AMCON Distributing Company (“AMCON”) (NYSE American: DIT), an

Omaha, Nebraska based consumer products company is pleased to

announce fully diluted earnings per share of $1.10 on net income

available to common shareholders of $0.7 million for its third

fiscal quarter ended June 30, 2019.

“AMCON’s emphasis on first class service and reliability is a

firm part of our tradition as a leader in the convenience

distribution industry. Our leadership team is proactively

evaluating strategic facility initiatives to support the growth

needs and competitive position of our customer base. As such, we

will continue to enthusiastically make investments in people,

facilities, and equipment necessary for sustained excellence,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive

Officer. He further noted, “Our Healthy Edge Retail Group

management team is planning a comprehensive merchandising and point

of sale solution to support our objective of being a total wellness

solution for our customers.”

“We collaborate closely with our customers to design cutting

edge foodservice programs that are competitive and profitable for

our customers. Our portfolio of foodservice warehouse and fleet

assets positions us as a leader in the convenience distribution

industry,” said Andrew C. Plummer, AMCON’s President and Chief

Operating Officer. In addition, he noted, “As the convenience

industry consolidates, AMCON’s platform of technology and history

of customer service position the business well for strategic

acquisitions.” Mr. Plummer further added, “We were pleased to close

June 30, 2019 with total shareholders’ equity of $65.4 million and

consolidated debt of $36.2 million.”

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates twenty-two (22) health

and natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Akin’s Natural Foods Market

www.akins.com in its Midwest market, and Chamberlin's Market &

Cafe www.chamberlins.com and Earth Origins Market

www.earthoriginsmarket.com in its Florida market.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Balance Sheets June 30, 2019

and September 30, 2018

June

September

2019

2018

(Unaudited)

ASSETS

Current assets:

Cash

$

314,007

$

520,644

Accounts receivable, less allowance for

doubtful accounts of $1.0 million at June 2019 and $0.9 million at

September 2018

34,459,786

31,428,845

Inventories, net

66,946,540

78,869,615

Income taxes receivable

114,276

272,112

Prepaid and other current assets

10,638,796

4,940,775

Total current assets

112,473,405

116,031,991

Property and equipment, net

17,376,511

15,768,484

Goodwill

4,436,950

4,436,950

Other intangible assets, net

3,373,269

3,414,936

Other assets

282,081

301,793

Total assets

$

137,942,216

$

139,954,154

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

23,403,140

$

20,826,834

Accrued expenses

8,604,004

8,556,620

Accrued wages, salaries and bonuses

2,376,347

3,965,733

Current maturities of long-term debt

808,103

1,096,306

Total current liabilities

35,191,594

34,445,493

Credit facility

32,114,531

35,428,597

Deferred income tax liability, net

1,895,240

1,782,801

Long-term debt, less current

maturities

3,260,455

3,658,391

Other long-term liabilities

41,022

38,055

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 592,767 shares outstanding at June 2019 and

615,777 shares outstanding at September 2018

8,561

8,441

Additional paid-in capital

23,185,173

22,069,098

Retained earnings

66,757,379

63,848,030

Treasury stock at cost

(24,511,739

)

(21,324,752

)

Total shareholders’ equity

65,439,374

64,600,817

Total liabilities and shareholders’

equity

$

137,942,216

$

139,954,154

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of

Operations for the three and nine months ended June 30, 2019 and

2018

For the three months ended

June

For the nine months ended

June

2019

2018

2019

2018

Sales (including excise taxes of $98.0

million and $96.2 million, and $274.0 million and $267.9 million,

respectively)

$

369,981,516

$

349,043,200

$

1,025,431,309

$

959,763,695

Cost of sales

349,455,624

329,930,190

963,683,859

905,392,747

Gross profit

20,525,892

19,113,010

61,747,450

54,370,948

Selling, general and administrative

expenses

18,513,048

17,008,355

53,861,943

48,981,383

Depreciation and amortization

620,142

614,710

1,869,378

1,683,618

19,133,190

17,623,065

55,731,321

50,665,001

Operating income

1,392,702

1,489,945

6,016,129

3,705,947

Other expense (income):

Interest expense

381,469

261,510

1,100,995

777,065

Other (income), net

(15,446

)

(18,615

)

(55,081

)

(51,158

)

366,023

242,895

1,045,914

725,907

Income from operations before income

taxes

1,026,679

1,247,050

4,970,215

2,980,040

Income tax expense

361,000

462,000

1,536,000

376,000

Net income available to common

shareholders

$

665,679

$

785,050

$

3,434,215

$

2,604,040

Basic earnings per share available to

common shareholders

$

1.12

$

1.21

$

5.65

$

3.85

Diluted earnings per share available to

common shareholders

$

1.10

$

1.18

$

5.56

$

3.79

Basic weighted average shares

outstanding

592,768

651,170

607,505

676,103

Diluted weighted average shares

outstanding

606,278

664,688

617,887

686,576

Dividends declared and paid per common

share

$

0.18

$

0.18

$

0.82

$

0.82

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of

Shareholders’ Equity for the three and nine months ended June 30,

2019 and 2018

Additional

Common Stock

Treasury Stock

Paid in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

THREE MONTHS ENDED JUNE 2018

Balance, April 1, 2018

844,089

$

8,441

(160,085

)

$

(14,245,830

)

$

22,036,562

$

62,296,042

$

70,095,215

Dividends on common stock, $0.18 per

share

—

—

—

—

—

(127,937

)

