UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of March, 2023

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

Suite 202, 595 Howe Street

Vancouver, British Columbia,

V6C 2T5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: March 16, 2023 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

Orla Mining Reports Fourth Quarter and Year End

2022 Results

Strong First Year at Camino

Rojo Provides Foundation for Growth

VANCOUVER, BC, March 16, 2023 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") today announces the results for the fourth quarter and

year ended December 31, 2022.

(All amounts are in U.S. dollars unless otherwise

stated)

Fourth Quarter and Full-Year 2022 Highlights:

- Gold production during the fourth

quarter was 32,017 ounces and total gold production for 2022 was 109,596 ounces, achieving high end of the increased annual production

guidance range of 100,000 to 110,000 ounces (pre-released, please see the news release dated January 16, 2023, Orla Mining Achieves

High End of Increased 2022 Production Guidance and Provides 2023 Guidance).

- All-in sustaining costs ("AISC")1,2

of $634 per ounce of gold sold during the fourth quarter 2022 resulting in a full year 2022 AISC of $611 per ounce, at the low end of

the guidance range of $600-$700/oz.

- Adjusted earnings for the fourth

quarter was $20.7 million or $0.07 per share and for the full year 2022 was $57.1 million or $0.21 per share.

- Net income for the fourth quarter

was $18.7 million or $0.06 per share which included $5.6 million in expensed exploration and development costs across the portfolio. Net

income for the full year 2022 was $45.8 million or $0.17 per share, which included $18.9 million in expensed exploration and development

costs.

- Cash flow from operating activities

before changes in non-cash working capital during the fourth quarter and for the full year 2022 were $55.1 million and $111.1 million,

respectively. Free cash flow1 during the fourth quarter and for the full year 2022 totalled $11.6 million and $82.0 million,

respectively.

- Cash balance of $96.3 million

and net debt of $49.5 million at December 31, 2022.

- Successfully completed the commissioning

and ramp-up of the Camino Rojo Oxide Mine on time and under budget with declaration of commercial production on April 1, 2022.

- Completed refinancing of project

facility in April 2022 with a $150 million secured credit facility.

- Strengthened growth pipeline with the acquisition of Gold Standard

Ventures Corp. ("Gold Standard"), the owner of the South Railroad Project ("South Railroad"), a permitting-stage,

open pit, heap leach project located on the Carlin trend in Nevada. Exploration at South Railroad was immediately reactivated upon completion

of the transaction.

"2022 was a monumental year for Orla as we transitioned

to a cash flowing gold producer," said Jason Simpson, President and Chief Executive Officer of Orla. "The strong cash flows

from Camino Rojo will provide a foundation to build upon. Our rich pipeline of exploration and development assets, which we are aggressively

advancing, will be critical in growing the Company and increasing value for shareholders. We thank our stakeholders and partners for their

continued support."

| _____________________________ |

| 1 Cash cost, AISC, free cash flow and adjusted earnings are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information. |

Financial and Operations Update

| Table 1: Financial and Operating Highlights |

|

Q4 2022 |

FY 2022 |

| Operating |

|

|

|

| Gold Produced |

oz |

32,017 |

109,596 |

| Gold Sold |

oz |

32,438 |

107,502 |

| Average Realized Gold Price1 |

$/oz |

$1,743 |

$1,790 |

| Cost of Sales – Operating Cost |

$M |

$13.5 |

$45.6 |

| Cash Cost per Ounce1,2 |

$/oz |

$453 |

$449 |

| All-in Sustaining Cost per Ounce1,2 |

$/oz |

$634 |

$611 |

| |

|

|

|

| Financial |

|

|

|

| Revenue |

$M |

$56.8 |

$193.2 |

| Net Income (loss) |

$M |

$18.7 |

$45.8 |

| Adjusted Earnings1 |

$M |

$20.7 |

$57.1 |

| Earnings (loss) per Share – basic |

$/sh |

$0.06 |

$0.17 |

| Adjusted Earnings per Share – basic1 |

$/sh |

$0.07 |

$0.21 |

| |

|

|

|

| Cash Flow from Operating Activities before Changes in Non-Cash Working Capital |

