Caledonia Mining Corporation Plc ("

Caledonia" or

the "

Company") (NYSE AMERICAN: CMCL; AIM: CMCL;

VFEX: CMCL) is pleased to announce that, further to the

announcement made at 7.05 a.m. today regarding the Fundraise (the

“

Launch Announcement”), it has raised, subject to

certain conditions, approximately £8.7 million (approximately

US$10.6 million) before expenses under the Placing. The Placing

received strong support from new and existing institutional

investors. As announced in the Launch Announcement, it is expected

that the Zimbabwe Placing will remain open until 12.00 p.m. on 31

March 2023 and a further announcement will be made in respect

thereof in due course.

A total of 781,749 Placing

Shares have been placed with domestic and international

institutional and sophisticated investors, conditional on

Admission, at the Placing Price. Cenkos, Liberum, and Standard Bank

acted as joint bookrunners in relation to the Placing.

The net proceeds of the Fundraise, together with

the Company's existing cash reserves and the future cash to be

generated from its ownership of the producing and cash generative

Blanket Mine and from the Bilboes oxide operation, will strengthen

the Company’s balance sheet and provide the Company with working

capital flexibility to accelerate planned work at the three new

gold projects it is currently undertaking in Zimbabwe.

Caledonia Mining Corporation Plc, Chief

Executive Officer, Mark Learmonth, commented:

“This modest fund raise allows us to accelerate

progress on our very attractive package of exploration and

development assets in Zimbabwe. In addition, I am pleased to see a

range of institutional investors who support Caledonia’s long-term

vision join the share register.”

Director / PDMR Dealing

Mark Learmonth, Chief Executive Officer, and

Toziyana Resources Limited (“Toziyana Resources”),

a company affiliated with Victor Gapare, executive Director of the

Company, have conditionally subscribed for 3,587 Placing Shares and

11,000 Placing Shares respectively, both at the Placing Price. The

resultant interests in shares of Mark Learmonth and Victor Gapare

are as follows:

|

Director |

CommonShares heldprior toPlacing |

Percentageinterest prior toPlacing |

Number of newCommon Sharesallocatedpursuant toPlacing |

Number ofCommon Sharesheld immediatelyafterAdmission |

PercentageinterestimmediatelyafterAdmission |

|

Mark Learmonth |

181,397 |

1.05% |

3,587 |

184,984 |

1.02% |

|

Victor Gapare¹ |

2,279,074 |

13.19% |

11,000 |

2,290,074 |

12.68% |

¹ Victor Gapare is the settlor of the trust which owns Toziyana

Resources and is therefore considered to be interested in such

Common Shares

Mark Learmonth and Victor Gapare are both

considered to be “Persons Discharging Managerial Responsibility”

within the meaning of the MAR (“PDMRs”) and copies of notification

forms are included below.

Admission, settlement and dealings

An application has been made to the London Stock

Exchange (“LSE”) for 781,749 Placing Shares to be

admitted to trading on AIM (“Admission”), with

Admission expected to occur at 8.00 a.m. on 30 March 2023. The

Placing Shares will rank pari passu with the Common Shares in the

Company, with settlement scheduled for 30 March 2023.

Following the issue of the 781,749 Placing

Shares, the Company will have a total of 18,065,061 Common Shares

in issue, all of which have voting rights. The figure of 18,065,061

Common Shares may be used by shareholders as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or change their interest in, the

Company.

Other than where defined, capitalised terms used

in this announcement have the meanings given to them in the Launch

Announcement.

Enquiries:

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel:

+44 7817 841 793 |

|

|

|

|

Cenkos Securities plc (Nomad and Joint

Bookrunner)Adrian HaddenNeil McDonaldGeorge Lawson |

Tel: +44 207 397 1965Tel: +44 131

220 9771Tel: +44 207 397 8966 |

|

|

|

| Liberum Capital Limited

(Joint Bookrunner)Scott MathiesonKane CollingsLucas

Bamber |

Tel: +44 20 3100 2000 |

| |

|

| The Standard Bank of

South Africa Limited (Joint Bookrunner)Sthembiso

MajolaAnders Alfredson |

Tel: +27 11 344 5891Tel

+44 203 1675174 |

| |

|

| IH Securities (Private)

Limited (VFEX Sponsor - Zimbabwe)Lloyd Mlotshwa |

Tel: +263 242 745 119 |

| BlytheRay Financial PR

(UK)Tim Blythe/Megan Ray |

Tel: +44 207 138 3204 |

| |

|

| 3PPB (Financial PR, North

America)Patrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203

940 2538 |

| |

|

| Curate Public Relations

(Zimbabwe)Debra Tatenda |

Tel: +263 7780 2131Tel: +263

(242) 745 119/33/39 |

IMPORTANT NOTICES

This announcement is not for publication or

distribution, directly or indirectly, in or into the United States

of America. This announcement is not an offer of securities for

sale into the United States. The securities referred to herein have

not been and will not be registered under the U.S. Securities Act

of 1933, as amended, and may not be offered or sold in the United

States, except pursuant to an applicable exemption from

registration. No public offering of securities is being made in the

United States.

