AMCON Distributing Company (“AMCON”) (NYSE MKT: DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $2.19 on net income available

to common stockholders of $1.6 million for the fiscal quarter ended

June 30, 2013.

"We are pleased with the continued strong performance of

the Company. Our management team is highly focused

on generating attractive rates of return on the capital we

deploy. Our lending group continues to work closely with our

management team to further our strategic initiatives and we are

delighted to announce the renewal and enhancement of our

existing credit facility," said Christopher H. Atayan, AMCON’s

Chairman and Chief Executive Officer. "We continue to actively seek

strategic acquisitions in both our business segments," added

Atayan.

Each of AMCON’s business segments reported good quarters. The

wholesale distribution segment reported revenues of $306.7 million

and operating income before depreciation and amortization of $4.4

million for the third fiscal quarter of 2013. The retail health

food segment reported revenues of $9.3 million and operating income

before depreciation and amortization of $0.5 million for the same

period.

"We continue to focus on developing non-tobacco products and

services to enhance the bottom line of our customers. AMCON has

made a long term commitment of resources to this end," said

Kathleen Evans, President of AMCON's wholesale distribution

segment.

"Both of our new retail stores are now operational and in their

initial build up phase. We are working diligently to generate store

traffic and sales volumes to enable these stores to contribute to

our bottom line," said Eric Hinkefent, President of AMCON’s retail

health food segment.

“We were able to utilize our balance sheet to implement

attractive merchant opportunities this quarter. We closely manage

our liquidity on a day-to-day basis to capitalize on these

opportunities in a meaningful way. At June 30, 2013, our

stockholders’ equity was $51.3 million and consolidated debt was

$33.4 million,” said Andrew Plummer, AMCON’s Chief Financial

Officer. Plummer added, “We are extremely pleased with the

favorable terms of our credit facility extension and the

enhancements thereto. This renewal provides increased flexibility,

ready access to capital, and reduced interest rates while extending

our deep relationship with our existing lending group through July

2018.”

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates sixteen (16) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets June 30, 2013 and

September 30, 2012 June

September 2013 2012 (Unaudited)

ASSETS Current assets: Cash $ 177,452 $ 491,387 Accounts

receivable, less allowance for doubtful accounts of $1.2 million at

both June 2013 and September 2012 35,454,486 32,681,835

Inventories, net 48,138,310 38,364,621 Deferred income taxes

1,730,126 1,916,619 Prepaid and other current assets

8,098,720 6,476,702

Total current assets 93,599,094 79,931,164 Property and

equipment, net 13,311,648 13,083,912 Goodwill 6,349,827 6,349,827

Other intangible assets, net 4,912,228 5,185,978 Other assets

442,361 1,258,985

$ 118,615,158

$ 105,809,866 LIABILITIES AND

SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable $

16,128,607 $ 17,189,208 Accrued expenses 6,663,762 6,931,859

Accrued wages, salaries and bonuses 2,830,924 2,503,361 Income

taxes payable 1,098,354 2,194,966 Current maturities of long-term

debt

1,214,256

1,182,829 Total current liabilities 27,935,903

30,002,223 Credit facility 28,051,389 14,353,732 Deferred

income taxes 3,896,085 3,633,390 Long-term debt, less current

maturities 4,160,330 5,075,680 Other long-term liabilities 330,152

336,186

Series A cumulative, convertible preferred

stock, $.01 par value 100,000 shares authorized and issued, and a

total liquidation preference of $2.5 million at both June 2013 and

September 2012

2,500,000 2,500,000

Series B cumulative, convertible preferred

stock, $.01 par value 80,000 shares authorized, 16,000 shares

issued and outstanding at June 30, 2013 and 58,000 shares issued

and outstanding at September 30, 2012, and a total liquidation

preference of $0.4 million and $1.5 million at June 2013 and

September 2012, respectively

400,000 1,450,000

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized, 116,000 and 158,000 shares outstanding and

issued in Series A and B referred to above

— —

Common stock, $.01 par value, 3,000,000

shares authorized, 623,115 shares outstanding at June 2013 and

612,327 shares outstanding at September 2012

6,543 6,293 Additional paid-in capital 12,485,773 11,021,109

Retained earnings 42,149,939 38,349,253 Treasury stock at cost

(3,300,956 )

