As filed with the Securities and Exchange Commission on February 27, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

POLYMET MINING CORP.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English (if applicable))

|

British Columbia, Canada

|

|

1000

|

|

84-1461363

|

|

(Province or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number

(if applicable))

|

|

(I.R.S. Employer Identification

Number (if applicable))

|

444 Cedar Street, Suite 2060

St. Paul, MN 55101

(651) 389-4100

(Address and telephone number of Registrant's principal executive offices)

Patrick Keenan

444 Cedar Street, Suite 2060,

St. Paul, MN 55101

(651) 389-4100

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

|

Joseph Walsh

Troutman Pepper Hamilton Sanders LLP

875 Third Avenue

New York, NY 10022

Tel: (212) 704-6000

|

|

Denise C. Nawata

Farris LLP

PO Box 10026, Pacific Centre South

25th Floor, 700 W Georgia Street

Vancouver, BC

Canada V7Y 1B3

Tel: (604) 684-9151

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement.

British Columbia, Canada

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check appropriate box)

|

A.

|

|

☒

|

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

| |

|

|

|

|

|

B.

|

|

☐

|

|

at some future date (check appropriate box below)

|

|

|

|

|

|

|

|

|

|

1.

|

|

☐

|

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

|

☐

|

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

|

|

|

|

|

|

|

|

|

3.

|

|

☐

|

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

|

|

|

|

|

|

|

|

|

4.

|

|

☐

|

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☐

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

POLYMET MINING CORP.

RIGHTS OFFERING NOTICE

Notice to security holders - February 27, 2023

The purpose of this notice is to advise holders of common shares (the "PolyMet Shares" or "Common Shares") of PolyMet Mining Corp. ("PolyMet") of a proposed offering of rights ("Rights") of PolyMet (the "Rights Offering").

References in this notice to we, our, us and similar terms mean to PolyMet. References in this notice to you, your and similar terms mean to PolyMet shareholders.

We currently have sufficient working capital to last one (1) month. We require 71% of the Rights Offering to last 12 months.

Glencore AG (“Glencore”), which owns approximately 71% of the outstanding PolyMet Shares, will subscribe for and purchase at the Subscription Price (as defined herein) all PolyMet Shares to which it is entitled under the Rights Offering. Under its Basic Subscription Privilege, Glencore will subscribe for 71% of all PolyMet Shares available under the Rights Offering for 71% of the gross proceeds of US$195,400,000. In addition, pursuant to that certain standby purchase agreement dated February 27, 2023 by and between PolyMet and Glencore (the "Standby Purchase Agreement"), Glencore will purchase at the Subscription Price, any PolyMet Shares (that would otherwise be issuable upon exercise of Rights offered under the Rights Offering) that are not otherwise subscribed for by holders of Rights pursuant to their Basic Subscription Privilege and Additional Subscription Privilege. Glencore may terminate the Standby Purchase Agreement prior to the Expiry Time in certain circumstances.

Proceeds from the Rights Offering will be used for: (a) the funding of PolyMet's portion of the transaction with Teck Resources Limited and its subsidiary Teck American Incorporated to form a 50:50 joint venture relating to the companies' respective NorthMet and Mesaba resources; (b) the repayment of all of its secured and convertible debt owed to Glencore; (c) the repayment of all of its unsecured debt owed to Glencore; (d) the payment of the Standby Fee (as defined in the Standby Purchase Agreement) in full; (e) the payment of the expenses of the Rights Offering; and general working capital.

1. Who can participate in the Rights Offering?

Each eligible shareholder of record as at 5:00 p.m. (Toronto time) on March 10, 2023 (the "Record Date") may participate in the Rights Offering. However, as discussed below, the Rights will only be offered to shareholders of PolyMet (the "Eligible Holders") in each province of Canada and the United States (the "Eligible Jurisdictions").

2. Who is eligible to receive Rights?

The Rights will be offered to the Eligible Holders in the Eligible Jurisdictions. You will be presumed to be resident in the place shown in our records as your registered address, unless the contrary is shown to our satisfaction.

This notice is not to be construed as an offering of the Rights, nor are the Common Shares issuable or exchangeable upon exercise of the Rights offered for sale, in any jurisdiction outside the Eligible Jurisdictions or to shareholders who are residents of any jurisdiction other than the Eligible Jurisdictions (the "Ineligible Holders"). The Rights and Common Shares have not and will not be registered under the laws of any jurisdiction ouside the Eligible Jurisdictions.

Ineligible Holders will not receive a DRS Advice (as defined below), but will be sent a letter from PolyMet describing how Ineligible Holders may participate in the Rights Offering.

3. How many Rights are we offering?

We are offering a total of 92,606,635 Rights to purchase 92,606,635 Common Shares pursuant to the Rights Offering.

4. How many Rights will you receive?

Each Eligible Holder will receive one (1) Right for every one (1) Common Share of PolyMet held. Each Right will be exercisable into 0.91068844 Common Shares. No fractional Rights will be issued. No fractional Common Shares will be issued. Where the exercise of Rights would appear to entitle a holder of Rights to receive fractional Common Shares, the holder’s entitlement will be reduced to the next lowest whole number of Common Shares. PolyMet will not be required to issue fractional Common Shares or pay cash in lieu thereof.

5. What does one Right entitle you to receive?

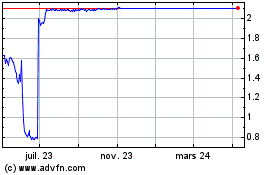

Before the Expiry Time (as defined below), you will be entitled to purchase 0.91068844 Common Shares for every one Right held at a subscription price of US$2.11 (the "Subscription Price") per Common Share (the "Basic Subscription Privilege") until 5:00 p.m. (Toronto time) on April 4, 2023 (the "Expiry Time").

Any Eligible Holder who exercises all of their Rights under the Basic Subscription Privilege will also have the additional privilege of subscribing, pro rata, for additional Common Shares at the Subscription Price (the "Additional Subscription Privilege"). The Common Shares available under the Additional Subscription Privilege will be the Common Shares issuable under the Rights Offering that have not been subscribed and paid for under the Basic Subscription Privilege by April 4, 2023.

Any Eligible Holder who exercises their Rights must enclose payment in U.S. funds by certified cheque, bank draft, bank transfer or money order payable to the order of Computershare Investor Services Inc. (the "Subscription Agent"), the subscription agent retained by PolyMet in connection with the Rights Offering. Any excess funds will be returned without interest or deduction.

6. How will you receive your Rights?

If you are a registered holder of Common Shares, a Direct Registration System ("DRS") advice (the "DRS Advice") representing the total number of Rights which you are entitled to as at the Record Date is enclosed with this notice.

If you are an Ineligible Holder, you will find enclosed an exempt purchaser status certificate. If you deliver a completed and executed exempt purchaser status certificate to PolyMet on or before March 27, 2023 and your eligibility to participate in the Rights Offering is confirmed by PolyMet, the Subscription Agent will forward to you a DRS Advice evidencing the number of Rights you are entitled to. If you do not satisfy PolyMet as to your eligibility to participate in the Rights Offering on or before March 27, 2023, the Subscription Agent will attempt, on a best efforts basis, to sell your rights on the Toronto Stock Exchange ("TSX") or the NYSE American ("NYSE American") prior to the Expiry Time. The Subscription Agent's ability to sell the Rights, and the prices obtained for the Rights, are dependent on market conditions. The proceeds received by the Subscription Agent, if any, from the sale of the Rights, net of any applicable costs, expenses and taxes, will be divided among the Ineligible Holders on a pro rata basis according to the total number of Common Shares held by them on the Record Date.