$M |

$55.1 |

$111.1 |

| Free Cash Flow1 |

$M |

$11.6 |

$82.0 |

| |

|

|

|

| Financial Position |

|

Dec 31, 2022 |

| Cash and Cash Equivalents |

$M |

$96.3 |

| Net Debt1 |

$M |

$49.5 |

| 1. |

"Average Realized Gold Price", "Cash Cost per Ounce", "All-in Sustaining Cost per Ounce", "Adjusted Earnings", "Adjusted Earnings per Share – basic", "Free Cash Flow", and "Net Debt" are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information. |

| 2. |

The Company declared commercial production at Camino Rojo effective April 1, 2022. Consequently, the "full year" figures for cash cost per ounce and all-in sustaining cost per ounce are for the period April 1, 2022 to December 31, 2022. |

Financial and Operations Summary

The Company declared commercial production at Camino

Rojo on April 1, 2022 following sixteen months of construction which began in December 2020. Camino Rojo achieved record quarterly gold

production of 32,017 ounces of gold in Q4 2022, primarily as a result of an increased ore stacking rate during the quarter which achieved

a record 19,591 tonnes per day, 9% above nameplate capacity of 18,000 tonnes per day. The average mining rate during the fourth quarter

was 41,128 tonnes per day which resulted in a strip ratio of 0.70 during the quarter and 0.67 for the full year 2022. The average grade

of ore processed during the fourth quarter was 0.78 g/t gold, in line with plan, and the average grade of processed for the full year

2022, was 0.82 g/t gold, approximately 5% higher than plan.

Gold sold during the fourth quarter and for the first

full year of operation totalled 32,438 ounces and 107,502 ounces, respectively.

Fourth quarter cash costs and AISC totalled $453 and

$634 per ounce of gold sold, respectively. The key contributors to the AISC being at the lower end of the guidance range is attributable

to mining softer ore than anticipated in the upper benches of the mine during the first year of operation. As a result of the softer ore,

maintenance required on the crushing, conveying and stacking systems was less than anticipated due to low wear. Lower consumption rates

on key inputs such as electricity and reagents also contributed to the low AISC. The Company's AISC guidance for 2023 is a range of $750

to $850 per ounce of gold sold. The increase in AISC from 2022 to 2023 is primarily related to increased maintenance costs as the operations

begin to encounter more competent ore conditions, and moderate price inflation on key costs inputs including reagents, consumables, and

labour. Sustaining capital in 2023 will be primarily the construction of a dome at the ore stockpile for dust control management. Infill

drilling on the layback area at the Camino Rojo oxide mine will be capitalized as sustaining capital and is expected to total $2 million.

During the first quarter of 2023, the Company will

make its first income tax payment (including the Special Mining Duty) in Mexico of approximately $34 million related to the 2022 fiscal

year. In 2023, the Company will continue to strengthen its balance sheet through the repayment of $45.0 million towards debt and other

obligations. The Company will also make increasing investments into its prospective exploration and development growth portfolio, enabled

by the Company's strong financial position and continued high margin gold production.

Exploration Update

Additional exploration details related to 2022 results

and 2023 plans on individual country exploration programs was provided in press releases dated January 31, 2023, February 8, 2023, and

February 16, 2023. In 2023, the exploration spending will be increased to $35 million, with the project spend breakdown in the Guidance

Summary outlined below.

Camino Rojo Sulphide Project and Regional Exploration Update (Mexico)

During the 2022 directional drill program into the

Camino Rojo Sulphide, drilling continued to intercept wide zones of higher-grade gold mineralization. These results in conjunction with

metallurgical results from the 2021 drilling supports the potential for underground development and a standalone processing option for

the Camino Rojo Sulphides. A large component of 2022 program included infilling the sulphide deposit and improving the geological model

to support potential underground mine development scenario. A total of 9,174 metres was completed in 15 holes in 2022, returning 32 significant

mineralized drill intercepts with grade-by-thickness factor greater than 50 g/t by metre Au (g/t * m), including 16 intercepts with grade-by-thickness

factor greater than 100 g/t by metre Au.

Drill results have also shown that gold mineralization

extends deeper than the limit of the current mineral resource. These deeper intercepts suggest gold mineralization remains open at depth

along and adjacent to interpreted feeder-like structures for the currently defined Camino Rojo deposit.

