UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2023.

Commission File Number: 001-40673

Cybin Inc.

(Exact Name of Registrant as Specified in Charter)

100 King Street West, Suite 5600, Toronto, Ontario, M5X 1C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F □ Form 40-F ⊠

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Form 6-K of Cybin Inc. (the “Company”) is hereby incorporated by reference into the Registration Statement on Form F-10 (File No. 333-272706) of the Company, as amended or supplemented.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | CYBIN INC. | |

| | (Registrant) | |

| | | | |

| Date: | October 27, 2023 | By: | /s/ Doug Drysdale | |

| | Name: | Doug Drysdale | |

| | Title: | Chief Executive Officer | |

EXHIBIT INDEX

FORM 51-102F4

BUSINESS ACQUISITION REPORT

Item 1 — Identity of Company

1.1 — Name and Address of Company

Cybin Inc. (“Cybin” or the “Company”)

100 King St. West, Suite 5600

Toronto, Ontario M5X 1C9

1.2 — Executive Officer

Greg Cavers

Chief Financial Officer

1-866-292-4601 ext. 715

Item 2 — Details of Acquisition

2.1 — Nature of Business Acquired

On October 23, 2023, Cybin acquired all of the issued and outstanding securities of Small Pharma Inc. (“Small Pharma”) by way of a plan of arrangement under Division 5 of Part 9 of the Business Corporations Act (British Columbia) (the “Arrangement”). The Arrangement was completed pursuant to the terms of an arrangement agreement between Cybin and Small Pharma dated August 28, 2023 (the “Arrangement Agreement”), a copy of which is available on SEDAR+ under Cybin’s profile at www.sedar.com.

Small Pharma is a biotechnology company progressing short-duration psychedelic-assisted therapies for the treatment of mental health conditions. Small Pharma has initiated programs across its “first-generation” and “second-generation” psychedelics portfolio. It is focused on the development of pharmaceutical psychedelic assets with the inclusion of support therapy, anticipating this treatment paradigm to be important for optimizing beneficial patient outcomes.

Small Pharma is focused on the research and development (“R&D”) of pharmaceutical drugs, with an intention to further advance its current portfolio into and through clinical trials towards commercialization. This progression may also extend to the sales and marketing of any of its assets that receive marketing authorization. In addition, Small Pharma may expand its R&D pipeline by initiating additional development programs.

Small Pharma has initiated and progressed its R&D efforts on four therapeutic candidates across its psychedelic and non-psychedelic compounds. It has two clinical stage development programs: SPL026 (injectable N, N-dimethyltryptamine (“DMT”)) and SPL028 (injectable deuterated DMT); two pre-clinical development programs: SPL029 (oral tryptamine) and SPL801B (oral ketamine metabolite); and additional preclinical research programs.

In line with its business model, the Corporation has ensured an intellectual property strategy is embedded in the development of all its therapeutic candidates. As at October 23, 2023 (the “Effective Date”), Small Pharma’s patent portfolio consisting of 17 active patent families with 92 pending applications and 30 granted patents across its psychedelic and non-psychedelic portfolio.

Additional information concerning Small Pharma, including information with respect to Small Pharma’s assets, operations and history prior to the Arrangement, may be found in Small Pharma’s annual information form dated September 12, 2023, for the year ended February 28, 2023, (the “Small Pharma AIF”), which is filed and available on SEDAR+ under Small Pharma’s profile at www.sedarplus.com. The Small Pharma AIF does not form part of, and is not incorporated by reference in, this report.

In connection with completion of the Arrangement, the common shares of Small Pharma (“Small Pharma Shares”) were voluntarily de-listed from the TSX Venture Exchange (the “TSXV”) and Small Pharma ceased to be a reporting issuer in all of the provinces and territories of Canada

2.2 — Acquisition Date

October 23, 2023.

2.3 — Consideration

As consideration for the acquisition of all of the issued and outstanding Small Pharma securities, former holders of Small Pharma Shares received 0.2409 common shares of Cybin (“Cybin Shares”) for each Small Pharma Share held. The aggregate consideration paid by Cybin for the Small Pharma Shares was approximately 80,945,254 Cybin Shares.

