0001369290false00013692902024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 21, 2024 |

MYOMO, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38109 |

47-0944526 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

137 Portland St. 4th Floor |

|

Boston, Massachusetts |

|

02114 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 996-9058 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

MYO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amended Employment Agreement for David Henry

On February 21, 2024, Myomo, Inc. (the “Company”) entered into an amendment (the “Henry Amendment”) to the employment agreement dated April 22,2021 (the "Original Henry Agreement") with David Henry, the Chief Financial Officer of the Company, effective on February 21, 2024. Pursuant to the Henry Amendment, Mr. Henry shall (i) receive a base salary of $260,000, and (ii) be eligible to receive an annual incentive compensation of up to 55% of his base salary, with the actual amount to be determined by the Compensation Committee of the Board of Directors of the Company.

As set forth in the Henry Amendment, in the event of a termination without cause which occurs within 12 months after the occurrence of a change in control, then notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement, all time-based stock options and other stock-based awards subject to time-based vesting held by Mr. Henry shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such change in control. In addition, the measurement date for any performance-based stock awards shall be accelerated to the closing date of the change in control. Should Mr. Henry be entitled to vesting of all or a portion of such performance-based stock awards, such earned portion shall accelerate and become fully exercisable or non-forfeitable as of the closing date of such change in control.

Except as amended by the Henry Amendment, all other provisions of the Original Henry Agreement remain in full force and effect.

The forgoing description of the Henry Amendment does not purport to be complete and is qualified in its entirety by the full text of the Henry Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Amended and Restated Change of Control and Severance Agreement for Harry Kovelman

On February 21, 2024, the Company entered into an amended and restated change of control and severance agreement (the “Amended Kovelman Agreement”) with Harry Kovelman, the Chief Medical Officer of the Company, effective on February 21, 2024, which amends and restates that certain Change of Control and Severance Agreement between the Company and Harry Kovelman, dated September 24, 2020. The term of the Amended Kovelman Agreement is for the period of Mr. Kovelman's employment with the Company.

Pursuant to the Amended Kovelman Agreement, in the event of termination without cause, the Company shall provide to Mr. Kovelman (i) 50% of his annual salary plus a pro-rata portion of his annual incentive bonus for the year (the "Severance Amount"), (ii) a monthly cash payment for six months or Mr. Kovelman's’ Consolidated Omnibus Budget Reconciliation Act (“COBRA”) health continuation period, whichever ends earlier, in an amount equal to the monthly employer contribution that the Company would have made to provide health insurance to Mr. Kovelman if he had remained employed by the Company, subject to Mr. Kovelman participating in the Company’s group health plan immediately prior to the date of termination and electing COBRA health continuation, and (iii) the vesting of all stock options and other stock-based awards held by Mr. Kovelman that would have vested if employment had continued for six additional months. The amounts payable above shall be paid out in equal installments over 6 months commencing within 60 days of the date of termination, provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, the Severance Amount shall begin to be paid by the last day of such 60-day period. Additionally, if such termination without cause occurs within 12 months after the occurrence of a change in control, then Mr. Kovelman is entitled to receive the payments referred to above, except that such payments shall occur in equal installments over nine months. Notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement, all time-based stock options and other stock-based awards subject to time-based vesting held by Mr. Kovelman shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such change of control. In addition, the measurement date for any performance-based stock awards shall be accelerated to the closing date of such change in control. Should Mr. Kovelman be entitled to vesting of all or a portion of such performance-based stock awards, such earned portion shall accelerate and become fully exercisable or non-forfeitable as of the closing date of such change in control.

The forgoing description of the Amended Kovelman Agreement does not purport to be complete and is qualified in its entirety by the full text of the Amended Kovelman Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K.

Item 9.01.

(d) Exhibits

The following exhibits related to Item 5.02 are attached hereto:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MYOMO, INC. |

|

|

|

|

Date: |

February 22, 2024 |

By: |

/s/ David A. Henry |

|

|

|

David A. Henry

Chief Financial Officer |

AMENDMENT TO EMPLOYMENT AGREEMENT

This Amendment (the “Amendment”) is made as of February 21, 2024 , and amends the Employment Agreement dated April 22, 2021 between Myomo, a Delaware corporation (the “Company”), and David Henry (the “Executive”) (such Agreement, the “Employment Agreement”).