A 34,000-metre, 57-hole follow-up drill program will

continue to infill the Camino Rojo Sulphides in 2023 (20% of the holes will extend to test the deep potential of the deposit). In addition,

6,500 metres will be drilled on the extensions of the Camino Rojo oxide deposit to update and expand resources and reserves. The 2023

drilling is expected to strengthen the confidence for the development of a Preliminary Economic Assessment that contemplates underground

mining by infilling the higher-grade (>2 g/t) portions of the deposit with 50 metre spacing of south-oriented drill holes. Overall

drill spacing at the end of this next phase, including historical north-oriented drill holes, will be 25-30 metres.

On the regional exploration program, Orla completed

its first diamond drill core hole outside Camino Rojo in 2022. The Guanamero target is approximately 7 kilometres northeast of Camino

Rojo and the initial drill results were encouraging. The team is targeting new discoveries on the large regional land package testing

targets on the northeast-southwest mine trend and the northwest-southeast regional trend.

For additional detail, please see the news release

dated January 31, 2023, Orla Mining Continues to Intersect Wide, Higher-Grade Sulphide Zones and Expose Deeper Potential at Camino

Rojo, Mexico.

South Railroad Project and Exploration Update (Nevada, US)

In August 2022, Orla completed the acquisition of

Gold Standard, the owner of South Railroad, a permitting-stage, open pit, heap leach project located on the Carlin trend in Nevada, USA.

A Feasibility Study on South Railroad was completed in February 2022 under the previous owner and South Railroad has been integrated into

the Company's growth plans with key priorities to include project permitting, review of project schedule including critical path activities,

and assessment of current exploration supporting resource expansion.

Upon completion of the transaction, Orla accelerated

exploration activities on the large, prospective land package. South Railroad is on the Carlin trend and is a target rich environment

with multiple styles and zones of mineralization. The immediate exploration objectives have been to upgrade current resources and define

new potential resources through infill and step out drilling. Drill results thus far have been significant and resource updates are expected

in 2023.

For additional detail, please see the news release

dated February 8, 2023, Orla Mining Drills Significant Gold Intersections at Multiple Oxide Targets upon Reactivation of Exploration

at South Railroad Project, Nevada.

Cerro Quema Exploration Update (Panama)

In 2022, exploration drilling at Cerro Quema began

with regional exploration at the La Prieta and La Pelona targets before moving to metallurgical, infill, and expansion drilling at Caballito

and La Pava mineralized zones and early-stage follow-up drilling at Quemita Norte target. In total, 9,044 metres were drilled in Panama

during the year.

Exploration at the Caballito and La Pava deposits

and the Quemita Norte target in the second half of 2022 continued to generate significant drill intersections. These new drill results

build on the previously reported 2022 positive drill results generated at the early stage La Pelona and La Prieta regional targets,

and further highlight the presence of significant copper and gold mineralization at the Cerro Quema project.

The 2023 exploration program will follow-up on the

encouraging results generated at La Pelona and La Prieta regional targets in 2022. Upon completion of the exploration and drilling

campaign during the dry season in the first half of 2023, exploration and operational activities will be reduced in Panama. Data interpretation

of the results will take place primarily in the second half of 2023 while on-the-ground activities will be minimal.

2023 Guidance Summary

On January 16, 2023, the Company announced its 2023

annual guidance which contained the outlook for production, operating and capital costs, and exploration spending across the Company's

portfolio, as set forth below. In addition, Orla expects to repay $45.0 million in debt and other obligations during the course of 2023.

This includes $22.2 million related to principal repayments on the credit facility and $22.8 million as a final payment on the Layback

Agreement.

| Gold Production |

oz |

100,000 - 110,000 |

| All-in Sustaining Costs ("AISC")1,2 |

$/oz Au sold |

$750 - $850 |

| Capital Expenditures 2 |

|

|

| Sustaining Capital Expenditures |

$m |

$6 |

| Non-Sustaining Capital Expenditures |

$m |

$4 |

| Exploration |

|

|

| Mexico |

$m |

$20 |

| USA (Nevada) |

$m |

$10 |

| Panama |

$m |

$3 |

| Total Exploration |

$m |

$33 |

| Site Admin & Permitting Expenses (Nevada/Panama) |

$m |

$11 |

| Corporate G&A |

$m |

$15 |

| 1. AISC is a non-GAAP measure. See the "Non-GAAP Measures" section of this news release for additional information. |

| 2. Exchange rates used to forecast cost metrics include MXN/USD of 20.0 and CAD/USD of 1.28 |

Financial Statements

Orla's audited financial statements and management's

discussion and analysis for the year ended December 31, 2022, will be available on the Company's website at www.orlamining.com, and under

the Company's profiles on SEDAR and EDGAR.