In addition, pursuant to the Arrangement, holders of outstanding options to purchase Small Pharma Shares (“Small Pharma Options”) that were “in-the-money” based on the volume weighted average trading price of the Small Pharma Shares on the TSXV for the five trading days immediately preceding the effective time of the Arrangement (the “Small Pharma Share Value”) received from Small Pharma such number of Small Pharma Shares equal to the number of Small Pharma Options held, multiplied by the amount by which the Small Pharma Share Value exceeded the exercise price of such Small Pharma Options, divided by the Small Pharma Share Value. These newly issued Small Pharma Shares were acquired by Cybin on the same terms as the other Small Pharma Shares. Each Small Pharma Option that was “out-of-the-money” based on the Small Pharma Share Value was deemed to be surrendered to Small Pharma for a cash payment of $0.001 per Small Pharma Option and cancelled.

Full details of the Arrangement are set out in the management information circular of Cybin dated September 13, 2023 (the “Cybin Circular”), a copy of which can be found under the Cybin’s profile on SEDAR+ at www.sedarplus.com.

2.4 — Effect on Financial Position

Cybin presently has no plans or proposals for material changes in Cybin’s business affairs or the affairs of the Small Pharma that may have a significant effect on the results of operations and financial position of Cybin.

For information relating to the anticipated effect of the Arrangement on Cybin’s financial performance and financial position, please refer to the unaudited pro forma combined financial statements and the accompanying notes thereto referred to under Item 3 below.

2.5 — Prior Valuations

To the knowledge of Cybin, there has been no valuation opinion obtained within the last 12 months by Small Pharma or Cybin required by securities legislation or a Canadian exchange or market to support the consideration paid by Cybin or any of its subsidiaries for Small Pharma.

2.6 — Parties to Transaction

The Arrangement was not with an “informed person” (as such term is defined in Section 1.1 of National Instrument 51-102 – Continuous Disclosure Obligations), associate or affiliate of Cybin.

2.7 — Date of Report

October 27, 2023

Item 3 — Financial Statements and Other Information

The following financial statements of Small Pharma, which have been filed on Small Pharma SEDAR+ profile at www.sedarplus.com, are incorporated by reference in, and form a part of, this business acquisition report:

(a) the audited consolidated financial statements for the financial years ended February 28, 2023 and 2022, together with the independent auditor’s report thereon and the notes thereto; and

(b) the unaudited interim condensed consolidated financial statements for the three months ended May 31, 2023 and 2022.

MNP LLP, the auditors of Small Pharma, consented to the incorporation by reference of their audit report on the financial statements of Small Pharma set out in (a) above into the Cybin Circular. As such, Cybin has not requested or obtained the consent of MNP LLP to include such audit report into this business acquisition report.

The following pro forma financial statements (collectively, the “Pro Forma Statements”) of Cybin are attached as Schedule “A” to this business acquisition report:

(a) the unaudited pro forma consolidated statement of financial position as at June 30, 2023;

(b) the unaudited pro forma consolidated statements of loss and comprehensive loss for the twelve months ended March 31, 2023, and for the three months ended June 30, 2023, including pro forma earnings (loss) per share; and

(c) notes to the unaudited pro forma consolidated financial statements.

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in this report, and in certain documents incorporated by reference herein, constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws (collectively, “forward-looking statements”). All statements other than statements of historical fact, including, without limitation, those regarding future financial position, business strategy, plans and objectives of management for future operations or changes, and any statements preceded by, followed by or that include the words “expect”, “likely”, “may”, “will”, “should”, “intend”, or “anticipate”, “potential”, “proposed”, “estimate”, “pro forma”, and “post-Arrangement” and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy, are forward-looking statements.

These forward-looking statements reflect management’s current beliefs and are based on information currently available to management, as well as certain expectations and assumptions with respect to the Arrangement. Although the forward-looking statements contained in this report, including in documents incorporated by reference into this report, are based upon assumptions that management currently believes to be reasonable based on information available to management as at the date of this report, there can be no assurance that actual results, performance or achievements will be consistent with these forward looking statements.