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, and in consideration for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree:

1.All references in the Employment Agreement to “Commencement Date” shall mean February 21, 2024.

2.Section 2(a) of the Employment Agreement is amended by replacing “$221,500” with “$260,000, and deleting the words “which shall be effective July 1, 2021.”

3.Section 2(b) of the Employment Agreement is hereby amended by replacing “75%” with “55%.”

4.In Section 5(a) of the Employment Agreement, the following two sentences are added between the heading “Change in Control” and the words “During the Term”:

During the Term, if the closing of a Change in Control occurs, and if Executive is engaged as the Chief Financial Officer at such time, notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement: (i) all time-based stock options and other stock-based awards subject to time-based vesting held by the Executive shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such Change in Control; and (ii) the measurement date of any unvested performance-based stock awards shall accelerate to the closing date of a Change in Control. If upon such acceleration of the measurement date, the Executive is entitled to vesting of all or a portion of such performance-based stock award, such earned portion shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such Change in Control.

5.Section 5(a)(ii) of the Employment Agreement is hereby deleted.

6.Section 7(b) of the Employment Agreement is amended by deleting the words between “For avoidance of doubt” and “made under seal.” and replacing them with the following language:

Nothing contained in this Agreement, any other agreement with the Company, or any Company policy limits the Executive’s ability, with or without notice to the Company, to: (i) file a charge or complaint with any federal, state or local governmental agency or

commission (a “Government Agency”), including without limitation, the Equal Employment Opportunity Commission, the National Labor Relations Board or the Securities and Exchange Commission; (ii) communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including by providing non-privileged documents or information; (iii) exercise any rights under Section 7 of the National Labor Relations Act, which are available to non-supervisory employees, including assisting co-workers with or discussing any employment issue as part of engaging in concerted activities for the purpose of mutual aid or protection; (iv) discuss or disclose information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that the Executive have reason to believe is unlawful; or (v) testify truthfully in a legal proceeding. Any such communications and disclosures must not violate applicable law and the information disclosed must not have been obtained through a communication that was subject to the attorney-client privilege (unless disclosure of that information would otherwise be permitted consistent with such privilege or applicable law). In addition, for the avoidance of doubt, pursuant to the federal Defend Trade Secrets Act of 2016, the Executive shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (i) is made (A) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney and (B) solely for the purpose of reporting or investigating a suspected violation of law ; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal

7.Except as expressly amended in this Amendment, the Employment Agreement remains in full effect. The Amendment, the Employment Agreement (as amended) and any confidentiality and restrictive covenant obligations Executive has to the Company constitute the entire agreement between the parties with respect to the subject matter hereof and supersede all prior agreements between the parties concerning such subject matter.

IN WITNESS WHEREOF, the parties have executed this Amendment effective on the date and year first above written.

Myomo, Inc.

By: /s/ Paul R. Gudonis__

Paul R. Gudonis

Its: CEO ____________

Executive

/s/ David Henry___________

David Henry

AMENDED AND RESTATED CHANGE OF CONTROL AND SEVERANCE AGREEMENT

This Amended and Restated Change of Control and Severance Agreement (“Agreement”) is made as of February 21, 2024, and amends, restates and supersedes the Change of Control and Severance Agreement dated September 24th 2020, between Myomo , a Delaware corporation (the “Company”), and Harry Kovelman (the “Executive”). The “Term” refers to the period of the Executive’s employment with the Company.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1.1Executive represents and certifies to MYOMO that it has not been convicted of, or sanctioned or excluded for violations of, any Federal or State laws governing the Medicare and Medicaid programs. Executive agrees to notify MYOMO within seventy-two (72) hours by certified mail if it is excluded from participation in any Medicare or Medicaid programs, or otherwise sanctioned by any Federal or State regulatory body having authority over such programs and will include the grounds for sanction or exclusion and the duration thereof.

1.2Executive certifies that he is not excluded, debarred, or otherwise ineligible for participation in any federal health care program or in any other governmental payment program. If Executive is excluded or debarred from participation in any federal health care program or other government payment program, or becomes otherwise ineligible to participate in any such program, Executive will notify MYOMO in writing within three (3) business days after learning of such event. If Executive becomes excluded, debarred or ineligible, whether or not such notice is given to MYOMO, MYOMO may immediately terminate the whole or any part of this Agreement, and will have no obligation to make any further payments.

