Form DEF 14A - Other definitive proxy statements

08 Février 2024 - 9:27PM

Edgar (US Regulatory)

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

|

Filed

by a Party other than the Registrant ☐

|

Check

the appropriate box:

|

|

☐

|

Preliminary

Proxy Statement

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☒

|

Definitive

Proxy Statement

|

|

|

☐

|

Definitive

Additional Materials

|

|

|

☐

|

Soliciting

Material Pursuant to Section 240.14a-12

|

CENTRAL

SECURITIES CORPORATION

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

|

|

☒

|

No

fee required.

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

(5)

|

Total

fee paid:

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

|

|

|

(1)

|

Amount

Previously Paid

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

(3)

|

Filing

Party:

|

|

(4)

|

Date

Filed:

|

CENTRAL SECURITIES CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

March 27, 2024

NOTICE is hereby given to the Stockholders of Central Securities Corporation (the “Corporation”) that the 2024 Annual Meeting of Shareholders (the “Meeting”) will be held at the University Club, One West 54th Street, 7th Floor, New York, New York at 10:30 a.m. (Eastern Time) on Wednesday, March 27, 2024, for the following purposes:

1. To elect a board of seven directors;

2. To act upon a proposal to ratify the selection of KPMG LLP as the independent registered public accounting firm for the Corporation for the ensuing year; and

3. To act upon such other matters as may properly come before the Meeting.

The Board of Directors has fixed the close of business on February 2, 2024 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting, and only stockholders of record on such date are entitled to vote on these matters at the Meeting or any adjournment thereof.

By order of the Board of Directors,

Marlene A. Krumholz

Secretary

New York, New York

February 7, 2024

A proxy is enclosed with this Notice and Proxy Statement. Please complete, SIGN and promptly return your proxy in the enclosed envelope. This will assure a quorum and save further solicitation costs.

PROXY STATEMENT

February 7, 2024

CENTRAL SECURITIES CORPORATION

630 FIFTH AVENUE

NEW YORK, NEW YORK 10111

(Tel. No. 212-698-2020)

This Proxy Statement and the enclosed proxy card are first being mailed to stockholders on or about February 7, 2024 in connection with the solicitation of proxies by the Board of Directors of Central Securities Corporation (the “Corporation”) for use at the Annual Meeting of Stockholders of the Corporation to be held on March 27, 2024, or any adjournment thereof (the “Meeting”). Properly executed proxies received by the Corporation prior to the Meeting will be voted in accordance with the specific voting instructions indicated on the proxy. If no instructions are specified, the shares will be voted FOR the nominees for director (Proposal 1) and FOR Proposal 2. Any proxy may be revoked at any time before it is exercised at the Meeting by the delivery of written notice to the Secretary of the Corporation, by executing and delivering a later-dated proxy or by appearing and voting in person by ballot at the Meeting.

The record date for stockholders entitled to vote at the Meeting is the close of business on February 2, 2024. On that date, the Corporation had outstanding 28,387,828 shares of common stock, par value $1.00 (“Common Stock”).

The holders of the Corporation’s Common Stock shall be entitled to one vote per share. The presence, in person or by proxy, of a majority of the issued and outstanding stock of the Corporation shall constitute a quorum for the transaction of business at the Meeting.

VOTING PROCEDURES

The election of directors (Proposal 1) requires the affirmative vote of a plurality of the shares of Common Stock present in person or represented by proxy at the Meeting and entitled to so vote. Shares of Common Stock represented by proxies which are marked “withhold authority” with respect to the election of any one or more nominees for election as director will not be voted with respect to the nominee or nominees so indicated. The ratification of the selection of the independent registered public accounting firm of the Corporation (Proposal 2) requires the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the Meeting and entitled to so vote. Shares of Common Stock represented by proxies which are marked “abstain” with respect to Proposal 2 will be counted for the purpose of determining the number of shares present and entitled to vote, and shall therefore have the same effect as if the shares represented thereby were voted against such matter. Broker non-votes (where a

nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and such nominee does not possess or choose to exercise discretionary authority with respect thereto) will be treated as present for purposes of determining a quorum but not entitled to vote at the Meeting for the purpose of determining the number of votes needed with respect to each item to be voted upon, and shall therefore have no effect on Proposal 1 or Proposal 2.

