UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of February, 2024

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

1010-1075

West Georgia Street

Vancouver,

BC

V6E

3C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: February 7, 2024 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

| News Release |  |

Orla Mining Concludes 2023 Camino Rojo Sulphides

Infill Program with Strong Results

138.6m @ 3.21 g/t Au incl.

8.7m @ 9.15 g/t

43.0m @ 4.12 g/t Au, incl. 11.5m @ 10.0 g/t, (and incl. 2.0m @ 32.2 g/t)

20.5m @ 5.30 g/t Au, incl. 14.5m @ 7.19 g/t Au, (and incl. 1.4m @ 37.0 g/t Au)

53.3m @ 3.65 g/t Au, incl. 1.3m @ 19.4 g/t Au & 1.4m @ 30.8 g/t Au

VANCOUVER, BC, Feb. 7, 2024 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an update on its exploration activities

at Camino Rojo Sulphides, concluding the year on a positive note.

2023 Camino Rojo Sulphides (Mexico) Highlights

Orla's 2023 Camino Rojo Sulphide drill program consisted

of 37,677 metres of drilling across 56 drill holes.

- Sulphide Infill Program: This release includes the results

of the remaining unreported 14 drill holes completed as part of the 52-drill hole, 35,070-metre infill program and builds on the results

previously reported on June 22, 2023, and January 25, 2024. The infill drilling in 2023 was to refine the geometry and extent of higher-grade

components of the Camino Rojo Sulphides deposit.

- Camino Rojo Extension: Selected drill holes also explored

the area beneath the sulphide infill area, investigating mineralization beyond the current open pit mineral resource boundaries, known

as the "Camino Rojo Extension". Initial drill results beneath the Caracol formation have revealed a new style of polymetallic

massive sulphide replacement mineralization within limestone-rich formations. Initial results are expected to be released in the coming

weeks.

"We're excited by the outcomes of Orla's Camino

Rojo Sulphide infill drill program. The results contribute to refining our understanding of the deposit's higher-grade zones to inform

future development planning. The discovery of a new mineralization style beneath the Caracol formation adds a compelling new dimension

to our exploration efforts in 2024."

- Sylvain Guerard,

Orla's Senior Vice President, Exploration

Momentum Building for 2024

Over three distinct campaigns covering a total of

50,924 drill metres, the Camino Rojo infill drill program, has consistently yielded impressive results setting the stage for an exciting

year ahead. These results include numerous intercepts of greater than 2.0 grams of gold per tonne (g/t Au) over tens of metres (core length),

resulting in grade-by-thickness factors exceeding 50 g/t gold per metre. The results also showed narrower intervals of 0.5 to 11.5 metres

of gold intersections exceeding 10 g/t Au. Full drill results are available in the Appendix to this news release and are available at

www.orlamining.com.

Combining Orla's drill holes, oriented from north

to south, and historical drill holes oriented in the opposite direction, has decreased drill spacing to approximately 25-30 metres within

the higher grade of the Camino Rojo Sulphides. The combined drilling has significantly improved the understanding of the primary controls

on gold mineralization. This approach has also contributed to refining the geometry and size of higher-grade zones within the extensive

mineralized envelope of the sulphide deposit.

A preliminary underground resource estimate on the

Camino Rojo Sulphides is eagerly anticipated to be completed in the second half of 2024. Metallurgy evaluation on the recent phase of

Camino Rojo sulphide infill drilling is expected to continue throughout 2024.

Camino Rojo Sulphide infill drill result highlights:

| Camino Rojo Sulphides |

| Hole CRSX23-28B: |

3.21 g/t Au over 138.6 m (127.0m TW) incl. 9.15 g/t Au over 8.7 m incl. 11.4g/t Au over 1.45m and incl. 20.9g/t Au over 1.5 m and incl. 12.2g/t Au over 1.3 m |

| Hole CRSX23-27B: |

4.12 g/t Au over 43.0 m (37.7m TW) incl. 10.04 g/t Au over 11.5 m incl. 32.17 g/t over 2.0 m and incl. 14.45 g/t Au over 1.5 m |

|

Hole CRSX23-28A:

and |

2.40 g/t Au over 53.0 m (51.7m TW) incl. 14.0 g/t Au over 1.5 m

2.41 g/t Au over 70.8 m (69.1m TW) incl. 9.35 g/t Au over 1.6 m and incl, 14.2 g/t Au over 2.9 m and incl. 19.35 g/t Au over 1.5 m and incl. 10.15 g/t Au over 1.5 m |

|

Hole CRSX23-26:

and |

4.42 g/t Au over 28.0 m (25.6m TW) incl. 7.55 g/t

Au over 15.0 m incl. 23.5 g/t Au over 1.1 m and incl. 33.2 g/t Au over 1.4 m

2.82 g/t Au over 56.5 m (52.8m TW) incl.8.02 g/t Au over

6.0 m incl. 24.4 g/t Au over 1.5 m and 3.41 g/t Au over 21.3 m |

| Hole CRSX23-25C: |

3.47 g/t Au over 45.0 m (38.3m TW) incl. 3.65 g/t Au over 12.0 m incl. 54.0 g/t Au over 1.5 m |

|

Hole CRSX23-26A:

and

and |

5.48 g/t Au over 17.0 m (16.5m TW) incl. 8.56 g/t Au over

10.0 m incl. 26.6 g/t Au over 1.5 m

2.77 g/t Au over 39.0 m (38.0m TW) incl. 3.64 g/t Au over

27.0 m incl. 30.6 g/t Au over 0.9 m and incl. 21.3 g/t Au over 0.6 m

2.34 g/t Au over 66.2m (64.3m TW) incl. 2.93 g/t Au over

41.0 m incl. 21.1 g/t au over 1.5 m |

| Hole CRSX23-25B: |

2.29 g/t Au over 52.9m (38.8m TW) incl. 3.08 g/t Au over 21.0 m |

| Hole CRSX23-25D: |

5.30 g/t Au over 20.5 m (14.5m TW) incl. 7.19 g/t Au over 14.5 m incl. 37.0 g/t Au over 1.4 m |

| TW: Estimated True Width |

| |

|

|

Camino Rojo Extension Program: Strategic Exploration for the Future

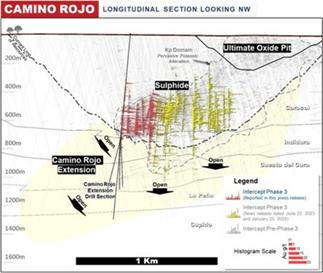

As part of the 2023 infill program, Orla extended

selected drill holes into the deeper stratigraphy beneath the Caracol Formation, the primary host of existing resources. A down-plunge

drill section was also executed to explore the extension of gold mineralization into lower stratigraphy, referred to as the Camino Rojo

Extension. Drilling beneath the Caracol formation unveiled a new style of polymetallic massive sulphide replacement mineralization within

limestone-rich formations. Results from the Camino Rojo Extension program are expected to be detailed in an upcoming news release.

In 2024, Orla is set to extensively explore the Camino

Rojo region while maintaining a steadfast commitment to near-mine exploration. As part of the near-mine exploration, the 2024 focus shifts

to the promising Camino Rojo Extension, with a 30,000-metre drill program designed to test and expand the potential of the still-open

mineralization at the expansive Camino Rojo deposit.

Figure 1: Camino Rojo Plan View Showing Location of

Reported Drill Holes (CNW Group/Orla Mining Ltd.)

Figure 2: Camino Rojo Long Section Overview (CNW Group/Orla

Mining Ltd.)

Figure 3: Camino Rojo Long Section Drill Result Highlights

(CNW Group/Orla Mining Ltd.)

Figure 4: Camino Rojo Cross Section Drill Intersection

Highlights for Fences CRSX23-25 & CRSX23-26 (CNW Group/Orla Mining Ltd.)

Figure 5: Camino Rojo Cross Section Drill Intersection

Highlights for Fence CRSX23-28 (CNW Group/Orla Mining Ltd.)

Qualified Persons Statement

The scientific and technical information in this news

release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as

defined under the definitions of National Instrument 43-101 ("NI 43-101").