1.3Executive acknowledges the existence of the Massachusetts Gift Ban Act, the CMS Sunshine Act and the Medicare and Medicaid Patient Protection Act of 1987, as amended, 42 U.S.C. §1320a-7b (the “Anti-kickback Statute”), that provides for criminal penalties for certain acts impacting Medicare and state health care (e.g., Medicaid) reimbursable services. Executive represents that it is a violation of MYOMO’s policy for any employee or Executive to offer any gift or gratuity to induce a product sale. Executive who procures goods and services under this Agreement may not accept gifts, gratuities or kickbacks from any vendors or service providers that may be in violation of this Federal statute or the laws known as the “Stark laws”, False Claims Act, or any state law such as the Massachusetts Gift Ban Act. MYOMO certifies that it has not paid kickbacks directly or indirectly to Executive for the purpose of inducing a provider to generate a MYOMO Purchase Order and agrees to cooperate fully with any investigation involving a possible violation of these laws and agrees to report any suspected violations of these laws to the proper authorities.

During the Term, the Executive’s employment hereunder may be terminated without any breach of this Agreement under the following circumstances:

a.Death. The Executive’s employment hereunder shall terminate upon his death.

b.Disability. The Company may terminate the Executive’s employment if he is disabled and unable to perform the essential functions of the Executive’s then existing position or positions under this Agreement with or without reasonable accommodation for a period of 180 days (which need not be consecutive) in any 12-month period. If any question shall arise as to whether during any period the Executive is disabled so as to be unable to perform the essential functions of the Executive’s then existing position or positions with or without reasonable accommodation, the Executive may, and at the request of the Company shall, submit to the Company a certification in reasonable detail by a physician selected by the Company to whom the Executive or the Executive’s guardian has no reasonable objection as to whether the Executive is so disabled or how long such disability is expected to continue, and such certification shall for the purposes of this Agreement be conclusive of the issue. The Executive shall cooperate with any reasonable request of the physician in connection with such certification. If such question shall arise and the Executive shall fail to submit such certification, the Company’s determination of such issue shall be binding on the Executive. Nothing in this Section 3(b) shall be construed to waive the Executive’s rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C. §2601 et seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

c.Termination by Company for Cause. The Company may terminate the Executive’s employment hereunder for Cause. For purposes of this Agreement, “Cause” shall mean: (i) conduct by the Executive constituting a material act of misconduct in connection with the performance of his duties, including, without limitation, misappropriation of funds or property of the Company or any of its subsidiaries or affiliates other than the occasional, customary and de minimus use of Company property for personal purposes; (ii) the commission by the Executive of any felony or a misdemeanor involving moral turpitude, deceit, dishonesty or fraud, or any conduct by the Executive that would reasonably be expected to result in material injury or reputational harm to the Company or any of its subsidiaries and affiliates if he were retained in his position; (iii) continued non-performance by the Executive of his duties hereunder (other than by reason of the Executive’s physical or mental illness, incapacity or disability) which has continued for more than 30 days

following written notice of such non-performance from the CEO; (iv) a breach by the Executive of any confidentiality or restrictive covenant obligations Executive has to the Company; (v) a material violation by the Executive of the Company’s written employment policies; or (vi) failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the Company to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation or the inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation.

d.Termination Without Cause. The Company may terminate the Executive’s employment hereunder at any time without Cause. Any termination by the Company of the Executive’s employment under this Agreement which does not constitute a termination for Cause under Section 2(c) and does not result from the death or disability of the Executive under Section 2(a) or (b) shall be deemed a termination without Cause.

e.Termination by the Executive. The Executive may terminate his employment hereunder at any time for any reason, including but not limited to Good Reason. For purposes of this Agreement, “Good Reason” shall mean that the Executive has complied with the “Good Reason Process” (hereinafter defined) following the occurrence of any of the following events: (i) a material diminution in the Executive’s responsibilities, authority or duties; (ii) a material diminution in the Executive’s base salary except for across-the-board salary reductions based on the Company’s financial performance similarly affecting all or substantially all senior management employees of the Company; (iii) a material change in the geographic location at which the Executive provides services to the Company; or (iv) the material breach of this Agreement by the Company. “Good Reason Process” shall mean that (i) the Executive reasonably determines in good faith that a “Good Reason” condition has occurred; (ii) the Executive notifies the Company in writing of the first occurrence of the Good Reason condition within 60 days of the first occurrence of such condition; (iii) the Executive cooperates in good faith with the Company’s efforts, for a period not less than 30 days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts, the Good Reason condition continues to exist; and (v) the Executive terminates his employment within 60 days after the end of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

f.Notice of Termination. Except for termination as specified in Section 2(a), any termination of the Executive’s employment by the Company or any such termination by the Executive shall be communicated by written

