Form 8-K - Current report

17 Juin 2024 - 10:06PM

Edgar (US Regulatory)

false

0001101396

0001101396

2024-06-06

2024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): June 6, 2024

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

| |

1-15583 |

|

| |

(Commission File Number) |

|

| |

|

|

| Georgia |

|

58-2508794

|

| (State or Other Jurisdiction of Incorporation) |

|

(IRS Employer Identification No.)

|

|

2750 Premiere Pkwy., Suite 100,

Duluth, Georgia 30097

|

|

30097

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

(678) 775-6900

|

|

|

(Registrant's Telephone Number Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

DLA

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On June 6, 2024, Delta Apparel, Inc. (the “Company”) committed to a plan to formally suspend its manufacturing operations in Honduras due to ongoing liquidity challenges. This plan follows the wind-down of the Company’s manufacturing operations in Mexico earlier this year, and the Company’s strategic decision to no longer emphasize Delta Activewear's Global Brands channel, as previously disclosed. The Company continues to seek to sell its El Salvador manufacturing operations servicing that channel, as previously disclosed.

The suspension of the Company’s manufacturing operations in Honduras is expected to impact approximately 2,413 employees and is expected to remain in effect for at least 120 days as the Company explores strategic initiatives involving its offshore manufacturing operations, which may include a sale or a permanent wind-down of all such operations. The Company expects to finalize its plan regarding its offshore manufacturing operations and substantially complete its implementation within 120 days. The final costs and cash expenditures relating to such plan will not be known until all related activities have been completed. The Company expects to incur (i) restructuring charges attributable to net cash payments primarily for employee-related benefits, the amount of which will depend in part on the duration of the suspension of operations, (ii) potential facility closure costs, and (iii) other restructuring costs and future cash expenditures, the amounts of which the Company is currently unable to estimate at the time of this Current Report on Form 8-K (“Report”). Such restructuring charges are expected to be incurred beginning in the third quarter of fiscal year 2024.

The costs and charges described above are subject to a number of assumptions and risks, and actual results may differ materially from such estimates. The Company may also incur other charges, costs, future cash expenditures or impairments not currently contemplated due to events that may occur as a result of, or in connection with, the above-referenced plan.

As previously disclosed in its Quarterly Report on Form 10-Q filed with the SEC on May 9, 2024, the Company has been keenly focused on evaluating its business strategies and managing its working capital and costs in light of significant market, operational and liquidity challenges, including, among others:

| |

●

|

the Company’s deteriorating liquidity position, including its limited cash and cash equivalents and its inability to date to raise additional capital or otherwise obtain necessary liquidity to have sufficient resources to fund its operations, which continues to prevent it from purchasing all of the yarn, dyes, chemicals and other production inputs required to supply its manufacturing facilities and allow them to run at the levels required to meet its business plans;

|

| |

●

|

significant reductions in demand across certain of the Company’s business units during fiscal year 2023 and the beginning of fiscal year 2024, which has impacted the Company’s operating results and financial position; and

|

| |

●

|

the Company’s continued non-compliance with certain covenants in its U.S. asset-based revolving credit facility, which constitutes a breach of that agreement and an event of default that remains uncured at the time of this Report.

|

The plan to suspend the Company’s manufacturing operations in Honduras was commenced as a result of the ongoing liquidity challenges discussed above, among other factors. The Company’s deteriorating liquidity position and lack of funding has continued to prevent it from purchasing raw materials necessary to operate its offshore manufacturing facilities and to pay compensation and benefits due to offshore employees. As previously disclosed, the Company also continues to explore the potential sale of its Salt Life business and continues to evaluate all strategic options and alternatives with its legal and financial advisors.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements including, but not limited to, statements related to the terms and conditions of the plan to suspend its manufacturing operations in Honduras, the number of employees affected by such plan, the restructuring costs expected to be incurred in connection with such plan, the cash expenditures expected to be incurred in connection with such plan, the expected timing of recognition of the charges associated with such plan, and statements related to the Company’s attempt to sell certain of its assets. These forward-looking statements are based on management’s beliefs and assumptions and on information available to management as of the date they are made. However, investors should not place undue reliance on any such forward-looking statements because they speak only as of the date they are made. The Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results, events and developments to differ materially from the Company’s historical experience and its present expectations or projections. These risks and uncertainties include, but are not necessarily limited to, those described in the Company’s filings with the Securities and Exchange Commission.

|

Exhibit Number

|

Description

|

| |

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

DELTA APPAREL, INC.

|

| |

|

|

| |

|

|

|

Date:

|

June 17, 2024

|

/s/ J. Tim Pruban

|

| |

|

J. Tim Pruban

|

| |

|

Chief Restructuring Officer

|

v3.24.1.1.u2

Document And Entity Information

|

Jun. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DELTA APPAREL, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jun. 06, 2024

|

| Entity, File Number |

1-15583

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, Tax Identification Number |

58-2508794

|

| Entity, Address, Address Line One |

2750 Premiere Pkwy., Suite 100

|

| Entity, Address, City or Town |

Duluth

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30097

|

| City Area Code |

678

|

| Local Phone Number |

775-6900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

|

| Trading Symbol |

DLA

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001101396

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

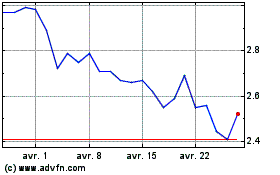

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024