7. When and how can you exercise your Rights?

If you are a registered Eligible Holder who receives a DRS Advice, you must complete and deliver the rights subscription form accompanying your DRS Advice on or before 5:00 pm (Toronto Time) on April 4, 2023. Rights not exercised at or before the Expiry Time will be void and of no value. The Rights will be listed on the TSX under the symbol "POM:RT" and on the NYSE American under the symbol "PLM:RT". The holders of the Rights may trade them through the facilities of the TSX and the NYSE American. Trading in the rights on the TSX will cease at 12:00 p.m. (Toronto time) on April 4, 2023 and will be suspended on the NYSE American prior to the markets opening on April 4, 2023.

Only registered Eligible Holders will be provided with a DRS Advice. If you hold your Common Shares through a securities broker or dealer, bank or trust company or other participant (each, a "Participant") in the book-based system administered by CDS Clearing and Depositary Services Inc. ("CDS") or Depository Trust Company ("DTC"), Rights will be issued in registered form to CDS or DTC, as the case may be, and will be deposited with CDS or DTC, as the case may be. PolyMet expects that each beneficial Eligible Holder will receive a confirmation of the number of Rights issued to it from its Participant in accordance with the practices and procedures of that Participant. CDS and DTC will be responsible for establishing and maintaining book-entry accounts for Participants holding Rights. Participants may establish their own deadlines for receiving instructions prior to the Expiry Time and you should therefore immediately contact your Participant to instruct them to exercise or sell or transfer your Rights.

If you are a beneficial Eligible Holder, you must arrange exercises, transfers or purchases of Rights through your Participant sufficiently in advance of the Expiry Time to allow the Participant to properly exercise the Additional Subscription Privilege on your behalf. Please contact your Participant for further details and instructions. We expect that each beneficial Eligible Holder will receive a customer confirmation of issuance or purchase, as applicable, from their Participant through which the Rights are issued in accordance with the practices and policies of such Participant.

Subscriptions for Common Shares made in connection with the Rights Offering will be irrevocable and subscribers will be unable to withdraw their subscriptions for Common Shares once submitted.

8. What are the next steps?

This notice contains key information that you should know about PolyMet. You can find more details in our Rights Offering Circular, a copy of which can be obtained on PolyMet's profile at SEDAR.com or at polymetmining.com. You can also ask your dealer representative for a copy or contact Tony Gikas at 612-817-6946 or tgikas@polymetmining.com. You should read the Rights Offering Circular, along with our continuous disclosure record, to make an informed decision. Holders in the United States should also review the PolyMet’s Registration Statement on Form F-10 filed with the United States Securities and Exchange Commission that can be found at www.sec.gov.

DATED FEBRUARY 27, 2023.

"Jonathan Cherry"

Jonathan Cherry

Chairman, President & Chief Executive Officer

PolyMet Mining Corp.

Please read this material carefully as you are required to make a decision prior to 5:00 p.m. (Toronto time) on April 4, 2023.

This rights offering circular (this "Circular") is prepared by management. No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this Circular. Any representation to the contrary is an offence.

This is the Circular that we referred to in the rights offering notice dated February 27, 2023 (the "Notice"), which you should have already received. Your rights direct registration system advice ("DRS Advice") and relevant forms were enclosed with the Notice. This Circular should be read in conjunction with the Notice and our continuous disclosure prior to making an investment decision.

This Circular does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. The rights offering (the "Rights Offering") is not being made to, nor will deposits be accepted from or on behalf of Shareholders (as defined herein) in any jurisdiction in which the making or acceptance of the Rights Offering would not be in compliance with the laws of such jurisdiction. However, PolyMet may, in its sole discretion, take such action as it may deem necessary to extend the Rights Offering in any such jurisdiction.

| Rights Offering Circular |

February 27, 2023 |

POLYMET MINING CORP.

(a company incorporated under the laws of British Columbia)

OFFERING OF RIGHTS TO SUBSCRIBE FOR 92,606,635 POLYMET SHARES

FOR GROSS PROCEEDS OF US$195,400,000

References in this Circular to "we", "our", "us" and similar terms mean PolyMet Mining Corp. ("PolyMet" or the "Company"). References in this Circular to "you", "your" and similar terms mean holders of the issued and outstanding common shares (the "PolyMet Shares") of PolyMet (the "Shareholders"). Unless otherwise indicated, references herein to "$" or "dollars" are to United States dollars.

We currently have sufficient working capital to last one (1) month. We require 71% of the Rights Offering to last twelve (12) months. See "Use of Available Funds".

Glencore AG ("Glencore" or the "Standby Purchaser"), which owns approximately 71% of the outstanding PolyMet Shares, subject to certain terms and conditions and limitations as provided for in the standby purchase agreement dated February 27, 2023 entered into by and between the Company and Glencore (the "Standby Purchase Agreement"), has agreed to exercise its Basic Subscription Privilege (as defined herein) in full and to purchase at the Subscription Price (as defined herein), that number of PolyMet Shares equal to the difference, if any, of (x) the total number of PolyMet Shares offered pursuant to the Rights Offering minus (y) the number of PolyMet Shares subscribed for pursuant to the Basic Subscription Privilege and the Additional Subscription Privilege (as defined herein). Glencore may terminate the Standby Purchase Agreement prior to the Expiry Time (as defined herein) in certain circumstances. See "Standby Commitment".

This Rights Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this Circular in accordance with the disclosure requirements under Canadian securities laws. Prospective investors should be aware that those requirements are different from those of the United States. Financial statements included herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and are subject to Public Company Accounting Oversight Board auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Such Shareholders are encouraged to consult their tax advisors in that regard.

The enforcement by investors of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that the Company is organized under the laws of British Columbia, Canada and that certain of its officers and directors are residents of Canada, or otherwise reside outside the United States, and that a substantial portion of the assets of said persons are located outside the United States.

THE SECURITIES OFFERED UNDER THIS RIGHTS OFFERING HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION ("SEC") OR ANY STATE SECURITIES REGULATOR NOR HAS THE SEC OR ANY STATE SECURITIES REGULATOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

FORWARD-LOOKING STATEMENTS

This Circular contains "forward-looking statements" and "forward-looking information" as defined under applicable Canadian and U.S. securities laws (collectively, "forward-looking statements"). All statements, other than statements of historical fact, that address activities, events or developments that we believe, expect or anticipate will or may occur in the future are forward-looking statements. When used in this Circular, the words "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may", "should", "will", or the negatives of these words or other variations thereof and comparable terminology are intended to identify forward-looking statements. Forward-looking statements in this include, without limitation, statements with respect to: our expectations regarding the estimated costs of the Rights Offering and the net proceeds to be available upon completion; the use of proceeds from the Rights Offering; the Company's expected portion of the costs of the Joint Venture's (as defined herein) initial work program; the availability of funds from sources other than the Rights Offering; the potential shareholdings of the various Shareholders, including the Standby Purchaser; and the future business and activities of the Company (including the continued listing of the PolyMet Shares on the TSX and the NYSE American) set out herein.

Forward-looking statements are subject to a number of risks and uncertainties that may cause PolyMet's actual results to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, PolyMet. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainties relating to the availability and cost of funds, uncertainties relating to closing of the Rights Offering and any commitments, the trading of the Rights, the value of the Rights, our ability to cancel the Rights Offering, delays in obtaining or failure to obtain required approvals to complete the Rights Offering, market risks in the business operated by us and other risks related to our business and the Rights Offering. Many of these factors are beyond the control of the Company.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, PolyMet disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although we believe that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be put on such statements due to their inherent uncertainty.