Notice of Termination to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a notice which shall indicate the specific termination provision in this Agreement relied upon.

g.Date of Termination. “Date of Termination” shall mean: (i) if the Executive’s employment is terminated by his death, the date of his death; (ii) if the Executive’s employment is terminated on account of disability under Section 2(b) or by the Company for Cause under Section 2(c), the date on which Notice of Termination is given; (iii) if the Executive’s employment is terminated by the Company under Section 2(d), the date on which a Notice of Termination is given; (iv) if the Executive’s employment is terminated by the Executive under Section 2(e) without Good Reason, 30 days after the date on which a Notice of Termination is given, and (v) if the Executive’s employment is terminated by the Executive under Section 2(e) with Good Reason, the date on which a Notice of Termination is given after the end of the Cure Period. Notwithstanding the foregoing, in the event that the Executive gives a Notice of Termination to the Company, the Company may unilaterally accelerate the Date of Termination and such acceleration shall not result in a termination by the Company for purposes of this Agreement.

3.Compensation Upon Termination.

a.Termination Generally. If the Executive’s employment with the Company is terminated for any reason, the Company shall pay or provide to the Executive (or to his authorized representative or estate) (i) any base salary earned through the Date of Termination, unpaid expense reimbursements and unused vacation that accrued through the Date of Termination on or before the time required by law but in no event more than 30 days after the Executive’s Date of Termination; and (ii) any vested benefits the Executive may have under any employee benefit plan of the Company through the Date of Termination, which vested benefits shall be paid and/or provided in accordance with the terms of such employee benefit plans (collectively, the “Accrued Benefit”).

b.Termination by the Company Without Cause or by the Executive with Good Reason. During the Term, if the Executive’s employment is terminated by the Company without Cause as provided in Section 2(d), or the Executive terminates his employment for Good Reason as provided in Section 2(e), then the Company shall pay the Executive his Accrued Benefit. In addition, if Executive has been employed by the Company for a minimum of one-hundred and eighty (180) days and subject to the Executive signing a separation agreement containing, among other provisions, a general release of claims in favor of the Company and related persons and entities, confidentiality, return of property and non-disparagement, in a form and manner satisfactory to the Company (the

“Separation Agreement and Release”) and the Separation Agreement and Release becoming irrevocable, all within 60 days after the Date of Termination:

(i)the Company shall pay the Executive an amount equal to 50% of sum of (A) the Executive’s annual salary plus a pro-rata portion of his bonus for the year of his employment termination, at the usual time bonuses are paid. Notwithstanding the foregoing, if the Executive breaches any of the provisions contained in the Restrictive Covenants Agreement , all payments of the Severance Amount shall immediately cease; and

(ii)upon the Date of Termination, all stock options and other stock-based awards held by the Executive in which the Executive would have vested if he had remained employed for an additional 6 months following the Date of Termination shall vest and become exercisable or non-forfeitable as of the Date of Termination; and

(iii)if the Executive was participating in the Company’s group health plan immediately prior to the Date of Termination and elects COBRA health continuation, then the Company shall pay to the Executive a monthly cash payment for six (6) months or the Executive’s COBRA health continuation period, whichever ends earlier, in an amount equal to the monthly employer contribution that the Company would have made to provide health insurance to the Executive if the Executive had remained employed by the Company; and

(iv)the amounts payable under this Section 3(b) shall be paid out in substantially equal installments in accordance with the Company’s payroll practice over six (6) months commencing within 60 days after the Date of Termination; provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, the Severance Amount shall begin to be paid in the second calendar year by the last day of such 60-day period; provided, further, that the initial payment shall include a catch-up payment to cover amounts retroactive to the day immediately following the Date of Termination. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2).

4.Change in Control Payment.