Forward-looking statements involve significant risks and uncertainties. A number of factors could cause actual results to differ materially from those anticipated in such forward-looking statements, including the risk factors described in the Company’s most recent Annual Information Form and other documents filed with the Canadian and United States securities regulatory authorities. Such risk factors are not exhaustive and there may be other factors that could affect the Company. Accordingly, you should not place undue reliance on forward-looking statements. For more information regarding the forward-looking statements in the documents incorporated by reference in this report, including the assumptions upon which they are based and the risk factors in respect of such forward-looking statements, please refer to the cautionary

notes regarding forward-looking statements in the documents in which the forward-looking statements are contained. Such documents are available online under the Company’s SEDAR+ profile at www.sedarplus.com, and on EDGAR at www.sec.com.

The forward-looking statements contained in this report are made as at the date of this report. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise, other than as required by law.

Cautionary Note Regarding Pro Forma Statements

The Pro Forma Statements have been prepared using certain of the Company’s and Small Pharma’s respective historical consolidated financial statements as more particularly described in the notes to such Pro Forma Statements. The Pro Forma Statements are not intended to be indicative of the results that would actually have occurred, or the results expected in future periods, had the events reflected in the Pro Forma Statements occurred on the dates indicated. Since the Pro Forma Statements were developed to retroactively show the effect of a transaction that occurred at a later date, and even though they were prepared following generally accepted practice using reasonable assumptions, the Pro Forma Statements reflect limitations inherent in the very nature of pro forma data. The data contained in the Pro Forma Statements represents only a simulation of the potential financial impact of the Arrangement and related adjustments which are preliminary in nature. The underlying assumptions for the pro forma adjustments provide a reasonable basis for presenting the financial effect directly attributable to the Arrangement. These pro forma adjustments are tentative and are based on currently available financial information, and certain estimates and assumptions that the Company believes are reasonable in the circumstances, as described in the notes to the Pro Forma Financial Statements. However, adjustments and assumptions of this nature require the exercise of judgement and are difficult to make with complete accuracy, and the estimates and assumptions reflected in the Pro Forma Statements may not, with the passage of time, turn out to be relevant or correct. The actual adjustments to the consolidated financial statements will depend on a number of factors. Therefore, it is expected that the actual adjustments will differ from the pro forma adjustments, and the differences may be material. Undue reliance should not be placed on the Pro Forma Statements.

SCHEDULE “A”

PRO FORMA STATEMENTS

See attached.

CYBIN INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at June 30, 2023

(Expressed in thousands of Canadian dollars)

CYBIN INC.

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

CYBIN INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at June 30, 2023

(Expressed in thousands of Canadian dollars)

| | | | | | | | | | | | | | | | | |

| Cybin Inc. June 30, 2023 $ | Small Pharma Inc. May 31, 2023 $ | Pro Forma Adjustments $ | Notes | Unaudited Pro Forma Consolidated June 30, 2023 $ |