The Company qualifies all the forward-looking statements contained in this Circular by the foregoing cautionary statements.

SUMMARY OF THE RIGHTS OFFERING

|

Why are you reading this Circular?

|

We are issuing to the Shareholders ("Eligible Holders") of record at the close of business on March 10, 2023 (the "Record Date") and who are resident in any province of Canada and the United States (the "Eligible Jurisdictions"), rights ("Rights") to subscribe for PolyMet Shares on the terms described in this Circular. The purpose of this Circular is to provide you with additional details about the Rights Offering referred to in the Notice, a copy of which has been filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov and on the Company's website at https://polymetmining.com and will be mailed to Shareholders on or about March 14, 2023 along with information about your rights and obligations in respect of this Rights Offering.

|

| |

|

|

What is being offered?

|

Each Eligible Holder will receive one (1) Right for every one (1) PolyMet Share held. Each Right will be exercisable into 0.91068844 PolyMet Shares. No fractional PolyMet Shares will be issued. Where the exercise of Rights would appear to entitle a holder of Rights to receive fractional PolyMet Shares, the holder's entitlement will be reduced to the next lowest whole number of PolyMet Shares. The Company will not be required to and will not issue fractional PolyMet Shares or pay cash in lieu thereof

|

| |

|

|

What does one Right entitle you to receive?

|

An Eligible Holder is entitled to purchase 0.91068844 PolyMet Shares for every Right held at a subscription price (the "Subscription Price") of $2.11 per PolyMet Share (the "Basic Subscription Privilege") until 5:00 p.m. (Toronto time) on April 4, 2023 (the "Expiry Time"). No fractional PolyMet Shares will be issued. Where the exercise of Rights would appear to entitle a holder of Rights to receive fractional PolyMet Shares, the holder's entitlement will be reduced to the next lowest whole number of PolyMet Shares. The Company will not be required to and will not issue fractional PolyMet Shares or pay cash in lieu thereof

If you exercise all of your Rights under the Basic Subscription Privilege, you will also have the additional privilege of subscribing, to the extent available, pro rata, for additional PolyMet Shares (the "Additional PolyMet Shares") at the Subscription Price (the "Additional Subscription Privilege"). The Additional PolyMet Shares available under the Additional Subscription Privilege will be the PolyMet Shares issuable under the Rights Offering that have not been subscribed and paid for under the Basic Subscription Privilege by the Expiry Time.

|

| |

|

|

What is the Subscription Price?

|

$2.11 per PolyMet Share.

|

| |

|

|

When does the Rights Offering expire?

|

5:00 p.m. (Toronto time) on April 4, 2023. Rights not validly exercised and received by Computershare Investor Services Inc. (the "Subscription Agent") before the Expiry Time will be void and have no value and will no longer be exercisable for any PolyMet Shares.

|

| |

|

|

What are the significant attributes of the Rights issued under the Rights Offering and the securities to be issued upon the exercise of the Rights?

|

The Rights permit the holders thereof to subscribe for and purchase from PolyMet an aggregate of 92,606,635 PolyMet Shares. Until 12:00 p.m. (Toronto time) on April 4, 2023 the Rights will trade on the Toronto Stock Exchange ("TSX") and will be suspended on the NYSE American ("NYSE American") prior to the markets opening on April 4, 2023, and holders of Rights may sell their Rights through the facilities of the TSX and NYSE American.

We are authorized to issue an unlimited number of PolyMet Shares. Shareholders are entitled to dividends, if, as and when declared by our directors, to one (1) vote per PolyMet Share at meetings of Shareholders, and, upon liquidation, to receive such assets of the Company as are distributable to the Shareholders.

|

|

What are the minimum and maximum number or amount of PolyMet Shares that may be issued under the Rights Offering?

|

There is no minimum offering.

Up to a maximum of 92,606,635 PolyMet Shares are issuable upon the exercise of Rights for gross proceeds of up to $195,400,000.

See also "Standby Commitment" for a description of certain limits and conditions in respect of Glencore.

|

| |

|

|

Where will the Rights and the securities issuable upon the exercise of the Rights be listed for trading?

|

The PolyMet Shares are listed on the TSX under the symbol “POM” and the NYSE American under the symbol “PLM”. The TSX and NYSE American have conditionally approved the listing of the Rights and the PolyMet Shares issuable upon the exercise of the Rights. Such listings will be subject to the Company fulfilling all of the listing requirements of the TSX and NYSE American, respectively. The Rights will be listed on the TSX under the symbol “POM:RT” and on the NYSE American under the symbol “PLM:RT” and holders of Rights may sell their Rights through facilities of the TSX and NYSE American. The approval of the listing of the Rights on the NYSE American is subject to the Company fulfilling all of the listing requirements of the NYSE American. See “How to exercise the Rights – Are there restrictions on the resale of securities?” below. Trading in the Rights on the TSX will cease at 12:00 p.m. (Toronto time) April 4, 2023 and will be suspended on the NYSE American prior to the markets opening on April 4, 2023.

|

| |

|

|

Who is the Standby Purchaser and what is the Standby Commitment?

|

Under the Standby Purchase Agreement, the Standby Purchaser, the Company's largest Shareholder, which owns approximately 71% of the outstanding PolyMet Shares, subject to certain terms and conditions and limitations, has agreed to exercise its Basic Subscription Privilege in full and to purchase at the Subscription Price, that number of PolyMet Shares equal to the difference, if any, of (x) the total number of PolyMet Shares offered pursuant to the Rights Offering minus (y) the number of PolyMet Shares subscribed for pursuant to the Basic Subscription Privilege and the Additional Subscription Privilege. In consideration of the agreement of the Standby Purchaser to purchase the PolyMet Shares as provided in the Standby Purchase Agreement (the "Standby Shares"), the Standby Purchaser will be entitled to a fee equal to 3.00% of the total funds committed by Glencore pursuant to the Standby Commitment (the "Standby Fee"). The Standby Fee will be payable, regardless of how many Standby Shares Glencore purchases, in cash in immediately available funds by wire transfer to the account designated by the Standby Purchaser or by set-off (at the option of Glencore).

The Standby Purchaser may terminate the Standby Purchase Agreement under certain circumstances. If the Standby Purchase Agreement is terminated, the Standby Purchaser would no longer be obligated to provide the Standby Commitment or exercise its Basic Subscription Privilege in full. See "Standby Commitment".

|

| |

|

|

Use of Proceeds

|

Upon closing of the Rights Offering and following payment of costs related to the Rights Offering and repayment of all of its unsecured and secured and convertible debt owed to Glencore (the "Glencore Debt"), the Company intends to use its available funds (the "Available Funds") for: (a) funding of the Company's portion of the costs of the 50:50 joint venture (the "Joint Venture") with Teck Resources Limited ("Teck") that will place the Company's NorthMet resource (the "NorthMet Project") and Teck's Mesaba resource (the "Mesaba Project") under single management; and (b) general corporate purposes.

|

USE OF AVAILABLE FUNDS

What will our Available Funds be upon the closing of the Rights Offering?

The Company estimates that upon closing of the Rights Offering, it will have the following Available Funds (the "Available Funds Table"):

|

|

|

Assuming 100% of Rights Offering

(through the exercise of Rights and/or the

Standby Purchase Agreement)

|

|

A

|

Amount to be raised by this Rights Offering

|

$195,400,000

|

|

B

|

Selling commissions and fees

|

Nil

|

|

C

|

Estimated Rights Offering costs (e.g., Standby Fee, legal, accounting, audit)

|

$7,700,000

|

|

D

|

Available Funds: D = A - (B+C)

|

$187,700,000

|

|

E

|

Additional sources of funding

|

Nil

|

|

F

|

Working capital deficiency(1)(2)

|

$88,000,000

|

|

G

|

Total G = (D+E) - F

|

$99,700,000

|

Notes:

(1) As at January 31, 2023, the most recent month end, the Company had a working capital deficiency of $90 million, inclusive of the Glencore Debt in the amount of approximately $97 million, which is a current liability due on March 31, 2023.