The provisions of this Section 4 set forth certain terms of an agreement reached between the Executive and the Company regarding the Executive’s rights and obligations upon the occurrence of a Change in Control of the Company. These provisions are intended to assure and encourage in advance the Executive’s continued attention and dedication to

his assigned duties and his objectivity during the pendency and after the occurrence of any such event. These provisions shall apply in lieu of, and expressly supersede, the provisions of Section 3(b) regarding severance pay and benefits upon a termination of employment, if such termination of employment by the Company Without Cause or by the Executive with Good Reason occurs within 12 months after the occurrence of the first event constituting a Change in Control. These provisions shall terminate and be of no further force or effect beginning 12 months after the occurrence of a Change in Control.

a.Change in Control. During the Term, if the closing of a Change in Control occurs, and if Executive is engaged as the CMO at such time, notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement: (i) all time-based stock options and other stock-based awards subject to time-based vesting held by the Executive shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such Change in Control; and (ii) the measurement date of any unvested performance-based stock awards shall accelerate to the closing date of a Change in Control. If upon such acceleration of the measurement date, the Executive is entitled to vesting of all or a portion of such performance-based stock award, such earned portion shall immediately accelerate and become fully exercisable or non-forfeitable as of the closing date of such Change in Control.

b.Change in Control Followed by Qualifying Termination.

During the Term, if within 12 months after a Change in Control, the Executive’s employment is terminated by the Company without Cause as provided in Section 2(d) or the Executive terminates his employment for Good Reason as provided in Section 2(e), then, subject to the signing of the Separation Agreement and Release by the Executive and the Separation Agreement and Release becoming irrevocable, all within 60 days after the Date of Termination,

(i)the Company shall pay the Executive an amount equal to 50% of sum of (A) the Executive’s annual salary plus a pro-rata portion of his bonus for the year of his employment termination, at the usual time bonuses are paid. Notwithstanding the foregoing, if the Executive breaches any confidentiality or restrictive covenant obligations Executive has to the Company, all payments of the Severance Amount shall immediately cease; and

(ii)if the Executive was participating in the Company’s group health plan immediately prior to the Date of Termination and elects COBRA health continuation, then the Company shall pay to the Executive a monthly cash payment for six (6) months or the Executive’s COBRA health continuation period, whichever ends earlier, in an amount equal to the monthly employer contribution

that the Company would have made to provide health insurance to the Executive if the Executive had remained employed by the Company; and

(iii)the amounts payable under this Section 4(b) shall be paid out in substantially equal installments in accordance with the Company’s payroll practice over nine (9) months commencing within 60 days after the Date of Termination; provided, however, that if the 60- day period begins in one calendar year and ends in a second calendar year, the Severance Amount shall begin to be paid in the second calendar year by the last day of such 60-day period; provided, further, that the initial payment shall include a catch-up payment to cover amounts retroactive to the day immediately following the Date of Termination. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2).

(i)Anything in this Agreement to the contrary notwithstanding, in the event that the amount of any compensation, payment or distribution by the Company to or for the benefit of the Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise, calculated in a manner consistent with Section 280G of the Code and the applicable regulations thereunder (the “Aggregate Payments”), would be subject to the excise tax imposed by Section 4999 of the Code, then the Aggregate Payments shall be reduced (but not below zero) so that the sum of all of the Aggregate Payments shall be $1.00 less than the amount at which the Executive becomes subject to the excise tax imposed by Section 4999 of the Code; provided that such reduction shall only occur if it would result in the Executive receiving a higher After Tax Amount (as defined below) than the Executive would receive if the Aggregate Payments were not subject to such reduction. In such event, the Aggregate Payments shall be reduced in the following order, in each case, in reverse chronological order beginning with the Aggregate Payments that are to be paid the furthest in time from consummation of the transaction that is subject to Section 280G of the Code: (1) cash payments not subject to Section 409A of the Code; (2) cash payments subject to Section 409A of the Code; (3) equity-based payments and acceleration; and (4) non-cash forms of benefits; provided that in the case of all the foregoing Aggregate Payments all amounts or payments that are not subject to calculation under Treas. Reg. §1.280G-1, Q&A-24(b) or (c) shall be reduced before

any amounts that are subject to calculation under Treas. Reg. §1.280G-1, Q&A-24(b) or (c).