To verify the information related to the 2022 and

2023 drilling programs at the Camino Rojo property, Mr. Guerard has visited the property in the past year; discussed logging, sampling,

and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel;

and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control –2023 Drill Program

All gold results at Camino Rojo were obtained by ALS

Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements,

including silver, copper, lead and zinc using a four-acid digestion with ICP-AES finish (ME-ICP61) method at ALS Laboratories in Canada.

If samples were returned with gold values in excess of 10 ppm or base metal values in excess of 1% by ICP analysis, samples are re-run

with gold (Au-GRA21) by fire assay and gravimetric finish or base metal by (OG62) four acid overlimit methods. Drill program design, Quality

Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control

program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and

blanks were inserted at a frequency of one in every 50 samples for Quality Assurance/Quality Control purposes by the Company as well as

the lab. ALS Minerals and ALS Laboratories are independent of Orla. There are no known drilling, sampling, recovery, or other factors

that could materially affect the accuracy or reliability of the drilling data at Camino Rojo.

For additional information on the Company's previously

reported drill results, see the Company's press releases dated June 22, 2023 (Orla Mining Provides Update On Successful Drilling Program

In Mexico) and January 25, 2024 (Orla Mining Provides an Update on Infill Drilling at Camino Rojo Sulphides Deposit with Multiple

Highly Positive Drill Intersections). Historical drill results at Camino Rojo were completed by Goldcorp. Inc. ("Goldcorp"),

a prior owner of the project. The Company's independent qualified person, Independent Mining Consultants, Inc. was of the opinion that

the drilling and sampling procedures for Camino Rojo drill samples by Goldcorp (and prior to its acquisition by Goldcorp, Canplats Resources

Corporation) were reasonable and adequate for the purposes of the Camino Rojo Report, and that the Goldcorp QA/QC program met or exceeded

industry standards. See the Camino Rojo Report (as defined below) for additional information.

All metres reported in this news release are down-hole

intervals, with true width estimates ranging from 60-98% of the reported interval for all composites >5 grade-by-thickness factor (Au

g/t*m). See Table 1 in the Appendix to this news release for estimated true widths of individual composites. A standard sampling length

of 1.5 metres is used with a minimum of 0.5 metres when required based on geological contacts. All drill core is HQ diameter. The reported

composites were not subject to "capping," however a preliminary analysis suggests that only 8 out of 3,802 samples from the

reported holes exceeded the potential capping level of 27.0 g/t. These samples averaged 40.8 g/t gold (max. 61.2 g/t). Orla believes that

applying a top cut would have a negligible effect on overall grades. Composites for the sulphide drilling were calculated using 1 g/t

Au cut-off grade and maximum 6 metres consecutive waste.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine,

a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over

160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained

Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico"

dated January 11, 2021 (the "Camino Rojo Report"), is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and

www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various

exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility

Study on the Cerro Quema oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro

Quema Project, Province of Los Santos, Panama" dated January 18, 2022, is available on SEDAR and EDGAR under the Company's

profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open

pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled "South

Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada" dated March 23, 2022, is available on

SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on

Orla's website at www.orlamining.com.

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time, including, without limitation, statements regarding: the potential mineralization and value at

the Camino Rojo Sulphides; the potential of the Camino Rojo Extension; the Company's 2024 exploration plans; and the completion and timing

of an underground mineral resource estimation at Camino Rojo. Forward-looking statements are statements that are not historical facts

which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the

beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and

uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions

regarding: the future price of gold and silver; anticipated costs and the Company's ability to fund its programs; the Company's ability

to carry on exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning

and reclamation estimates; the Company's ability to secure and to meet obligations under property agreements, including the layback agreement

with Fresnillo plc; that all conditions of the Company's credit facility will be met; the timing and results of drilling programs; mineral

reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves

on the Company's mineral properties; that political and legal developments will be consistent with current expectations; the timely receipt

of required approvals and permits, including those approvals and permits required for successful project permitting, construction, and

operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company's ability to operate

in a safe, efficient, and effective manner; the Company's ability to obtain financing as and when required and on reasonable terms; that

the Company's activities will be in accordance with the Company's public statements and stated goals; and that there will be no material

adverse change or disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will

prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking

statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those

anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral

reserves; the Company's dependence on the Camino Rojo oxide mine; risks related to the Company's indebtedness; risks related to exploration,

development, and operation activities; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations,

including the COVID-19 pandemic; foreign country and political risks, including risks relating to foreign operations and expropriation

or nationalization of mining operations and risks associated with operating in Mexico and Panama; delays in obtaining or failure to obtain

governmental permits, or non-compliance with permits; environmental and other regulatory requirements; delays in or failures to enter

into a subsequent agreement with Fresnillo plc with respect to accessing certain additional portions of the mineral resource at the Camino

Rojo project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino Rojo project

being only estimates and relying on certain assumptions; loss of, delays in, or failure to get access from surface rights owners; uncertainties

related to title to mineral properties; water rights; financing risks and access to additional capital; risks related to guidance estimates

and uncertainties inherent in the preparation of feasibility and pre-feasibility studies; uncertainty in estimates of production, capital,

and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown labilities in connection

with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals;

conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's securities;

assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history;

litigation risks; the Company's ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental

organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the

Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy

the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment

company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; and risks

associated with executing the Company's objectives and strategies; as well as those risk factors discussed in the Company's most recently

filed management's discussion and analysis, as well as its annual information form dated March 20, 2023, which are available on www.sedarplus.ca

and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes

no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance

with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current

standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral

reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated

mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents

incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National

Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy

and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council,

as amended (the "CIM Definition Standards").

For United States reporting purposes, the United

States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization

Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the

Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements

and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace

the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required

to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer

that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required

to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101

and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference

herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities

laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred

mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral

reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101.

While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral

resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into

a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these

terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves.

Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred

mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further,

"inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically.

Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher

category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not

form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar"

to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly,

there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable

mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources"

under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC

Modernization Rules or under the prior standards of SEC Industry Guide 7.

Appendix: Drill Results

Table 1: Camino Rojo Sulphide Infill Composite

Drill Results (Composites 1g/t Au cog)