(918,000 ) Total shareholders’ equity

51,341,299

48,458,655 $

118,615,158 $

105,809,866 AMCON Distributing

Company and Subsidiaries Condensed Consolidated Unaudited

Statements of Operations for the three and nine months ended

June 30, 2013 and 2012 For the three

months For the nine months ended

June ended June 2013

2012 2013

2012 Sales (including excise taxes of $100.2

million and $96.1 million, and $285.4 million and $272.7 million,

respectively) $ 316,031,197 $ 307,112,774 $ 892,817,669 $

866,505,090 Cost of sales

296,220,406

287,211,769

835,480,069 808,750,009

Gross profit

19,810,791

19,901,005 57,337,600

57,755,081

Selling, general and administrative

expenses

16,065,285 15,845,201 47,351,952 47,096,958 Depreciation and

amortization

598,061

552,888 1,791,708

1,780,309 16,663,346

16,398,089

49,143,660 48,877,267

Operating income

3,147,445

3,502,916 8,193,940

8,877,814 Other expense (income):

Interest expense 309,445 361,756 874,489 1,105,707 Other (income),

net

(49,487 )

(47,841 )

(225,682 )

(292,979 )

259,958 313,915

648,807

812,728 Income from operations before income

tax expense 2,887,487 3,189,001 7,545,133 8,065,086 Income tax

expense

1,255,000

1,343,000 3,236,000

3,316,000 Net income 1,632,487 1,846,001

4,309,133 4,749,086 Preferred stock dividend requirements

(48,642 )

(66,907 )

(156,041 )

(201,454 ) Net income

available to common shareholders

$

1,583,845 $ 1,779,094

$ 4,153,092 $

4,547,632 Basic earnings per

share available to common shareholders $ 2.54 $ 2.92 $ 6.67 $ 7.38

Diluted earnings per share available to common shareholders $ 2.19

$ 2.37 $ 5.73 $ 6.06 Basic weighted average shares

outstanding 623,115 608,271 622,833 615,913 Diluted weighted

average shares outstanding 744,732 779,106 751,946 783,987

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements of Cash Flows

for the nine months ended June 30, 2013 and 2012

2013

2012 CASH FLOWS FROM OPERATING

ACTIVITIES: Net income $ 4,309,133 $ 4,749,086 Adjustments to

reconcile net income from operations to net cash flows from

operating activities: Depreciation 1,517,958 1,496,868 Amortization

273,750 283,441 Gain on sale of property and equipment (72,318 )

(28,606 ) Equity-based compensation 971,954 930,593 Deferred income

taxes 449,188 1,022,701 Provision for losses on doubtful accounts

80,000 75,757 Provision for losses on inventory obsolescence 54,028

98,789 Other (6,034 ) (6,034 ) Changes in assets and

liabilities: Accounts receivable (2,852,651 ) (1,144,999 )

Inventories (9,827,717 ) (11,031,978 ) Prepaid and other current

assets (1,622,018 ) 1,097,241 Other assets 55,753 (51,138 )

Accounts payable (1,070,612 ) (2,396,748 ) Accrued expenses and

accrued wages, salaries and bonuses 525,856 (19,827 ) Income tax

payable

(1,096,612 )

(1,796,182 ) Net cash flows from operating activities

(8,310,342 ) (6,721,036 ) CASH FLOWS FROM INVESTING

ACTIVITIES: Purchases of property and equipment (1,808,206 )

(914,486 ) Proceeds from sales of property and equipment

144,841 48,984 Net

cash flows from investing activities (1,663,365 ) (865,502 )

CASH FLOWS FROM FINANCING ACTIVITIES: Net borrowings on bank credit

agreements 13,697,657 9,308,869 Principal payments on long-term

debt (883,923 ) (1,018,587 ) Repurchase of Series B Convertible

Preferred Stock and common stock (2,572,085 ) (918,000 ) Dividends

paid on convertible preferred stock (156,041 ) (201,454 ) Dividends

on common stock (352,406 ) (354,723 ) Proceeds from exercise of

stock options 1,180 1,180 Withholdings on the exercise of

equity-based awards

(74,610 )

(51,452 ) Net cash flows from

financing activities

9,659,772

6,765,833 Net change in cash (313,935 )

(820,705 )

Cash, beginning of period

491,387 1,389,665

Cash, end of period

$ 177,452

$ 568,960

2013 2012

Supplemental disclosure of cash flow information: Cash paid during

the period for interest $ 851,665 $ 1,094,086 Cash paid during the

period for income taxes 3,883,424 4,089,482 Supplemental

disclosure of non-cash information: Equipment acquisitions

classified as accounts payable 21,248 28,282

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

1,389,258 950,562 Conversion by holder of Series B Convertible

Preferred Stock to common stock 100,000 — Common stock acquired

with other consideration 760,871 —

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

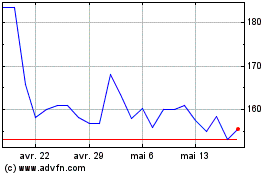

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

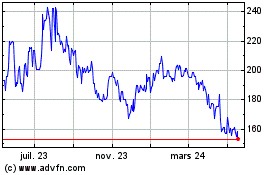

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024