Qualified Persons Statement

The scientific and technical information in this news

release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, and Mr. Sylvain Guerard,

P. Geo., Senior Vice President, Exploration of the Company, who are the Qualified Persons as defined under NI 43-101 - Standards

of Disclosure for Mineral Projects.

Fourth Quarter and Year End 2022 Conference Call

Orla will host a conference call on Friday, March

17, 2023, at 10:00 AM, Eastern Time, to provide a corporate update following the release of its financial and operating results for the

fourth quarter and year ended 2022:

Dial-In Numbers:

Conference ID: 5844017

Toll Free Dial-In: 1 (888) 550-5302

Toll Dial-In: 1 (646) 960-0685

Webcast: https://orlamining.com/investors/presentations-and-events/

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine,

a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over

160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained

Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico"

dated January 11, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively.

Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro

Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema

oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of

Los Santos, Panama" dated January 18, 2022, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and

www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located

on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled "South Railroad Project, Form 43-101F1

Technical Report Feasibility Study, Elko County, Nevada" dated March 23, 2022, is available on SEDAR and EDGAR under the Company's

profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla's website at www.orlamining.com.

Non-GAAP Measures

The Company has included certain performance measures

in this news release which are not specified, defined, or determined under generally accepted accounting principles (in the Company's

case, International Financial Reporting Standards ("IFRS"")). These are common performance measures in the gold mining

industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented

by other issuers. Accordingly, the Company uses such measures to provide additional information and you should not consider them in isolation

or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP").

In this section, all currency figures in tables are

in thousands, except per-share and per-ounce amounts.

Average Realized Gold Price

Average realized gold price per ounce sold is calculated

by dividing gold sales proceeds received by the Company for the relevant period by the ounces of gold sold. The Company believes the measure

is useful in understanding the gold price realized by the Company throughout the period.

| AVERAGE REALIZED GOLD PRICE |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Revenue |

$ 56,758 |

4,091 |

|

$ 193,230 |

4,091 |

| Silver sales |

(229) |

(30) |

|

(836) |

(30) |

| Gold sales |

56,529 |

4,061 |

|

192,394 |

4,061 |

| Ounces of gold sold |

32,438 |

2,422 |

|

107,502 |

2,422 |

| AVERAGE REALIZED GOLD PRICE PER OUNCE SOLD |

$ 1,743 |

1,677 |

|

$ 1,790 |

1,677 |

Net Debt

Net debt is calculated as total debt adjusted for

unamortized deferred financing charges less cash and cash equivalents and short-term investments at the end of the reporting period. This

measure is used by management to measure the Company's debt leverage. The Company believes that in addition to conventional measures prepared

in accordance with IFRS, net debt is useful to evaluate the Company's leverage and is also a key metric in determining the cost of debt.

| NET DEBT |

December 31,

2022 |

December 31,

2021 |

| Current portion of long term debt |

$ 45,000 |

$ 25,293 |

| Long term debt |

100,795 |

136,060 |

| Less: Cash and cash equivalents |

(96,278) |

(20,516) |

| NET DEBT |

$ 49,517 |

$ 140,837 |

Adjusted Earnings (Loss) and Adjusted Earnings

(Loss) per share

Adjusted earnings (loss) excludes deferred taxes,

unrealized foreign exchange, changes in fair values of financial instruments, impairments and reversals due to net realizable values,

restructuring and severance, and other items which are significant but not reflective of the underlying operational performance of the

Company. We believe these measures are useful to market participants because they are important indicators of the strength of our

operations and the performance of our core business.

| ADJUSTED EARNINGS |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Net income (loss) for the period |