(2) As of the date hereof, the Company estimates it has a working capital deficiency of $88 million, inclusive of the Glencore Debt in the amount of approximately $98 million, which is a current liability due on March 31, 2023. The Company intends to use approximately $98 million of the amount raised under the Rights Offering to repay the Glencore Debt in full.

How will we use the Available Funds?

The following table provides a breakdown of how the Company will use the Available Funds after repayment of the Glencore Debt:

|

Description of intended use of Available Funds listed in

order of priority

|

Assuming 100% of Rights Offering

(through the exercise of Rights and/or the

Standby Purchase Agreement)

|

|

Funding of Company's portion of the costs of the Joint Venture(1)

|

$85,000,000

|

|

General corporate purposes following repayment of the Glencore Debt(2)

|

$14,700,000

|

|

Total (Equal to G in Available Funds Table above)

|

$99,700,000

|

Notes:

(1) The Company is responsible for funding its portion of the Joint Venture's initial work program costs. These costs are expected to be incurred during the next 24 months and support the business objectives of the Joint Venture in: (a) maintaining social and regulatory support for the NorthMet Project and the Mesaba Project; (b) finalizing the NorthMet Project development plan and implementation plan; and (c) advancing the Mesaba Project baseline environmental studies, resource definition studies and mineral processing studies.

(2) The Company intends to use approximately $98 million of the amount raised under the Rights Offering to repay the Glencore Debt in full. The Glencore Debt is a current liability and is due on March 31, 2023. After repaying the Glencore Debt and funding the Company's portion of the Joint Venture costs (see Note 1 above), the Company expects to have approximately $14.7 million remaining which will be used for general corporate purposes.

Glencore Debt

Since October 31, 2008, the Company and the Standby Purchaser have entered into a series of financing agreements (the “Financing Agreements”). Other than the Glencore Debt and the Warrant, details of which are set out below, all previous Financing Agreements have been of, or converted into, PolyMet Shares.

As at January 31, 2023, the Glencore Debt was approximately $97 million, with additional interest accruing of approximately $800,000, for total Glencore Debt payable at March 31, 2023 of $98,000,000. Although certain of the Glencore Debt is due on March 31, 2023, Glencore has confirmed it will: (a) not convert any convertible debt; and (b) extend the maturity date of the Glencore Debt, in each case until the date that is two business days after the expiry date of the Rights Offering at which time PolyMet will repay the Glencore Debt.

Upon closing of the Rights Offering, the Company intends to use part of the proceeds raised to repay the Glencore Debt. Glencore is an insider of the Company by nature of Glencore holding approximately 71% of the issued and outstanding PolyMet Shares.

On March 17, 2020, the Company agreed to issue unsecured convertible debentures to Glencore in four tranches with a total minimum principal amount of $20.0 million and total maximum principal amount of $30.0 million, the amount of each tranche to be determined jointly by the Company and Glencore. The debentures are due on the earlier of March 31, 2023 or upon $100 million of NorthMet Project financing. Interest accrues at 4% per annum on the balance drawn and the principal amount of the debentures is convertible into PolyMet Shares at a conversion price equal to $2.223 per PolyMet Share. The first tranche in the amount of $7.0 million was issued on March 17, 2020, the second tranche in the amount of $7.0 million was issued on June 23, 2020, the third tranche in the amount of $9.0 million was issued on September 30, 2020 and the final tranche of $7.0 million was issued on January 28, 2021.

On July 15, 2021, the Company issued to Glencore an unsecured convertible debenture in the amount of $10.0 million. The debenture is due on the earlier of March 31, 2023 or upon $100 million of NorthMet Project financing. Interest accrues at 4% per annum on the balance drawn and the principal amount of the debenture is convertible into PolyMet Shares at a conversion price equal to $3.4550 per PolyMet Share.

On February 14, 2022, the Company agreed to issue unsecured convertible debentures to Glencore in four tranches during 2022 with a total principal amount of up to $40.0 million, the amount of each tranche to be determined jointly by the Company and Glencore. The debentures are due on the earlier of March 31, 2023 or upon $100 million of NorthMet Project financing. Interest accrues at 4% per annum on the balance drawn and the principal amount of the debentures is convertible into PolyMet Shares at a conversion price equal to $2.57 per PolyMet Share. The Company also agreed to pay a facilitation fee of 5% for each convertible debenture. The first tranche in the amount of $26.0 million was issued on February 14, 2022 with $17.8 million used to repay the promissory note and related accrued interest due February 28, 2022. The second tranche in the amount of $7.0 million was issued on May 13, 2022. The third and fourth tranches were combined in the total amount of $7.0 million and issued on September 15, 2022.

On December 15, 2022 the Company agreed to borrow $10 million from the Standby Purchaser on terms set out in a promissory note dated the same date to provide working capital to last the Company through closing of the Rights Offering. The funds evidenced by the promissory note are due on the release date of the proceeds raised under the Rights Offering. Interest accrues at a rate equal to the secured overnight financing rate as administered by the Federal Reserve Bank of New York plus 6% per annum.

The principal purpose for which the proceeds of the Glencore Debt has been used in the last three (3) years were related primarily to the permitting of the NorthMet Project. Other spending related to engineering and studies, early works to prepare the site for construction, maintaining existing infrastructure, financing and general corporate purposes.

Glencore also holds a warrant issued in 2019 under which it is entitled to purchase 745,306 PolyMet Shares with an exercise price of $6.3840 per PolyMet Share (the “Warrant”).

Use of Available Funds

As at January 31, 2023, the most recent month end, the Company had a working capital deficiency of $90 million, inclusive of the Glencore Debt in the amount of approximately $97 million, with additional interest accruing of approximately $800,000, for total Glencore Debt payable at March 31, 2023 of $98,000,000, which is a current liability. As of the date hereof, the Company estimates it has a working capital deficiency of $88 million, inclusive of the Glencore Debt. There are no other existing, non-contingent financial resources of the Company.

Upon closing of the Rights Offering, the Company will continue operating using its currently available resources and the remaining proceeds of the Rights Offering and will have available funding for the next 24 months following the closing of the Rights Offering. Management believes, based upon the underlying value of the NorthMet Project, the advanced status of permits necessary to construct and operate the NorthMet Project, the history of support from Shareholders (including Glencore), the Joint Venture, the Rights Offering and ongoing discussions with potential financiers, that financing will continue to be available to allow the Company to fund the Company's portion of the Joint Venture and generate future profitable operations. Glencore has committed to provide financial support to enable the Company to continue its business operations through at least March 31, 2024.

To the extent that the Company continues to have negative cash flow from operating activities in future periods, the Company will be required to raise additional funds through the issuance of equity securities or through loan financing. Factors that could affect the availability of financing include the state of international debt and equity markets, investor perceptions and expectations and the global metals markets. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to the Company as those previously obtained pursuant to the Glencore Debt, or at all. If the Company does not begin to generate revenues, the Company may either have to suspend or cease operations. The Company will need to raise sufficient funds for ongoing development, capital expenditures and administration expenses.

Upon closing of the Rights Offering and following payment of costs related to the Rights Offering and repayment of the Glencore Debt, the Company intends to use the Available Funds for funding of the Company's portion of the costs of the Joint Venture and general corporate purposes.

