AMCON Distributing Company (�AMCON�) (AMEX:DIT), an Omaha, Nebraska

based consumer products company, is pleased to report fully diluted

earnings available to common stock holders of 41 cents per share on

net income of $241,865 for the period end June 30, 2006. �We are

delighted at the continued progress the corporation has made since

we announced our internal reorganization in March 2006� said

Christopher Atayan, AMCON�s Chief Executive Officer. �Our core

businesses continued their trend of strong performance during the

quarter and we began to reap some of the benefits of the aggressive

efforts we have instituted to control our non-core water

businesses. Our corporate strategic objective in the short to

medium term is to reduce the levels of debt we employ at AMCON,

which will enhance our ability to grow in the long term. The two

primary elements supporting this objective are to preserve and

enhance the operating earnings we generate from our core business

units and the disposition of assets no longer central to our

mission. We believe that by taking this approach and continuing our

tradition of superior customer service we are well positioned to

enhance shareholder value. We are diligently working as a Company

on resolving the issues presented by our Beverage businesses and as

a result have expended very little cash resources into those

businesses. This has resulted in increasing liquidity and financial

strength for the entire company� added Atayan. For the first nine

months of fiscal 2006, AMCON�s wholesale consumer products

distribution business reported segment operating income before

depreciation and amortization of approximately $6.6 million and the

retail health food business reported segment operating income

before depreciation and amortization of approximately $2.4 million.

This compares to $5.6 million and $1.2 million for the wholesale

and retail businesses, respectively, in the comparable periods one

year ago. �AMCON�s legacy of premium customer service has served us

well as we remain highly competitive in the market place� noted

Kathleen Evans, President of AMCON�s wholesale distribution

business, � Our solid performance year to date is a direct

reflection of the programs and systems we are developing to enhance

our customers profits.� �Our retail health food stores are

continuing to perform at historically high levels of revenues and

profitability. Consumers are continuing to move in the direction of

natural products and we are well positioned to serve them�

commented Eric Hinkefent, President of AMCON�s retail health food

business, �We continue to differentiate our self in the market

place by our high levels of customer service. This has a direct

bottom line effect as we benefit from repeat customer business.�

Another positive factor in the quarter was the narrowing of losses

from Hawaiian Natural Water Company in our beverage segment. Price

increases and active financial management of the enterprise

contributed to this result. Senior management has invested a

significant amount of time and energy toward revitalizing this

enterprise. As previously announced, AMCON is actively in

negotiations to divest the business. AMCON received an extension of

its Revolving Credit agreement through July 2007 and is in active

discussions with the bank group with respect to a long term

extension. �Our bank group has been very responsive to our needs.

Their solid support has enabled us to take advantage of several

short term profit opportunities developed by our management team,�

commented Andy Plummer, AMCON�s Acting Chief Financial Officer.

Plummer also added, �During the recently completed fourth quarter

we have incurred substantial professional fees in connection with

our prior period audit and the Trinity Springs, Inc. litigation

settlement discussions which will impact bottom line profitability

when we report those results.� Concurrently with this press release

AMCON has filed its third quarter 10-Q with the Securities and

Exchange Commission. This now brings AMCON into compliance with the

financial reporting compliance requirements of the American Stock

Exchange. AMCON is a leading wholesale distributor of consumer

products, including beverages, candy, tobacco, groceries, food

service, frozen and chilled foods, and health and beauty care

products with distribution centers in Illinois, Missouri, Nebraska,

North Dakota and South Dakota. Chamberlin's Natural Foods, Inc. and

Health Food Associates, Inc., both wholly-owned subsidiaries of The

Healthy Edge, Inc., operate health and natural product retail

stores in central Florida (6), Kansas, Missouri, Nebraska and

Oklahoma (4). The retail stores operate under the names

Chamberlin's Market & Cafe and Akins Natural Foods Market.