SHARE OWNERSHIP OF DIRECTORS, NOMINEES FOR ELECTION TO

THE BOARD OF DIRECTORS, EXECUTIVE OFFICERS,

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information based on data provided to the Corporation, as of December 31, 2023, regarding the share ownership of each person who is known to the Corporation to have been a beneficial owner of more than five percent of the Common Stock of the Corporation, of each director, each nominee for election to the Board of Directors of the Corporation, of certain executive officers, and of all directors and executive officers as a group:

|

|

|

|

|

|

|

|

Name of Director, Nominee to the Board

of Directors, Officer, or Name

of Beneficial Owner and Address

|

|

Amount and

Nature of Beneficial

Ownership (1)

|

|

Percent

of Class

|

|

Independent Directors and nominees to the Board of Directors:

|

|

|

|

|

|

|

L. Price Blackford

|

|

44,571

|

|

(2

|

)

|

|

Simms C. Browning

|

|

23,226

|

|

(2

|

)

|

|

Donald G. Calder

|

|

114,535

|

(3)

|

(2

|

)

|

|

Jay R. Inglis

|

|

15,156

|

|

(2

|

)

|

|

David M. Poppe

|

|

14,171

|

|

(2

|

)

|

|

Interested Directors and nominees to the Board of Directors (4):

|

|

|

|

|

|

|

John C. Hill

|

|

67,963

|

|

(2

|

)

|

|

Wilmot H. Kidd

|

|

2,225,744

|

(5)

|

7.8

|

|

|

Wilmot H. Kidd IV

|

|

312,946

|

|

1.1

|

|

|

Other officers:

|

|

|

|

|

|

|

Marlene A. Krumholz

|

|

18,488

|

|

(2

|

)

|

|

Andrew J. O’Neill

|

|

84,039

|

|

(2

|

)

|

|

Lawrence P. Vogel

|

|

13,849

|

|

(2

|

)

|

|

All directors and officers as a group

|

|

2,934,688

|

|

10.3

|

|

|

Other greater than 5% beneficial owners:

|

|

|

|

|

|

|

The Endeavor Foundation, Inc. (6)

|

|

9,427,234

|

|

33.2

|

|

|

1060 Park Avenue

|

|

|

|

|

|

|

New York, New York 10128

|

|

|

|

|

|

|

Mrs. Wilmot H. Kidd

|

|

2,225,744

|

(6)

|

7.8

|

|

|

1060 Park Avenue

|

|

|

|

|

|

|

New York, New York 10128

|

|

|

|

|

|

(Footnotes on following page)

(Footnotes for table on previous page)

The address of each nominee to the Board of Directors and officer is c/o Central Securities Corporation, 630 Fifth Avenue, New York, New York, 10111.

(1)Except as otherwise indicated, to the Corporation’s knowledge the beneficial owner had sole investment power and sole voting power with respect to the shares shown opposite the name of such beneficial owner.

(2)As calculated on the basis of 28,387,828 shares of Common Stock outstanding on December 31, 2023, Messrs. Blackford, Browning, Calder, Inglis, Poppe, Hill, O’Neill, Vogel and Ms. Krumholz each owned less than 1 percent of the outstanding Common Stock.

(3)Includes 14,784 shares of Common Stock owned by Mr. Calder’s wife and 11,056 shares of Common Stock owned by the Donald Grant and Ann Martin Calder Foundation (the “Calder Foundation”). Mr. Calder is the President and Treasurer of the Calder Foundation. Mr. Calder disclaims beneficial ownership of all such shares.

(4)Each of Mr. Hill, Mr. Kidd and Mr. Kidd IV is an “interested person” as defined under the Investment Company Act of 1940, as amended. Mr. Hill is the Chief Executive Officer of the Corporation, Mr. Kidd is Chairman of the Corporation, and Mr. Kidd IV is the son of Mr. Kidd.

