AMCON Distributing Company (“AMCON”) (NYSE MKT:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $7.79 on net income available

to common shareholders of $5.7 million for the fiscal year ended

September 30, 2013. AMCON earned $2.07 per fully diluted share on

net income available to common shareholders of $1.5 million for the

fourth fiscal quarter ended September 30, 2013.

“We are pleased with the results for fiscal 2013. AMCON has

earned a leadership position in the convenience distribution

industry as a result of our relentless focus on customer service

and reliability. We believe these philosophies directly correlate

to the positive results for the year,” said Christopher H. Atayan

AMCON’s Chairman and Chief Executive Officer. He further noted, “We

continue to experience highly competitive conditions in both of our

operating segments. Our objective is to deliver attractive risk

adjusted rates of return on the assets as we navigate this

challenging environment. We believe our focused strategic plan and

customer centric philosophy are essential elements as we seek to

meet our short, medium, and long term objectives.”

“We take a long term approach to customer relationships and this

has proven to be mutually beneficial,” said Kathleen Evans,

President of AMCON’s Wholesale Distribution Segment. “Our fall

trade shows have provided positive momentum as we enter fiscal

2014. Our accrual and foodservice programs as well as our new

product introductions are developed with our customers’

profitability in mind,” added Ms. Evans.

“We opened two new stores during fiscal 2013 and are actively

seeking additional locations that are consistent with our business

model,” said Eric Hinkefent, President of AMCON’s Retail Health

Food Segment. “The competition is expanding in our marketplace as a

result of the industry’s growth. Margins will continue to

experience pressure as a result of these new entrants,” added

Hinkefent.

“We are very focused on increasing our shareholders’ equity per

share and maintaining high levels of balance sheet liquidity. Debt

reduction is an important priority for us because it improves our

debt to equity ratio. At September 30, 2013 our shareholders’

equity was $52.7, resulting in adjusted book value per share of

$74.91. We turned our inventory twenty-seven times and consolidated

debt was reduced to $19.9 million. This was after share repurchases

and new store investments totaling $4.4 million,” said Andrew

Plummer, AMCON’s Chief Financial Officer. “We have made a

commitment to expand our foodservice facilities at our Rapid City,

South Dakota branch which commenced in fiscal 2014. In addition, we

continue to invest in information technology for internal and

external purposes,” added Plummer.

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates sixteen (16) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED BALANCE SHEETS

September 30,

2013 2012

ASSETS Current assets: Cash $ 275,036 $ 491,387 Accounts

receivable, less allowance for doubtful accounts of $1.1 million at

2013 and $1.2 million at 2012 28,383,205 32,681,835 Inventories,

net 46,125,187 38,364,621 Deferred income taxes 1,831,933 1,916,619

Prepaid and other current assets

5,001,992

6,476,702 Total current assets

81,617,353 79,931,164 Property and equipment, net 13,088,859

13,083,912 Goodwill 6,349,827 6,349,827 Other intangible assets,

net 4,820,978 5,185,978 Other assets

497,882

1,258,985 $

106,374,899 $

105,809,866 LIABILITIES AND SHAREHOLDERS’

