SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 3)

IMPERIAL OIL LIMITED

(Name of Subject Company (Issuer))

IMPERIAL OIL LIMITED

(Filing Person(s) (Offeror(s))

Common Stock, without par value

(Title of Class of Securities)

453038408

(CUSIP Number of Class of Securities)

Ian Laing

Vice-President, General Counsel and Corporate Secretary

505 Quarry Park Boulevard S.E.

Calgary, Alberta

Canada T2C 5N1

(800) 567-3776

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

Copies to:

| | | | | | | | |

| Patrick S. Brown Sullivan & Cromwell LLP 1888 Century Park East 21st Floor Los Angeles, California 90067 (310) 712-6600 | |

☐ Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer).

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer).

This Amendment No. 3 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the “SEC”) on November 3, 2023 (“Schedule TO”), as amended by Amendment No. 1 to the Schedule TO, filed with the SEC on November 15, 2023 and Amendment No. 2 to the Schedule TO, filed with the SEC on December 11, 2023, relating to an offer by Imperial Oil Limited, a Canadian corporation (the “Company”), to purchase a number of shares of its common stock, without par value (the “Shares”), for an aggregate purchase price not exceeding C$1,500,000,000, at a purchase price not less than C$78.50 and not more than C$94.00 per Share, in cash, without interest, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated November 3, 2023 (the “Offer to Purchase”), together with the accompanying issuer bid circular (the “Issuer Bid Circular”), and in the related Letter of Transmittal and Notice of Guaranteed Delivery (which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

The information in the Schedule TO, including all exhibits to the Schedule TO, which were previously filed with the Schedule TO or any amendment thereto, is incorporated herein by reference in response to Items 1 through 11 of the Schedule TO, except that such information is hereby amended and supplemented to the extent specifically provided in this Amendment. All capitalized terms used but not specifically defined in this Amendment shall have the meanings given to such terms in the Offer to Purchase and the Issuer Bid Circular. The items of the Schedule TO set forth below are hereby amended and supplemented as follows:

ITEM 11.

Item 11 of the Schedule TO is hereby amended and supplemented by adding the following to the end thereof:

“On December 13, 2023, the Company issued a press release announcing the final results of the Offer, which expired at 5:00 p.m. (Calgary time) on December 8, 2023. A copy of such press release is filed as Exhibit (a)(5)(vi) to this Schedule TO and is incorporated herein by reference.”

ITEM 12. EXHIBITS.

The following are attached as exhibits to this Schedule TO:

| | | | | |

| (a)(1)(i) | |

| (a)(1)(ii) | |

| (a)(1)(iii) | |

| (a)(1)(iv) | |

| (a)(1)(v) | |

| (a)(5)(i) | |

| (a)(5)(ii) | |

| (a)(5)(iii) | |

| | | | | |

| (a)(5)(iv) | |

| (a)(5)(v) | |

| (a)(5)(vi) | |

| (d)(i) | Form of Letter relating to Supplemental Retirement Income (Incorporated herein by reference to Exhibit (10)(c)(3) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1980 (File No. 2-9259)).* |

| (d)(ii) | Deferred Share Unit Plan for Nonemployee Directors (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1998 (File No. 0-12014)).* |

| (d)(iii) | |

| (d)(iv) | |

| (d)(v) | |

| (d)(vi) | |

| (d)(vii) | |

| 99.1 | |

| 107 | |

| |

† Included in mailing to shareholders.

* Previously Filed.

** Filed herewith.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

Not Applicable.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | | | | | | | |

| Imperial Oil Limited |

| | | |

| By: | /s/ Ian Laing |

| | | |

| | | |

| | Name: | Ian Laing |

| | Title: | Vice President, General Counsel and Corporate Secretary |

| | | |

| | | |

| By: | /s/ Cathryn Walker |

| | | |

| | | |

| | Name: | Cathryn Walker |

| | Title: | Assistant Corporate Secretary |

| | | |

Date: December 13, 2023

EXHIBIT INDEX

| | | | | |

| Exhibit | |

| (a)(1)(i) | Offer to Purchase, dated November 3, 2023, together with the Issuer Bid Circular.* |