| ASSETS | | | | | |

| Current | | | | | |

| Cash | 9,349 | 13,152 | (5,250) | 6(a) | |

| | | 411 | 4 | 17,662 |

| Accounts receivable | 3,211 | 626 | – | | 3,837 |

| Prepaid expenses | 1,300 | 874 | – | | 2,174 |

| Other current assets | 1,787 | – | – | | 1,787 |

| Total Current Assets | 15,647 | 14,652 | (4,839) | | 25,460 |

| | | | | |

| Non-current | | | | | |

| Equipment | 388 | 49 | – | | 437 |

| Right of use asset | – | 541 | – | | 541 |

| Intangible assets | 5,401 | – | – | | 5,401 |

| Goodwill | 24,255 | – | 21,201 | 5 | 45,456 |

| Total Non-Current Assets | 30,044 | 590 | 21,201 | | 51,835 |

| TOTAL ASSETS | 45,691 | 15,242 | 16,362 | | 77,295 |

| | | | | |

| LIABILITIES | | | | | |

| Current | | | | | |

| Accounts payable and accrued liabilities | 5,999 | 2,687 | – | | 8,686 |

| Lease Liabilities | – | 315 | – | | 315 |

| Total Current Liabilities | 5,999 | 3,002 | - | | 9,001 |

| | | | | |

| Non-current | | | | | |

| Lease Liabilities | – | 233 | – | | 233 |

| Total Non-Current Liabilities | – | 233 | – | | 233 |

| TOTAL LIABILITIES | 5,999 | 3,235 | – | | 9,234 |

| | | | | |

| SHAREHOLDERS' EQUITY | | | | | |

| Share capital | 161,682 | 69,723 | (69,723) | 6(b) | |

| | | 33,619 | 4 | 195,301 |

| Contributed surplus | 2,277 | – | – | | 2,277 |

| Share-based payment reserve | – | 4,233 | (4,233) | 7 | – |

| Options reserve | 28,383 | – | – | | 28,383 |

| Warrants reserve | 10,873 | – | – | | 10,873 |

| Accumulated other comprehensive deficit | (858) | (1,665) | 1,665 | 6(b) | (858) |

| Deficit | (162,665) | (60,284) | 60,284 | 6(b) | |

| | | (5,250) | 6(a) | (167,915) |

| TOTAL SHAREHOLDERS' EQUITY | 39,692 | 12,007 | 16,362 | | 68,061 |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | 45,691 | 15,242 | 16,362 | | 77,295 |

CYBIN INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF LOSS AND COMPREHENSIVE LOSS

For the three months ended June 30, 2023

(Expressed in thousands of Canadian dollars)

| | | | | | | | | | | | | | | | | |

| Cybin Inc. | Small Pharma Inc. | Pro Forma Adjustments | Notes | Unaudited Pro Forma Consolidated |

| Three months ended June 30, 2023 $ | Three months ended May 31, 2023 $ |

$ | | $ |

| EXPENSES | | | | | |

| Research | 6,384 | – | 2,494 | 3(i) | |

| | | 455 | 3(l) | 9,333 |

| General and administrative costs | 5,048 | – | 1,550 | 3(a)-(h) | |

| | | 1,131 | 3(l) | 7,729 |

| Share-based compensation | 1,275 | | 115 | 3(k) | 1,390 |

| Investor and public relations | – | 170 | (170) | 3(a) | – |

| Consulting fees | – | 5 | (5) | 3(b) | – |

| Depreciation | – | 86 | (86) | 3(c) | – |

| Directors’ fees | – | 82 | (82) | 3(d) | – |

| Foreign exchange loss | – | 4 | (4) | 3(j) | – |

| Office and miscellaneous | – | 247 | (247) | 3(e) | – |

| Professional fees | – | 933 | (933) | 3(f) | – |

| Occupancy costs | – | 13 | (13) | 3(g) | – |

| Research and development | – | 2,494 | (2,494) | 3(i) | – |

| Salaries and benefits | – | 1,586 | (1,586) | 3(l) | – |

| Share-based payment expense | – | 115 | (115) | 3(k) | – |

| Transfer agent and filing fees | – | 14 | (14) | 3(h) | – |

| TOTAL EXPENSES | 12,707 | 5,749 | (4) | | 18,452 |

| | | | | |

| OTHER INCOME (EXPENSES) | | | | | |

| Foreign currency translation gain (loss) | (1,891) | – | (4) | 3(j) | (1,895) |

| Interest income | 84 | 113 | – | | 197 |

| Interest expense | – | (8) | – | | (8) |

| TOTAL OTHER INCOME (EXPENSES) | (1,807) | 105 | (4) | | (1,706) |

| | | | | |

| NET LOSS FOR THE PERIOD | (14,514) | (5,644) | – | | (20,158) |

| | | | | |

| OTHER COMPREHENSIVE LOSS | | | | | |

| Foreign currency translation differences for foreign operations | 1,177 | 378 | – | | 1,555 |

| COMPREHENSIVE LOSS FOR THE PERIOD | (13,337) | (5,266) | – | | (18,603) |

| | | | | |

| Basic loss per share for the period attributable to common shareholders | (0.07) | | | | (0.07) |

| Weighted average number of common shares outstanding - basic | 206,157,780 | | 80,367,585 | 4 | 286,525,365 |