Hawaiian Natural Water Company, Inc. produces and sells natural

spring water under the Hawaiian Springs label in Hawaii and other

foreign markets and purified bottled water on the Island of Oahu in

Hawaii. The natural spring water is bottled at the source on the

Big Island of Hawaii. This news release contains forward-looking

statements that are subject to risks and uncertainties and which

reflect management's current beliefs and estimates of future

economic circumstances, industry conditions, Company performance

and financial results. A number of factors could affect the future

results of the Company and could cause those results to differ

materially from those expressed in the Company's forward-looking

statements including, without limitation, availability of

sufficient cash resources to conduct its business and meet its

capital expenditures needs. Moreover, past financial performance

should not be considered a reliable indicator of future

performance. Accordingly, the Company claims the protection of the

safe harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 with respect to all such

forward-looking statements. Visit AMCON Distributing Company's web

site at: www.amcon.com Set forth below are the full unaudited

results for the three and nine month periods ended June 30, 2006:

AMCON Distributing Company and Subsidiaries Condensed Consolidated

Balance Sheets June 30, 2006 and September 30, 2005 June

2006(Unaudited) September 2005 � ASSETS Current assets: Cash $

84,020� $ 546,273� Accounts receivable, less allowance for doubtful

accounts of $1.0 million and $0.6 million, respectively 30,134,256�

28,202,857� Inventories 30,492,996� 23,977,889� Deferred income

taxes 1,642,212� 1,642,212� Current assets of discontinued

operations 37,544� 1,159,228� Prepaid and other current assets

4,843,534� 5,269,784� Total current assets 67,234,562� 60,798,243�

� Property and equipment 14,102,301� 15,162,007� Deferred income

taxes 6,863,737� 6,300,503� Noncurrent assets from discontinued

operations 2,382,801� 2,475,803� Goodwill 5,848,808� 5,848,808�

Other intangible assets 3,449,736� 3,464,534� Other assets

1,084,769� 1,258,899� $100,966,714� $ 95,308,797� LIABILITIES AND

SHAREHOLDERS' EQUITY (DEFICIENCY) Current liabilities: Accounts

payable $ 15,550,519� $ 17,047,833� Accrued expenses 4,837,193�

4,990,814� Accrued wages, salaries and bonuses 1,171,914�

1,601,666� Income taxes payable -� 118,798� Current liabilities of

discontinued operations 4,339,022� 4,098,412� Current maturities of

revolving credit facility 3,932,000� 1,432,000� Current maturities

of long-term debt 815,005� 936,198� Total current liabilities

30,645,653� 30,225,721� Revolving credit facility, less current

maturities 52,768,394� 47,730,388� Long-term debt, less current

maturities 7,508,260� 7,636,468� Noncurrent liabilities of

discontinued operations 5,651,744� 5,648,648� � Series A

cumulative, convertible preferred stock, $.01 par value 100,000

shares authorized and issued, liquidation preference $25.00 per

share 2,438,355� 2,438,355� � Series B cumulative, convertible

preferred stock, $.01 par value 80,000 shares authorized and

issued, liquidation preference $25.00 per share 1,857,645�

1,857,645� � Series C cumulative, convertible preferred stock, $.01

par value 80,000 shares authorized and issued, liquidation

preference $25.00 per share 1,982,372� -� � Commitments and

contingencies � Shareholders' equity (deficiency): Preferred stock,

$0.01 par, 1,000,000 shares authorized, none outstanding -� -�

Common stock, $.01 par value, 3,000,000 shares authorized, 527,062

shares issued 5,271� 5,271� Additional paid-in capital 6,263,476�

6,218,476� Accumulated other comprehensive income, net of tax of

$0.1 million in 2005 -� 101,294� Accumulated deficit (8,154,456)

(6,553,469) Total shareholders' deficiency (1,885,709) (228,428)

$100,966,714� $ 95,308,797� AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of