How long will the Available Funds last?

Assuming the full exercise of the Rights, the Company expects the Available Funds will be sufficient to cover expected expenditures over the next 24 months.

As at January 31, 2023, the Company had negative cash flow from operating activities. The Company has historically been reliant on Glencore to providing financing for its activities, but there is no certainty it will be able to obtain financing from Glencore or any other person in the future. As a development stage company with no holdings in any producing mines, PolyMet continues to incur losses and expects to incur losses in the immediate future. The Company currently has negative cash flow from operating activities. The Company cannot predict if or when it will generate positive cash flows. While in the past the Company has been successful in closing financing agreements with the Standby Purchaser and other parties and the Company expects the Rights Offering to be completed, there can be no assurance the Rights Offering will be completed and if the Rights Offering does not close, Glencore will be in a position to demand repayment of the Glencore Debt and exercise its rights and remedies pursuant to the Financing Agreements. There are no assurances that the Company will be able to secure financing again in the future. Factors that could affect the availability of financing include the state of international debt and equity markets, investor perceptions and expectations and the global metals markets.

INSIDER PARTICIPATION

Will Insiders be participating?

Certain insiders (as defined in applicable Canadian securities laws), including Glencore, have indicated their intention to participate in the Rights Offering. However, such insiders may alter their intentions before the Expiry Time.

Glencore and its associates, directly or indirectly, own or control, 71% of the PolyMet Shares. Glencore intends to exercise its Basic Subscription Privilege in full and may also, in its sole discretion, exercise its Additional Subscription Privilege. See "Standby Commitment".

Who are the holders of 10% or more of the PolyMet Shares before and after the Rights Offering?

To our knowledge, no person or company beneficially owns or exercises control or direction, directly or indirectly, or will own or exercise control or direction, directly or indirectly, after the Rights Offering, 10% or more of the PolyMet Shares other than the following set out below:

|

Name

|

Holdings before the Rights

Offering

|

Holdings after the Rights

Offering

|

|

|

Number of

PolyMet Shares

|

%

|

Number of

PolyMet Shares

|

%

|

|

Glencore AG

|

72,008,404

|

71.0%

|

164,615,039 (1)

|

84.7%

|

(1) Assuming no Shareholders other than Glencore subscribe for PolyMet Shares under their Basic Subscription Privilege or Additional Subscription Privilege.

See "Standby Commitment" for additional details on the Standby Purchaser and its holdings.

DILUTION

If you do not exercise my Rights, by how much will your security holdings be diluted?

If you do not exercise all of your Rights pursuant to the Basic Subscription Privilege, your equity ownership in the Company will be diluted by the issuance of PolyMet Shares upon the exercise of Rights by other Shareholders and, if applicable, the Standby Purchaser, and your shareholdings will be diluted by approximately 47.7%. In the event that none of the holders of Rights other than the Standby Purchaser exercises their Rights and all of the PolyMet Shares issuable upon the exercise of Rights held by such holders are purchased by the Standby Purchaser pursuant to the Standby Purchase Agreement, the Standby Purchaser will acquire 92,606,635 PolyMet Shares under the Rights Offering and, following the closing of the Rights Offering, will beneficially own 164,615,039 PolyMet Shares representing approximately 84.7% of the then outstanding PolyMet Shares.

SOLICITING DEALER

Who is the managing dealer / soliciting dealer and what are its fees?

We have not retained a managing dealer or a soliciting dealer for the Rights Offering.

STANDBY COMMITMENT

Who is the Standby Purchaser and what are the fees?

Under the Standby Purchase Agreement, the Standby Purchaser, subject to certain terms and conditions and limitations, has agreed to exercise its Basic Subscription Privilege in full and to purchase at the Subscription Price, that number of PolyMet Shares equal to the difference, if any, of (x) the total number of PolyMet Shares offered pursuant to the Rights Offering minus (y) the number of PolyMet Shares subscribed for pursuant to the Basic Subscription Privilege and the Additional Subscription Privilege (the "Standby Commitment").

The Standby Purchaser will exercise its Basic Subscription Privilege in full and may also, in its sole discretion, exercise its Additional Subscription Privilege.

In consideration for the Standby Commitment, the Standby Purchaser will be entitled to the Standby Fee upon the successful completion of the Rights Offering in the amount equal to 3.00% of the total funds committed by the Standby Purchaser pursuant to the Standby Commitment. The Standby Fee will be payable, regardless of how many Standby Shares the Standby Purchaser purchases, in cash in immediately available funds by wire transfer to the account designated by the Standby Purchaser or by set-off (at the option of Glencore).

The Standby Purchaser is an "insider" and a "related party" of the Company (as such term is defined under applicable Canadian securities laws) by virtue of it having beneficial ownership of, or control or direction over, directly or indirectly, securities of the Company carrying more than 10% of the voting rights attached to all of the Company's outstanding voting securities.

What rights does the Standby Purchaser have?

The obligation of the Standby Purchaser to complete the subscription under the Rights Offering is subject to the following conditions, among others, being satisfied in full: (i) the Company and the Standby Purchaser having entered into a registration rights agreement; (ii) the Standby Purchase Agreement having not been terminated; (iii) the closing of the Rights Offering having occurred by April 28, 2023; and (iv) certain other customary closing conditions.

The Company has provided certain representations, warranties and covenants under the Standby Purchase Agreement including representations and warranties with respect to corporate authority of the Company, PolyMet U.S., Inc. and NewRange Copper Nickel LLC, governmental approvals, authorized capitalization, no undisclosed material changes, tax and tax filings, use and title to owned and leased real property, proper permits, pension plans, environmental and mineral rights, intellectual property, financial reporting, securities law matters, anti-corruption, anti-money laundering and trade sanction matters, amongst others.

The Standby Purchaser has provided certain representations, warranties and covenants under the Standby Purchase Agreement including representations and warranties with respect to corporate authority and governmental approvals amongst others.

The obligations of the Standby Purchaser under the Standby Purchase Agreement may be terminated at the discretion of the Standby Purchaser in certain circumstances, including, without limitation:

(a) by giving written notice to the Company at any time prior to, but not after, the date on which this Circular or the Registration Statement (as defined herein) is mailed to the holders in the Eligible Jurisdictions if:

(i) the Company has committed a breach of the Standby Purchase Agreement (which shall include, for the avoidance of doubt, any breach of any representations or warranties set out in the Standby Purchase Agreement) and, if capable of cure, has not cured it within a reasonable time; or

(ii) the Company or one of its Affiliates (as defined in the Standby Purchase Agreement) has committed a breach of any other material agreement between the Company and/or its Affiliates (as defined in the Standby Purchase Agreement) on the one hand and the Standby Purchaser and/or its Affiliates (as defined in the Standby Purchase Agreement) on the other hand and if capable of cure, has not been cured in the time permitted under the applicable agreement;

(b) the Company fails to:

(i) obtain final listing approval from the TSX and the NYSE American for the Rights at least two (2) days prior to the Record Date;

(ii) obtain conditional listing approval from the TSX and NYSE American in respect of the PolyMet Shares issuable upon exercise of the Rights and the Standby Shares, prior to or on the completion of the Rights Offering, subject to receipt of customary final documentation; and

(iii) satisfy any of the applicable conditions set out in the Standby Purchase Agreement on or before the completion of the Rights Offering, including that the Rights Offering closing occurs on or before April 28, 2023;

(c) the PolyMet Shares are de-listed or suspended or halted for trading for a period greater than one (1) business day for any reason by the TSX or NYSE American at any time; or

(d) the Rights Offering is otherwise terminated or cancelled.