CYBIN INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF LOSS AND COMPRENSIVE LOSS

For the twelve months ended March 31, 2023

(Expressed in thousands of Canadian dollars)

| | | | | | | | | | | | | | | | | |

| Cybin Inc. | Small Pharma Inc. | Pro Forma Adjustments | Notes | Unaudited Pro Forma Consolidated |

| Year ended March 31, 2023 $ | Year ended February 28, 2023 $ | $ | $ |

| EXPENSES | | | | | |

| Research | 25,491 | – | 11,382 | 3(u) | |

| | | 2,008 | 3(x) | 38,881 |

| General and administrative costs | 21,341 | – | 6,255 | 3(m)-(t) | |

| | | 3,867 | 3(x) | |

| | | 5,250 | 6(a) | 36,713 |

| Share-based compensation | 4,686 | – | 1,189 | 3(w) | 5,875 |

| Investor and public relations | – | 1,241 | (1,241) | 3(m) | – |

| Consulting fees | – | 482 | (482) | 3(n) | – |

| Depreciation | – | 48 | (48) | 3(o) | – |

| Directors’ fees | – | 345 | (345) | 3(p) | – |

| Foreign exchange loss | – | 41 | (41) | 3(v) | – |

| Office and miscellaneous | – | 864 | (864) | 3(q) | – |

| Professional fees | – | 2,898 | (2,898) | 3(r) | – |

| Occupancy costs | – | 199 | (199) | 3(s) | – |

| Research and development | – | 11,382 | (11,382) | 3(u) | – |

| Salaries and benefits | – | 5,875 | (5,875) | 3(x) | – |

| Share-based payment expense | – | 1,189 | (1,189) | 3(w) | – |

| Transfer agent and filing fees | – | 178 | (178) | 3(t) | – |

| TOTAL EXPENSES | 51,518 | 24,742 | 5,209 | | 81,469 |

| | | | | |

| OTHER INCOME (EXPENSES) | | | | | |

| Foreign currency translation gain (loss) | 4,027 | – | (41) | 3(v) | 3,986 |

| Interest income | 603 | 21 | – | | 624 |

| Change in fair value of investments measured at fair value through profit or loss | (260) | – | – | | (260) |

| Contingent consideration accretion | (13) | – | – | | (13) |

| Change in fair value of contingent consideration | (329) | – | – | | (329) |

| Interest expense | – | – | – | | - |

| TOTAL OTHER INCOME (EXPENSES) | 4,028 | 21 | (41) | | 4,008 |

| | | | | |

| NET LOSS FOR THE PERIOD BEFORE INCOME TAX | (47,490) | (24,721) | (5,250) | | (77,461) |

| | | | | |

| Income tax recovery | – | 1,885 | – | | 1,885 |

| NET LOSS FOR THE PERIOD | (47,490) | (22,836) | (5,250) | | (75,576) |

| | | | | |

| OTHER COMPREHENSIVE LOSS | | | | | |

| Foreign currency translation differences for foreign operations | (1,669) | (1,849) | – | | (3,518) |

| COMPREHENSIVE LOSS FOR THE PERIOD | (49,159) | (24,685) | (5,250) | | (79,094) |

| | | | | |

| Basic loss per share for the period attributable to common shareholders | (0.26) | | | | (0.28) |

| Weighted average number of common shares outstanding - basic | 185,428,767 | | 80,367,585 | 4 | 265,796,352 |

CYBIN INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of Canadian dollars except for share and option amounts and share and option prices)

1. ACQUISITION OF SMALL PHARMA

Cybin Inc. (“Cybin”) is a clinical-stage biopharmaceutical company committed to revolutionizing mental healthcare by developing new and innovative psychedelic-based treatment options. On August 29, 2023, Cybin entered into a definitive agreement with Small Pharma Inc. (“Small Pharma”), in which Cybin is to acquire Small Pharma in an all-shares transaction (the “Transaction”).