(5)An aggregate of 2,225,744 shares of Common Stock are included in the shares beneficially owned by each of Mr. and Mrs. Kidd. The shares set forth for each of Mr. and Mrs. Kidd include (i) 526,404 shares of Common Stock owned by a trust for the benefit of Mr. Kidd as to which Mr. Kidd had shared investment power and voting power and as to which Mrs. Kidd disclaims beneficial ownership; (ii) 692,799 shares of Common Stock held in trust for the benefit of Mrs. Kidd as to which Mr. and Mrs. Kidd had shared investment power and shared voting power and as to which Mr. Kidd disclaims beneficial ownership; (iii) 553,417 shares of Common Stock held in trust for the benefit of the adult children of Mr. and Mrs. Kidd as to which Mrs. Kidd had shared investment power and shared voting power and as to which Mr. and Mrs. Kidd disclaim beneficial ownership; (iv) 353,920 shares of Common Stock held either in trust or by a limited liability company for the benefit of the adult children of Mr. and Mrs. Kidd as to which Mr. and Mrs. Kidd had shared investment power and shared voting power and as to which Mr. and Mrs. Kidd disclaim beneficial ownership; and (v) 85,176 shares of Common Stock held in trust for the benefit of the adult children of Mr. and Mrs. Kidd as to which Mrs. Kidd had investment and voting power and as to which Mr. and Mrs. Kidd disclaim beneficial ownership. The shares set forth for each of Mr. and Mrs. Kidd also include 14,028 shares of Common Stock held in trust for the benefit of other non-related individuals, as to which Mr. Kidd had shared investment power and shared voting power and as to which Mr. and Mrs. Kidd disclaim beneficial ownership.

(6)Mrs. Wilmot H. Kidd, whose husband is the Chairman of the Corporation, is President and a Trustee of The Endeavor Foundation, Inc.

VALUE OF BENEFICIAL SHARE OWNERSHIP BY DIRECTORS

The dollar range of the value of equity securities of the Corporation beneficially owned by each director as of December 31, 2023, is as follows:

|

|

|

|

|

Independent Directors

|

|

Dollar Range of

Share Ownership

|

|

L. Price Blackford

|

|

Over $100,000

|

|

Simms C. Browning

|

|

Over $100,000

|

|

Donald G. Calder

|

|

Over $100,000

|

|

Jay R. Inglis

|

|

Over $100,000

|

|

David M. Poppe

|

|

Over $100,000

|

|

|

|

|

|

Interested Directors

|

|

|

|

John C. Hill

|

|

Over $100,000

|

|

Wilmot H. Kidd

|

|

Over $100,000

|

|

Wilmot H. Kidd IV

|

|

Over $100,000

|

PROPOSAL 1. ELECTION OF DIRECTORS

Upon the death of director David C. Colander in December 2023, the Board of Directors reduced the number of Directors constituting the full Board to eight. Upon the death of director Jay R. Inglis in January 2024, the Board of Directors further reduced the number of Directors constituting the full Board to seven. The Board of Directors nominates, based on the recommendation of the Corporation’s Compensation and Nominating Committee, seven directors to hold office until the next Annual Meeting of Stockholders and until their successors are elected and qualified. The Board of Directors seeks as directors individuals who have high integrity, business acumen, maintain an owner-oriented attitude and possess a genuine interest in the Corporation. The Board of Directors has nominated and recommends for election Mr. L. Price Blackford, Mr. Simms C. Browning, Mr. Donald G. Calder, Mr. John C. Hill, Mr. Wilmot H. Kidd, Mr. Wilmot H. Kidd IV and Mr. David M. Poppe. All of the nominees have consented to become directors and all were elected at the last Annual Meeting of Stockholders.

Duly authorized proxies will be voted for the above-listed nominees. If any nominee for director is unable or declines to serve, for any reason, the discretionary authority provided in the proxy will be exercised to vote for a substitute. Information about the nominees, including positions with the Corporation and directorships of public corporations during the past five years, is set forth below. This information includes the experience, qualifications and skills that each individual brings to the Board.

Independent Directors:

L. Price Blackford, age 72, has been a director of the Corporation since 2012. He currently serves as the Corporation’s Lead Independent Director. He has been a Managing Director with Scott-Macon Group, Inc., an investment bank, since 2013. He has served as a director of Maersk Line, Limited (shipping and transportation) since 2017. Mr. Blackford brings to the Board experience in mergers and acquisitions, recapitalizations, financing and general corporate finance advisory activities.

Simms C. Browning, age 83, has been a director of the Corporation since 2005. Mr. Browning retired in 2003 following a 33-year career with Neuberger Berman, LLC, an asset manager, where he served as a Vice President in research, sales and asset management capacities. He is a certified financial analyst. Mr. Browning brings to the Board extensive experience in research and investing.

Donald G. Calder, age 86, has been a director of the Corporation since 1982. Mr. Calder was the Chairman of Clear Harbor Asset Management, LLC from 2010 to 2020 after a 45-year affiliation with G.L. Ohrstrom & Co., a private investment firm, where he served as President. Mr. Calder previously served as a director of Brown-Forman Corporation until 2010, Carlisle Companies, Inc. until 2009 and Roper Technologies, Inc. until 2008. Mr. Calder brings to the Board knowledge of private equity investing. Mr. Calder’s prior service on other public company boards provides him with valuable experience.