Operations for the three and nine month periods ended June 30, 2006

and 2005 For the three monthsended June For the nine monthsended

June 2006 2005 2006 2005 Sales (including excise taxes of $52.5

million and $50.1 million, and $147.7 million and $145.2 million,

respectively) � � $ 223,954,710� $ 215,124,070� $ 620,973,352� $

621,859,811� � Cost of sales 208,168,019� 199,928,910� 576,622,438�

577,790,948� Gross profit 15,786,691� 15,195,160� 44,350,914�

44,068,863� Selling, general and administrative expenses

13,096,950� 12,720,659� 38,989,674� 38,533,701� Depreciation and

amortization 525,170� 571,940� 1,510,767� 1,718,209� 13,622,120�

13,292,599� 40,500,441� 40,251,910� Operating income 2,164,571�

1,902,561� 3,850,473� 3,816,953� Other (income) expense: Interest

expense 1,227,561� 1,063,338� 3,505,530� 3,114,773� Other (income)

expense, net (44,424) (32,827) � (94,015) (48,679) 1,183,137�

1,030,511� 3,411,515� 3,066,094� Income from continuing operations

before income taxes 981,434� 872,050� 438,958� 750,859� Income tax

expense 392,000� 347,000� 246,000� 358,000� Minority interest -� -�

-� (97,100) Income from continuing operations 589,434� 525,050�

192,958� 489,959� Loss from discontinued operations, net of income

tax benefit of $0.1 million and $0.5 million, $0.9 million and $1.9

million, respectively � � (243,183) (751,473) � (1,533,453)

(3,084,832) Net income (loss) 346,251� (226,423) � (1,340,495)

(2,594,873) Preferred stock dividend requirements (104,386)

(74,053) � (260,492) (219,773) Net income (loss) available to

common shareholders $ 241,865� $ (300,476) � $ (1,600,987) $

(2,814,646) Basic earnings (loss) per share available to common

shareholders: � Continuing operations $ 0.92� $ 0.86� $ (0.13) $

0.51� Discontinued operations (0.46) (1.43) � (2.91) (5.85) Net

basic earnings (loss) per share available to common shareholders $

0.46� $ (0.57) � $ (3.04) $ (5.34) Diluted earnings (loss) per

share available to common shareholders: � Continuing operations $

0.69� $ 0.73� $ (0.13) $ 0.49� Discontinued operations (0.28)

(1.05) � (2.91) (5.63) Net diluted earnings (loss) per share

available to common shareholders $ 0.41� $ (0.32) � $ (3.04) $

(5.14) Weighted average shares outstanding: Basic 527,062� 527,062�

527,062� 527,062� Diluted 854,187� 712,881� 527,062� 547,774� AMCON

Distributing Company and Subsidiaries Condensed Consolidated

Unaudited Statements of Cash Flows for the nine month periods ended

June 30, 2006 and 2005 2006 2005 CASH FLOWS FROM OPERATING

ACTIVITIES: Net (Loss) $ (1,340,495) $ (2,594,873) Deduct: (Loss)

from discontinued operations, net of tax 1,533,453� 3,084,832�

Income from continuing operations Adjustments to reconcile net

(loss) income from continuing operations to net cash flows from

operating activities: 192,958� 489,959� � � � Depreciation

1,606,824� 1,735,404� Amortization 29,798� 146,196� (Gain) loss on

sale of property and equipment 11,570� (20,361) Stock based

compensation 45,000� -� Deferred income taxes (563,234) (1,558,608)

Provision for losses on doubtful accounts 505,295� 259,080�

Provision for losses on inventory obsolescence 46,204� 237,167�

Impairment on assets held for sale -� 77,680� Minority interest -�

(97,100) Changes in assets and liabilities, net of effect of

acquisitions: � Accounts receivable (2,436,694) (3,698,445)

Inventories (6,561,311) 7,338,879� Other current assets 324,956�

(494,133) Other assets 174,130� (42,286) Accounts payable

(1,134,598) (2,391,119) Accrued expenses and accrued wages,

salaries and bonuses (583,373) 935,587� Income tax payable and

receivable (118,798) 190,445� Net cash flows from operating

activities - continuing operations (8,461,273) 3,108,345� Net cash

flows from operating activities - discontinued operations (779,463)

(1,761,749) Net cash flows from operating activities (9,240,736)