Under the terms of the Transaction, Cybin is to acquire all of the issued and outstanding common shares of Small Pharma at a fixed exchange ratio of 0.2409 Cybin common shares for each Small Pharma common share. The exchange ratio implies a 43.6% premium to Small Pharma’s 30-day volume weighted average closing share price for the 30-day period ended August 25, 2023.

2. BASIS OF PRESENTATION

The accompanying unaudited pro forma consolidated financial statements (the “Pro Forma Consolidated Financial Statements”) of Cybin have been prepared from information derived from, and should be read in conjunction with the following:

the audited annual consolidated financial statements of Cybin, together with the notes thereto, as at and for the year ended March 31, 2023 as filed on SEDAR;

the unaudited interim consolidated financial statements of Cybin, together with the notes thereto, as at and for the three-month periods ended June 30, 2023 and 2022 as filed on SEDAR;

the audited annual consolidated financial statements of Small Pharma, together with the notes thereto, as at and for the year ended February 28, 2023 as filed on SEDAR, and

the unaudited interim consolidated financial statements of Small Pharma, together with the notes thereto, as at and for the three-month periods ended May 31, 2023 and 2022 as filed on SEDAR;

The Pro Forma Consolidated Financial Statements are based on Cybin’s historical consolidated financial statements as well as Small Pharma’s historical consolidated financial statements, as adjusted to give effect to the Transaction.

The accompanying unaudited pro forma consolidated statement of financial position as at June 30, 2023 has been prepared as if the acquisition of Small Pharma has occurred on June 30, 2023. The unaudited pro forma consolidated statements of income and loss for the year ended March 31, 2023, and three-month period ended June 30, 2023, have been prepared to give effect to the acquisition of Small Pharma as if it had occurred on April 1, 2022.

The historical consolidated financial information of Cybin and Small Pharma are presented in accordance with the International Financial Reporting Standards (“IFRS”) and therefore, there were no significant adjustments to Small Pharma’s consolidated financial statements to conform to Cybin’s accounting framework. The assumptions and estimates underlying the adjustments to the Pro Forma Consolidated Financial Statements are described in the accompanying notes, which should be read together with the Pro Forma Consolidated Financial Statements. These Pro Forma Consolidated Financial Statements have been prepared by Management of Cybin in accordance with IFRS on a consistent basis with those disclosed in Note 2 of Cybin’s consolidated financial statements as at and for the year ended March 31, 2023 and Note 2 to Cybin’s condensed interim consolidated financial statements as at and for the three-month period ended June 30, 2023.

In preparing the Pro Forma Consolidated Financial Statements, Management reviewed Small Pharma’s accounting policies and financial statement presentation to identify any differences between Cybin’s and Small Pharma’s IFRS accounting policies and financial statement presentation. Certain historical balances have been reclassified to conform to Cybin’s financial statement presentation and for the purposes of the pro forma presentation. Additional accounting

CYBIN INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of Canadian dollars except for share and option amounts and share and option prices)

policy and financial statement presentation differences may be identified after the filing of this circular as more information is obtained by Cybin, and therefore these adjustments are subject to change.

It is management’s opinion that the Pro Forma Consolidated Financial Statements have been prepared within acceptable limits of materiality, using accounting policies consistent with IFRS appropriate in the circumstances. The Pro Forma Consolidated Financial Statements are not intended to reflect the consolidated financial position and consolidated financial performance of the companies which would have actually resulted had the Transaction been affected on the dates indicated. Actual amounts recorded upon consummation of the Transaction will differ from those recorded in the Pro Forma Consolidated Financial Statements and the differences may be material. Management has not made any fair value adjustment allocation to the value of the acquired assets and liabilities on the balance sheet of Small Pharma due to the uncertainty with respect to the measurement of amounts at this time.