David M. Poppe, age 59, has been a director of the Corporation since 2020. He has served as President of Giverny Capital Asset Management since 2020. Prior thereto, he was a private investor after a twenty-year career with Ruane, Cunniff & Goldfarb (“RCG”), the investment adviser to Sequoia Fund. He served as Chief Executive Officer of RCG from 2016 to 2018, and as President of RCG from 2006 to 2016. He served as a Director and Co-manager of Sequoia Fund from 2006 to 2016. He brings extensive investment experience as well as corporate governance experience to the Board.

Interested Directors:

John C. Hill, age 50, has been a director of the Corporation since 2021 and Chief Executive Officer of the Corporation since January 1, 2022. Mr. Hill has also served as President of the Corporation since 2018. Mr. Hill joined the Corporation in 2016 as a Vice President and was an Analyst with Davis Advisers, an investment management firm, prior thereto. Mr. Hill is primarily responsible for the Corporation’s investments and research and oversees its operations. Mr. Hill brings extensive investment experience and knowledge of the Corporation’s operations to the Board.

Wilmot H. Kidd, age 82, has been a director of the Corporation since 1972 and is Chairman of the Board of Directors. He served as its President from 1973 to 2018, and Chief Executive Officer from 2018 to 2021. Mr. Kidd has provided guidance to the Corporation and brings to the Board an understanding of the Corporation and its strategy acquired through fifty years of involvement with the Corporation. Mr. Kidd was also a director of Silvercrest Asset Management Group Inc. from 2013 to 2020.

Wilmot H. Kidd IV, age 44, has been a director of the Corporation since 2017. He has been an independent photographer, cinematographer and film producer since 2005. Certain of his works elaborate on the architectural documentary photography tradition and have been influenced by his experience with cinema and literature. He brings to the Board a deep knowledge of the history of the Corporation. He is the son of the Corporation’s Chairman and former Chief Executive Officer, Wilmot H. Kidd.

The Board believes that each director’s experience, qualifications, attributes and skills should be evaluated on an individual basis and in consideration of the perspective such director brings to the entire Board, with no single director, or particular factor, being indicative of Board effectiveness.

Board Composition and Leadership Structure

Currently, all of the directors are independent except Mr. Hill, Mr. Kidd and Mr. Kidd IV, each of whom is an “interested person” as defined under the Investment Company Act of 1940, as amended (the “Act”). Mr. Kidd is the Chairman of the Board of Directors. The Board has also designated a Lead Independent Director who presides over executive sessions of the directors and serves between meetings as a liaison between the directors and management on various matters, including determining agenda items for Board meetings. Currently, Mr. Blackford serves as the Lead Independent Director; however, the individual designated as Lead Independent Director may rotate from time to time. The Board holds executive sessions, without interested directors or members of management, at least quarterly.

The Board has determined that its current leadership structure is appropriate because it enables the Board to exercise informed and independent judgment. Mr. Kidd’s extensive knowledge of the Corporation together with his strategic abilities provides the Board with strong leadership and helps improve the efficiency of decision making by the Board. The Board believes that this leadership structure is in the best interest of the Corporation and its stockholders at this time in light of Mr. Kidd’s unique qualifications, and that the appropriate leadership structure is a matter that should be discussed and determined by the Board from time to time based on all of the then-existing facts and circumstances.

Board Committees and Meetings

The Board of Directors held eight regular meetings in 2023. All directors attended at least 75 percent of the meetings of the Board of Directors and meetings of the committees on which they served except Mr. Poppe who attended 73 percent. The Board of Directors maintains an Audit Committee and a Compensation and Nominating Committee. Both the Audit Committee and the Compensation and Nominating Committee consist of Messrs. Blackford, Browning, Calder and Poppe, each of whom are independent as defined in Section 803(A) of the NYSE American exchange’s listing standards and none of whom are “interested persons” as defined under the Act.

The Audit Committee assists the Board of Directors by overseeing the accounting and financial reporting process of the Corporation and the audits of its financial statements. It operates subject to a charter which has been reviewed by the Audit Committee and approved and adopted by the Board of Directors. The Audit Committee charter may be viewed on the Corporation’s website at www.centralsecurities.com. The Audit Committee met twice during 2023.