EQUITY Current liabilities: Accounts payable $ 15,859,636 $

17,189,208 Accrued expenses 6,714,444 6,931,859 Accrued wages,

salaries and bonuses 2,754,136 2,503,361 Income taxes payable

1,922,351 2,194,966 Current maturities of long-term debt

998,788 1,182,829

Total current liabilities 28,249,355 30,002,223 Credit

facility 14,841,712 14,353,732 Deferred income taxes 3,327,010

3,633,390 Long-term debt, less current maturities 4,076,892

5,075,680 Other long-term liabilities 239,396 336,186

Series A cumulative, convertible preferred

stock, $.01 par value 100,000 shares authorized and issued, and a

total liquidation preference of $2.5 million at both September 2013

and September 2012

2,500,000

2,500,000 Series B cumulative, convertible preferred stock, $.01

par value 80,000 shares authorized, 16,000 shares issued and

outstanding at September 30, 2013 and 58,000 shares issued and

outstanding at September 30, 2012, and a total liquidation

preference of $0.4 million and $1.5 million at September 2013 and

September 2012, respectively 400,000 1,450,000

Commitments and contingencies

Shareholders’ equity: Preferred stock, $0.01 par value,

1,000,000 shares authorized, 116,000 and 158,000 shares outstanding

and issued in Series A and B referred to above — — Common stock,

$0.01 par value, 3,000,000 shares authorized, 623,115 shares issued

and outstanding at September 2013 and 612,327 shares issued and

outstanding at September 2012 6,543 6,293 Additional paid-in

capital 12,502,135 11,021,109 Retained earnings 43,532,812

38,349,253 Treasury stock at cost

(3,300,956

) (918,000 ) Total

shareholders’ equity

52,740,534

48,458,655 $

106,374,899 $

105,809,866

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

Fiscal Years Ended September

2013 2012

Sales (including excise taxes of $386.4 million and $371.3 million,

respectively) $ 1,211,052,634 $ 1,174,167,758 Cost of sales

1,133,695,309 1,095,105,573

Gross profit

77,357,325

79,062,185

Selling, general and administrative

expenses

63,880,109 63,250,681 Depreciation and amortization

2,412,613 2,392,414

66,292,722

65,643,095 Operating income 11,064,603

13,419,090

Other expense (income):

Interest expense 1,108,146 1,359,241 Other (income), net

(277,215 )

(340,713 )

830,931 1,018,528

Income from operations before income tax expense 10,233,672

12,400,562 Income tax expense

4,375,000

5,033,000 Net income 5,858,672 7,367,562

Preferred stock dividend requirements

(205,218

)

(269,095 ) Net income available to common

shareholders

$ 5,653,454

$ 7,098,467

Basic earnings per share available to

common shareholders:

$ 9.08 $ 11.56

Diluted earnings per share available to

common shareholders:

$ 7.79 $ 9.40 Basic weighted average shares outstanding

622,904 614,046 Diluted weighted average shares outstanding 751,812

784,108

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

Fiscal Years Ended September

2013 2012

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 5,858,672 $

7,367,562 Adjustments to reconcile income from operations to net

cash flows

from operating activities:

Depreciation 2,047,613 2,017,726 Amortization 365,000 374,688 Gain

on sale of property and equipment (56,829 ) (36,900 ) Equity-based

compensation 1,303,310 1,426,848 Deferred income taxes (221,694 )

681,422 Recoveries of losses on doubtful accounts (55,000 ) (5,243

) Recoveries for losses on inventory obsolescence (91,494 ) (20,512

) Other (93,328 ) (8,045 )

Changes in assets and liabilities:

Accounts receivable 4,353,630 287,101 Inventories (7,669,072 )

103,873 Prepaid and other current assets 1,474,710 (403,166 ) Other

assets 232 (20,160 ) Accounts payable (1,391,539 ) (1,250,790 )

Accrued expenses and accrued wages, salaries and bonuses 181,294

(710,302 ) Income taxes payable

(272,615

) 94,786 Net cash flows

from operating activities

5,732,890

9,898,888

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment (2,113,426 ) (1,480,782 )

Proceeds from sales of property and equipment

179,662 129,834 Net

cash flows from investing activities

(1,933,764

)

(1,350,948 )

CASH FLOWS FROM FINANCING ACTIVITIES:

Net borrowings (payments) on bank credit agreements 487,980

(6,417,881 ) Principal payments on long-term debt (1,182,829 )

(1,320,311 ) Repurchase of Series B Convertible Preferred Stock and

common stock (2,572,085 ) (918,000 ) Dividends paid on convertible

preferred stock (205,218 ) (269,095 ) Dividends on common stock

(469,895 ) (470,659 ) Proceeds from exercise of stock options 1,180

1,180 Withholdings on the exercise of equity-based awards

(74,610 )

(51,452 ) Net cash flow

from financing activities

(4,015,477

) (9,446,218 )

Net change in cash

(216,351 ) (898,278 ) Cash, beginning of year

491,387 1,389,665

Cash, end of year

$ 275,036

$ 491,387

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS - (Continued)

Fiscal Years Ended

September 2013

2012 Supplemental disclosure of cash flow

information: Cash paid during the year for interest $ 1,115,991 $

1,393,470 Cash paid during the year for income taxes 4,867,986

4,256,794

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified as accounts payable $ 73,204 $