| Composites 1g/t Au cog |

| HOLE-ID |

From

(m) |

To

(m) |

Core Length

(m) |

Estimated

True Width

(m) |

Au

g/t |

Ag

g/t |

Pb

ppm |

Zn

ppm |

Cu

ppm |

As

ppm |

AuEq g/t |

Au GXM |

Au GXM

(TW) |

Including

10g/t Au HG |

Litho |

Met Code |

| CRSX23-25A |

481.00 |

485.50 |

4.5 |

4.2 |

1.25 |

2.4 |

67 |

75 |

34 |

3989 |

1.29 |

5.65 |

5.31 |

|

Caracol |

SX |

| CRSX23-25A |

506.50 |

517.80 |

11.3 |

10.6 |

1.26 |

8.9 |

764 |

1844 |

84 |

1904 |

1.47 |

14.27 |

13.34 |

|

506.5 - 515 Caracol

515 - 517.8 Breccia |

SX |

| CRSX23-25A |

532.00 |

539.50 |

7.5 |

7.0 |

1.95 |

8.1 |

1055 |

4124 |

106 |

2967 |

2.26 |

14.62 |

13.65 |

|

Caracol |

SX |

| CRSX23-25A |

556.00 |

622.00 |

66.0 |

42.7 |

1.44 |

5.4 |

307 |

1142 |

119 |

1202 |

1.58 |

95.25 |

61.65 |

1.5m @ 12.75g/t Au |

Caracol |

SX |

| CRSX23-25A |

635.00 |

639.50 |

4.5 |

2.9 |

1.61 |

6.2 |

112 |

1099 |

109 |

1053 |

1.75 |

7.24 |

4.70 |

|

Caracol |

SX |

| CRSX23-25A |

650.35 |

660.55 |

10.2 |

9.6 |

1.05 |

3.6 |

177 |

887 |

111 |

964 |

1.15 |

10.75 |

10.16 |

|

Caracol |

SX |

| CRSX23-25B |

453.40 |

455.40 |

2.0 |

1.8 |

1.59 |

29.5 |

719 |

596 |

37 |

1613 |

1.98 |

3.19 |

2.86 |

|

Caracol |

SX |

| CRSX23-25B |

485.50 |

487.00 |

1.5 |

1.3 |

1.18 |

6.2 |

55 |

89 |

30 |

2030 |

1.26 |

1.76 |

1.57 |

|

Caracol |

SX |

| CRSX23-25B |

496.00 |

497.50 |

1.5 |

1.3 |

4.20 |

75.8 |

7940 |

15550 |

404 |

9510 |

5.90 |

6.30 |

5.63 |

|

Caracol |

SX |

| CRSX23-25B |

506.50 |

509.50 |

3.0 |

2.7 |

1.76 |

6.8 |

514 |

4200 |

60 |

2390 |

2.04 |

5.27 |

4.70 |

|

Caracol |

SX |

| CRSX23-25B |

522.00 |

540.00 |

18.0 |

16.0 |

1.48 |

10.8 |

1220 |

3876 |

150 |

1617 |

1.81 |

26.65 |

23.76 |

|

Caracol |

SX |

| CRSX23-25B |

549.00 |

550.50 |

1.5 |

1.3 |

2.64 |

4.6 |

128 |

1335 |

70 |

1460 |

2.77 |

3.96 |

3.53 |

|

Caracol |

SX |

| CRSX23-25B |

557.00 |

567.50 |

10.5 |

9.4 |

2.07 |

6.0 |

675 |

1409 |

117 |

2609 |

2.22 |

21.72 |

19.35 |

|

Caracol |

SX |

| CRSX23-25B |

582.50 |

592.85 |

10.4 |

7.6 |

1.04 |

4.0 |

572 |

1338 |

76 |

728 |

1.16 |

10.76 |

7.85 |

|

Caracol |

SX |

| CRSX23-25B |

596.00 |

613.00 |

17.0 |

15.2 |

2.06 |

11.9 |

288 |

537 |

78 |

891 |

2.24 |

35.04 |

31.24 |

0.7m @ 33.8g/t Au |

Caracol |

SX |

| CRSX23-25B |

626.50 |

628.00 |

1.5 |

1.1 |

1.42 |

6.2 |

181 |

4290 |

95 |

814 |

1.71 |

2.13 |

1.55 |

|

Caracol |

SX |

| CRSX23-25B |

634.00 |

638.50 |

4.5 |

4.0 |

1.82 |

7.9 |

832 |

2084 |

207 |

1486 |

2.04 |

8.21 |

7.30 |

|

Caracol |

SX |

| CRSX23-25B |

644.50 |

646.00 |

1.5 |

1.1 |

1.55 |

4.6 |

67 |

302 |

122 |

3060 |

1.63 |

2.32 |

1.69 |

|

Caracol |

SX |

| CRSX23-25B |

659.50 |

661.00 |

1.5 |

1.3 |

5.38 |

10.5 |

184 |

9430 |

170 |

2310 |

5.97 |

8.07 |

7.17 |

|

Caracol |

SX |

| CRSX23-25B |

676.10 |

683.50 |

7.4 |

5.4 |

1.22 |

2.8 |

43 |

168 |

93 |

1386 |

1.28 |

9.06 |

6.62 |

|

Caracol |

SX |

| CRSX23-25B |

691.00 |

704.50 |

13.5 |

12.0 |

1.31 |

5.2 |

140 |

3377 |

158 |

713 |

1.55 |

17.69 |

15.69 |

|

Caracol |

SX |

| CRSX23-25B |

715.00 |

767.90 |

52.9 |

38.8 |

2.29 |

9.5 |

448 |

3279 |

186 |

2055 |

2.58 |

121.13 |

88.83 |

1.5m @ 11.9g/t Au |

715 - 729.55 Caracol

729.55 - 732 Breccia

732 - 744.15 Caracol

744.15 - 746.8 Breccia

746.8 - 750.1 Caracol

750.1 - 767.9 Indidura |

SX |

| CRSX23-25B |

775.35 |

781.50 |

6.1 |

4.5 |

2.65 |

6.2 |

144 |

1663 |

142 |

1625 |

2.82 |

16.28 |

11.90 |

|

Indidura |

SX |

| CRSX23-25B |

793.50 |

795.00 |

1.5 |

1.3 |

2.62 |

8.6 |

78 |

401 |

184 |

695 |

2.77 |

3.93 |

3.48 |

|

Indidura |

SX |

| CRSX23-25B |

801.00 |

802.50 |

1.5 |

1.1 |

2.07 |

1.6 |

21 |

2420 |

121 |

3250 |

2.22 |

3.11 |

2.27 |

|

Indidura |

SX |

| CRSX23-25B |

808.55 |

811.80 |

3.3 |

2.9 |

4.27 |

12.5 |

115 |

2409 |

485 |

9037 |

4.60 |

13.89 |

12.33 |

|

Indidura |

SX |

| CRSX23-25B |

819.05 |

819.65 |

0.6 |

0.4 |

4.43 |

59.0 |

426 |

12150 |

2460 |

6190 |

6.05 |

2.66 |

1.94 |

|

Indidura |

SX |

| CRSX23-25B |

855.50 |

857.00 |

1.5 |

1.3 |

2.36 |

5.5 |

169 |

768 |

191 |

111 |

2.49 |

3.54 |

3.15 |

|

Indidura |

SX |

| CRSX23-25C |

496.50 |

510.40 |

13.9 |

12.0 |

1.59 |

18.4 |

1921 |

5001 |

83 |

4047 |

2.06 |

22.11 |

19.05 |

|

Caracol |

SX |

| CRSX23-25C |

522.50 |

525.50 |

3.0 |

2.6 |

2.73 |

34.2 |

3453 |

4970 |

381 |

3109 |

3.42 |

8.18 |

7.04 |

|

Caracol |

SX |

| CRSX23-25C |

540.50 |

551.00 |

10.5 |

9.1 |

2.56 |

15.8 |

1425 |

6580 |

225 |

3845 |

3.09 |

26.90 |

23.24 |

|

Caracol |

SX |

| CRSX23-25C |

561.50 |

569.00 |

7.5 |

6.5 |

4.42 |

6.0 |

327 |

1818 |

95 |

3116 |

4.59 |

33.12 |

28.75 |

1.5m @ 15.4g/t Au |

Caracol |

SX |

| CRSX23-25C |

576.50 |

606.50 |

30.0 |

25.7 |

1.59 |