The Compensation and Nominating Committee is responsible for the review and recommendation of candidates for the Board of Directors. In addition to these responsibilities, the Compensation and Nominating Committee reviews and approves the compensation of the officers of the Corporation. The Compensation and Nominating Committee operates pursuant to the terms of a charter which may be viewed on the Corporation’s website at www.centralsecurities.com. The Compensation and Nominating Committee met once during 2023.

The Compensation and Nominating Committee considers director nominee recommendations by stockholders provided that the names of such nominees, accompanied by relevant biographical information, are submitted in writing to the Secretary of the Corporation. Any such recommendation must be accompanied by a written statement from the individual indicating his or her consent to be named as a candidate, and, if nominated and elected, willingness to serve as director.

The process that the Compensation and Nominating Committee uses in reviewing and recommending candidates includes identifying, through soliciting, recruiting and interviewing, candidates who meet the current needs of the Board. The Compensation and Nominating Committee does not have any specific minimum qualifications that must be met by a nominee. The Compensation and Nominating Committee considers, among other things, an individual’s judgment, background and experience. Each director should have very high integrity, the ability to work constructively with others, business acumen, an owner-oriented attitude and a genuine interest in the Corporation. With respect to nomination of continuing directors, the individual’s past service to the Board is also considered. Each director should have sufficient time available to devote to the affairs of the Corporation and should be free of any conflict which would interfere with the proper performance of the responsibilities of a director. The independence requirements of NYSE American and whether the individual is an “interested person” under the Act are also considered. The Compensation and Nominating Committee does not have a formal policy regarding the consideration of diversity of Board candidates. There are no differences in the manner in which the Compensation and Nominating Committee evaluates stockholder-recommended director nominees.

Oversight Responsibilities

The Corporation’s operations entail a variety of risks including investment, administration, valuation and compliance matters. Although management of the Corporation is responsible for managing these risks on a day-to-day basis, the Board also addresses these risks as part of its regular meetings. In particular, as part of its general oversight, the Board reviews with management the risks being undertaken by the Corporation. The Audit Committee discusses the Corporation’s financial reporting and internal controls with management and the independent registered public accounting firm engaged by the Corporation. The Board also receives periodic reports from the Corporation’s Chief Compliance Officer regarding compliance matters relating to the Corporation and its major service providers, including the results of the implementation and testing of compliance programs. The Board reviews valuation policies and procedures and with the assistance of management, determines the valuation of significant illiquid securities. The Board’s oversight function is facilitated by management reporting processes that are designed to provide visibility to the Board about the identification, assessment and management of critical risks and the controls, policies and procedures to mitigate those risks. The Corporation believes that its leadership structure enhances risk oversight.

Stockholder Communications

Stockholders may send written communications to any member of the Board of Directors c/o Secretary, Central Securities Corporation, 630 Fifth Avenue, New York, New York, 10111. All communications will be compiled by the Secretary of the Corporation and submitted to the applicable director.

Each of the Corporation’s directors is encouraged to attend the annual meeting of stockholders. Each of the Corporation’s directors attended the Corporation’s 2023 Annual Meeting.

The Board of Directors recommends a vote FOR the election of each of the seven nominees for director.

EXECUTIVE OFFICERS OF THE CORPORATION

The executive officers of the Corporation are Mr. John C. Hill, Chief Executive Officer and President; Ms. Marlene A. Krumholz, Vice President, Secretary and Chief Compliance Officer; Mr. Andrew J. O’Neill, Vice President; and Mr. Lawrence P. Vogel, Vice President and Treasurer. Information concerning Mr. Hill is given above under “Election of Directors.” Ms. Krumholz, 60, was elected Secretary in 2001, Chief Compliance Officer in 2004, and Vice President in 2009. Mr. O’Neill, 51, joined the Corporation in 2009 and was elected Vice President in 2011. Mr. Vogel, 67, joined the Corporation in 2009 and was elected Vice President in 2009 and Treasurer in 2010. Executive officers serve as such until the election of their successors.