(ii)For purposes of this Section 4(b), the “After Tax Amount” means the amount of the Aggregate Payments less all federal, state, and local income, excise and employment taxes imposed on the Executive as a result of the Executive’s receipt of the Aggregate Payments. For purposes of determining the After Tax Amount, the Executive shall be deemed to pay federal income taxes at the highest marginal rate of federal income taxation applicable to individuals for the calendar year in which the determination is to be made, and state and local income taxes at the highest marginal rates of individual taxation in each applicable state and locality, net of the maximum reduction in federal income taxes which could be obtained from deduction of such state and local taxes.

(iii)The determination as to whether a reduction in the Aggregate Payments shall be made pursuant to Section 4(b)(i) shall be made by a nationally recognized accounting firm selected by the Company (the “Accounting Firm”), which shall provide detailed supporting calculations both to the Company and the Executive within 15 business days of the Date of Termination, if applicable, or at such earlier time as is reasonably requested by the Company or the Executive. Any determination by the Accounting Firm shall be binding upon the Company and the Executive.

d.Definitions. For purposes of this Section, the following terms shall have the following meanings:

“Change in Control” shall mean any of the following:

(i)any “person,” as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Act”) (other than the Company, any of its subsidiaries, or any trustee, fiduciary or other person or entity holding securities under any employee benefit plan or trust of the Company or any of its subsidiaries), together with all “affiliates” and “associates” (as such terms are defined in Rule 12b-2 under the Act) of such person, shall become the “beneficial owner” (as such term is defined in Rule 13d-3 under the Act), directly or indirectly, of securities of the Company representing 50 percent or more of the combined voting power of the Company’s then outstanding securities having the right to vote in an election of the Board (“Voting Securities”) (in such case other than as a result of an acquisition of securities directly from the Company); or

(ii)the date a majority of the members of the Board is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the Board before the date of the appointment or election; or

(iii)the consummation of (A) any consolidation or merger of the Company where the stockholders of the Company, immediately prior to the consolidation or merger, would not, immediately after the consolidation or merger, beneficially own (as such term is defined in Rule 13d-3 under the Act), directly or indirectly, shares representing in the aggregate more than [50] percent of the voting shares of the Company issuing cash or securities in the consolidation or merger (or of its ultimate parent corporation, if any), or (B) any sale or other transfer (in one transaction or a series of transactions contemplated or arranged by any party as a single plan) of all or substantially all of the assets of the Company.

Notwithstanding the foregoing, a “Change in Control” shall not be deemed to have occurred for purposes of the foregoing clause (i) solely as the result of an acquisition of securities by the Company which, by reducing the number of shares of Voting Securities outstanding, increases the proportionate number of Voting Securities beneficially owned by any person to 50 percent or more of the combined voting power of all of the then outstanding Voting Securities; provided, however, that if any person referred to in this sentence shall thereafter become the beneficial owner of any additional shares of Voting Securities (other than pursuant to a stock split, stock dividend, or similar transaction or as a result of an acquisition of securities directly from the Company) and immediately thereafter beneficially owns 50 percent or more of the combined voting power of all of the then outstanding Voting Securities, then a “Change in Control” shall be deemed to have occurred for purposes of the foregoing clause (i).

a.Anything in this Agreement to the contrary notwithstanding, if at the time of the Executive’s separation from service within the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the meaning of Section 409A(a)(2)(B)(i) of the Code, then to the extent any payment or benefit that the Executive becomes entitled to under this Agreement on account of the Executive’s separation from service would be considered deferred compensation otherwise subject to the 20 percent additional tax imposed pursuant to Section 409A(a) of the Code as a result of the application of Section 409A(a)(2)(B)(i) of the Code, such payment shall not be payable and such benefit shall not be provided until the date that is the earlier of (A) six months and one day after the Executive’s separation from service, or (B) the Executive’s death. If any such delayed cash payment is otherwise

payable on an installment basis, the first payment shall include a catch-up payment covering amounts that would otherwise have been paid during the six-month period but for the application of this provision, and the balance of the installments shall be payable in accordance with their original schedule.

