0001026655false3/11/2024800 Manor Park DriveColumbusOhio00010266552024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2024

Core Molding Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-12505 | 31-1481870 | |

| (State or other jurisdiction incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| | | | |

| 800 Manor Park Drive, Columbus, Ohio | | 43228-0183 | |

| (Address of principal executive office) | | (Zip Code) | |

Registrant’s telephone number, including area code: (614) 870-5000

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | CMT | NYSE American LLC |

| Preferred Stock purchase rights, par value $0.01 | N/A | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01 Entry into a Material Definitive Agreement

On March 7, 2024, Core Molding Technologies, Inc. (the “Company”) entered into a First Amendment (the “First Amendment”) to the Credit Agreement dated July 22, 2022 (the “Credit Agreement”) with The Huntington National Bank, as administrative agent, sole lead arranger and sole bookrunner, and the lenders from time-to-time party thereto. Unless otherwise defined herein, defined terms shall have the meanings set forth in the Credit Agreement. The First Amendment increased the Restricted Payments the Company may make for the purpose of repurchasing Equity Interests of the Company under any share buyback plan from an aggregate amount not to exceed $500,000 in any calendar year to an aggregate amount not to exceed $5,000,000 in any calendar year.

The foregoing descriptions of the First Amendment do not purport to be complete and are qualified in their entirety by reference to the First Amendment, a copy of which is attached to this Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 Other Events

On March 11, 2024, Core Molding Technologies, Inc. (the “Company”) issued a press release announcing that its Board of Directors has approved a stock repurchase program authorizing the Company to repurchase up to $7,500,000 of its outstanding shares of common stock. Repurchases of shares of common stock under the stock repurchase program will be made in the open market and in accordance with applicable securities laws. The stock repurchase program does not obligate the Company to acquire any particular amount of common stock, and it may be suspended or terminated at any time at the Company’s discretion. The foregoing description of the press release is qualified in its entirety by reference to the complete text of the press release furnished as Exhibit 99.1 hereto, which is hereby incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | CORE MOLDING TECHNOLOGIES, INC. |

| | |

| Date: March 11, 2024 | | By: | | /s/ John P. Zimmer |

| | Name: | | John P. Zimmer |

| | Title: | | Executive Vice President, Treasurer, Secretary and Chief Financial Officer |

FIRST AMENDMENT TO

CREDIT AGREEMENT

THIS FIRST AMENDMENT TO CREDIT AGREEMENT (this “Amendment”), is entered as of March 7, 2024 (the “Amendment Effective Date”), by and among CORE MOLDING TECHNOLOGIES, INC., a Delaware corporation (the “Borrower”), the other Loan Parties party hereto, the Lenders party hereto, and THE HUNTINGTON NATIONAL BANK, a national banking association, as Administrative Agent (the “Administrative Agent”). All capitalized terms used herein which are defined in the Credit Agreement (as defined below) and not otherwise defined herein shall have the meanings given in the Credit Agreement.

Recitals

A.The Borrower, the other Loan Parties party thereto, the Lenders party thereto and the Administrative Agent have entered into that certain Credit Agreement, dated as of July 22, 2022 (as the same may be further amended, restated, modified or supplemented from time to time, the “Credit Agreement”), pursuant to which the Lenders have made, and will continue to make, certain loans and other financial accommodations available to the Borrower; and

B.The Borrower, the other Loan Parties, the Lenders and the Administrative Agent desire to make certain amendments to the Credit Agreement, all as more fully set forth herein.

Agreement

NOW, THEREFORE, the parties hereto, intending to be legally bound, hereby agree as follows:

1.Amendment to the Credit Agreement. Section 5.15 of the Credit Agreement is hereby amended and restated in its entirety as follows:

“5.15 Restricted Payments. No Company shall make or commit itself to make any Restricted Payment at any time; provided, however, that so long as no Default or Event Default has occurred and is continuing or would result therefrom, the Borrower may make Restricted Payments for the purpose of repurchasing Equity Interests of the Borrower under the existing share buyback plan, as it may be amended from time to time, or under any other share buyback plan approved from time to time by the Borrower’s board of directors, in an aggregate amount not to exceed $5,000,000 in any calendar year.”

2.Representations and Warranties. Each Loan Party hereby represents and warrants to the Administrative Agent and the Lenders as follows:

2.1 Authority; Execution; Enforceability. Each Loan Party has full power and authority to enter into and to perform its obligations under this Amendment, and the execution and delivery of, and the performance of its obligations under and arising out of, this Amendment has been duly authorized by all necessary action. This Amendment has been duly and validly executed by an authorized officer of each Loan Party and constitutes the legal, valid and binding obligation of the Loan Parties enforceable against the Loan Parties in accordance with its terms,

except that the enforceability thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by application of general principles of equity (regardless of whether enforcement is considered in proceedings at law or in equity).

2.2 Representations. The representations and warranties of the Loan Parties contained in the Credit Agreement and the other Loan Documents are true and correct in all material respects as of the Amendment Effective Date. Each Loan Party hereby ratifies and confirms the Loan Documents to which such Loan Party is a party.