COMPENSATION

The table below sets forth for all directors and for each of the three highest-paid executive officers the aggregate compensation received from the Corporation for 2023 for services in all capacities:

|

|

|

|

|

|

|

|

|

Name of Person, Position

|

|

Aggregate

Compensation (1)

|

|

Pension or

Retirement

Benefits Accrued

as Part of

Expenses (1)

|

|

L. Price Blackford

|

|

|

|

|

|

|

|

Director

|

|

$61,000

|

|

|

—

|

|

|

Simms C. Browning

|

|

|

|

|

|

|

|

Director

|

|

50,000

|

|

|

—

|

|

|

Donald G. Calder

|

|

|

|

|

|

|

|

Director

|

|

51,000

|

|

|

—

|

|

|

David C. Colander

|

|

|

|

|

|

|

|

Director

|

|

49,000

|

|

|

—

|

|

|

Jay R. Inglis

|

|

|

|

|

|

|

|

Director

|

|

51,000

|

|

|

—

|

|

|

Wilmot H. Kidd

|

|

|

|

|

|

|

|

Chairman (2)(6)

|

|

208,000

|

|

|

—

|

|

|

Wilmot H. Kidd IV

|

|

|

|

|

|

|

|

Director (2)

|

|

48,000

|

|

|

—

|

|

|

David M. Poppe

|

|

|

|

|

|

|

|

Director

|

|

48,000

|

|

|

—

|

|

|

John C. Hill

|

|

|

|

|

|

|

|

Chief Executive Officer, President and Director (2)(3)

|

|

1,549,500

|

|

|

$49,500

|

|

|

Andrew J. O’Neill

|

|

|

|

|

|

|

|

Vice President

|

|

999,500

|

|

|

49,500

|

|

|

Lawrence P. Vogel

|

|

|

|

|

|

|

|

Vice President and Treasurer

|

|

623,000

|

|

|

49,500

|

|

(1) Represents contributions to the Corporation’s 401(k) Profit Sharing Plan, and are also included in the column “Aggregate Compensation.”

(2) This individual is an interested person under the Act.

(3) All remuneration received by Mr. Hill was in his capacity as Chief Executive Officer and President of the Corporation.

In 2023, each director who was not an officer was paid an annual retainer of $40,000 and a fee of $1,000 for each Board of Directors meeting that they participate in. Each member of the Audit Committee and the Compensation and Nominating Committee received an additional payment of $1,000 for each committee meeting that they participate in. The Lead Independent Director was paid an additional annual retainer of $10,000. Mr. Wilmot Kidd receives an additional annual retainer of $160,000 for his strategic consulting with management of the Corporation based on the value that his many years of experience with the Corporation and the investment management industry bring to such consulting. Directors are reimbursed for their out-of-pocket expenses incurred in attending meetings and industry conferences.

401(k) Profit Sharing Plan

The Corporation maintains a 401(k) Profit Sharing Plan (the “Profit Sharing Plan”). Generally, all salaried employees of the Corporation are eligible to participate in the Profit Sharing Plan. Employees are able to make pre-tax or after-tax contributions from their compensation to the Profit Sharing Plan, subject to Internal Revenue Code limitations. In addition, the Profit Sharing Plan allows contributions by the Corporation from its profits of up to 25 percent of an employee’s compensation. The Corporation has agreed to contribute at least three percent of each participant’s qualifying compensation to the Profit Sharing Plan, which is immediately vested. For the year ended December 31, 2023, the Corporation contributed 15 percent of employee compensation to the Profit Sharing Plan, subject to Internal Revenue Code limitations. Each participant’s contributions received from the Corporation in excess of three percent are fully vested after three years of employment. Under the Profit Sharing Plan, each employee is permitted to invest the assets in his account in the capital stock of one or more investment companies including that of the Corporation.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed the audited financial statements of the Corporation for the year ended December 31, 2023, and has met with management and KPMG LLP, the Corporation’s independent registered public accounting firm, to discuss the audited financial statements.

The Audit Committee received from KPMG LLP written disclosures regarding its independence and the letter required by the applicable requirements of the Public Company Accounting Oversight Board (United States) (“PCAOB”), and has discussed with KPMG LLP its independence. In connection with its review, the Audit Committee has also discussed with KPMG LLP the matters required to be discussed by the applicable requirements of the PCAOB.

Members of the Audit Committee necessarily rely on the information provided to them by management and the independent auditors. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Corporation’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Corporation’s auditors are “independent.”

Based on its review and discussions with management and KPMG LLP, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Corporation’s Annual Report to Stockholders for the year ended December 31, 2023.