| (a)(1)(ii) | Form of Letter of Transmittal.* |

| (a)(1)(iii) | Form of Notice of Guaranteed Delivery.* |

| (a)(1)(iv) | Form of Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9.† |

| (a)(1)(v) | Summary Advertisement as published on November 3, 2023 in the Wall Street Journal.* |

| (a)(5)(i) | Pre-Commencement Press Release Announcing Earnings issued by the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 27, 2023).* |

| (a)(5)(ii) | Pre-Commencement Press Release Announcing Intention to Launch Substantial Issuer Bid issued by the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 27, 2023).* |

| (a)(5)(iii) | Transcript of earnings release conference call of the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 30, 2023).* |

| (a)(5)(iv) | Pre-Commencement Press Release Announcing Terms of Substantial Issuer Bid issued by the Company on October 30, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 31, 2023).* |

| (a)(5)(v) | Preliminary Press Release issued by the Company on December 11, 2023 (Incorporated herein by reference to Exhibit 99.1 of the Company’s Form 8-K filed on December 11, 2023 (File No. 0-12014)).* |

| (a)(5)(vi) | Press Release issued by the Company on December 13, 2023 (Incorporated herein by reference to Exhibit 99.1 of the Company’s Form 8-K filed on December 13, 2023 (File No. 0-12014)).** |

| (d)(i) | Form of Letter relating to Supplemental Retirement Income (Incorporated herein by reference to Exhibit (10)(c)(3) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1980 (File No. 2-9259)).* |

| (d)(ii) | Deferred Share Unit Plan for Nonemployee Directors (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1998 (File No. 0-12014)).* |

| (d)(iii) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2011 and subsequent years, as amended effective November 14, 2011 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on February 23, 2012 (File No. 0-12014)).* |

| | | | | |

| (d)(iv) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)).* |

| (d)(v) | Amended Short Term Incentive Program with respect to awards granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)).* |

| (d)(vi) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2020 and subsequent years, as amended effective November 24, 2020 (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 (File No. 0-12014)).* |

| (d)(vii) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2022 and subsequent years, as amended effective November 29, 2022 (Incorporated herein by reference to Exhibit (10)(iii)(A)(7) of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (File No. 0-12014)). |

| 99.1 | Material Change Report, dated November 3, 2023.* |

| 107 | Filing Fee Table.** |

| |

| |

† Included in mailing to shareholders.

* Previously Filed.

** Filed herewith.

Exhibit 107

Calculation of Filing Fee Tables

SC TO

(Form Type)

IMPERIAL OIL LIMITED

(Exact Name of Registrant as Specified in its Charter)

Table 1 – Transaction Valuation

| | | | | | | | | | | |

| Transaction Valuation |

Fee rate | Amount of Filing Fee |

Fees to Be Paid | $1,084,350,000.00(1) | 0.00014760 | $160,050.06 |

Fees Previously Paid | | | |

Total Transaction Valuation | | | $1,084,350,000.00 |

Total Fees Due for Filing | | | $160,050.06(2) |

Total Fees Previously Paid | | | |

Total Fee Offsets | | | |

Net Fee Due | | | $160,050.06 |

| | | | | | | | | | | | | | |

| (1) | The transaction value is estimated for purposes of calculating the amount of the filing fee only. The repurchase price of the Common Shares, as described in the Schedule TO, is C$1,500,000,000. The repurchase price has been converted into U.S. dollars based on an exchange rate on October 30, 2023, as reported by the Bank of Canada, for the conversion of Canadian dollars into U.S. dollars of C$1 equals US$0.7229. |

| (2) | The fee of $160,050.06 was paid in connection with the filing of the Schedule TO-I by the Company (File No. 005-35902) on November 3, 2023. |

Imperial announces completion of its $1.5 billion substantial issuer bid

Calgary, AB – December 13, 2023 – Imperial Oil Limited (TSE: IMO, NYSE American: IMO) announced today that it has taken up and paid for 19,108,280 common shares (“Shares”) at a price of $78.50 per Share (the “Purchase Price”) under Imperial’s offer (the “Offer”) to purchase for cancellation up to $1.5 billion of its Shares. All amounts are in Canadian dollars.