1,346,596� � CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of

property and equipment (609,637) (2,469,156) Proceeds from sales

property and equipment 50,949� 85,265� Purchase of trademark

(15,000) -� Net cash flows from investing activities - continuing

operations (573,688) (2,383,891) Net cash flows from investing

activities - discontinued operations (2,671) (92,872) Net cash

flows from investing activities (576,359) (2,476,763) � CASH FLOWS

FROM FINANCING ACTIVITIES: Net borrowings (payments) on revolving

credit facility 7,538,006� 10,977,882� Net proceeds from preferred

stock issuance 1,982,372� 1,857,645� Proceeds from borrowings of

long-term debt 125,988� 1,399,636� Dividends paid on preferred

stock (260,492) (219,773) Principal payments on long-term debt and

subordinated debt (738,105) (12,907,705) Debt issue costs -�

(446,641) Net cash flows from financing activities - continuing

operations 8,647,769� 661,044� Net cash flows from financing

activities - discontinued operations 707,073� 421,489� Net cash

flows from financing activities 9,354,842� 1,082,533� Net change in

cash (462,253) (47,634) � Cash, beginning of period 546,273�

416,073� Cash, end of period $ 84,020� $ 368,439� Supplemental

disclosure of cash flow information: Cash paid during the period

for interest $ 3,488,161� $ 2,661,734� Cash refunded during the

period for income taxes (1,577) (185,630) � Supplemental disclosure

of non-cash information: Issuance of note payable in exchange for

accounts payable $ 362,716� $ -� Acquisition of equipment through

capital leases -� 91,343� AMCON Distributing Company ("AMCON")

(AMEX:DIT), an Omaha, Nebraska based consumer products company, is

pleased to report fully diluted earnings available to common stock

holders of 41 cents per share on net income of $241,865 for the

period end June 30, 2006. "We are delighted at the continued

progress the corporation has made since we announced our internal

reorganization in March 2006" said Christopher Atayan, AMCON's

Chief Executive Officer. "Our core businesses continued their trend

of strong performance during the quarter and we began to reap some

of the benefits of the aggressive efforts we have instituted to

control our non-core water businesses. Our corporate strategic

objective in the short to medium term is to reduce the levels of

debt we employ at AMCON, which will enhance our ability to grow in

the long term. The two primary elements supporting this objective

are to preserve and enhance the operating earnings we generate from

our core business units and the disposition of assets no longer

central to our mission. We believe that by taking this approach and

continuing our tradition of superior customer service we are well

positioned to enhance shareholder value. We are diligently working

as a Company on resolving the issues presented by our Beverage

businesses and as a result have expended very little cash resources

into those businesses. This has resulted in increasing liquidity

and financial strength for the entire company" added Atayan. For

the first nine months of fiscal 2006, AMCON's wholesale consumer

products distribution business reported segment operating income

before depreciation and amortization of approximately $6.6 million

and the retail health food business reported segment operating

income before depreciation and amortization of approximately $2.4

million. This compares to $5.6 million and $1.2 million for the

wholesale and retail businesses, respectively, in the comparable

periods one year ago. "AMCON's legacy of premium customer service

has served us well as we remain highly competitive in the market

place" noted Kathleen Evans, President of AMCON's wholesale

distribution business, " Our solid performance year to date is a

direct reflection of the programs and systems we are developing to

enhance our customers profits." "Our retail health food stores are

continuing to perform at historically high levels of revenues and

profitability. Consumers are continuing to move in the direction of

natural products and we are well positioned to serve them"

commented Eric Hinkefent, President of AMCON's retail health food

business, "We continue to differentiate our self in the market

place by our high levels of customer service. This has a direct

bottom line effect as we benefit from repeat customer business."

Another positive factor in the quarter was the narrowing of losses

from Hawaiian Natural Water Company in our beverage segment. Price

increases and active financial management of the enterprise

contributed to this result. Senior management has invested a

significant amount of time and energy toward revitalizing this

enterprise. As previously announced, AMCON is actively in

negotiations to divest the business. AMCON received an extension of

its Revolving Credit agreement through July 2007 and is in active

discussions with the bank group with respect to a long term

extension. "Our bank group has been very responsive to our needs.