b.All in-kind benefits provided and expenses eligible for reimbursement under this Agreement shall be provided by the Company or incurred by the Executive during the time periods set forth in this Agreement. All reimbursements shall be paid as soon as administratively practicable, but in no event shall any reimbursement be paid after the last day of the taxable year following the taxable year in which the expense was incurred. The amount of in-kind benefits provided or reimbursable expenses incurred in one taxable year shall not affect the in-kind benefits to be provided or the expenses eligible for reimbursement in any other taxable year (except for any lifetime or other aggregate limitation applicable to medical expenses). Such right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

c.To the extent that any payment or benefit described in this Agreement constitutes “non-qualified deferred compensation” under Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Executive’s termination of employment, then such payments or benefits shall be payable only upon the Executive’s “separation from service.” The determination of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation Section 1.409A-1(h).

d.The parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any provision of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so that all payments hereunder comply with Section 409A of the Code. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2). The parties agree that this Agreement may be amended, as reasonably requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations in order to preserve the payments and benefits provided hereunder without additional cost to either party.

e.The Company makes no representation or warranty and shall have no liability to the Executive or any other person if any provisions of this Agreement are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption from, or the conditions of, such Section.

6.Arbitration of Disputes.

Any controversy or claim arising out of or relating to this Agreement or the breach thereof or otherwise arising out of the Executive’s employment or the termination of that employment (including, without limitation, any claims of unlawful employment discrimination whether based on age or otherwise) shall, to the fullest extent permitted by law, be settled by arbitration in any forum and form agreed upon by the parties or, in the absence of such an agreement, under the auspices of the American Arbitration Association (“AAA”) in Boston, Massachusetts in accordance with the Employment Dispute Resolution Rules of the AAA, including, but not limited to, the rules and procedures applicable to the selection of arbitrators. In the event that any person or entity other than the Executive or the Company may be a party with regard to any such controversy or claim, such controversy or claim shall be submitted to arbitration subject to such other person or entity’s agreement. Judgment upon the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. This Section shall be specifically enforceable. Notwithstanding the foregoing, this Section shall not preclude either party from pursuing a court action for the sole purpose of obtaining a temporary restraining order or a preliminary injunction in circumstances in which such relief is appropriate; provided that any other relief shall be pursued through an arbitration proceeding pursuant to this Section.

7.Consent to Jurisdiction.

To the extent that any court action is permitted consistent with or to enforce the preceding Section (“Arbitration of Disputes”) of this Agreement, the parties hereby consent to the jurisdiction of the Superior Court of the Commonwealth of Massachusetts and the United States District Court for the District of Massachusetts. Accordingly, with respect to any such court action, the Executive (a) submits to the personal jurisdiction of such courts; (b) consents to service of process; and (c) waives any other requirement (whether imposed by statute, rule of court, or otherwise) with respect to personal jurisdiction or service of process.

8.THE PARTIES EACH WAIVE THEIR RESPECTIVE RIGHT TO A TRIAL BY JURY OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR ARISING OUT OF OR RELATED TO THIS AGREEMENT IN ANY ACTION, PROCEEDING OR OTHER LITIGATION OF ANY TYPE BROUGHT BY ANY OF THE PARTIES AGAINST ANY OTHER PARTY OR ANY AFFILIATE OF ANY OTHER SUCH PARTY, WHETHER WITH RESPECT TO CONTRACT CLAIMS, TORT CLAIMS OR OTHERWISE. THE PARTIES EACH AGREE THAT ANY SUCH CLAIM OR CAUSE OF ACTION WILL BE TRIED BY A COURT TRIAL WITHOUT A JURY. WITHOUT LIMITING THE FOREGOING, THE PARTIES FURTHER AGREE THAT THEIR RESPECTIVE RIGHT TO A TRIAL BY JURY IS WAIVED BY OPERATION OF THIS SECTION AS TO ANY ACTION, COUNTERCLAIM OR OTHER PROCEEDING WHICH SEEKS, IN WHOLE OR IN PART, TO CHALLENGE THE VALIDITY OR ENFORCEABILITY OF THIS AGREEMENT OR ANY

PROVISION HEREOF. THIS WAIVER WILL APPLY TO ANY SUBSEQUENT AMENDMENTS, RENEWALS, SUPPLEMENTS OR MODIFICATIONS TO THIS AGREEMENT.