4.6 |

332 |

740 |

79 |

928 |

1.69 |

47.64 |

40.83 |

|

Caracol |

SX |

| CRSX23-25C |

614.00 |

615.50 |

1.5 |

1.3 |

1.02 |

1.7 |

91 |

136 |

80 |

838 |

1.05 |

1.52 |

1.31 |

|

Caracol |

SX |

| CRSX23-25C |

644.00 |

645.50 |

1.5 |

1.2 |

1.10 |

2.0 |

29 |

31 |

29 |

594 |

1.12 |

1.64 |

1.26 |

|

Caracol |

SX |

| CRSX23-25C |

672.50 |

677.00 |

4.5 |

3.9 |

2.17 |

2.7 |

260 |

1446 |

64 |

446 |

2.28 |

9.77 |

8.43 |

|

Caracol |

SX |

| CRSX23-25C |

702.50 |

747.50 |

45.0 |

38.3 |

3.47 |

8.7 |

472 |

2950 |

205 |

1836 |

3.74 |

156.03 |

132.66 |

1.5m @ 54g/t Au |

Caracol |

SX |

| CRSX23-25C |

755.00 |

771.50 |

16.5 |

14.3 |

2.45 |

9.7 |

605 |

4165 |

212 |

2701 |

2.79 |

40.37 |

35.03 |

|

755 - 756.77 Caracol

756.77 - 757.69 Breccia

757.69 - 771.33 Indidura

771.33 - 771.5 Breccia |

SX |

| CRSX23-25C |

780.50 |

782.00 |

1.5 |

1.3 |

1.54 |

3.9 |

52 |

1050 |

114 |

2880 |

1.65 |

2.31 |

2.00 |

|

Indidura |

SX |

| CRSX23-25C |

788.00 |

789.55 |

1.5 |

1.3 |

1.12 |

4.4 |

230 |

1100 |

124 |

1065 |

1.24 |

1.73 |

1.50 |

|

Indidura |

SX |

| CRSX23-25C |

800.00 |

807.50 |

7.5 |

6.5 |

2.79 |

6.0 |

72 |

5258 |

213 |

4571 |

3.14 |

20.95 |

18.12 |

|

Indidura |

SX |

| CRSX23-25C |

815.00 |

816.50 |

1.5 |

1.1 |

1.15 |

11.6 |

105 |

15150 |

319 |

2120 |

2.04 |

1.72 |

1.31 |

|

Indidura |

SX |

| CRSX23-25C |

834.50 |

836.00 |

1.5 |

1.3 |

1.49 |

4.2 |

113 |

5150 |

119 |

454 |

1.80 |

2.24 |

1.93 |

|

Indidura |

SX |

| CRSX23-25C |

840.50 |

842.00 |

1.5 |

1.3 |

1.58 |

13.6 |

200 |

8910 |

469 |

967 |

2.22 |

2.36 |

2.04 |

|

Indidura |

SX |

| CRSX23-25C |

854.00 |

860.00 |

6.0 |

5.2 |

2.20 |

3.5 |

49 |

963 |

333 |

271 |

2.33 |

13.18 |

11.43 |

|

Indidura |

SX |

| CRSX23-25C |

868.00 |

868.70 |

0.7 |

0.6 |

2.72 |

128.0 |

377 |

11250 |

1590 |

11950 |

5.00 |

1.90 |

1.65 |

|

Indidura |

SX |

| CRSX23-25C |

895.00 |

896.50 |

1.5 |

1.3 |

1.40 |

2.0 |

36 |

677 |

209 |

65 |

1.48 |

2.09 |

1.82 |

|

FG Intrusives - hdb-bi-pl |

SX |

| CRSX23-25C |

902.50 |

906.45 |

4.0 |

3.4 |

1.78 |

1.9 |

33 |

3333 |

134 |

55 |

1.98 |

7.04 |

6.12 |

|

Indidura |

SX |

| CRSX23-25C |

922.35 |

922.85 |

0.5 |

0.4 |

13.30 |

21.3 |

208 |

129500 |

932 |

1040 |

19.77 |

6.65 |

5.80 |

0.5m @ 13.3g/t Au |

Indidura |

SX |

| CRSX23-25C |

949.05 |

951.00 |

2.0 |

1.7 |

9.20 |

13.0 |

105 |

29897 |

329 |

11676 |

10.80 |

17.93 |

15.70 |

0.5m @ 26.4g/t Au |

Cuesta de Cura |

SX |

| CRSX23-25C |

974.50 |

977.00 |

2.5 |

2.2 |

1.69 |

5.1 |

31 |

27852 |

180 |

6523 |

3.09 |

4.24 |

3.71 |

|

Cuesta de Cura |

SX |

| CRSX23-25D |

496.70 |

498.00 |

1.3 |

0.9 |

1.19 |

9.1 |

273 |

4480 |

86 |

2290 |

1.52 |

1.55 |

1.08 |

|

Caracol |

SX |

| CRSX23-25D |

504.00 |

505.50 |

1.5 |

1.1 |

1.30 |

21.8 |

2350 |

10650 |

100 |

3810 |

2.07 |

1.94 |

1.36 |

|

Caracol |

SX |

| CRSX23-25D |

516.00 |

520.50 |

4.5 |

3.2 |

1.53 |

34.4 |

4346 |

5639 |

113 |

1361 |

2.22 |

6.87 |

4.83 |

|

Caracol |

SX |

| CRSX23-25D |

526.55 |

534.00 |

7.5 |

5.2 |

1.02 |

6.0 |

541 |

2362 |

72 |

1033 |

1.21 |

7.59 |

5.35 |

|

Caracol |

SX |

| CRSX23-25D |

550.00 |

557.50 |

7.5 |

5.3 |

2.00 |

13.9 |

1675 |

2362 |

85 |

3577 |

2.28 |

14.96 |

10.55 |

|

Caracol |

SX |

| CRSX23-25D |

568.00 |

588.50 |

20.5 |

14.5 |

5.30 |

19.2 |

850 |

2683 |

290 |

5977 |

5.69 |

108.59 |

76.64 |

1.5m @ 10.8g/t Au

1.35m @ 11.65g/t Au

1.35m @ 37g/t Au |

Caracol |

SX |

| CRSX23-25D |

596.00 |

602.00 |

6.0 |

4.2 |

1.13 |

4.8 |

293 |

1372 |

62 |

903 |

1.26 |

6.79 |

4.79 |

|

Caracol |

SX |

| CRSX23-25D |

605.00 |

606.50 |

1.5 |

1.1 |

1.86 |

21.7 |

3170 |

270 |

120 |

3370 |

2.15 |

2.79 |

1.97 |

|

Caracol |

SX |

| CRSX23-25D |

614.00 |

615.50 |

1.5 |

1.1 |

2.71 |

3.9 |

74 |

3720 |

37 |

6250 |

2.94 |

4.07 |

2.87 |

|

Caracol |

SX |

| CRSX23-25D |

644.00 |

645.50 |

1.5 |

1.1 |

1.03 |

7.6 |

1655 |

2030 |

62 |

2900 |

1.22 |

1.54 |

1.09 |

|

Caracol |

SX |

| CRSX23-25D |

683.55 |

684.70 |

1.2 |

0.8 |

1.60 |

3.1 |

86 |

104 |

20 |

8550 |

1.64 |

1.83 |

1.31 |

|

Caracol |

SX |

| CRSX23-26 |

412.50 |

419.15 |

6.6 |

6.1 |

1.27 |

4.0 |

343 |

736 |

39 |

2123 |

1.35 |

8.42 |

7.73 |

|

412.5 - 414.38 Breccia

414.38 - 419.15 Caracol |

SX |

| CRSX23-26 |

489.45 |

491.15 |

1.7 |

1.6 |

7.63 |

37.0 |

538 |

1965 |

126 |

4470 |

8.18 |

12.97 |

11.89 |

|

Caracol |

SX |

| CRSX23-26 |

538.50 |

549.50 |

11.0 |

10.2 |

3.43 |

5.7 |

376 |

4260 |

83 |

2118 |

3.71 |

37.77 |

34.99 |

1m @ 21.9g/t Au |

Caracol |

SX |

| CRSX23-26 |

570.50 |

576.50 |

6.0 |

5.5 |

1.99 |

5.6 |

106 |

491 |

69 |

3073 |

2.08 |

11.91 |

10.86 |

|

Caracol |

SX |

| CRSX23-26 |

587.00 |

610.00 |

23.0 |

20.9 |

1.97 |

8.1 |