Members of the Audit Committee are:

L. Price Blackford

Simms C. Browning

Donald G. Calder

David M. Poppe

January 31, 2024

PROPOSAL 2. RATIFICATION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Pursuant to its charter, the Audit Committee is responsible for recommending the selection, approving the compensation and overseeing the independence, qualifications and performance of the independent accountants. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants. In assessing requests for services by the independent accountants, the Audit Committee considers whether such services are consistent with the auditor’s independence; whether the independent accountants are likely to provide the most effective and efficient service based upon their familiarity with the Corporation; and whether the service could enhance the Corporation’s ability to manage or control risk or improve audit quality. The Audit Committee may delegate pre-approval authority to one or more of its members. Any pre-approvals by a member under this delegation are to be reported to the Audit Committee at its next scheduled meeting.

Audit Fees and Services

During the last two fiscal years, the Corporation engaged KPMG LLP for its services as follows:

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

|

2022

|

|

|

Audit fees

|

|

$147,500

|

(1)

|

|

$141,500

|

(1)

|

|

Audit-related fees

|

|

—

|

|

|

—

|

|

|

Tax fees

|

|

30,100

|

(2)

|

|

29,000

|

(2)

|

|

All other fees

|

|

—

|

|

|

—

|

|

|

Total

|

|

$177,600

|

|

|

$170,500

|

|

(1)Includes fees for review of the Corporation’s semi-annual financial statements and audit of the annual financial statements included in reports to stockholders.

(2)Includes fees for services performed with respect to tax compliance and tax planning.

All of the services provided by KPMG LLP for fiscal years 2023 and 2022 (described in the footnotes to the table above) and related fees were approved in advance by the Audit Committee.

At a meeting held January 31, 2024, the Audit Committee recommended and a majority of the directors who were not “interested persons” (as defined under the Act) selected KPMG LLP to act as independent registered public accountants for the Corporation during 2024. A representative of KPMG LLP is not expected to be present at the Meeting.

Stockholders are invited to ratify the selection of KPMG LLP as the independent registered public accounting firm of the Corporation for the year 2024. KPMG LLP has no direct or material indirect financial interest in the Corporation other than its employment in such capacity.

The Board of Directors recommends a vote FOR this proposal.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires our directors, officers or persons who beneficially own more than 10% of any class of our equity securities to file with the SEC reports of ownership and changes in ownership of the Corporation’s common stock held by them. Copies of these reports must also be provided to the Corporation. Based on our review of these reports, we believe that, during the year ended December 31, 2023, all such reports that were required to be filed were filed on a timely basis.

OTHER MATTERS

The Board of Directors knows of no other matters which may properly be, and are likely to be, brought before the Meeting. However, if any proper matters are brought before the Meeting, the persons named in the enclosed form of proxy will have discretionary authority to vote thereon according to their best judgment.

2025 STOCKHOLDER PROPOSALS

Any stockholder proposals for inclusion in the Corporation’s proxy statement for the 2025 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities and Exchange Act of 1934 (“Rule 14a-8 proposals”) must be received by the Corporation at its office at 630 Fifth Avenue, New York, New York 10111 on or prior to October 10, 2024.

The Corporation’s current Bylaws include an advance notice provision. Stockholders who intend to present a proposal at the 2025 Annual Meeting without including such proposal in the Corporation’s proxy statement as a Rule 14a-8 proposal must provide the Corporation of notice of such proposal no later than December 27, 2024 and no earlier than November 27, 2024 in accordance with the requirements of the Corporation’s Bylaws. For full details on the advance notice requirements, please contact the Corporation’s Secretary for a copy of the Corporation’s current Bylaws.

MISCELLANEOUS

The Corporation will pay all costs of soliciting proxies in the accompanying form. Solicitation will be made by mail, and officers and regular employees of the Corporation may also solicit proxies by telephone or personal interview. The Corporation will request brokers, banks and nominees who hold stock in their names to furnish this proxy material to the beneficial owners thereof and to solicit proxies from them, and will reimburse such brokers, banks and nominees for their out-of-pocket and reasonable clerical expenses in connection therewith.

A copy of the Annual Report including financial statements for the year ended December 31, 2023 is enclosed.