If the Standby Purchase Agreement is terminated, then:

(a) the parties' obligations under the Standby Purchase Agreement will cease immediately, except certain customary sections of the Standby Purchase Agreement including the definitions, the confidentiality provisions, indemnification provisions and general provisions;

(b) neither the Company nor the Standby Purchaser will have any claim against each other, provided however, that this limitation will not apply in respect of: (x) any fraud; or (y) a breach of the Standby Purchase Agreement which occurred on or prior to the termination of the Standby Purchase Agreement (which fraud or breach and liability therefore are not affected by the termination of the Standby Purchase Agreement); and

(c) the applications for the listing of the Rights shall be withdrawn and the Company shall procure that the listing will not become effective (except to the extent such listing has already become effective).

Once the Rights have commenced trading on the TSX and have been admitted for trading on the NYSE American, the Company will be required to proceed with the Rights Offering, subject to limited exceptions, even if the Standby Purchaser does not purchase the Standby Shares. Under TSX and NYSE American rules, once the Rights have commenced trading, the essential terms of the Rights Offering, including the Subscription Price and Expiry Time, cannot be modified absent extremely exceptional circumstances.

The Company has agreed to indemnify the Standby Purchaser for certain matters including any and all, direct or indirect losses, claims, damages, demands, costs, and expenses and other liabilities of any kind caused or incurred by reason of any misrepresentations or alleged misrepresentations in this Circular or the Registration Statement (as defined herein), any order made or any inquiry, investigation or proceeding instituted, threatened or announced based upon a misrepresentation in this Circular or the Registration Statement (as defined herein), noncompliance or alleged non-compliance with securities laws by the Company and any breach or default of the Company under the Standby Purchase Agreement.

If the Standby Commitment is terminated, the Standby Purchaser may take all steps it deems advisable, including, without limitation, demanding payment of the Glencore Debt and therefore enforcing any and all remedies available. The failure to complete the Rights Offering and to receive the anticipated $195,400,000 in gross proceeds (assuming full exercise of the Rights) will have a material adverse effect on the Company as it does not currently have sufficient cash or alternate sources of financing available to otherwise repay the Glencore Debt.

Have we confirmed that the Standby Purchaser has the financial ability to carry out the Standby Commitment?

Yes. The Standby Purchaser has confirmed to the Company that it has the financial ability to carry out the Standby Commitment.

What are the security holdings of the Standby Purchaser before and after the Rights Offering?

If none of the holders of Rights (other than Glencore) exercise their Rights and all of the PolyMet Shares issuable upon the exercise of Rights held by such holders are purchased by Glencore as Standby Shares pursuant to the Standby Commitment, Glencore will acquire 92,606,635 PolyMet Shares under the Rights Offering and, following the closing of the Rights Offering, will beneficially own 164,615,039 PolyMet Shares representing approximately 84.7% of the then outstanding PolyMet Shares.

See "Insider Participation" for more information on the security holdings of the Standby Purchaser before and after the Rights Offering.

Glencore will have significant influence over the Company

The Standby Purchaser, or affiliates thereof, have and are expected to continue to have significant influence with respect to actions to be taken or approved by our directors, including with respect to certain mergers or business combinations, and with respect to matters to be sent to the Shareholders for approval, including without limitation the election and removal of directors, amendments to the Company's constating documents and the approval of certain business combinations, and in considering such matters its interests may not always align with the interests of the other Shareholders, including without limitation with respect to matters such as the efficacy of the Company continuing to have the PolyMet Shares listed for trading on the TSX and the NYSE American. Shareholders other than the Standby Purchaser will continue to have a limited role in the Company's affairs. This concentration of holdings may cause the market price of the PolyMet Shares to decline, delay or prevent any acquisition or delay or discourage take-over attempts that Shareholders may consider to be favorable, or make it more difficult or impossible for a third-party to acquire control of the Company or effect a change in the board of directors and management.

Any delay or prevention of a change of control transaction could deter potential acquirors or prevent the completion of a transaction in which the Shareholders could receive a substantial premium over the then current market price for their PolyMet Shares. Subject to certain limits, the Standby Purchaser is not prohibited from selling a significant interest in us to a third party and may do so without your approval and, subject to applicable laws, without providing for a purchase of your PolyMet Shares.

As part of the entering into of the Joint Venture, the Standby Purchaser and PolyMet have entered into an investor rights agreement dated February 14, 2023 (the "IRGA"). Pursuant to the IRGA, the Standby Purchaser is provided with, among other things, certain informational and consultation rights with respect to future material ventures and the right to maintain their pro-rata ownership of PolyMet Shares in connection with future financing transactions.

The Standby Purchaser is not engaged as an underwriter in connection with the Rights Offering and has not been involved in the preparation of, or performed any review of, this Circular in the capacity of an underwriter. No underwriter has been involved in the preparation of this Circular or performed any review of the contents of this Circular.

HOW TO EXERCISE THE RIGHTS

Subscriptions for PolyMet Shares made in connection with this Rights Offering will be irrevocable.

How does a security holder that is a registered holder of PolyMet Shares participate in the Rights Offering?

If you are a registered holder of PolyMet Shares, you will receive a rights subscription form enclosed with a DRS Advice representing the total number of Rights to which you are entitled as at the Record Date. To exercise the Rights represented by the DRS Advice, you must complete and deliver the rights subscription form in accordance with the instructions set out below. Rights not exercised at or prior to the Expiry Time will be void and of no value. The method of delivery is at the discretion and risk of the holder of the Rights and delivery to the Subscription Agent will only be effective when documents are actually received by the Subscription Agent at its subscription office. Subscription forms and payments received after the Expiry Time will not be accepted. See "Appointment of Subscription Agent - Who is the Subscription Agent?"

In order to exercise your Rights you must:

1. Complete and sign Box 1 on the Subscription Form. The maximum number of Rights that you may exercise under the Basic Subscription Privilege is equal to the number of Rights referenced on the DRS Advice. If you complete Box 1 so as to exercise some but not all of the Rights evidenced by the DRS Advice, you will be deemed to have waived the unexercised balance of such Rights. The rights subscription form will be enclosed with such advice.

2. Additional Subscription Privilege. Complete and sign Box 2 on the rights subscription form only if you also wish to participate in the Additional Subscription Privilege and you have already exercised all of your Rights under the Basic Subscription Privilege. See "How to exercise the Rights - What is the Additional Subscription Privilege and how can you exercise this privilege?" below.

3. Enclose payment in United States funds by certified cheque, bank draft or money order payable to the order of Computershare Investor Services Inc. To exercise the Rights you must pay $2.11 per PolyMet Share. In addition to the amount payable for any PolyMet Shares you wish to purchase under the Basic Subscription Privilege, you must also pay the amount required for any PolyMet Shares subscribed for under the Additional Subscription Privilege.

4. Delivery. Deliver or mail the completed DRS Advice and rights subscription form and payment in the enclosed return envelope addressed to the Subscription Agent so that it is received by the office of the Subscription Agent set forth below before the Expiry Time. If you are mailing your documents, registered mail is recommended. Please allow sufficient time to avoid late delivery.

The signature of the Rights holder must correspond in every particular way with the name that appears on the face of the DRS Advice.

Signatures by a trustee, executor, administrator, guardian, attorney, officer of a company or any person acting in a fiduciary or representative capacity should be accompanied by evidence of authority satisfactory to the Subscription Agent. We will determine all questions as to the validity, form, eligibility (including time of receipt) and acceptance of any subscription in our sole discretion. Subscriptions are irrevocable. We reserve the right to reject any subscription if it is not in proper form or if the acceptance thereof or the issuance of PolyMet Shares pursuant thereto could be unlawful. We also reserve the right to waive any defect in respect of any particular subscription. Neither we nor the Subscription Agent is under any duty to give any notice of any defect or irregularity in any subscription, nor will we be liable for the failure to give any such notice.