Cenkos and Liberum are authorised and regulated

by the Financial Conduct Authority (the "FCA") in the United

Kingdom and are acting exclusively for the Company and no one else

in connection with the Bookbuilding process and the Placing will

not regard anyone (including any Placees) (whether or not a

recipient of this Announcement) as a client, and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Bookbuild and/or the Placing or any other matters

referred to in this Announcement.

Standard Bank is acting exclusively for the

Company and no one else in connection with the Bookbuild and the

Placing, and will not regard anyone (including the Placees)

(whether or not a recipient of this document) as a client in

relation to the Placing, and will not be responsible to anyone

other than the Company for providing the protections afforded to

their respective clients, nor for providing advice, in relation to

the Bookbuild and/or the Placing or any other matter referred to in

this Announcement.

Forward-looking statements

This announcement may include certain

"forward-looking statements" and "forward-looking information"

under applicable securities laws. Except for statements of

historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are

frequently characterised by words such as "plan", "expect",

"project", "intend", "believe", "anticipate", "estimate", and other

similar words, or statements that certain events or conditions

"may" or "will" occur. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements. Assumptions upon which

such forward-looking statements are based include that all required

third party regulatory and governmental approvals will be obtained.

Many of these assumptions are based on factors and events that are

not within the control of the Company and there is no assurance

they will prove to be correct. Factors that could cause actual

results to vary materially from results anticipated by such

forward-looking statements include changes in market conditions and

other risk factors discussed or referred to in this announcement

and other documents filed with the applicable securities regulatory

authorities. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

The Company undertakes no obligation to update forward-looking

statements if circumstances or management's estimates or opinions

should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking

statements.

General

Neither the content of the Company's website (or

any other website) nor any website accessible by hyperlinks on the

Company's website (or any other website) or any previous

announcement made by the Company is incorporated in, or forms part

of, this Announcement.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY

PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM

|

1 |

Details of the person discharging managerial

responsibilities / person closely associated |

|

a) |

Name |

Mark Learmonth |

|

2 |

Reason for the notification |

|

a) |

Position/status |

Chief Executive Officer |

|

b) |

Initial notification/Amendment |

Initial Notification |

|

3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name |

Caledonia Mining Corporation Plc |

|

b) |

LEI |

21380093ZBI4BFM75Y51 |

|

4 |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument |

Depositary interests representing common shares of no par

value |

|

|

Identification code |

JE00BF0XVB15 |

|

b) |

Nature of the transaction |

Purchase of Placing Shares |

|

c) |

Price(s) and volumes(s) |

Price(s) |

Volume(s) |

|

£11.15 |

3,587 |

|

d) |

Aggregated information |

N/A single transaction |

|

|

Aggregated volume |

N/A single transaction |

|

|

Price |

N/A single transaction |

|

e) |

Date of the transaction |

24 March 2023 |

|

f) |

Place of the transaction |

Outside of a trading venue |

|

1 |

Details of the person discharging managerial

responsibilities / person closely associated |

|

a) |

Name |

Victor Gapare through Toziyana Resources Limited |

|

2 |

Reason for the notification |

|

a) |

Position/status |

Executive Director |

|

b) |

Initial notification/Amendment |

Initial Notification |

|

3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name |

Caledonia Mining Corporation Plc |

|

b) |

LEI |

21380093ZBI4BFM75Y51 |

|

4 |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument |

Depositary interests representing common shares of no par

value |

|

|

Identification code |

JE00BF0XVB15 |

|

b) |

Nature of the transaction |

Purchase of Placing Shares |

|

c) |

Price(s) and volumes(s) |

Price(s) |

Volume(s) |

|

£11.15 |

11,000 |

|

d) |

Aggregated information |

N/A single transaction |

|

|

Aggregated volume |

N/A single transaction |

|

|

Price |

N/A single transaction |

|

e) |

Date of the transaction |

24 March 2023 |

|

f) |

Place of the transaction |

Outside of a trading venue |

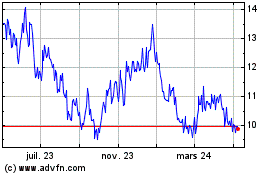

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

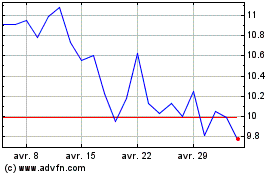

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024