilutive to the Company’s existing stockholders

by decreasing such stockholders’ percentage of equity ownership in the Company. Please see “Potential Anti-Takeover Effect”

below for more information on potential anti-takeover effects of the Reverse Stock Split.

Fractional

Shares

No

fractional shares will be issued. Any fractional share resulting from the Reverse Stock Split will be rounded up to the next whole share.

Effect

on Equity Compensation Plans and Outstanding Warrants

The

proposed Reverse Stock Split, if effectuated, will reduce the number of shares of common stock available for issuance under the Company’s

Amended and Restated 2019 Incentive Award Plan in proportion to the exchange ratio selected by the Board.

Under

the terms of the Company’s outstanding equity awards and warrants, the proposed Reverse Stock Split will cause a reduction in the

number of shares of common stock issuable upon exercise or vesting of such awards and warrants in proportion to the exchange ratio of

the Reverse Stock Split and will cause a proportionate increase in the exercise price of such awards and warrants. The number of shares

of common stock issuable upon exercise or vesting of outstanding equity awards and warrants will be rounded up to the nearest whole share

and no cash payment will be made in respect of such rounding.

The

following table contains approximate information relating to the Company’s common stock immediately following the Reverse Stock

Split under certain possible exchange ratios, based on share information as of February 15, 2024.

| | |

February 15, 2024 | | |

1-for-25 | | |

1-for-35 | | |

1-for-45 | |

| Number of authorized shares of common stock | |

| 200,000,000 | | |

| 200,000,000 | | |

| 200,000,000 | | |

| 200,000,000 | |

| Number of outstanding shares of common stock | |

| 36,240,690 | | |

| 1,449,628 | | |

| 1,035,449 | | |

| 805,349 | |

| Number of shares of common stock reserved for issuance upon exercise of outstanding options and warrants | |

| 10,422,577 | | |

| 416,903 | | |

| 297,788 | | |

| 231,613 | |

| Number of shares of common stock reserved for issuance in connection with future awards under our equity compensation plans | |

| 9,980,290 | | |

| 399,212 | | |

| 285,151 | | |

| 221,784 | |

| Number of shares of common stock reserved for issuance upon conversion of our outstanding convertible notes | |

| - | | |

| - | | |

| - | | |

| - | |

| Number of authorized and unreserved shares of common stock not outstanding | |

| 143,356,443 | | |

| 197,734,257 | | |

| 198,381,613 | | |

| 198,741,254 | |

Potential

Anti-Takeover Effect

Since

the Reverse Stock Split, if effectuated, will result in increased available shares, the Reverse Stock Split may be construed as having

an anti-takeover effect. Although neither the Board nor the Company’s management views this proposal as an anti-takeover measure,

the Company could use the increased available shares to frustrate persons seeking to effect a takeover or otherwise gain control

of the Company. For example, the Company could privately place shares with purchasers who might side with the Board in opposing a hostile

takeover bid or issue shares to a holder that would, thereafter, have sufficient voting power to assure that any proposal to amend or

repeal the Company’s bylaws or certain provisions of the Company’s certificate of incorporation would not receive the requisite

vote. The Company’s certificate of incorporation already includes authorized preferred stock, which can also be seen as an anti-takeover

measure, and the Board can designate the rights, preferences, privileges and restrictions of series of preferred stock without further

stockholder action. The Company’s certificate of incorporation and bylaws also include other provisions that may have an anti-takeover

effect.

Vote

Required

Pursuant

to DGCL and the Company’s Certificate of Incorporation, the approval of the Reverse Stock Split required a majority of the Company’s

outstanding voting capital stock. Pursuant to the and the Company’s Certificate of Incorporation, each share of Common Stock is

entitled to one vote on all matters submitted to the Company’s stockholders for approval. As discussed above, stockholders

owning greater than a majority of the outstanding shares of Common Stock have consented to Reverse Stock Split.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTER TO BE ACTED UPON

None

of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted

upon:

| |

● |

Any

director or officer of our Company, |

| |

|

|

| |

● |

Any

proposed nominee for election as a director of our Company, and |

| |

|

|

| |

● |

Any

associate or affiliate of any of the foregoing persons. |

The

stockholdings of our directors and officers are listed below in the section entitled “Security Ownership of Certain Beneficial

Owners and Management.”