11,237 Issuance of common stock in connection with the vesting and

exercise of equity-based awards 1,389,258 950,562 Conversion by

holders of Series B Convertible Preferred Stock to common stock

100,000 100,000 Common stock acquired with other consideration

760,871 —

AMCON Distributing Company and

Subsidiaries

FISCAL YEAR 2013

(dollars in thousands, except per share data)

First Second

Third Fourth Sales $

302,218 $ 274,568 $ 316,031 $ 318,235

Gross profit

19,230 18,297

19,811 20,020

Income from operations before income tax

expense

2,533 2,125

2,887 2,689

Net Income

1,463 1,214 1,632 1,549

Preferred stock dividend requirements

(59 )

(48 )

(49 )

(49 )

Net income available to common

shareholders

$ 1,403 $

1,166 $ 1,584

$ 1,500

Basic earnings per share available to

common shareholders

$ 2.26 $

1.87 $ 2.54

$ 2.41

Diluted earnings per share available to

common shareholders

$ 1.90 $

1.63 $ 2.19

$ 2.07

FISCAL YEAR 2012

(dollars in thousands, except per share data)

First Second

Third Fourth Sales $

283,563 $ 275,829 $ 307,113 $ 307,663

Gross profit

18,638 19,216

19,901 21,307

Income from operations before income tax

expense

2,401 2,475

3,189 4,335

Net Income

1,438 1,465 1,846 2,618

Preferred stock dividend requirements

(67 )

(67 )

(67 )

(67 )

Net income available to common

shareholders

$ 1,371 $

1,398 $ 1,779

$ 2,551

Basic earnings per share available to

common shareholders

$ 2.21 $

2.26 $ 2.92

$ 4.19

Diluted earnings per share available to

common shareholders

$ 1.83 $

1.87 $ 2.37

$ 3.33

The Company’s quarterly earnings per share are based on weighted

average shares outstanding for the quarter; therefore the sum of

the quarters may not equal the full year earnings per share

amount.

AMCON Distributing Company and

Subsidiaries

GAAP Reconciliation and Management Explanation of Non-GAAP

Financial Measures

The financial measure of adjusted book value per share included

in this press release (“adjusted book value per share”) has been

determined by methods other than in accordance with U.S. generally

accepted accounting principles (“GAAP”). Management believes that

this non-GAAP financial measurement reflects an additional way of

viewing aspects of the Company’s business that, when viewed

together with its financial results computed in accordance with

GAAP, provides a more complete understanding of factors affecting

historical financial performance of the Company. This measure is

important to investors interested in determining the amount of book

value per share if all potentially dilutive shares were exercised

or converted. This non-GAAP financial measurement is not intended

to be a substitute for the comparable GAAP measurements and should

be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP.

The Company has defined the non-GAAP financial measure of

adjusted book value per share as follows:

- “Adjusted book value per share” is

defined as total shareholders’ equity increased by the impact of

proceeds from the exercise of all stock options, conversion of

convertible preferred stock and vesting of restricted stock units

divided by total common shares outstanding plus common shares

issuable upon the exercise of all stock options, conversion of

convertible preferred stock and vesting of restricted stock

units.”

September 2013

Number of common shares outstanding at September 30, 2013 623,115

Total shareholders’ equity at September 30, 2013

$

52,740,534 Book value per share at September

30, 2013 $ 84.64

September 2013

Number of common shares outstanding at September 30, 2013 623,115

Add: common shares potentially issuable for stock options,

convertible preferred stock, and unvested restricted stock units

/1/

173,308 796,423

Total shareholders’ equity at September 30, 2013 $ 52,740,534

Equity impact if all potential common shares were converted /1/

6,918,739 $

59,659,273 Adjusted book value per share at

September 30, 2013 $ 74.91 /1/ Assumes the exercise

of all vested and unvested stock options, conversion of all

preferred stock, and vesting of all outstanding restricted stock

units at September 30, 2013.

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

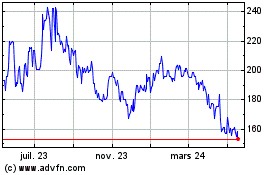

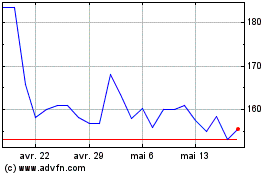

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024