3. ADJUSTMENTS TO SMALL PHARMA’S FINANCIAL STATEMENTS

Reclassifications to Small Pharma’s consolidated income statement for three-month period ending June 30, 2023 include:

a) Presentation of investor and public relations as general and administrative costs

b) Presentation of consulting fees as general and administrative costs

c) Presentation of depreciation as general and administrative costs

d) Presentation of directors’ fees as general and administrative costs

e) Presentation of office and miscellaneous as general and administrative costs

f) Presentation of professional fees as general and administrative costs

g) Presentation of occupancy costs as general and administrative costs

h) Presentation of transfer agent and filing fees as general and administrative costs

i) Presentation of research and development as research

j) Presentation of foreign exchange loss as foreign currency translation gain (loss)

k) Presentation of share-based payment expense to share-based compensation

l) Presentation of salaries and benefits as follows:

i. General and administrative costs: $1,131

ii. Research: $455

Reclassifications to the Small Pharma’s consolidated income statement for the twelve-month period ended March 31, 2023 include:

m) Presentation of investor and public relations as general and administrative costs

n) Presentation of consulting fees as general and administrative costs

o) Presentation of depreciation as general and administrative costs

p) Presentation of directors’ fees as general and administrative costs

q) Presentation of office and miscellaneous as general and administrative costs

r) Presentation of professional fees as general and administrative costs

s) Presentation of occupancy costs as general and administrative costs

t) Presentation of transfer agent and filing fees as general and administrative costs

u) Presentation of research and development as research

v) Presentation of foreign exchange loss as foreign currency translation gain (loss)

w) Presentation of share-based payment expense to share-based compensation

x) Presentation of salaries and benefits as follows:

i. General and administrative costs: $3,867

ii. Research: $2,008

CYBIN INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of Canadian dollars except for share and option amounts and share and option prices)

4. FAIR VALUE OF CONSIDERATION TRANSFERRED

The following is an estimate of the number of Cybin common shares that are to be issued in exchange for Small Pharma common shares:

| | | | | |

| Small Pharma common shares outstanding as at May 31, 2023 | 321,562,487 |

Small Pharma options exercised prior to the Transaction1,2 | 14,720,150 |

| Total Small Pharma common shares to be converted | 336,282,637 |

| Conversion Ratio | 0.2409 |

| Cybin common shares to be issued | 81,010,487 |

1Refer to note 7 for additional details surrounding Small Pharma’s options.

2As of the date of the circular, 2,891,300 of the 14,720,150 Small Pharma options have already been exercised, leaving an estimated 11,828,850 Small Pharma options remaining to be exercised prior to the Transaction.

For the purpose of determining the number of Small Pharma options exercised prior to the Transaction, the implied consideration of $0.10 per Small Pharma common share based on the quoted fair market value of the Cybin common shares on August 25, 2023 was used. Based on the exercise price of the assumed Small Pharma options exercised prior to the Transaction, Small Pharma will receive $411 in cash proceeds. The final number of Cybin common shares to be issued is to be determined as of the closing date of the Transaction.

The following is a summary of the purchase price for the Transaction:

| | | | | |

| Cybin common shares to be issued | 81,010,487 |

| Fair value of Cybin common shares | $0.415 |

| Total estimated purchase price | $33,619 |

The fair value of Cybin’s common shares for the purpose of this exercise is based on their quoted fair market value as at August 25, 2023. The final purchase price is to be determined as of the closing date of the Transaction.

5. PRELIMINARY PURCHASE PRICE ALLOCATION

The following table represents the preliminary allocation of the purchase price consideration to reflect value of the assets

acquired and liabilities assumed at June 30, 2023:

Assets acquired and liabilities assumed.