Nothing contained in this Agreement, any other agreement with the Company, or any Company policy limits Executive’s ability, with or without notice to the Company, to: (i) file a charge or complaint with any federal, state or local governmental agency or commission (a “Government Agency”), including without limitation, the Equal Employment Opportunity Commission, the National Labor Relations Board or the Securities and Exchange Commission; (ii) communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including by providing non-privileged documents or information; (iii) exercise any rights under Section 7 of the National Labor Relations Act, which are available to non-supervisory employees, including assisting co-workers with or discussing any employment issue as part of engaging in concerted activities for the purpose of mutual aid or protection; (iv) discuss or disclose information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Executive have reason to believe is unlawful; or (v) testify truthfully in a legal proceeding. Any such communications and disclosures must not violate applicable law and the information disclosed must not have been obtained through a communication that was subject to the attorney-client privilege (unless disclosure of that information would otherwise be permitted consistent with such privilege or applicable law). In addition, for the avoidance of doubt, pursuant to the federal Defend Trade Secrets Act of 2016, the Executive shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (i) is made (A) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney and (B) solely for the purpose of reporting or investigating a suspected violation of law ; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal

This Agreement and the fully executed Offer Letter and its attachments, and any confidentiality and restrictive covenant obligations Executive has to the Company constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements between the parties concerning such subject matter.

All payments made by the Company to the Executive under this Agreement shall be net of any tax or other amounts required to be withheld by the Company under applicable law.

12.Successor to the Executive.

This Agreement shall inure to the benefit of and be enforceable by the Executive’s personal representatives, executors, administrators, heirs, distributees, devisees and legatees. In the event of the Executive’s death after his termination of employment but prior to the completion by the Company of all payments due him under this Agreement, the Company shall continue such payments to the Executive’s beneficiary designated in writing to the Company prior to his death (or to his estate, if the Executive fails to make such designation).

If any portion or provision of this Agreement (including, without limitation, any portion or provision of any section of this Agreement) shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

The provisions of this Agreement shall survive the termination of this Agreement and/or the termination of the Executive’s employment to the extent necessary to effectuate the terms contained herein.

No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

Any notices, requests, demands and other communications provided for by this Agreement shall be sufficient if in writing and delivered in person or sent by a nationally recognized overnight courier service or by registered or certified mail, postage prepaid, return receipt requested, to the Executive at the last address the Executive has filed in writing with the Company or, in the case of the Company, at its main offices, attention of the Board.

This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative of the Company.

This is a Massachusetts contract and shall be construed under and be governed in all respects by the laws of the Commonwealth of Massachusetts, without giving effect to the conflict of laws principles of such Commonwealth. With respect to any disputes concerning federal law, such disputes shall be determined in accordance with the law as it would be interpreted and applied by the United States District Court for the First Circuit.

This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be taken to be an original; but such counterparts shall together constitute one and the same document.

The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business or assets of the Company expressly to assume and agree to perform this Agreement to the same extent that the Company would be required to perform it if no succession had taken place. Failure of the Company to obtain an assumption of this Agreement at or prior to the effectiveness of any succession shall be a material breach of this Agreement.

Wherever used herein, a pronoun in the masculine gender shall be considered as including the feminine gender unless the context clearly indicates otherwise.

22.Transfer and Assignment.

This Agreement is personal as to Executive and shall not be assigned or transferred by Executive.

The compensation provisions that were offered in connection with the Change of Control and Severance Agreement dated September 24th 2020, were set in advance and the grant date fair value of restricted stock awards and the exercise price of stock options were determined using the fair market value of MYOMO’s common shares at the date of the grant of those stock awards.

IN WITNESS WHEREOF, the parties have executed this Agreement effective on the date and year first above written.

Myomo, Inc.

By: __/s/ Paul R. Gudonis_______________

Paul R. Gudonis

Its: CEO ________________________

Executive

/s/ Harry Kovelman____________________

Harry Kovelman

v3.24.0.1

Document And Entity Information

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

MYOMO, INC.

|

| Entity Central Index Key |

0001369290

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38109

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-0944526

|

| Entity Address, Address Line One |

137 Portland St.

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02114

|

| City Area Code |

617

|

| Local Phone Number |

996-9058

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

MYO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

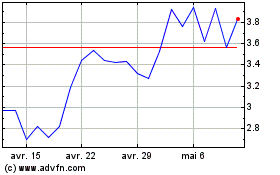

Myomo (AMEX:MYO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Myomo (AMEX:MYO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024