Amex Gold Miners Index (GDM) Up 23.7% Through August

12 Septembre 2006 - 8:02PM

PR Newswire (US)

NEW YORK, Sept. 12 /PRNewswire/ -- The Amex Gold Miners Index (GDM)

gained 4.7 percent in August and 23.7 percent for the eight months

ending August 31, 2006.* GDM is a modified market

capitalization-weighted index that is comprised of the common

stocks or ADRs of publicly traded companies involved primarily in

the mining of gold and silver. As of August 31, 2006, GDM included

45 securities. The combined market capitalization of its

constituents is approximately $150 billion and its beta** to gold

bullion is 2.03. The Market Vectors -- Gold Miners ETF (AMEX:GDX)

is an exchange-traded fund that seeks to replicate, as closely as

possible, before fees and expenses, the price and yield performance

of GDM. GDX generally holds all of the securities that comprise GDM

in proportion to their weighting in GDM. Since its inception on May

16, 2006, the NAV of GDX has gained 2.06 percent while gold bullion

lost 9.14 percent. In August, the NAV of GDX gained 4.71 percent***

while gold bullion lost 1.48 percent. Since it started trading, GDX

has had average daily trading volume of over 529,000 shares. It had

approximately $237 million in assets as of August 31, 2006. Options

on GDX are listed on the Amex, CBOE, and Archipelago. GDX options

volume was 15,055 for the four weeks ending September 1, 2006, up

more than 27 percent from the 11,786 contracts traded during the

four weeks ending August 4, 2006. GDX is rebalanced quarterly

according to any reconstitution of GDM. The last rebalancing took

place on June 16, 2006 pursuant to which Great Basin Gold Kimber

Resources and Vista Gold were added to the portfolio and Entree

Gold was removed. The next rebalancing will occur on September 15,

2006. *Past performance does not guarantee future results. GDM's

return does not represent the performance of any fund. GDM does not

charge any fees, including management fees or brokerage expenses,

and no such fees or expenses were deducted from the performance

shown. Investors cannot invest directly in GDM. **Beta: A

quantitative measure of volatility relative to a benchmark. A beta

above 1 indicates greater volatility than the benchmark, while a

beta below 1 indicates less volatility. ***Performance data quoted

represents past performance which is not a guarantee of future

results. Current performance may be higher or lower than

performance quoted. Investment returns and principal value will

fluctuate and shares, when sold, may be worth more or less than

their original value. Please call 1-888-MKT-VCTR or visit

http://www.vaneck.com/gdx for the most recent month-end

performance. This information will be available no later than seven

business days after the most recent month end. About

Exchange-Traded Funds ETFs are passively managed baskets of

securities that trade in a manner similar to stocks. They have

grown in popularity as investment tools because of their relatively

low expense ratios and the tax efficiency they offer compared to

most mutual funds. Investors can buy and sell ETFs intra-day and

they can hold them both long and short, offering the opportunity to

prosper from both bear and bull markets. About the American Stock

Exchange The American Stock Exchange LLC (Amex(R)) currently leads

the industry in ETF listings with more than $200 billion in assets

under management in 167 ETFs. The Amex is the only primary exchange

that offers trading across a full range of equities, options and

ETFs, including structured products and HOLDRS(SM). In addition to

its role as a national equities market, the Amex is the pioneer of

the ETF, responsible for bringing the first domestic product to

market in 1993. The Amex is also one of the largest options

exchanges in the U.S., facilitating the trading of options on

broad-based and sector indexes as well as domestic and foreign

stocks. For more information, please visit http://www.amex.com/.

About Van Eck Global Founded in 1955, Van Eck Global was among the

first U.S. money managers to help investors achieve greater

diversification through global investing. In 1968, it introduced

the nation's first gold mutual fund. Today the firm continues its

50+ year tradition by offering global investment choices in hard

assets, emerging markets, precious metals including gold, and other

specialized asset classes. Van Eck Global's mutual funds and ETF

are sold nationwide through retail brokers, financial planners and

investment advisors. Designed for investors seeking innovative

choices for portfolio diversification, they are often categorized

in asset classes having returns with low correlations to those of

more traditional U.S. equity and fixed income investments. Van Eck

Global also offers separate accounts and alternative investments.

In addition, it offers the Worldwide Insurance Trust Fund, a series

of investment choices within the variable annuity contracts and

variable life policies of widely known and highly regarded

insurers. As of August 1, 2006, the company managed over $3.8

billion. About the Amex Gold Miners Index The Amex Gold Miners

Index (GDM) is a modified market-capitalization- weighted index

comprised of common stocks or ADRs of publicly traded companies

involved primarily in the mining for gold and silver. As of August

31, 2006, GDM included 45 securities. The Amex launched GDM in 2004

and its performance history dates to September 1993. GDM is

calculated using a modified market capitalization weighting

methodology. Only companies with a market capitalization greater

than $100 million that have had an average daily trading volume of

at least 50,000 shares over the past six months are eligible for

inclusion in GDM. The weight of any single component stock may not

account for more than 20% of the total value of GDM and the

aggregate weight of those component stocks which individually

represent more than 4.5 percent of the total value of GDM may not

account for more than 50 percent of GDM's total value. GDM

composition and share weightings are reviewed quarterly. The value

of GDM is disseminated every 15 seconds between the hours of

approximately 9:30 am and 4:15 pm Eastern Time. For a more complete

description of GDM, please read the GDX prospectus. The Amex Gold

Miners Index is a trademark of the Amex, which is licensed for use

by Van Eck Associates Corporation in connection with GDX. GDX is

not sponsored or endorsed by the Amex and the Amex makes no

warranty or representation as to the accuracy and/or completeness

of GDM or the results to be obtained by any person from the use of

GDM in connection with the trading of GDX. Investors may call

1.888.MKT.VCTR or visit http://www.vaneck.com/gdx for a free

prospectus. Investors should consider the investment objective,

risks, and charges and expenses of GDX carefully before investing.

The prospectus contains this and other information about GDX.

Please read the prospectus carefully before investing. Van Eck

Securities Corporation, Distributor, 99 Park Avenue, New York, NY

10016 DATASOURCE: Van Eck Global CONTACT: Mike MacMillan/Andrew

Schiff of MacMillan Communications, +1-212-473-4442, Web site:

http://www.vaneck.com/gdx http://www.amex.com/

Copyright

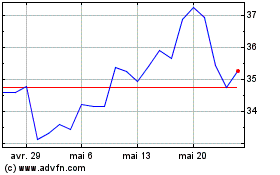

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024