Their solid support has enabled us to take advantage of several

short term profit opportunities developed by our management team,"

commented Andy Plummer, AMCON's Acting Chief Financial Officer.

Plummer also added, "During the recently completed fourth quarter

we have incurred substantial professional fees in connection with

our prior period audit and the Trinity Springs, Inc. litigation

settlement discussions which will impact bottom line profitability

when we report those results." Concurrently with this press release

AMCON has filed its third quarter 10-Q with the Securities and

Exchange Commission. This now brings AMCON into compliance with the

financial reporting compliance requirements of the American Stock

Exchange. AMCON is a leading wholesale distributor of consumer

products, including beverages, candy, tobacco, groceries, food

service, frozen and chilled foods, and health and beauty care

products with distribution centers in Illinois, Missouri, Nebraska,

North Dakota and South Dakota. Chamberlin's Natural Foods, Inc. and

Health Food Associates, Inc., both wholly-owned subsidiaries of The

Healthy Edge, Inc., operate health and natural product retail

stores in central Florida (6), Kansas, Missouri, Nebraska and

Oklahoma (4). The retail stores operate under the names

Chamberlin's Market & Cafe and Akins Natural Foods Market.

Hawaiian Natural Water Company, Inc. produces and sells natural

spring water under the Hawaiian Springs label in Hawaii and other

foreign markets and purified bottled water on the Island of Oahu in

Hawaii. The natural spring water is bottled at the source on the

Big Island of Hawaii. This news release contains forward-looking

statements that are subject to risks and uncertainties and which

reflect management's current beliefs and estimates of future

economic circumstances, industry conditions, Company performance

and financial results. A number of factors could affect the future

results of the Company and could cause those results to differ

materially from those expressed in the Company's forward-looking

statements including, without limitation, availability of

sufficient cash resources to conduct its business and meet its

capital expenditures needs. Moreover, past financial performance

should not be considered a reliable indicator of future

performance. Accordingly, the Company claims the protection of the

safe harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 with respect to all such

forward-looking statements. Visit AMCON Distributing Company's web

site at: www.amcon.com Set forth below are the full unaudited

results for the three and nine month periods ended June 30, 2006:

-0- *T AMCON Distributing Company and Subsidiaries Condensed

Consolidated Balance Sheets June 30, 2006 and September 30, 2005

----------------------------------------------------------------------

June 2006 (Unaudited) September 2005 -------------- --------------

ASSETS Current assets: Cash $84,020 $546,273 Accounts receivable,

less allowance for doubtful accounts of $1.0 million and $0.6

million, respectively 30,134,256 28,202,857 Inventories 30,492,996

23,977,889 Deferred income taxes 1,642,212 1,642,212 Current assets

of discontinued operations 37,544 1,159,228 Prepaid and other

current assets 4,843,534 5,269,784 -------------- --------------

Total current assets 67,234,562 60,798,243 Property and equipment

14,102,301 15,162,007 Deferred income taxes 6,863,737 6,300,503

Noncurrent assets from discontinued operations 2,382,801 2,475,803

Goodwill 5,848,808 5,848,808 Other intangible assets 3,449,736

3,464,534 Other assets 1,084,769 1,258,899 --------------

-------------- $100,966,714 $95,308,797 ==============

============== LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIENCY)

Current liabilities: Accounts payable $15,550,519 $17,047,833

Accrued expenses 4,837,193 4,990,814 Accrued wages, salaries and

bonuses 1,171,914 1,601,666 Income taxes payable - 118,798 Current

liabilities of discontinued operations 4,339,022 4,098,412 Current

maturities of revolving credit facility 3,932,000 1,432,000 Current

maturities of long-term debt 815,005 936,198 --------------

-------------- Total current liabilities 30,645,653 30,225,721

-------------- -------------- Revolving credit facility, less

current maturities 52,768,394 47,730,388 Long-term debt, less

current maturities 7,508,260 7,636,468 Noncurrent liabilities of

discontinued operations 5,651,744 5,648,648 Series A cumulative,

convertible preferred stock, $.01 par value 100,000 shares

authorized and issued, liquidation preference $25.00 per share

2,438,355 2,438,355 Series B cumulative, convertible preferred

stock, $.01 par value 80,000 shares authorized and issued,

liquidation preference $25.00 per share 1,857,645 1,857,645 Series

C cumulative, convertible preferred stock, $.01 par value 80,000

shares authorized and issued, liquidation preference $25.00 per

share 1,982,372 - Commitments and contingencies Shareholders'