$ 18,690 |

$ (5,018) |

|

$ 45,770 |

$ (26,278) |

| Unrealized foreign exchange |

1,971 |

1,903 |

|

(1,862) |

3,921 |

| Loss on early settlement of project loan |

— |

— |

|

13,219 |

— |

| ADJUSTED EARNINGS (LOSS) |

$ 20,661 |

$ (3,115) |

|

$ 57,127 |

$ (22,357) |

| |

|

|

|

|

|

| Millions of shares outstanding – basic |

304.5 |

247.6 |

|

272.2 |

241.4 |

| Adjusted earnings (loss) per share – basic |

$ 0.07 |

$ (0.01) |

|

$ 0.21 |

$ (0.09) |

| |

|

|

|

|

|

Companies may choose to expense or capitalize their

exploration expenditures. Orla generally expense our exploration costs based on our accounting policy. To assist the reader

in comparing against those companies which capitalize their exploration costs, we note that included within Orla's net income (loss) for

each period are exploration costs which were expensed, as follows:

| |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Exploration & evaluation expense |

$ 5,605 |

$ 2,863 |

|

$ 18,939 |

$ 15,108 |

| |

|

|

|

|

|

Free Cash Flow

The Company believes market participants use Free

Cash Flow to evaluate the Company's operating cash flow capacity to meet non-discretionary outflows of cash. Free Cash Flow is not

meant to be a substitute for the cash flow information presented in accordance with IFRS. Free Cash Flow is calculated as the sum of cash

flow from operating activities and cash flow from investing activities, excluding certain unusual transactions.

| FREE CASH FLOW |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Cash flow from operating activities |

$ 31,836 |

$ (17,087) |

|

$ 95,311 |

$ (24,742) |

| Cash flow from investing activities |

(20,188) |

(10,563) |

|

(13,356) |

(113,266) |

| FREE CASH FLOW |

$ 11,648 |

$ (27,650) |

|

$ 81,955 |

$ (138,008) |

| |

|

|

|

|

|

| Millions of shares outstanding – basic |

304.5 |

247.6 |

|

272.2 |

241.4 |

| Free cash flow per share – basic |

$ 0.04 |

$ (0.11) |

|

$ 0.30 |

$ (0.57) |

Cash Costs and All-In Sustaining Costs

The Company calculates cash cost per ounce by dividing

the sum of operating costs and royalty costs, net of by-product silver credits, by ounces of gold sold. Management believes that

this measure is useful to market participants in assessing operating performance.

The Company has provided an AISC performance measure

that reflects all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized

meaning of the measure across the industry, the Company's definition conforms to the all-in sustaining cost definition as set out by the

World Gold Council in its guidance dated November 14, 2018. Orla believes that this measure is useful to market participants in assessing

operating performance and the Company's ability to generate free cash flow from current operations.

Figures are presented only from April 1, 2022, as

the Camino Rojo Oxide Gold Mine commenced commercial production on that date.

| CASH COST |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Cost of sales – operating costs |

$ 13,482 |

$ — |

|

$ 36,231 |

$ — |

| Related to previous quarter |

— |

— |

|

(503) |

— |

| Royalties |

1,439 |

— |

|

3,755 |

— |

| Silver sales |

(229) |

— |

|

(617) |

— |

| CASH COST |

$ 14,692 |

$ — |

|

$ 38,866 |

$ — |

| |

|

|

|

|

|

| Ounces sold |

32,438 |

— |

|

86,618 |

— |

| Cash cost per ounce sold |

$ 453 |

$ n/a |

|

$ 449 |

$ n/a |

| |

|

|

|

|

|

| ALL-IN SUSTAINING COST |

Q4 2022 |

Q4 2021 |

|

2022 |

2021 |

| Cash cost, as above |

$ 14,692 |

$ — |

|

$ 38,866 |

$ — |

| General and administrative |

2,741 |

— |

|

7,634 |

— |

| Share based payments |

526 |

— |

|

1,582 |

— |

| Accretion of site closure provision |

160 |

— |

|

395 |

— |

| Amortization of site closure provision |

105 |

— |

|

448 |

— |

| Sustaining capital |

2,116 |

— |

|

3,533 |

— |

| Lease payments |

216 |

— |

|

442 |

— |

| ALL-IN SUSTAINING COST |

$ 20,556 |

$ — |

|

$ 52,900 |

$ — |

| |

|

|

|

|

|

| Ounces sold |

32,438 |

— |

|

86,618 |

— |

| All-in sustaining cost per ounce sold |

$ 634 |

$ n/a |

|

$ 611 |

$ n/a |

| |

|

|

|

|

|

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time, including, without limitation, statements regarding the Company's 2023 guidance, including production,

operating costs and capital costs; the Company's exploration plans, including timing, expenditures and the goals thereof; and the timing