253 |

954 |

204 |

2867 |

2.14 |

45.34 |

41.30 |

0.75m @ 10.8g/t Au |

Caracol |

SX |

| CRSX23-26 |

624.50 |

627.50 |

3.0 |

2.7 |

2.14 |

14.1 |

651 |

9675 |

280 |

7465 |

2.80 |

6.41 |

5.83 |

|

Caracol |

SX |

| CRSX23-26 |

639.50 |

641.00 |

1.5 |

1.1 |

1.07 |

2.2 |

270 |

983 |

61 |

592 |

1.15 |

1.61 |

1.13 |

|

Caracol |

SX |

| CRSX23-26 |

650.00 |

678.00 |

28.0 |

25.6 |

4.42 |

10.9 |

201 |

1604 |

255 |

2981 |

4.66 |

123.84 |

113.02 |

1.05m @ 23.5g/t Au

1.4m @ 33.2g/t Au |

650 - 676.4 Caracol

676.4 - 678 Breccia |

SX |

| CRSX23-26 |

685.50 |

686.75 |

1.3 |

1.1 |

4.31 |

1.1 |

59 |

113 |

70 |

252 |

4.34 |

5.39 |

4.94 |

|

Caracol |

SX |

| CRSX23-26 |

703.50 |

706.65 |

3.1 |

2.1 |

4.57 |

22.8 |

562 |

7286 |

272 |

1680 |

5.22 |

14.39 |

9.67 |

|

Caracol |

SX |

| CRSX23-26 |

731.00 |

787.50 |

56.5 |

52.8 |

2.82 |

22.9 |

394 |

5346 |

350 |

4655 |

3.39 |

159.35 |

148.87 |

1.5m @ 24.4g/t Au

1.1m @ 12.75g/t Au

1.1m @ 10g/t Au

1.5m @ 12.1g/t Au |

731 - 767.13 Caracol

767.13 - 778.48 FG Intrusives - hdb-bi-pl

778.48 - 787.5 Caracol |

SX |

| CRSX23-26 |

802.50 |

805.50 |

3.0 |

2.0 |

1.74 |

5.8 |

136 |

640 |

82 |

2383 |

1.85 |

5.21 |

3.39 |

|

Caracol |

SX |

| CRSX23-26 |

819.00 |

837.00 |

18.0 |

16.8 |

1.26 |

5.1 |

85 |

2058 |

88 |

1212 |

1.43 |

22.65 |

21.13 |

|

Caracol |

SX |

| CRSX23-26A |

401.00 |

402.10 |

1.1 |

1.1 |

1.74 |

5.2 |

568 |

1090 |

41 |

3080 |

1.86 |

1.91 |

1.87 |

|

Breccia |

SX |

| CRSX23-26A |

415.00 |

416.50 |

1.5 |

0.8 |

1.78 |

1.9 |

39 |

119 |

16 |

1825 |

1.81 |

2.67 |

1.41 |

|

Caracol |

SX |

| CRSX23-26A |

495.50 |

497.00 |

1.5 |

1.5 |

1.42 |

12.8 |

1595 |

3750 |

157 |

1590 |

1.77 |

2.13 |

2.08 |

|

Caracol |

SX |

| CRSX23-26A |

513.50 |

515.00 |

1.5 |

1.5 |

1.30 |

3.6 |

227 |

160 |

35 |

1340 |

1.36 |

1.95 |

1.90 |

|

Caracol |

SX |

| CRSX23-26A |

522.50 |

533.50 |

11.0 |

10.7 |

5.41 |

29.0 |

3283 |

7009 |

266 |

3686 |

6.12 |

59.48 |

58.07 |

1.55m @ 10.25g/t Au

1.55m @ 18.9g/t Au |

Caracol |

SX |

| CRSX23-26A |

549.00 |

550.50 |

1.5 |

1.5 |

4.82 |

173.0 |

5100 |

9880 |

1025 |

8840 |

7.50 |

7.23 |

7.06 |

|

Caracol |

SX |

| CRSX23-26A |

557.50 |

565.00 |

7.5 |

7.3 |

2.51 |

15.9 |

823 |

1097 |

254 |

4107 |

2.79 |

18.83 |

18.37 |

|

Caracol |

SX |

| CRSX23-26A |

577.05 |

594.00 |

17.0 |

16.5 |

5.48 |

5.9 |

341 |

779 |

76 |

1249 |

5.60 |

92.93 |

90.64 |

1.5m @ 26.6g/t Au

1.55m @ 10.15g/t Au

1.5m @ 13.85g/t Au |

Caracol |

SX |

| CRSX23-26A |

603.00 |

642.00 |

39.0 |

38.0 |

2.77 |

19.2 |

1439 |

1960 |

122 |

2522 |

3.11 |

107.91 |

105.15 |

0.9m @ 30.6g/t Au

0.55m @ 21.3g/t Au |

Caracol |

SX |

| CRSX23-26A |

649.50 |

682.50 |

33.0 |

32.2 |

1.76 |

7.3 |

531 |

2578 |

153 |

1046 |

1.99 |

58.18 |

56.70 |

|

Caracol |

SX |

| CRSX23-26A |

693.85 |

760.00 |

66.2 |

64.3 |

2.34 |

9.4 |

523 |

2150 |

169 |

2003 |

2.58 |

154.91 |

150.49 |

1.5m @ 21.1g/t Au |

693.85 - 712.96 Caracol

712.96 - 730.03 FG Intrusives - hdb-bi-pl

730.03 - 760 Caracol |

693.85 - 737.9 SX

737.9 - 753.1

753.1 - 760 SX |

| CRSX23-26A |

769.00 |

788.50 |

19.5 |

19.0 |

1.30 |

5.5 |

426 |

3262 |

99 |

1684 |

1.53 |

25.26 |

24.55 |

|

Caracol |

SX |

| CRSX23-26A |

797.50 |

799.00 |

1.5 |

1.5 |

1.49 |

6.4 |

170 |

2150 |

108 |

481 |

1.68 |

2.23 |

2.17 |

|

Caracol |

SX |

| CRSX23-26A |

809.50 |

823.50 |

14.0 |

13.6 |

4.11 |

8.4 |

221 |

3264 |

89 |

2900 |

4.37 |

57.49 |

55.90 |

1.5m @ 13.85g/t Au

1.62m @ 15.35g/t Au |

Caracol |

SX |

| CRSX23-26A |

843.00 |

844.50 |

1.5 |

1.5 |

1.32 |

4.2 |

202 |

5990 |

80 |

1100 |

1.66 |

1.98 |

1.92 |

|

Caracol |

SX |

| CRSX23-26A |

856.55 |

858.00 |

1.5 |

0.8 |

3.21 |

3.3 |

348 |

347 |

49 |

1270 |

3.27 |

4.65 |

2.44 |

|

Caracol |

SX |

| CRSX23-27 |

368.00 |

369.50 |

1.5 |

1.2 |

6.40 |

9.1 |

623 |

519 |

46 |

2830 |

6.54 |

9.60 |

7.93 |

|

Caracol |

SX |

| CRSX23-27 |

434.00 |

435.50 |

1.5 |

1.2 |

1.90 |

5.8 |

343 |

314 |

39 |

1950 |

1.98 |

2.84 |

2.28 |

|

Caracol |

SX |

| CRSX23-27 |

474.50 |

476.00 |

1.5 |

1.3 |

1.05 |

25.7 |

2820 |

5440 |

64 |

1965 |

1.62 |

1.58 |

1.32 |

|

Caracol |

SX |

| CRSX23-27 |

551.50 |

557.50 |

6.0 |

5.0 |

1.08 |

8.4 |

358 |

853 |

77 |

1843 |

1.23 |

6.50 |

5.43 |

|

Caracol |

SX |

| CRSX23-27 |

578.50 |

585.00 |

6.5 |

5.4 |

3.28 |

16.6 |

211 |

8474 |

193 |

5427 |

3.90 |

21.31 |

17.77 |

|

Caracol |

SX |

| CRSX23-27 |

663.50 |

697.00 |

33.5 |

28.1 |

1.31 |

6.0 |

566 |

945 |

50 |

1245 |

1.44 |

44.04 |

36.91 |

|

Caracol |

SX |

| CRSX23-27 |

706.00 |

709.00 |

3.0 |

2.5 |

1.50 |

11.8 |

647 |

920 |

59 |

4825 |

1.69 |

4.49 |

3.75 |

|

Caracol |

SX |

| CRSX23-27 |

764.50 |

766.00 |

1.5 |

1.3 |

8.06 |

5.2 |