Please date, sign and return the enclosed proxy at your earliest convenience. No postage is required for mailing in the United States.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDER MEETING TO BE HELD ON MARCH 27, 2024

This Proxy Statement and the Annual Report are available free of charge on the Corporation’s website at www.centralsecurities.com/reports.

|

CENTRAL

SECURITIES CORPORATION

PO Box 43131

Providence,

RI 02940-3131

|

EVERY

VOTE IS IMPORTANT

EASY

VOTING OPTIONS:

|

| |

|

|

|

| |

|

|

VOTE ON THE INTERNET

Log on to:

www.proxy-direct.com

or scan the QR code

Follow the on-screen instructions

available 24 hours |

| |

|

|

|

| |

|

|

VOTE BY PHONE

Call 1-800-337-3503

Follow the recorded instructions

available 24 hours |

| |

|

|

|

| |

|

|

VOTE BY MAIL

Vote, sign and

date this Proxy

Card and return in the

postage-paid envelope |

| |

|

|

|

| |

|

|

VOTE IN PERSON

Attend Stockholder

Meeting

The University Club

One West 54th ST, 7th Floor,

New York, NY 10019

on March 27, 2024 |

Please

detach at perforation before mailing.

CENTRAL

SECURITIES CORPORATION

PROXY

FOR ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON MARCH 27, 2024, at 10:30 a.m. Eastern Time

This

proxy is solicited on behalf of the Board of Directors of the Company. The undersigned hereby appoints JOHN C. HILL and MARLENE

A. KRUMHOLZ, and each of them, as attorneys with power of substitution, to represent the undersigned at the annual meeting of stockholders

of Central Securities Corporation to be held at The University Club, One West 54th Street, 7th Floor, New York,

NY 10019 on March 27, 2024 at 10:30 a.m. (Eastern time), and at any adjournments thereof, on all matters which may properly come before

the meeting.

A

majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that

one) shall have and may exercise all of the power and authority of said proxies hereunder. The undersigned hereby revokes any proxy previously

given.

This

proxy when properly executed will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, this

proxy will be voted FOR the election of directors and FOR Proposal 2. Please refer to the Proxy Statement for a discussion of the Proposals.

| |

VOTE

VIA THE INTERNET: www.proxy-direct.com

VOTE

VIA THE TELEPHONE: 1-800-337-3503

|

| |

|

|

|

| |

|

|

|

CSC_33755_012924

PLEASE

SIGN, DATE ON THE REVERSE SIDE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

STOCKHOLDER’S VOTE IS IMPORTANT!

VOTE

THIS PROXY CARD TODAY!

Important

Notice Regarding the Availability of Proxy Materials for the

Annual

Meeting of Stockholders to be held on March 27, 2024.

The

Proxy Statement and Proxy Card for this Meeting are available at:

https://www.proxy-direct.com/csc-33755

IF

YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU

NEED NOT RETURN THIS PROXY CARD

Please

detach at perforation before mailing.

TO

VOTE, MARK A BOX BELOW IN BLUE OR BLACK INK. EXAMPLE: ☒

| A | Proposals

THE BOARD OF DIRECTORS RECOMMEND A VOTE “FOR” ALL THE NOMINEES LISTED

AND “FOR” PROPOSAL 2. |

| 1. |

Election of Directors: |

FOR |

WITHHOLD |

FOR ALL |

|

| |

|

|

|

|

|

|

ALL |

ALL |

EXCEPT |

|

| |

01. |

L. Price Blackford |

02. |

Simms C. Browning |

03. |

Donald G. Calder |

☐ |

☐ |

☐ |

|

| |

04. |

John C. Hill |

05. |

Wilmot H.

Kidd |

06. |

Wilmot H.

Kidd IV |

|

|

|

|

| |

07. |

David M. Poppe |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

INSTRUCTIONS: To withhold authority

to vote for any individual nominee(s), mark the box

“FOR ALL EXCEPT” and write the nominee’s number on the line provided below. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

FOR |

AGAINST |

ABSTAIN |

|

| 2. |

Ratification of the appointment of KPMG LLP

as independent registered public accounting firm for 2024. |

☐ |

☐ |

☐ |

|

| |

|

|

|

|

|

|

|

|

|

|

| B | Authorized

Signatures ─ This section must be completed for your vote to be counted.─ Sign

and Date Below |

Note:

Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign.

When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative

capacity, please give the full title under the signature.

| Date

(mm/dd/yyyy) ─ Please print date below |

|

Signature

1 ─ Please keep signature within the box |

|

Signature

2 ─ Please keep signature within the box |

| /

/ |

|

|

|

|

| |

|

|

|

|

| Scanner

bar code |

| xxxxxxxxxxxxxx |

|

CSC 33755 |

|

xxxxxxxx |

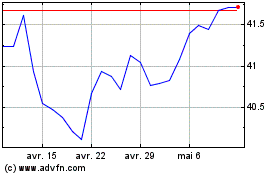

Central Securities (AMEX:CET)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Central Securities (AMEX:CET)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024