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information as of February 15, 2024 with respect to the beneficial ownership of shares of our common stock

by (i) each person known by us to be the owner of more than 5% of the outstanding shares of common stock, (ii) each director and executive

officer, and (iii) all executive officers and directors as a group. The percentages in the table have been calculated on the basis of

treating as outstanding for a particular person, all shares of our common stock outstanding on such date and all shares of our common

stock issuable to such holder in the event of exercise of outstanding options, warrants, rights or conversion privileges owned by such

person at said date which are exercisable within 60 days of February 15, 2024. Except as otherwise indicated, the persons listed below

have sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent such power may

be shared with a spouse. Except as otherwise indicated, the address of each of the persons in this table is c/o Better Choice Company,

12400 Race Track Road, Tampa, Florida 33626.

| | |

Shares Beneficially Owned | |

| Name of Beneficial Owner | |

Number (1) | | |

% | |

| Named Executive Officers and Directors: | |

| | | |

| | |

| Kent Cunningham | |

| — | | |

| — | % |

| Carolina Martinez | |

| — | | |

| — | % |

| John M. Word III | |

| 6,572,979 | | |

| 10.6 | % |

| Michael Young | |

| 2,326,081 | | |

| 5.9 | % |

| Lionel F. Conacher | |

| 1,445,193 | | |

| 3.9 | % |

| Gil Fronzaglia | |

| 630,945 | | |

| 1.6 | % |

| Arlene Dickinson | |

| 619,638 | | |

| 1.6 | % |

| All executive officers and directors as a group (9 persons) | |

| 11,594,836 | | |

| 30.1 | % |

| | |

| | | |

| | |

| 5% Shareholders: | |

| | | |

| | |

| HH-Halo LP | |

| 2,511,538 | | |

| 6.6 | % |

| Edward J. Brown | |

| 4,127,397 | | |

| 6.4 | % |

| (*) |

Represents

beneficial ownership of less than 1% of class. |

| |

|

| (1) |

In

calculating the number of shares beneficially owned by an individual or entity and the percentage ownership of that individual or

entity, shares underlying options, warrants or restricted stock units held by that individual or entity that are either currently

exercisable or exercisable within 60 days from the date hereof are deemed outstanding. These shares, however, are not deemed outstanding

for the purpose of computing the percentage ownership of any other individual or entity. Unless otherwise indicated and subject to

community property laws where applicable, the individuals and entities named in the table above have sole voting and investment power

with respect to all shares of our common stock shown as beneficially owned by them. |

PROPOSALS

BY SECURITY HOLDERS

The

Board knows of no other matters or proposals other than the actions described in this Information Statement which have been approved

or considered by the holders of a majority of the shares of the Company’s voting capital stock.

DISSENTERS’

RIGHTS

There

are no rights of appraisal or similar rights of dissenters with respect to any matter described in this Information Statement.

EXPENSES

The

costs of preparing, printing and mailing this Information Statement will be borne by the Company.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

STOCKHOLDERS’

RIGHTS

The

elimination of the need for a special meeting of the stockholders to approve the actions described in this Information Statement is authorized

by the DGCL which provides that any action required or permitted to be taken at a meeting of stockholders of a corporation may be taken

without a meeting, before or after the action, if a written consent thereto is signed by the stockholders holding at least a majority

of the voting power. In order to eliminate the costs and management time involved in holding a special meeting and in order to effect

the action disclosed herein as quickly as possible in order to accomplish the purposes of our Company, we chose to obtain the written

consent of a majority of our voting power to approve the action described in this Information Statement.

ADDITIONAL

INFORMATION

We

are subject to the disclosure requirements of the Exchange Act, and in accordance therewith, file reports, information statements and

other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information

filed by us can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington DC

20549. Copies of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street,

N.E., Washington DC 20549 at prescribed rates. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, information

statements and other information regarding issuers that file electronically with the SEC through the EDGAR system. You may request a

copy of documents filed with or furnished to the SEC by us, at no cost, by writing to Better Choice Company, Inc. 12400 Race Track Road,

Tampa, Florida 33626, Attn: Kent Cunningham, Chief Executive Officer, or by telephoning the Company at (212) 896-1254.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If

hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders

who share a single address unless we receive contrary instructions from any stockholder at that address. This practice, known

as “householding,” is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon

written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the

Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your

name, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement,

to Better Choice Company, Inc. 12400 Race Track Road, Tampa, Florida 33626, Attn: Kent Cunningham, Chief Executive Officer, or by telephoning

the Company at (212) 896-1254.

If

multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would

prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at,

its principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information

Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared

address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

NO

ADDITIONAL ACTION IS REQUIRED BY OUR STOCKHOLDERS IN CONNECTION WITH THESE ACTIONS. HOWEVER, SECTION 14C OF THE EXCHANGE ACT REQUIRES

THE MAILING TO OUR STOCKHOLDERS OF THE INFORMATION SET FORTH IN THIS INFORMATION STATEMENT AT LEAST 20 DAYS PRIOR TO THE EARLIEST DATE

ON WHICH THE CORPORATE ACTION MAY BE TAKEN.

| February

27, 2024 |

By

Order of the Board of Directors |

| |

|

| |

/s/

Kent Cunningham |

| |

Kent

Cunningham |

| |

Chief

Executive Officer |

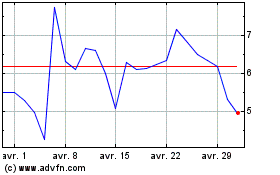

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024