379 |

416 |

64 |

2140 |

8.15 |

12.09 |

10.14 |

|

Caracol |

SX |

| CRSX23-27 |

775.00 |

776.50 |

1.5 |

1.3 |

1.58 |

5.2 |

125 |

53 |

34 |

2900 |

1.64 |

2.36 |

1.98 |

|

Caracol |

SX |

| CRSX23-27 |

783.10 |

796.50 |

13.4 |

11.3 |

1.13 |

3.2 |

220 |

2490 |

29 |

2287 |

1.29 |

15.08 |

12.67 |

|

FG Intrusives - hdb-bi-pl |

SX |

| CRSX23-27 |

854.35 |

862.15 |

7.8 |

6.5 |

1.65 |

13.5 |

2051 |

7599 |

45 |

4566 |

2.18 |

12.90 |

10.82 |

|

FG Intrusives - hdb-bi-pl |

SX |

| CRSX23-27 |

875.50 |

877.00 |

1.5 |

1.3 |

2.88 |

6.9 |

81 |

574 |

88 |

770 |

3.00 |

4.32 |

3.63 |

|

Indidura |

SX |

| CRSX23-27A |

407.50 |

409.00 |

1.5 |

1.4 |

3.10 |

161.0 |

5530 |

3300 |

103 |

2560 |

5.20 |

4.65 |

4.33 |

|

Caracol |

SX |

| CRSX23-27A |

425.00 |

431.00 |

6.0 |

4.0 |

1.40 |

16.6 |

193 |

769 |

49 |

1962 |

1.64 |

8.38 |

5.55 |

|

Caracol |

SX |

| CRSX23-27A |

453.50 |

455.00 |

1.5 |

1.4 |

1.32 |

25.6 |

1405 |

1710 |

57 |

1595 |

1.71 |

1.97 |

1.83 |

|

Caracol |

SX |

| CRSX23-27A |

476.00 |

477.50 |

1.5 |

1.4 |

1.62 |

85.8 |

3900 |

3740 |

118 |

1590 |

2.84 |

2.42 |

2.25 |

|

Caracol |

SX |

| CRSX23-27A |

483.50 |

485.00 |

1.5 |

1.4 |

1.52 |

30.2 |

2380 |

3880 |

51 |

4250 |

2.07 |

2.27 |

2.11 |

|

Caracol |

SX |

| CRSX23-27A |

513.50 |

514.50 |

1.0 |

0.9 |

3.53 |

40.2 |

516 |

871 |

119 |

4970 |

4.07 |

3.53 |

3.27 |

|

Caracol |

SX |

| CRSX23-27A |

601.00 |

613.50 |

12.5 |

11.6 |

5.32 |

27.1 |

1084 |

3120 |

203 |

4392 |

5.82 |

66.56 |

61.55 |

2.5m @ 21.74g/t Au |

Caracol |

SX |

| CRSX23-27A |

622.50 |

625.50 |

3.0 |

2.8 |

1.73 |

7.6 |

496 |

2158 |

92 |

2109 |

1.93 |

5.18 |

4.78 |

|

Caracol |

SX |

| CRSX23-27A |

636.00 |

637.50 |

1.5 |

1.4 |

1.14 |

6.6 |

438 |

1295 |

53 |

1775 |

1.29 |

1.71 |

1.58 |

|

Caracol |

SX |

| CRSX23-27A |

648.00 |

649.70 |

1.7 |

1.6 |

6.97 |

115.0 |

21200 |

27100 |

764 |

13400 |

9.73 |

11.85 |

10.94 |

|

FG Intrusives - hdb-bi-pl |

SX |

| CRSX23-27A |

669.00 |

684.50 |

15.5 |

14.3 |

1.20 |

11.5 |

1151 |

1148 |

92 |

1594 |

1.41 |

18.63 |

17.20 |

|

669 - 671.9 FG Intrusives - hdb-bi-pl

671.9 - 684.5 Caracol |

SX |

| CRSX23-27A |

690.50 |

692.95 |

2.5 |

2.3 |

1.38 |

10.5 |

756 |

920 |

428 |

1351 |

1.61 |

3.38 |

3.12 |

|

Caracol |

SX |

| CRSX23-27A |

703.50 |

705.00 |

1.5 |

1.4 |

2.05 |

3.9 |

53 |

393 |

130 |

3190 |

2.13 |

3.08 |

2.85 |

|

Caracol |

SX |

| CRSX23-27A |

709.50 |

711.00 |

1.5 |

1.4 |

1.06 |

31.4 |

4250 |

191 |

91 |

1985 |

1.45 |

1.58 |

1.46 |

|

Caracol |

SX |

| CRSX23-27A |

722.50 |

725.50 |

3.0 |

2.8 |

3.42 |

46.0 |

6828 |

10275 |

345 |

3923 |

4.50 |

10.25 |

9.48 |

|

Caracol |

SX |

| CRSX23-27B |

365.00 |

369.05 |

4.1 |

3.6 |

5.27 |

7.2 |

135 |

289 |

81 |

2805 |

5.38 |

21.33 |

18.75 |

1.4m @ 10.9g/t Au |

365 - 366.6 Caracol

366.6 - 369.05 Porph Intrusives - hdb-bi-pl |

SX |

| CRSX23-27B |

469.00 |

470.50 |

1.5 |

1.3 |

4.69 |

31.4 |

2290 |

4120 |

84 |

1855 |

5.27 |

7.04 |

6.17 |

|

Caracol |

SX |

| CRSX23-27B |

546.50 |

549.50 |

3.0 |

2.6 |

6.05 |

61.4 |

655 |

1444 |

231 |

11233 |

6.89 |

18.15 |

15.86 |

1.5m @ 11.1g/t Au |

Caracol |

SX |

| CRSX23-27B |

558.50 |

560.00 |

1.5 |

1.1 |

4.09 |

61.6 |

2410 |

18950 |

301 |

4600 |

5.76 |

6.14 |

4.64 |

|

Caracol |

SX |

| CRSX23-27B |

579.50 |

581.00 |

1.5 |

1.3 |

1.29 |

1.1 |

43 |

152 |

34 |

393 |

1.31 |

1.93 |

1.69 |

|

Caracol |

SX |

| CRSX23-27B |

639.85 |

665.50 |

25.7 |

22.4 |

2.44 |

9.8 |

795 |

1545 |

154 |

1664 |

2.66 |

62.69 |

54.79 |

1.65m @ 17.85g/t Au

1.5m @ 10.5g/t Au |

Caracol |

SX |

| CRSX23-27B |

673.00 |

674.50 |

1.5 |

1.3 |

2.26 |

4.9 |

257 |

80 |

16 |

1560 |

2.32 |

3.39 |

2.96 |

|

Caracol |

SX |

| CRSX23-27B |

695.50 |

697.00 |

1.5 |

1.3 |

1.14 |

16.1 |

2270 |

6430 |

99 |

3390 |

1.65 |

1.71 |

1.49 |

|

Caracol |

SX |

| CRSX23-27B |

716.50 |

718.00 |

1.5 |

1.3 |

1.42 |

0.9 |

15 |

101 |

33 |

269 |

1.44 |

2.12 |

1.86 |

|

Caracol |

SX |

| CRSX23-27B |

725.50 |

768.50 |

43.0 |

37.7 |

4.12 |

10.6 |

583 |

4060 |

164 |

7016 |

4.46 |

177.04 |

155.37 |

2m @ 32.17g/t Au

1.5m @ 14.45g/t Au |

725.5 - 732.4 Caracol

732.4 - 733.55 Breccia

733.55 - 734.12 FG Intrusives - hdb-bi-pl

734.12 - 734.6 Caracol

734.6 - 735 FG Intrusives - hdb-bi-pl

735 - 736.15 Caracol

736.15 - 752.23 Porph Intrusives - hdb-bi-pl

752.23 - 768.5 Caracol |

SX |

| CRSX23-27B |

786.50 |

788.00 |

1.5 |

1.1 |

1.03 |

3.5 |

100 |

74 |

53 |

1225 |

1.08 |

1.54 |

1.15 |

|

Caracol |

SX |

| CRSX23-27B |

806.00 |

809.00 |

3.0 |

2.2 |

4.30 |

3.3 |

156 |

179 |

28 |

9075 |

4.35 |

12.89 |

9.62 |

|

Caracol |

SX |

| CRSX23-27B |

819.50 |

821.00 |

1.5 |

1.1 |

1.31 |

7.4 |

1825 |

3760 |

59 |

1425 |

1.58 |