of new mineral resource estimates. Forward-looking statements are statements that are not historical facts which address events,

results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain

material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the future

price of gold, silver, and copper; anticipated costs and the Company's ability to fund its programs; the Company's ability to carry on

exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning

and reclamation estimates; the Company's ability to secure and to meet obligations under property agreements, including the layback agreement

with Fresnillo plc; that all conditions of the Company's credit facility will be met; the timing and results of drilling programs; mineral

reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves

on the Company's mineral properties; that political and legal developments will be consistent with current expectations; the timely receipt

of required approvals and permits, including those approvals and permits required for successful project permitting, construction, and

operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company's ability to operate

in a safe, efficient, and effective manner; the Company's ability to obtain financing as and when required and on reasonable terms; the

impact of the COVID-19 pandemic on the Company's operations; that the Company's activities will be in accordance with the Company's public

statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company or its properties.

Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ

materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties,

which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty

and variations in the estimation of mineral resources and mineral reserves; the Company's dependence on the Camino Rojo oxide mine; risks

related to the Company's indebtedness; risks related to exploration, development, and operation activities; risks related to natural disasters,

terrorist acts, health crises, and other disruptions and dislocations, including the COVID-19 pandemic; foreign country and political

risks, including risks relating to foreign operations and expropriation or nationalization of mining operations; concession risks at the

Cerro Quema project; the receipt of a Category III EIA for Cerro Quema; delays in obtaining or failure to obtain governmental permits,

or non-compliance with permits; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement

with Fresnillo plc with respect to accessing certain additional portions of the mineral resource at the Camino Rojo project and to obtain

the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino Rojo project being only estimates

and relying on certain assumptions; loss of, delays in, or failure to get access from surface rights owners; uncertainties related to

title to mineral properties; water rights; financing risks and access to additional capital; risks related to guidance estimates and uncertainties

inherent in the preparation of feasibility and pre-feasibility studies; uncertainty in estimates of production, capital, and operating

costs and potential production and cost overruns; the fluctuating price of gold, silver, and copper; unknown labilities in connection

with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals;

conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's securities;

assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history;

litigation risks; the Company's ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental

organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the

Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy

the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment

company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; and risks

associated with executing the Company's objectives and strategies; as well as those risk factors discussed in the Company's most recently

filed management's discussion and analysis, and annual information form, which are available on www.sedar.com and www.sec.gov. Except

as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update

these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance

with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current

standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral

reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources", "indicated

mineral resources", "measured mineral resources" and "mineral resources" used or referenced in this news release

are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure

for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") –

CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For United States reporting purposes, the United

States Securities and Exchange Commission ("SEC") has adopted amendments to its disclosure rules (the "SEC Modernization

Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the

Securities Exchange Act of 1934, as amended. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies

for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical

property disclosure requirements for mining registrants that were included in Industry Guide 7 under the U.S. Securities Act. As a foreign

private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not

required to provide disclosure on its mineral properties under the SEC Modernization Rules and provides disclosure under NI 43-101 and

the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained in this news release may not be

comparable to similar information disclosed by United States companies.

As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred

mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral

reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101.

While the above terms are "substantially similar" to CIM Definition Standards, there are differences in the definitions under

the SEC Modernization Rules and the CIM Definition Standards. There is no assurance any mineral reserves or mineral resources that the

Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources",

"indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared

the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of Industry

Guide 7. Accordingly, information contained in this news release may not be comparable to similar information made public by U.S. companies

subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

SOURCE Orla Mining Ltd.

View original content: http://www.newswire.ca/en/releases/archive/March2023/16/c0898.html

%CIK: 0001680056

For further information: Jason Simpson, President & Chief Executive

Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development, www.orlamining.com, info@orlamining.com

CO: Orla Mining Ltd.

CNW 19:28e 16-MAR-23

This regulatory filing also includes additional resources:

ex991.pdf

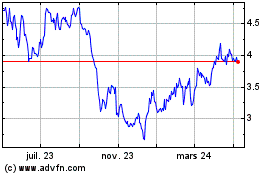

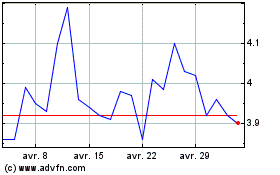

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024