2.3 No Default. No Default or Event of Default has occurred and is continuing.

3.Reaffirmation. Each Loan Party, under each of the Loan Documents (in each case, where applicable, as amended and restated or otherwise amended or modified as of the Amendment Effective Date pursuant to this Amendment or otherwise) to which it is a party (including in the capacity of obligor, grantor, mortgagor, pledgor, guarantor, indemnitor and assignor, as applicable, and each other similar capacity, if any, in which such Loan Party has granted Liens on all or any part of the properties or assets of such Loan Party, or otherwise acts as an accommodation party, guarantor, indemnitor or surety with respect to all or any part of the Secured Obligations), hereby (i) acknowledges agrees that the terms and provisions hereof shall not affect in any way any payment, performance, observance or other obligations or liabilities of the Loan Parties hereunder or under any of the other Loan Documents, all of which obligations and liabilities shall remain in full force and effect and extend to the further loans, extensions of credit and other Secured Obligations incurred hereunder and under the Loan Documents, and each of which obligations and liabilities are hereby ratified, confirmed and reaffirmed in all respects, and (ii) acknowledges and agrees that all references in the Credit Agreement to the “Agreement” and all references in the Loan Documents to the “Credit Agreement” shall each refer to the Credit Agreement as amended hereby. Each Loan Party, the Administrative Agent and the Lenders hereby expressly intend that this Amendment shall not in any manner: (a) constitute the refinancing, refunding, payment or extinguishment of the existing Secured Obligations; (b) be deemed to evidence a novation of the outstanding balance of the Secured Obligations; or (c) affect, replace, impair, or extinguish the creation, attachment, perfection or priority of the Liens on the Collateral granted pursuant to any of the Security Documents. Each Loan Party ratifies and reaffirms any and all grants of Liens in the Collateral to the Administrative Agent, for the benefit of the Secured Parties, as security for the Secured Obligations, and each Loan Party acknowledges and confirms that the grant of the Liens in the Collateral to the Administrative Agent, for the benefit of the Secured Parties: (i) represent continuing Liens on all of the Collateral, (ii) secure all of the Secured Obligations, and (iii) represent valid, first-priority Liens on all of the Collateral except to the extent, if any, of Liens permitted under Section 5.9 of the Credit Agreement.

4.Conditions Precedent To Effectiveness. In addition to all of the other conditions and agreements set forth herein, the effectiveness of this Amendment is subject to the each of the following conditions precedent:

4.1 Amendment to Credit Agreement. The Administrative Agent shall have received this Amendment, duly completed, executed and delivered by each Loan Party and each Lender.

4.2 Fees. On or before the Amendment Effective Date, the Administrative Agent shall have received all fees (if any) required to be paid to the Administrative Agent on behalf of the Lenders on or prior to the Amendment Effective Date pursuant to this Amendment or the Credit Agreement.

5.Miscellaneous.

5.1 Governing Law; Severability. This Amendment shall be governed by, and construed in accordance with, the law of the state of Ohio. If any term of this Amendment is found invalid under Ohio law or laws of mandatory application by a court of competent jurisdiction, the invalid term will be considered excluded from this Amendment and will not invalidate the remaining terms of this Amendment.

5.2 Captions. Captions and section headings used in this Amendment are included solely for convenience of reference and are not intended to affect the interpretation of any provision of this Amendment.

5.3 Counterparts; Entire Agreement; Electronic Signature. This Amendment may be executed in any number of counterparts, each of which shall be identical and all of which, taken together, shall constitute one and the same instrument, and any of the parties hereto may execute this Amendment by signing any such counterpart. This Amendment sets forth the entire agreement of the parties with respect to its subject matter and supersedes all previous understandings, written or oral, in respect thereof. Any documents delivered by, or on behalf of, any party to this Amendment by fax transmission or other electronic delivery of an image file reflecting the execution hereof: (i) may be relied on by each other party to this Amendment as if the document were a manually signed original and (ii) will be binding on each party to this Amendment for all purposes of the Loan Documents. In the event of any discrepancy between the terms of this Amendment and the Credit Agreement, this Amendment shall control.

5.4 Release. Each Loan Party acknowledges that (a) as of the Amendment Effective Date, such Loan Party has no defenses, claims or set-offs to the enforcement of any liabilities, obligations and agreements owing to the Administrative Agent or any other Secured Party and (b) the Administrative Agent and each other Secured Party have fully performed all obligations to the Loan Parties that the Administrative Agent or any other Secured Party may have had or have on and as of the Amendment Effective Date. Each Loan Party hereby irrevocably releases and forever discharges the Administrative Agent, each Secured Party, and each of the foregoing’s respective affiliates, subsidiaries, successors, assigns, directors, officers, employees, agents, consultants and attorneys (each, a “Released Person”) of and from all damages, losses, claims, demands, liabilities, obligations, actions or causes of action whatsoever that such Loan Party may now have or claim to

have currently against any Released Person on account of or in any way concerning, arising out of or founded upon this Amendment, the Credit Agreement or any other Loan Document, whether presently known or unknown and of every nature and extent whatsoever, but only to the extent relating to matters arising on or before the Amendment Effective Date.