1.97 |

1.47 |

|

Indidura |

SX |

| CRSX23-28A |

582.20 |

598.50 |

16.3 |

15.9 |

1.33 |

28.0 |

2761 |

2715 |

94 |

1672 |

1.81 |

21.69 |

21.11 |

|

Caracol |

SX |

| CRSX23-28A |

630.50 |

642.00 |

11.5 |

11.2 |

1.47 |

2.4 |

114 |

1093 |

45 |

2039 |

1.56 |

16.96 |

16.59 |

|

Caracol |

SX |

| CRSX23-28A |

652.50 |

654.00 |

1.5 |

1.5 |

1.81 |

48.0 |

8250 |

13500 |

207 |

1730 |

3.04 |

2.71 |

2.65 |

|

Caracol |

SX |

| CRSX23-28A |

664.00 |

685.00 |

21.0 |

20.5 |

1.07 |

2.4 |

119 |

782 |

61 |

494 |

1.14 |

22.45 |

21.93 |

|

Caracol |

SX |

| CRSX23-28A |

696.00 |

716.00 |

20.0 |

19.5 |

2.77 |

5.6 |

367 |

1649 |

93 |

3035 |

2.93 |

55.46 |

54.11 |

1.5m @ 14.75g/t Au |

Caracol |

SX |

| CRSX23-28A |

723.00 |

775.95 |

53.0 |

51.7 |

2.40 |

13.1 |

800 |

2248 |

153 |

2023 |

2.68 |

126.88 |

123.78 |

1.5m @ 14g/t Au |

Caracol |

SX |

| CRSX23-28A |

783.50 |

854.30 |

70.8 |

69.1 |

2.41 |

6.5 |

402 |

1844 |

110 |

3304 |

2.59 |

170.52 |

166.37 |

1.35m @ 26.7g/t Au

1.5m @ 19.35g/t Au

1.5m @ 10.15g/t Au |

783.5 - 801.7 Caracol

801.7 - 803.03 FG Intrusives - hdb-bi-pl

803.03 - 843.88 Caracol

843.88 - 854.3 FG Intrusives - hdb-bi-pl |

SX |

| CRSX23-28A |

866.00 |

873.50 |

7.5 |

7.3 |

2.61 |

1.9 |

47 |

805 |

44 |

1594 |

2.67 |

19.56 |

19.07 |

|

Caracol |

SX |

| CRSX23-28B |

590.10 |

592.55 |

2.4 |

2.2 |

2.80 |

15.9 |

1686 |

3606 |

111 |

2787 |

3.17 |

6.85 |

6.27 |

|

Caracol |

SX |

| CRSX23-28B |

604.50 |

624.50 |

20.0 |

18.3 |

1.95 |

5.8 |

430 |

2013 |

71 |

3188 |

2.12 |

38.97 |

35.59 |

|

Caracol |

SX |

| CRSX23-28B |

642.55 |

645.50 |

3.0 |

2.7 |

1.25 |

5.7 |

311 |

89 |

188 |

1742 |

1.35 |

3.69 |

3.37 |

|

Caracol |

SX |

| CRSX23-28B |

662.50 |

663.45 |

1.0 |

0.9 |

2.55 |

6.3 |

374 |

658 |

58 |

2320 |

2.66 |

2.42 |

2.21 |

|

Caracol |

SX |

| CRSX23-28B |

671.00 |

692.00 |

21.0 |

19.2 |

1.19 |

4.5 |

433 |

404 |

66 |

568 |

1.27 |

25.03 |

22.93 |

|

Caracol |

SX |

| CRSX23-28B |

701.00 |

839.55 |

138.6 |

127.0 |

3.21 |

7.4 |

575 |

1237 |

111 |

2854 |

3.37 |

444.12 |

407.15 |

1.5m @ 11.75g/t Au

1.5m @ 13.25g/t Au

1.45m @ 11.35g/t Au

1.5m @ 20.9g/t Au

1.25m @ 12.2g/t Au

0.85m @ 61.2g/t Au

1.5m @ 10.8g/t Au

1.05m @ 17.05g/t Au |

701 - 835.2 Caracol

835.2 - 839.55 Indidura |

SX |

| CRSX23-29A |

430.00 |

431.50 |

1.5 |

1.4 |

1.14 |

37.7 |

2570 |

3020 |

74 |

805 |

1.74 |

1.71 |

1.62 |

|

Caracol |

SX |

| CRSX23-29A |

446.50 |

448.00 |

1.5 |

1.4 |

1.12 |

3.2 |

165 |

246 |

29 |

1280 |

1.17 |

1.67 |

1.58 |

|

Caracol |

SX |

| CRSX23-29A |

475.00 |

478.00 |

3.0 |

2.8 |

1.20 |

42.7 |

4045 |

5305 |

62 |

1523 |

1.97 |

3.61 |

3.41 |

|

Caracol |

SX |

| CRSX23-29A |

487.00 |

488.50 |

1.5 |

1.4 |

2.90 |

72.2 |

5970 |

3530 |

82 |

1730 |

3.94 |

4.35 |

4.11 |

|

Caracol |

SX |

| CRSX23-29A |

512.50 |

514.00 |

1.5 |

1.4 |

2.12 |

30.2 |

2570 |

1690 |

70 |

682 |

2.57 |

3.18 |

3.00 |

|

Caracol |

SX |

| CRSX23-29A |

538.00 |

539.50 |

1.5 |

1.4 |

3.93 |

58.6 |

868 |

614 |

873 |

5090 |

4.78 |

5.90 |

5.56 |

|

Caracol |

SX |

| CRSX23-29A |

548.50 |

550.00 |

1.5 |

1.4 |

1.08 |

4.4 |

192 |

624 |

51 |

2900 |

1.16 |

1.61 |

1.52 |

|

Caracol |

SX |

| CRSX23-29A |

562.00 |

563.50 |

1.5 |

1.4 |

1.47 |

2.4 |

152 |

1945 |

36 |

1005 |

1.59 |

2.20 |

2.07 |

|

Caracol |

SX |

| CRSX23-29A |

583.00 |

590.50 |

7.5 |

7.1 |

3.92 |

10.1 |

1205 |

1967 |

99 |

8292 |

4.15 |

29.41 |

27.71 |

|

Caracol |

SX |

| CRSX23-29A |

619.00 |

632.50 |

13.5 |

12.7 |

3.66 |

8.8 |

284 |

1348 |

81 |

4237 |

3.84 |

49.42 |

46.52 |

|

Caracol |

SX |

| CRSX23-29A |

649.00 |

655.00 |

6.0 |

5.6 |

2.88 |

20.8 |

1489 |

7760 |

241 |

4377 |

3.53 |

17.27 |

16.23 |

|

Caracol |

SX |

| CRSX23-29A |

667.00 |

731.50 |

64.5 |

60.7 |

1.98 |

7.9 |

597 |

2423 |

94 |

2688 |

2.20 |

127.43 |

119.96 |

|

667 - 693.2 Caracol

693.2 - 709 Porph Intrusives - hdb-bi-pl

709 - 731.5 Caracol |

SX |

| CRSX23-29A |

743.50 |

757.00 |

13.5 |

12.7 |

3.05 |

8.9 |

190 |

4720 |

160 |

5074 |

3.40 |

41.12 |

38.75 |

1.5m @ 12.6g/t Au |

Caracol |

SX |

| CRSX23-29A |

772.00 |

773.50 |

1.5 |

1.4 |

1.86 |

6.0 |

215 |

772 |

69 |

1935 |

1.98 |

2.79 |

2.63 |

|

Caracol |

SX |

| CRSX23-29A |

781.00 |

782.50 |

1.5 |

1.4 |

7.32 |

8.8 |

222 |

337 |

108 |

2160 |

7.46 |

10.98 |

10.35 |

|

Caracol |

SX |

| CRSX23-29A |

808.00 |

812.50 |

4.5 |

4.2 |

2.46 |

8.2 |

580 |

2345 |

64 |

2152 |

2.67 |

11.06 |

10.43 |

|

Caracol |

SX |

| CRSX23-29A |

829.00 |

832.00 |

3.0 |

2.8 |

16.23 |

21.6 |

573 |

957 |

295 |

13490 |

16.57 |

48.69 |

45.99 |

1.5m @ 22.6g/t Au |

Caracol |

SX |

| CRSX23-29A |

849.50 |

850.80 |

1.3 |

1.2 |

1.37 |

3.1 |

145 |

1540 |

91 |

1975 |

1.49 |

1.77 |