How does a security holder that is not a registered holder of PolyMet Shares participate in the Rights Offering?

Only registered Eligible Holders will be provided with a DRS Advice. For Eligible Holders whose PolyMet Shares are held through a securities broker or dealer, bank or trust company or other participant (each, a "Participant") in the book based system administered by CDS Clearing and Depositary Services Inc. ("CDS") or Depository Trust Company ("DTC") (such Shareholders being referred to as "Beneficial Eligible Holders"), Rights will be issued in registered form to CDS or DTC, as the case may be, and will be deposited with CDS or DTC, as the case may be. The Company expects that each Beneficial Eligible Holder will receive a confirmation of the number of Rights issued to it from its Participant in accordance with the practices and procedures of that Participant. CDS and DTC will be responsible for establishing and maintaining book-entry accounts for Participants holding Rights. A Beneficial Eligible Holder holding PolyMet Shares through a Participant may subscribe for PolyMet Shares by instructing the Participant holding its Rights to exercise all or a specified number of such Rights and forwarding the aggregate Subscription Price for each PolyMet Share subscribed for in accordance with the terms of the Rights Offering to the Participant which holds the Beneficial Eligible Holder's Rights. Participants may have an earlier deadline for receipt of instructions and payment than the Expiry Time. Beneficial Eligible Holders should contact their particular Participant for complete details on how to exercise their Basic Subscription Privilege and Additional Subscription Privilege.

The aggregate Subscription Price is payable by direct debit from the Beneficial Eligible Holder's brokerage account or by electronic funds transfer or other payment mechanism satisfactory to the Participant. The entire Subscription Price for PolyMet Shares subscribed for must be paid at the time of subscription and must be received by the Subscription Agent prior to the Expiry Time. Accordingly, if a Beneficial Eligible Holder is subscribing through a Participant, such Beneficial Eligible Holder must deliver payment (by method described above) and instructions to the Participant sufficiently in advance of the Expiry Time to allow the Participant to properly exercise the Rights on such Beneficial Eligible Holder's behalf.

Participants that hold Rights for more than one Beneficial Eligible Holder may, upon providing evidence satisfactory to the Company and the Subscription Agent, exercise Rights on behalf of their accounts on the same basis as if the Beneficial Eligible Holders were registered holders of PolyMet Shares.

The Company and the Subscription Agent shall have no liability for: (a) the records maintained by CDS or DTC, as the case may be, or Participants relating to the Rights or the book-entry accounts maintained by CDS or DTC, as the case may be; (b) maintaining, supervising or reviewing any records relating to such Rights; (c) any advice or representation made or given by CDS, DTC or Participants with respect to the rules and regulations of CDS or DTC, as the case may be; (d) any action to be taken by CDS, DTC or Participants; or (e) any failure by Participants to take any action or any matter relating to the Rights or the exercise thereof.

The ability of a person having an interest in Rights held through a Participant to pledge such interest or otherwise take action with respect to such interest (other than through a Participant) may be limited due to the lack of a DRS Advice.

Beneficial Eligible Holders whose PolyMet Shares are held through a Participant must arrange purchases or transfers of Rights and the exercise of Rights to purchase PolyMet Shares through their Participant. The Company anticipates that each such purchaser of a Right or PolyMet Shares will receive a customer confirmation of purchase from the Participant from whom such Right or PolyMet Shares is purchased in accordance with the practices and procedures of such Participant.

If mail is used for delivery of subscription funds to a CDS Participant, for the protection of the Beneficial Eligible Holder, registered mail return receipt requested should be used and sufficient time should be allowed to avoid the risk of late delivery. Any subscription for PolyMet Shares made in connection with this Rights Offering either directly or through a Participant will be irrevocable once submitted and subscribers will be unable to withdraw their subscriptions for PolyMet Shares once submitted.

Who is eligible to receive the Rights?

No offering outside of Eligible Jurisdictions. The Rights are being offered to Shareholders who are resident in a province of Canada or the United States. Shareholders will be presumed to be resident in the place of their registered address, unless the contrary is shown to the satisfaction of the Company. This Circular is not to be construed as an offering of the Rights, nor are the PolyMet Shares issuable upon exercise of the Rights offered for sale, in any jurisdiction outside the Eligible Jurisdictions or to Shareholders who are residents of any jurisdiction other than the Eligible Jurisdictions (the "Ineligible Holders").

Ineligible Holders may not acquire Rights or the PolyMet Shares issuable upon exercise of the Rights unless approved by the Company. We will not issue or forward DRS Advices to an Ineligible Holder unless we have determined that a Rights Offering to and a subscription under the Basic Subscription Privilege or under the Additional Subscription Privilege by such Ineligible Holder (an "Approved Ineligible Holder") is lawful and in compliance with all securities and other laws applicable in the jurisdiction where such Ineligible Holder is resident.

Ineligible Holders will be sent the Notice, for information purposes only, together with a letter advising them that their Rights will be held by the Subscription Agent (except in the case of an Approved Ineligible Holder as set out below) and that the Rights will be issued to and held on their behalf by the Subscription Agent. An Approved Ineligible Holder may have its DRS Advice representing Rights issued and forwarded by the Subscription Agent upon direction from the Company. Ineligible Holders must satisfy the Company as to their eligibility to participate in the Rights Offering on or before 5:00 p.m. (Toronto time) on or before March 27, 2023, or such other date as determined by the Company, to claim the Rights. The Rights, and any PolyMet Shares that may be issued upon the exercise of the Rights, may be endorsed with restrictive legends according to applicable securities laws.

Holders of Rights who are not resident in a province of Canada should be aware that the purchase and sale of Rights or PolyMet Shares may have tax consequences in the jurisdiction where they reside, which are not described herein. Accordingly, such holders should consult their own tax advisors about the specific tax consequences in the jurisdiction where they reside on acquiring, holding, and disposing of Rights or PolyMet Shares.

What is the Additional Subscription Privilege and how can you exercise this privilege?

Registered holders of Rights

If you exercise all of your Rights under the Basic Subscription Privilege, you may subscribe for additional PolyMet Shares that have not been subscribed and paid for pursuant to the Basic Subscription Privilege pursuant to the Additional Subscription Privilege.

If you wish to exercise the Additional Subscription Privilege, you must first exercise your Basic Subscription Privilege in full by completing Box 1 on the rights subscription form for the maximum number of PolyMet Shares that you may subscribe for and also complete Box 2 on the rights subscription form, specifying the number of Additional PolyMet Shares desired. You must then send the subscription funds for the Additional PolyMet Shares under the Additional Subscription Privilege with your DRS Advice and rights subscription form to the Subscription Agent. The purchase price is payable in United States funds by certified cheque, bank draft or money order payable to the order of Computershare Investor Services Inc. These funds will be placed in a segregated account pending allocation of the Additional PolyMet Shares, with any excess funds being returned by mail without interest or deduction.

If the aggregate number of Additional PolyMet Shares subscribed for by those who exercise their Additional Subscription Privilege is less than the number of available Additional PolyMet Shares, each such holder of Rights will be allotted the number of Additional PolyMet Shares subscribed for under the Additional Subscription Privilege.