5.5 Costs and Expenses. As a condition of this Amendment, the Borrower will promptly on demand pay or reimburse the Administrative Agent for all out-of-pocket costs and expenses incurred by the Administrative Agent in connection with this Amendment and the transactions contemplated hereby and in connection herewith, including, without limitation, reasonable attorneys’ fees.

[Signature pages to follow]

IN WITNESS WHEREOF, the parties hereto have duly executed and delivered this Amendment to be effective as of the Amendment Effective Date.

ADMINISTRATIVE AGENT AND LENDER:

THE HUNTINGTON NATIONAL BANK,

a national banking association

By: /s/ Viren Patel

Viren Patel, Senior Vice President

SIGNATURE PAGE TO

FIRST AMENDMENT TO

CREDIT AGREEMENT

BORROWER:

CORE MOLDING TECHNOLOGIES, INC.,

a Delaware corporation

By: /s/ John P. Zimmer

John P. Zimmer, Executive Vice President,

Secretary, Treasurer and Chief Financial Officer

LOAN PARTIES:

CORE COMPOSITES CORPORATION,

a Delaware corporation

By: /s/ John P. Zimmer

John P. Zimmer, Executive Vice President,

Secretary, Treasurer and Chief Financial Officer

HORIZON PLASTICS INTERNATIONAL INC.,

a British Columbia company

By: /s/ John P. Zimmer

John P. Zimmer, Chief Financial Officer

SIGNATURE PAGE TO

FIRST AMENDMENT TO

CREDIT AGREEMENT

FOR IMMEDIATE RELEASE

Core Molding Technologies Announces $7,500,000 Stock Repurchase Program

COLUMBUS, OH, March 11, 2024 – Core Molding Technologies, Inc. (NYSE American: CMT) (“Core Molding”, “Core” or the “Company”), a leading engineered materials company specializing in molded structural products, principally in building products, industrial and utilities, medium and heavy-duty truck and powersports industries across the United States, Canada and Mexico, today announced that its Board of Directors authorized a stock repurchase program of up to $7,500,000 of the Company’s issued and outstanding common stock, par value $1.00 per share.

“The combination of the Company’s operational performance and the strength of the balance sheet enables the Company to allocate capital to the repurchase of Company shares while also allocating capital to the growth of the Company,” said Core Chief Executive Officer David Duvall. “The timing of this decision is just another step in the Company’s transformation plan that started several years ago.”

Repurchases of shares of common stock under the stock repurchase program will be made in the open market and in accordance with applicable securities laws. The stock repurchase program does not obligate the Company to acquire any particular amount of common stock, and it may be suspended or terminated at any time at the Company’s discretion.

About Core Molding Technologies, Inc.

Core Molding Technologies is a leading engineered materials company specializing in molded structural products, principally in building products, utilities, transportation and powersports industries across North America. The Company operates in one operating segment as a molder of thermoplastic and thermoset structural products. The Company’s operating segment consists of one reporting unit, Core Molding Technologies. The Company offers customers a wide range of manufacturing processes to fit various program volume and investment requirements. These thermoset processes include compression molding of sheet molding compound (“SMC”), resin transfer molding (“RTM”), liquid molding of dicyclopentadiene (“DCPD”), spray-up and hand-lay-up. The thermoplastic processes include direct long-fiber thermoplastics (“DLFT”) and structural foam and structural web injection molding. Core Molding Technologies serves a wide variety of markets, including the medium and heavy-duty truck, marine, automotive, agriculture, construction, and other commercial products. The demand for Core Molding Technologies’ products is affected by economic conditions in the United States, Mexico, and Canada. Core Molding Technologies’ operations may change proportionately more than revenues from operations.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws that are subject to risks and uncertainties. These statements often include words

such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about the Company’s expectations for future periods with respect to its plans to improve financial results and the future of the Company’s end markets. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: general macroeconomic, social, regulatory and political conditions, including uncertainties surrounding volatility in financial markets; the short-term and long-term impact of the coronavirus (COVID-19) pandemic, or other pandemics in the future, on our business; changes in the plastics, transportation, marine and commercial product industries; efforts of the Company to expand its customer base and develop new products to diversify markets, materials and processes and increase operational enhancements; the Company’s initiatives to quote and execute manufacturing processes for new business, acquire raw materials, address inflationary pressures, regulatory matters and labor relations; and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including those included in the Company’s filings with the SEC. There can be no assurance that statements made in this press release relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements.

Company Contact

Core Molding Technologies, Inc.

John Zimmer

Executive Vice President & Chief Financial Officer

jzimmer@coremt.com

Investor Relations Contact

Three Part Advisors, LLC

Sandy Martin or Steven Hooser

214-616-2207

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

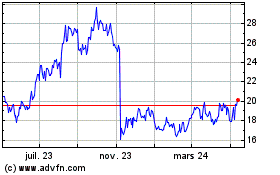

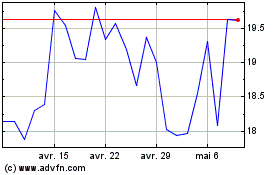

Core Molding Technologies (AMEX:CMT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Core Molding Technologies (AMEX:CMT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024