1.69 |

|

Caracol |

SX |

| CRSX23-29B |

480.00 |

481.50 |

1.5 |

1.3 |

2.30 |

33.4 |

3160 |

11850 |

97 |

5160 |

3.27 |

3.45 |

3.07 |

|

Caracol |

SX |

| CRSX23-29B |

552.50 |

561.50 |

9.0 |

8.0 |

1.24 |

9.0 |

261 |

502 |

93 |

2189 |

1.39 |

11.18 |

9.97 |

|

Caracol |

SX |

| CRSX23-29B |

573.55 |

576.50 |

3.0 |

2.6 |

9.50 |

60.3 |

442 |

1371 |

431 |

13977 |

10.35 |

28.03 |

24.98 |

1.45m @ 17.15g/t Au |

Caracol |

SX |

| CRSX23-29B |

585.50 |

587.00 |

1.5 |

1.3 |

1.81 |

3.4 |

113 |

117 |

33 |

2440 |

1.86 |

2.72 |

2.42 |

|

Caracol |

SX |

| CRSX23-29B |

649.50 |

679.00 |

29.5 |

26.2 |

2.19 |

11.7 |

948 |

1410 |

124 |

1902 |

2.42 |

64.72 |

57.38 |

1.4m @ 10.5g/t Au |

Caracol |

SX |

| CRSX23-29B |

694.00 |

696.90 |

2.9 |

2.6 |

3.63 |

100.3 |

16951 |

9448 |

366 |

5374 |

5.32 |

10.52 |

9.31 |

0.6m @ 10.2g/t Au |

Caracol |

SX |

| CRSX23-29B |

708.70 |

713.00 |

4.3 |

3.8 |

8.93 |

10.2 |

867 |

4909 |

104 |

1584 |

9.29 |

38.38 |

33.97 |

1.5m @ 22.6g/t Au |

Caracol |

SX |

| CRSX23-29B |

730.00 |

774.00 |

44.0 |

38.9 |

2.91 |

4.9 |

198 |

2037 |

88 |

2882 |

3.08 |

127.99 |

113.14 |

1.5m @ 21.6g/t Au

1.5m @ 15.1g/t Au |

730 - 740.05 Caracol

740.05 - 753.8 FG Intrusives - hdb-bi-pl

753.8 - 774 Caracol |

SX |

| CRSX23-29B |

802.15 |

809.00 |

6.9 |

6.1 |

4.51 |

8.0 |

175 |

4388 |

41 |

9035 |

4.82 |

30.87 |

27.30 |

|

802.15 - 807.9 FG Intrusives - hdb-bi-pl

807.9 - 809 Indidura |

SX |

| CRSX23-30A |

540.50 |

633.50 |

93.0 |

87.9 |

1.55 |

7.0 |

650 |

1576 |

78 |

1838 |

1.71 |

143.78 |

135.84 |

1.5m @ 15.7g/t Au |

Caracol |

SX |

| CRSX23-30A |

641.00 |

665.00 |

24.0 |

22.6 |

1.25 |

6.4 |

598 |

957 |

129 |

1559 |

1.39 |

30.03 |

28.34 |

|

Caracol |

SX |

| CRSX23-30A |

675.50 |

695.00 |

19.5 |

18.4 |

1.57 |

7.0 |

495 |

519 |

110 |

2034 |

1.69 |

30.61 |

28.91 |

|

Caracol |

SX |

| CRSX23-30A |

708.50 |

746.00 |

37.5 |

22.6 |

2.45 |

9.1 |

201 |

2703 |

192 |

4807 |

2.71 |

91.78 |

55.41 |

1.4m @ 14.4g/t Au |

Caracol |

SX |

| CRSX23-30A |

753.00 |

785.50 |

32.5 |

19.7 |

1.86 |

14.8 |

1257 |

3792 |

184 |

2692 |

2.24 |

60.36 |

36.58 |

|

Caracol |

753-765.9 TRSX

765.9-785.5 SX |

| CRSX23-30A |

793.00 |

794.50 |

1.5 |

0.9 |

1.08 |

5.8 |

328 |

1385 |

84 |

676 |

1.22 |

1.61 |

0.98 |

|

Caracol |

SX |

| CRSX23-30A |

796.00 |

797.50 |

1.5 |

1.4 |

1.51 |

3.5 |

215 |

1590 |

116 |

82 |

1.64 |

2.26 |

2.13 |

|

Caracol |

SX |

| CRSX23-30A |

807.50 |

852.00 |

44.5 |

26.9 |

1.71 |

10.2 |

143 |

2186 |

170 |

3142 |

1.96 |

76.10 |

46.01 |

|

807.5 - 842.9 Caracol

842.9 - 852 Porph Intrusives - hdb-bi-pl |

SX |

| CRSX23-30A |

880.50 |

883.50 |

3.0 |

1.8 |

1.28 |

1.6 |

28 |

703 |

45 |

186 |

1.33 |

3.83 |

2.31 |

|

Indidura |

SX |

| Criteria: Cut off grade 1g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m, if Au grade x length > 1.5 the composite will be added |

| Price Assumptions: Au = 1750usd oz, Ag = 21usd oz, Cu = 3.5usd lb, Zn = 1.2usd lb. AuEq: Au+Ag+Cu+Zn |

| FR= Fresh Rock, OX= Oxide, TROL= Transition Oxide Low, TROH= Transition Oxide High, MX= Mixed, TRSX= Transition Sulphide, SX= Sulphide |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 2: Camino Rojo Drill Hole Collars

| HOLE-ID |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth (m) |

| CRSX23-25 |

243501.5 |

2676087.5 |

1954.6 |

146.0 |

-76.00 |

228.4 |

| CRSX23-25A |

243501.5 |

2676087.5 |

1954.6 |

154.0 |

-52.00 |

660.6 |

| CRSX23-25B |

243501.5 |

2676087.5 |

1954.6 |

149.8 |

-59.30 |

879.7 |

| CRSX23-25C |

243501.5 |

2676087.5 |

1954.6 |

150.3 |

-64.23 |

1000.2 |

| CRSX23-25D |

243500.9 |

2676089.7 |

1955.1 |

135.0 |

-79.00 |

720.1 |

| CRSX23-26 |

243579.9 |

2676156.9 |

1954.5 |

164.0 |

-57.38 |

870.8 |

| CRSX23-26A |

243579.9 |

2676156.9 |

1954.5 |

162.0 |

-47.00 |

861.3 |

| CRSX23-27 |

243413.3 |

2675987.7 |

1955.2 |

161.5 |

-69.00 |

890.3 |

| CRSX23-27A |

243413.8 |

2675987.7 |

1955.2 |

158.0 |

-56.00 |

738.2 |

| CRSX23-27B |

243413.3 |

2675987.7 |

1955.2 |

161.0 |

-61.00 |

825.2 |

| CRSX23-28A |

243384.3 |

2676158.3 |

1956.5 |

153.1 |

-49.60 |

880.5 |

| CRSX23-28B |

243384.3 |

2676158.3 |

1956.5 |

154.2 |

-55.18 |

923.8 |

| CRSX23-29A |

243401.7 |

2675996.6 |

1955.6 |

152.0 |

-51.80 |

850.8 |

| CRSX23-29B |

243401.7 |

2675996.6 |

1955.6 |

152.4 |

-60.36 |

810.2 |

| CRSX23-30A |

243402.7 |

2676157.9 |

1956.4 |

146.0 |

-49.74 |

890.0 |

SOURCE Orla Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2024/07/c0814.html

%CIK: 0001680056

For further information: Jason Simpson, President & Chief Executive

Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development, www.orlamining.com, info@orlamining.com

CO: Orla Mining Ltd.

CNW 06:00e 07-FEB-24

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024