FALSE000004993800000499382023-12-132023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

Date of Report (Date of earliest event reported): | December 13, 2023 | |

IMPERIAL OIL LIMITED

___________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Canada | | 0-12014 | | 98-0017682 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | |

| 505 Quarry Park Boulevard S.E., Calgary, Alberta | | T2C 5N1 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | | | | | | | | | | | | | | | | | | | |

Registrant's telephone number, including area code: | 1-800-567-3776 | |

____________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on

which registered |

| None |

| None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

| | | | | | | | | | | | | | |

Item 7.01 | | Regulation FD Disclosure |

| | | | |

On December 13, 2023, Imperial Oil Limited (the “company”) by means of a press release announced it has taken up and paid for 19,108,280 common shares at a price of $78.50 per share under the company’s offer to purchase for cancellation up to $1.5 billion of its common shares. A copy of the press release is attached as Exhibit 99.1 to this report. |

| | | | |

Item 9.01 | | Financial Statements and Exhibits. |

| | | | |

(d) | | Exhibits. |

| | | | |

| | The following exhibit is furnished as part of this report on Form 8-K: |

| | | | |

| | | | News release of the company on December 13, 2023 announcing that it has taken up and paid for 19,108,280 common shares at a price of $78.50 per share under the company’s offer to purchase for cancellation up to $1.5 billion of its common shares. |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 13, 2023

| | | | | | | | | | | |

| By: | /s/ Ian Laing | |

| | | |

| Name: | Ian Laing | |

| Title: | Vice-president, general counsel and corporate secretary | |

| | | |

| By: | /s/ Cathryn Walker | |

| | | |

| Name: | Cathryn Walker | |

| Title: | Assistant corporate secretary | |

Imperial announces completion of its $1.5 billion substantial issuer bid

Calgary, AB – December 13, 2023 – Imperial Oil Limited (TSE: IMO, NYSE American: IMO) announced today that it has taken up and paid for 19,108,280 common shares (“Shares”) at a price of $78.50 per Share (the “Purchase Price”) under Imperial’s offer (the “Offer”) to purchase for cancellation up to $1.5 billion of its Shares. All amounts are in Canadian dollars.

The Shares purchased represent an aggregate purchase of $1.5 billion and 3.4 percent of the total number of Imperial’s issued and outstanding Shares as of the close of business on October 30, 2023. Immediately following completion of the Offer, Imperial has 535,836,803 Shares issued and outstanding.

A total of 5,784,055 Shares were taken up and purchased pursuant to auction tenders at or below the Purchase Price and pursuant to purchase price tenders. Since the Offer was oversubscribed, shareholders who made auction tenders at or below the Purchase Price and shareholders who made, or were deemed to have made, purchase price tenders had approximately 20 percent of their tendered Shares taken up by Imperial (other than “odd lot” tenders, which were not subject to proration). 13,324,225 Shares were taken up and purchased pursuant to proportionate tenders.

Exxon Mobil Corporation (“ExxonMobil”), Imperial’s majority shareholder, made a proportionate tender under the Offer in order to maintain its proportionate Share ownership at approximately 69.6 percent, resulting in 13,299,349 Shares being taken up pursuant to the Offer. Immediately following completion of the Offer, ExxonMobil holds 372,942,029 Shares.

Imperial has accepted the Shares tendered for purchase and has made payment for the Shares by delivering the aggregate purchase price to Computershare Investor Services Inc., the depositary for the Offer (the “Depositary”). Payment and settlement with shareholders will be effected by the Depositary on or about December 19, 2023, all in accordance with the Offer and applicable law. Any Shares not purchased, including such Shares not purchased as a result of proration or Shares tendered pursuant to auction tenders at prices higher than the Purchase Price or invalidly tendered, will be returned to shareholders as soon as practicable.

To assist shareholders in determining the tax consequences of the Offer, Imperial estimates that a deemed dividend in the amount of $76.75 per Share was triggered on the repurchase of each Share, based on the estimated paid-up capital of $1.75 per Share at December 8, 2023. The dividend deemed to have been paid by Imperial to Canadian resident persons is designated as an “eligible dividend” for purposes of the Income Tax Act (Canada) and any corresponding provincial and territorial tax legislation.

For the purposes of subsection 191(4) of the Income Tax Act (Canada), the “specified amount” in respect of each Share is $75.32.

Shareholders should consult with their own tax advisors with respect to the income tax consequences of the disposition of their Shares under the Offer.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

Imperial retained RBC Capital Markets to act as financial advisor and dealer manager in connection with the Offer.

The full details of the Offer are described in the offer to purchase and issuer bid circular dated November 3, 2023, as well as the related letter of transmittal and notice of guaranteed delivery, copies of which were filed and are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

This news release is for informational purposes only and does not constitute an offer to buy or the solicitation of an offer to sell Shares.

Imperial is one of Canada’s largest integrated oil companies. It is active in all phases of the petroleum industry in Canada, including the exploration for, and production and sale of, crude oil and natural gas. In Canada, it is a major producer of crude oil, the largest petroleum refiner and a leading marketer of petroleum products. It is also a major producer of petrochemicals. The company’s operations are conducted in three main segments: Upstream, Downstream and Chemical.

| | | | | | | | |

For further information: |

| | |

Investor Relations | | Media Relations |

| (587) 962-4401 | | (587) 476-7010 |

| | |

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

Cautionary statement: Statements of future events or conditions in this release, including projections, expectations and estimates are forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, expect, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this release include, but are not limited to, references to timing of payment and settlement with shareholders by the Depositary; the return of Shares not purchased; the estimated paid-up capital per Share; and the estimated deemed dividend triggered on the repurchase of each Share.

Forward-looking statements are based on the company's current expectations, estimates, projections and assumptions at the time the statements are made. Actual results, including expectations and assumptions could differ materially depending on a number of factors. These factors include those discussed in Item 1A risk factors and Item 7 management’s discussion and analysis of financial condition and results of operations of Imperial Oil Limited’s most recent annual report on Form 10-K and subsequent interim reports on Form 10-Q.

Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial Oil Limited. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

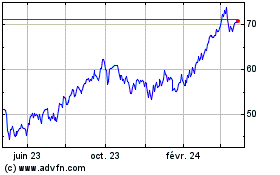

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

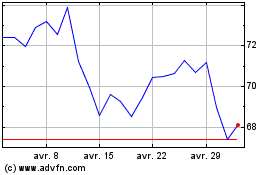

De Juin 2024 à Juil 2024

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024