CYBIN INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of Canadian dollars except for share and option amounts and share and option prices)

| | | | | |

| $ |

| ASSETS | |

| Current | |

Cash1 | 13,563 |

| Accounts receivable | 626 |

| Prepaid expenses | 874 |

| Total Current Assets | 15,063 |

| |

| Non-current | |

| Equipment | 49 |

| Right of use asset | 541 |

| Total Non-Current Assets | 590 |

| TOTAL ASSETS | 15,653 |

| LIABILITIES | |

| Current | |

| Accounts payable and accrued liabilities | 2,687 |

| Lease Liabilities | 315 |

| Total Current Liabilities | 3,002 |

| |

| Non-current | |

| Lease Liabilities | 233 |

| Total Non-Current Liabilities | 233 |

| TOTAL LIABILITIES | 3,235 |

| Net Assets assumed excluding intangible assets/goodwill | 12,418 |

Intangibles/Goodwill on acquisition2 | 21,201 |

| Estimated purchase price | 33,619 |

1Adjusted to include $411 related to the exercise of Small Pharma options prior to the close of the Transaction.

2For the purpose of the pro forma statements, this amount has been allocated to “Goodwill” on the statement of financial position. The split between “Goodwill” and “Intangible Assets” will be determined upon completion of the fair value assessment and the purchase price allocation.

The Transaction is to be accounted for as a business combination using the acquisition method of accounting in accordance with IFRS 3. Under this method, the assets acquired, and liabilities assumed are to be recorded based on their fair values as of the closing date of the Transaction. In accordance with IFRS 3, the final purchase price allocation will be completed within one year. For the purposes of these Pro Forma Consolidated Financial Statements, Cybin has not made any fair value adjustment allocation to the value of the acquired assets and liabilities on the balance sheet of Small Pharma given the uncertainty with respect to the measurement of fair value amounts at this time. Therefore, the difference between the purchase price and the net assets has been allocated to intangible assets and goodwill on acquisition. Cybin expects that a significant portion of the unallocated purchase price will be allocated among intangible assets and goodwill. Intangible assets acquired primarily include in-process research and development and patents, and goodwill is calculated as the excess of the preliminary estimate of the acquisition-date fair value of the consideration transferred, over the preliminary estimate of the fair values assigned to the identifiable assets acquired and liabilities assumed. The actual purchase accounting adjustments are to be finalized once Cybin has completed detailed valuations and necessary calculations and may differ materially from the adjustment reflected in the Pro Forma Consolidated Financial Statements.

CYBIN INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of Canadian dollars except for share and option amounts and share and option prices)

6. PRO FORMA ADJUSTMENTS

(a) Additional Transaction costs of $5,250 have been charged to deficit and presented as a reduction of cash. These are comprised as follows:

a. Cybin Inc. professional fees of $400.

b. Small Pharma professional fees of $2,350.

c. Additional closing costs of $2,500

(b) Reflects the elimination of historical equity balances of Small Pharma as at June 30, 2023.

7. PRO FORMA OPTIONS RESERVE

| | | | | | | | |

| Number of Options | Amount |

| Cybin option reserve as at June 30, 2023 | 40,980,425 | 28,383 |

| Small Pharma option reserve as at May 31, 2023 | 26,596,400 | 4,233 |

| Pro forma adjustment for Small Pharma options exercised and cancelled | (26,596,400) | (4,233) |

| Pro forma consolidated option reserve as at June 30, 2023 | 40,980,425 | 28,383 |

Immediately prior to the closing of the Transaction, each in-the-money Small Pharma option outstanding (whether vested or unvested) are to be deemed to be exercised and surrendered to Small Pharma for cancellation and the holders thereof are to receive common shares of Cybin for each option at the conversion ratio of 0.2409. Each out-of-the-money Small Pharma option outstanding immediately prior to the closing of the Transaction, is to be, and is to be deemed to be, surrendered to Small Pharma for cancellation and the holders thereof are to receive, in respect of each such surrendered out-of-the-money Small Pharma option, a cash payment from the Small Pharma equal to $0.001 per out-of-the-money Small Pharma option.

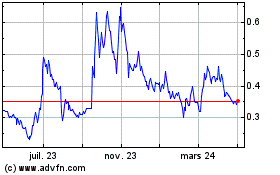

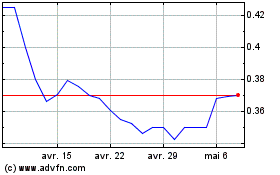

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024