If the aggregate number of Additional PolyMet Shares subscribed for by those who exercise their Additional Subscription Privilege exceeds the number of available Additional PolyMet Shares, each such holder of Rights will be entitled to receive the number of Additional PolyMet Shares equal to the lesser of:

1. the number of Additional PolyMet Shares subscribed for by the holder under the Additional Subscription Privilege; and

2. the product (disregarding fractions) obtained by multiplying the aggregate number of Additional PolyMet Shares available through unexercised Rights by a fraction, the numerator of which is the number of Rights previously exercised by the holder and the denominator of which is the aggregate number of Rights previously exercised by all holders of Rights who have subscribed for Additional PolyMet Shares under the Additional Subscription Privilege.

The effect of this allocation process is that the allocation of the Additional PolyMet Shares available through unexercised Rights will be allocated based on the relative amount of oversubscription, and not based on the number of PolyMet Shares held by the parties that elect to utilize the Additional Subscription Privilege.

As soon as practicable after the Expiry Time, the Subscription Agent will mail to each holder of Rights who completed a Box 2 on the rights subscription form a DRS Advice for the Additional PolyMet Shares which that holder has purchased and shall return to the holder any excess funds paid for the subscription of Additional PolyMet Shares by such holder under the Additional Subscription Privilege, without interest or deduction.

Beneficial holders of Rights

If you are a Beneficial Eligible Holder and you wish to exercise your Additional Subscription Privilege, you must deliver your payment and instructions to the Participant sufficiently in advance of the Expiry Time to allow the Participant to properly exercise the Additional Subscription Privilege on your behalf. Please contact your Participant for further details and instructions.

How does a Rights holder sell or transfer the Rights?

The Rights will trade on the TSX until 12:00 p.m. (Toronto time) on April 4, 2023 and will be suspended on the NYSE American prior to the markets opening on April 4, 2023.

DRS Advices are in registered form. A holder of Rights may, rather than exercising such holder's Rights to subscribe for PolyMet Shares, sell or transfer such Rights into and within Canada and the United States to others (except Ineligible Holders) personally or through the usual investment channels (such as stock brokers or investment dealers qualified to do business in the holder's jurisdiction) by completing and executing a valid form of stock power of attorney and delivering such form so completed and exercised to the Subscription Agent. The transferee may exercise all of the Rights of the transferring holder, without obtaining a new DRS Advice, by completing Box 1 on the rights subscription form and delivering it, in addition to their subscription funds, to the Subscription Agent. Rights will not be registered in the name of an Ineligible Holder. Payment of any service charge, commission or other fee payable in connection with the trading of Rights will be the responsibility of the holders of the Rights.

A holder of Rights who wishes to transfer such rights must obtain and duly complete a stock power of attorney form (the "Transfer Form") from the Subscription Agent, have their signature guaranteed by an "eligible institution" to the satisfaction of the Subscription Agent, and must deliver the DRS Advice, a duly completed rights subscription form and Transfer Form to the transferee. An "Eligible Institution" means a major Canadian Schedule I chartered bank, a member of the Securities Transfer Agents Medallion Program (STAMP), a member of the Stock Exchanges Medallion Program (SEMP) or a member of the New York Stock Exchange, Inc. Medallion Signature Program (MSP). Members of these programs are usually members of recognized stock exchanges in Canada and members of the Investment Dealers Association of Canada. The signature of the transferee on any one or more of the forms on the rights subscription form must correspond exactly with the name of the transferee shown on the Transfer Form. If the Transfer Form is properly completed, the Company and the Subscription Agent will treat the transferee (or the bearer if no transferee is specified) as the absolute owner of the Rights for all purposes and will not be affected by notice to the contrary. A Transfer Form and rights subscription form so completed, together with the DRS Advice, should be delivered to the appropriate person in ample time for the transferee to use it before the expiration of the Rights.

If you are a beneficial holder, you must arrange for the transfer of Rights through CDS, DTC or otherwise.

If the Rights Offering does not proceed for any reason, although any payments made in connection with the exercise of Rights would be returned promptly to subscribers by the Subscription Agent without interest or deduction, all outstanding Rights would cease to be exercisable for PolyMet Shares and would lose all of their value. In such circumstances, any person who had purchased Rights in the market would lose the entire purchase price paid to acquire such Rights.

When can you trade securities issuable upon the exercise of the Rights?

The PolyMet Shares are listed on the TSX under the symbol “POM” and the NYSE American under the symbol “PLM”. The TSX and NYSE American have conditionally approved the listing of the PolyMet Shares issuable upon the exercise of the Rights. Such listings will be subject to the Company fulfilling all of the listing requirements of the TSX and NYSE American. The PolyMet Shares issuable upon the exercise of the Rights will also be listed on TSX and NYSE American. The PolyMet Shares issuable upon the exercise of the Rights will be available for trading as soon as practicable after April 5, 2023.

Are there restrictions on the resale of securities?

The Rights being issued hereunder and the PolyMet Shares issuable upon exercise of the Rights are being distributed by the Company pursuant to exemptions from the registration and prospectus requirements under Canadian securities laws.

Rights and the PolyMet Shares issuable upon exercise of such Rights distributed to Shareholders in the Eligible Jurisdictions may be resold without hold period restrictions under the applicable securities laws of the Eligible Jurisdictions provided that: (i) the sale is not by a "control person" of PolyMet; (ii) no unusual effort is made to prepare the market or create a demand for the securities being resold; (iii) no extraordinary commission or consideration is paid to a person or company in respect of the resale; and (iv) if the selling security holder is an insider or officer of PolyMet, the selling security holder has no reasonable grounds to believe that PolyMet is in default of securities laws.

Each holder is urged to consult his, her, their or its professional advisors to determine the exact conditions and restrictions applicable to trades of the Rights and the underlying PolyMet Shares.

The Company has filed with the SEC in the United States a registration statement on Form F-10 under the U.S. Securities Act (the "Registration Statement") so that the PolyMet Shares issuable upon the exercise of the Rights will not be subject to transfer restrictions.

The Company has filed with the SEC a registration statement on Form F-10 under the U.S. Securities Act, and expects to make other certain filings with the SEC and the NYSE American so that the Rights and the PolyMet Shares issuable upon the exercise of the Rights issued to Shareholders that are U.S. residents and are not affiliates of the Company will not be subject to transfer restrictions under U.S. securities law.

Will the Company issue fractional securities upon exercise of the Rights?

No, the Company will not issue fractional PolyMet Shares upon the exercise of the Rights. The holder's entitlement will be reduced to the next lowest whole number of PolyMet Shares with no additional compensation. No fractional PolyMet Shares will be issued. Where the exercise of Rights would appear to entitle a holder of Rights to receive fractional PolyMet Shares, the holder's entitlement will be reduced to the next lowest whole number of PolyMet Shares. The Company will not be required to and will not issue fractional PolyMet Shares or pay cash in lieu thereof

The foregoing is a summary only and is not intended to be exhaustive. Holders of Rights should be aware that the acquisition and disposition of Rights and the underlying PolyMet Shares may have tax consequences in Canada as well as the jurisdiction where they reside which are not described herein. Accordingly, holders should consult their own tax advisors about the specific tax consequences to them of acquiring, holding and disposing of Rights and the underlying PolyMet Shares having regard to their particular circumstances.

APPOINTMENT OF THE SUBSCRIPTION AGENT

Who is the Subscription Agent?

Computershare Investor Services Inc. is the Subscription Agent for the Rights Offering. The Subscription Agent has been appointed to receive subscriptions and payments from holders of Rights and to perform the services relating to the exercise of the Rights.

What happens if we do not proceed with the Rights Offering?

If we terminate the Rights Offering, the Subscription Agent will return all funds held by it to holders of Rights that have subscribed for securities under the Rights Offering.

What happens if we do not receive funds from the Standby Purchaser?