equity (deficiency): Preferred stock, $0.01 par, 1,000,000 shares

authorized, none outstanding - - Common stock, $.01 par value,

3,000,000 shares authorized, 527,062 shares issued 5,271 5,271

Additional paid-in capital 6,263,476 6,218,476 Accumulated other

comprehensive income, net of tax of $0.1 million in 2005 - 101,294

Accumulated deficit (8,154,456) (6,553,469) --------------

-------------- Total shareholders' deficiency (1,885,709) (228,428)

-------------- -------------- $100,966,714 $95,308,797

============== ============== *T -0- *T AMCON Distributing Company

and Subsidiaries Condensed Consolidated Unaudited Statements of

Operations for the three and nine month periods ended June 30, 2006

and 2005

----------------------------------------------------------------------

For the three months For the nine months ended June ended June

--------------------------- --------------------------- 2006 2005

2006 2005 ------------- ------------- ------------- -------------

Sales (including excise taxes of $52.5 million and $50.1 million,

and $147.7 million and $145.2 million, respectively) $223,954,710

$215,124,070 $620,973,352 $621,859,811 Cost of sales 208,168,019

199,928,910 576,622,438 577,790,948 ------------- -------------

------------- ------------- Gross profit 15,786,691 15,195,160

44,350,914 44,068,863 ------------- ------------- -------------

------------- Selling, general and administrative expenses

13,096,950 12,720,659 38,989,674 38,533,701 Depreciation and

amortization 525,170 571,940 1,510,767 1,718,209 -------------

------------- ------------- ------------- 13,622,120 13,292,599

40,500,441 40,251,910 ------------- ------------- -------------

------------- Operating income 2,164,571 1,902,561 3,850,473

3,816,953 ------------- ------------- ------------- -------------

Other (income) expense: Interest expense 1,227,561 1,063,338

3,505,530 3,114,773 Other (income) expense, net (44,424) (32,827)

(94,015) (48,679) ------------- ------------- -------------

------------- 1,183,137 1,030,511 3,411,515 3,066,094 -------------

------------- ------------- ------------- Income from continuing

operations before income taxes 981,434 872,050 438,958 750,859

Income tax expense 392,000 347,000 246,000 358,000 Minority

interest - - - (97,100) ------------- ------------- -------------

------------- Income from continuing operations 589,434 525,050

192,958 489,959 Loss from discontinued operations, net of income

tax benefit of $0.1 million and $0.5 million, $0.9 million and $1.9

million, respectively (243,183) (751,473) (1,533,453) (3,084,832)

------------- ------------- ------------- ------------- Net income

(loss) 346,251 (226,423) (1,340,495) (2,594,873) Preferred stock

dividend requirements (104,386) (74,053) (260,492) (219,773)

------------- ------------- ------------- ------------- Net income

(loss) available to common shareholders $241,865 $ (300,476)

$(1,600,987) $(2,814,646) ============= ============= =============

============= Basic earnings (loss) per share available to common

shareholders: Continuing operations $0.92 $0.86 $(0.13) $0.51

Discontinued operations (0.46) (1.43) (2.91) (5.85) -------------

------------- ------------- ------------- Net basic earnings (loss)

per share available to common shareholders $0.46 $ (0.57) $(3.04)

$(5.34) ============= ============= ============= =============

Diluted earnings (loss) per share available to common shareholders:

Continuing operations $0.69 $0.73 $(0.13) $0.49 Discontinued

operations (0.28) (1.05) (2.91) (5.63) ------------- -------------

------------- ------------- Net diluted earnings (loss) per share

available to common shareholders $0.41 $ (0.32) $(3.04) $(5.14)

============= ============= ============= ============= Weighted

average shares outstanding: Basic 527,062 527,062 527,062 527,062

Diluted 854,187 712,881 527,062 547,774 *T -0- *T AMCON

Distributing Company and Subsidiaries Condensed Consolidated

Unaudited Statements of Cash Flows for the nine month periods ended

June 30, 2006 and 2005

----------------------------------------------------------------------

2006 2005 ------------ ------------ CASH FLOWS FROM OPERATING

ACTIVITIES: Net (Loss) $(1,340,495) $(2,594,873) Deduct: (Loss)

from discontinued operations, net of tax 1,533,453 3,084,832

------------ ------------ Income from continuing operations 192,958

489,959 Adjustments to reconcile net (loss) income from continuing

operations to net cash flows from operating activities:

Depreciation 1,606,824 1,735,404 Amortization 29,798 146,196 (Gain)

loss on sale of property and equipment 11,570 (20,361) Stock based

compensation 45,000 - Deferred income taxes (563,234) (1,558,608)

Provision for losses on doubtful accounts 505,295 259,080 Provision

for losses on inventory obsolescence 46,204 237,167 Impairment on

assets held for sale - 77,680 Minority interest - (97,100) Changes

in assets and liabilities, net of effect of acquisitions: Accounts

receivable (2,436,694) (3,698,445) Inventories (6,561,311)

7,338,879 Other current assets 324,956 (494,133) Other assets

174,130 (42,286) Accounts payable (1,134,598) (2,391,119) Accrued

expenses and accrued wages, salaries and bonuses (583,373) 935,587

Income tax payable and receivable (118,798) 190,445 ------------

------------ Net cash flows from operating activities - continuing

operations (8,461,273) 3,108,345 Net cash flows from operating

activities - discontinued operations (779,463) (1,761,749)

------------ ------------ Net cash flows from operating activities

(9,240,736) 1,346,596 CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment (609,637) (2,469,156) Proceeds

from sales property and equipment 50,949 85,265 Purchase of

trademark (15,000) - ------------ ------------ Net cash flows from

investing activities - continuing operations (573,688) (2,383,891)

Net cash flows from investing activities - discontinued operations

(2,671) (92,872) ------------ ------------ Net cash flows from

investing activities (576,359) (2,476,763) CASH FLOWS FROM

FINANCING ACTIVITIES: Net borrowings (payments) on revolving credit

facility 7,538,006 10,977,882 Net proceeds from preferred stock

issuance 1,982,372 1,857,645 Proceeds from borrowings of long-term

debt 125,988 1,399,636 Dividends paid on preferred stock (260,492)

(219,773) Principal payments on long-term debt and subordinated

debt (738,105) (12,907,705) Debt issue costs - (446,641)

------------ ------------ Net cash flows from financing activities

- continuing operations 8,647,769 661,044 Net cash flows from

financing activities - discontinued operations 707,073 421,489

------------ ------------ Net cash flows from financing activities

9,354,842 1,082,533 ------------ ------------ Net change in cash

(462,253) (47,634) Cash, beginning of period 546,273 416,073

------------ ------------ Cash, end of period $84,020 $368,439

============ ============ Supplemental disclosure of cash flow

information: Cash paid during the period for interest $3,488,161

$2,661,734 Cash refunded during the period for income taxes (1,577)

(185,630) Supplemental disclosure of non-cash information: Issuance

of note payable in exchange for accounts payable $362,716 $-

Acquisition of equipment through capital leases - 91,343 *T

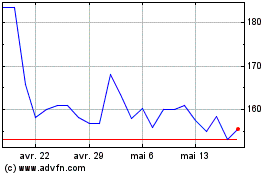

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

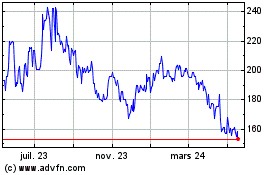

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024