The Shares purchased represent an aggregate purchase of $1.5 billion and 3.4 percent of the total number of Imperial’s issued and outstanding Shares as of the close of business on October 30, 2023. Immediately following completion of the Offer, Imperial has 535,836,803 Shares issued and outstanding.

A total of 5,784,055 Shares were taken up and purchased pursuant to auction tenders at or below the Purchase Price and pursuant to purchase price tenders. Since the Offer was oversubscribed, shareholders who made auction tenders at or below the Purchase Price and shareholders who made, or were deemed to have made, purchase price tenders had approximately 20 percent of their tendered Shares taken up by Imperial (other than “odd lot” tenders, which were not subject to proration). 13,324,225 Shares were taken up and purchased pursuant to proportionate tenders.

Exxon Mobil Corporation (“ExxonMobil”), Imperial’s majority shareholder, made a proportionate tender under the Offer in order to maintain its proportionate Share ownership at approximately 69.6 percent, resulting in 13,299,349 Shares being taken up pursuant to the Offer. Immediately following completion of the Offer, ExxonMobil holds 372,942,029 Shares.

Imperial has accepted the Shares tendered for purchase and has made payment for the Shares by delivering the aggregate purchase price to Computershare Investor Services Inc., the depositary for the Offer (the “Depositary”). Payment and settlement with shareholders will be effected by the Depositary on or about December 19, 2023, all in accordance with the Offer and applicable law. Any Shares not purchased, including such Shares not purchased as a result of proration or Shares tendered pursuant to auction tenders at prices higher than the Purchase Price or invalidly tendered, will be returned to shareholders as soon as practicable.

To assist shareholders in determining the tax consequences of the Offer, Imperial estimates that a deemed dividend in the amount of $76.75 per Share was triggered on the repurchase of each Share, based on the estimated paid-up capital of $1.75 per Share at December 8, 2023. The dividend deemed to have been paid by Imperial to Canadian resident persons is designated as an “eligible dividend” for purposes of the Income Tax Act (Canada) and any corresponding provincial and territorial tax legislation.

For the purposes of subsection 191(4) of the Income Tax Act (Canada), the “specified amount” in respect of each Share is $75.32.

Shareholders should consult with their own tax advisors with respect to the income tax consequences of the disposition of their Shares under the Offer.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

Imperial retained RBC Capital Markets to act as financial advisor and dealer manager in connection with the Offer.

The full details of the Offer are described in the offer to purchase and issuer bid circular dated November 3, 2023, as well as the related letter of transmittal and notice of guaranteed delivery, copies of which were filed and are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

This news release is for informational purposes only and does not constitute an offer to buy or the solicitation of an offer to sell Shares.

Imperial is one of Canada’s largest integrated oil companies. It is active in all phases of the petroleum industry in Canada, including the exploration for, and production and sale of, crude oil and natural gas. In Canada, it is a major producer of crude oil, the largest petroleum refiner and a leading marketer of petroleum products. It is also a major producer of petrochemicals. The company’s operations are conducted in three main segments: Upstream, Downstream and Chemical.

| | | | | | | | |

For further information: |

| | |

Investor Relations | | Media Relations |

| (587) 962-4401 | | (587) 476-7010 |

| | |

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

Cautionary statement: Statements of future events or conditions in this release, including projections, expectations and estimates are forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, expect, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this release include, but are not limited to, references to timing of payment and settlement with shareholders by the Depositary; the return of Shares not purchased; the estimated paid-up capital per Share; and the estimated deemed dividend triggered on the repurchase of each Share.

Forward-looking statements are based on the company's current expectations, estimates, projections and assumptions at the time the statements are made. Actual results, including expectations and assumptions could differ materially depending on a number of factors. These factors include those discussed in Item 1A risk factors and Item 7 management’s discussion and analysis of financial condition and results of operations of Imperial Oil Limited’s most recent annual report on Form 10-K and subsequent interim reports on Form 10-Q.

Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial Oil Limited. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

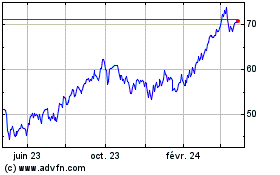

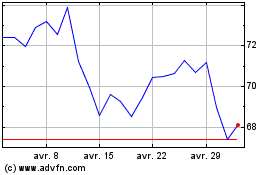

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024