(127,937

)

Compensation expense and issuance of stock

in connection with equity-based awards

—

—

—

—

5,593

—

5,593

Repurchase of common stock

—

—

(68,016

)

(7,059,864

)

—

—

(7,059,864

)

Net income

—

—

—

—

—

785,050

785,050

Balance, June 30, 2018

844,089

$

8,441

(228,101

)

$

(21,305,694

)

$

22,042,155

$

62,953,155

$

63,698,057

THREE MONTHS ENDED JUNE 2019

Balance, April 1, 2019

856,039

$

8,561

(263,271

)

$

(24,511,598

)

$

23,148,372

$

66,203,466

$

64,848,801

Dividends on common stock, $0.18 per

share

—

—

—

—

—

(111,766

)

(111,766

)

Compensation expense and issuance of stock

in connection with equity-based awards

—

—

—

—

36,801

—

36,801

Repurchase of common stock

—

—

(1

)

(141

)

—

—

(141

)

Net income

—

—

—

—

—

665,679

665,679

Balance, June 30, 2019

856,039

$

8,561

(263,272

)

$

(24,511,739

)

$

23,185,173

$

66,757,379

$

65,439,374

Additional

Common Stock

Treasury Stock

Paid in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

NINE MONTHS ENDED JUNE 2018

Balance, October 1, 2017

831,438

$

8,314

(153,432

)

$

(13,601,302

)

$

20,825,919

$

60,935,911

$

68,168,842

Dividends on common stock, $0.82 per

share

—

—

—

—

—

(586,796

)

(586,796

)

Compensation expense and issuance of stock

in connection with equity-based awards

12,651

127

—

—

1,216,236

—

1,216,363

Repurchase of common stock

—

—

(74,669

)

(7,704,392

)

—

—

(7,704,392

)

Net income

—

—

—

—

—

2,604,040

2,604,040

Balance, June 30, 2018

844,089

$

8,441

(228,101

)

$

(21,305,694

)

$

22,042,155

$

62,953,155

$

63,698,057

NINE MONTHS ENDED JUNE 2019

Balance, October 1, 2018

844,089

$

8,441

(228,312

)

$

(21,324,752

)

$

22,069,098

$

63,848,030

$

64,600,817

Dividends on common stock, $0.82 per

share

—

—

—

—

—

(524,866

)

(524,866

)

Compensation expense and issuance of stock

in connection with equity-based awards

11,950

120

—

—

1,116,075

—

1,116,195

Repurchase of common stock

—

—

(34,960

)

(3,186,987

)

—

—

(3,186,987

)

Net income

—

—

—

—

—

3,434,215

3,434,215

Balance, June 30, 2019

856,039

$

8,561

(263,272

)

$

(24,511,739

)

$

23,185,173

$

66,757,379

$

65,439,374

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of Cash

Flows for the nine months ended June 30, 2019 and 2018

June

June

2019

2018

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

3,434,215

$

2,604,040

Adjustments to reconcile net income from

operations to net cash flows from

operating activities:

Depreciation

1,827,711

1,619,868

Amortization

41,667

63,750

Gain on sales of property and

equipment

(15,376

)

(5,300

)

Equity-based compensation

1,035,128

957,656

Deferred income taxes

112,439

(672,431

)

Provision for losses on doubtful

accounts

179,000

23,000

Inventory allowance

454,357

(267,389

)

Other

2,967

2,967

Changes in assets and liabilities:

Accounts receivable

(3,209,941

)

(3,276,391

)

Inventories

11,468,718

22,167,954

Prepaid and other current assets

(5,698,021

)

(5,843,877

)

Other assets

19,712

(4,928

)

Accounts payable

2,485,721

1,584,358

Accrued expenses and accrued wages,

salaries and bonuses

(1,460,935

)

125,758

Income taxes receivable

157,836

11,751

Net cash flows from operating

activities

10,835,198

19,090,786

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(3,385,977

)

(2,120,358

)

Proceeds from sales of property and

equipment

56,200

5,300

Net cash flows (used in) investing

activities

(3,329,777

)

(2,115,058

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facility

1,022,309,940

1,043,415,401

Repayments under revolving credit

facility

(1,025,624,006

)

(1,051,967,147

)

Principal payments on long-term debt

(686,139

)

(279,339

)

Repurchase of common stock

(3,186,987

)

(7,704,392

)

Dividends on common stock

(524,866

)

(586,796

)

Withholdings on the exercise of

equity-based awards

—

(101,200

)

Net cash flows (used in) financing

activities

(7,712,058

)

(17,223,473

)

Net change in cash

(206,637

)

(247,745

)

Cash, beginning of period

520,644

523,065

Cash, end of period

$

314,007

$

275,320

Supplemental disclosure of cash flow

information:

Cash paid during the period for

interest

$

1,140,562

$

764,557

Cash paid during the period for income

taxes

1,265,725

1,036,680

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

91,838

$

8,203

Issuance of common stock in connection

with the vesting and exercise of

equity-based awards

1,005,792

1,183,091

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190718005759/en/

Christopher H. Atayan AMCON Distributing Company Ph

402-331-3727

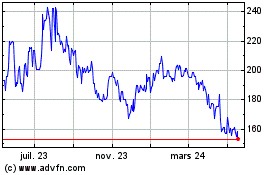

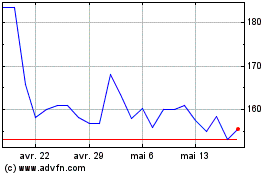

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024