UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024.

Commission File Number 001-38628

| | |

| SilverCrest Metals Inc. |

| (Translation of registrant’s name into English) |

| | |

570 Granville Street, Suite 501 Vancouver, British Columbia V6C 3P1 Canada |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| Date: March 11, 2024 | /s/ Anne Yong______________ Anne Yong Chief Financial Officer |

INDEX TO EXHIBITS

SilverCrest Reports Fourth Quarter and 2023 Annual Financial Results

2023 Sales and Corporate AISC Beat Guidance, Driving $54.4 million Increase in Treasury Assets

TSX: SIL | NYSE American: SILV For Immediate Release

VANCOUVER, BC – March 11, 2024 – SilverCrest Metals Inc. (“SilverCrest” or the “Company”) is pleased to announce its financial results for the fourth quarter of 2023 (“Q4, 2023”) and the year ended December 31, 2023. This release also provides additional operational results, expanding on the January 23, 2024 release of Q4, 2023 operational results from the Company’s Las Chispas operation (“Las Chispas” or the “Operation”) located in Sonora, Mexico. All amounts herein are presented in United States Dollars (“US$”), unless otherwise stated. Certain amounts shown in this news release may not total to exact amounts due to rounding differences. References to corporate all-in sustaining costs (“AISC”), free cash flow, cash costs, average realized gold and silver price, and treasury assets are described in more detail in the "Non-GAAP Financial Measures" section of this news release.

N. Eric Fier, CEO, commented, “2023 marked a successful first full year of commercial production at Las Chispas, with the Operation exceeding the high end of sales guidance, beating the low end of AISC guidance, delivering impressive operating margins of 61%, and generating $121.1 million in free cash flow. We are extremely proud that within seven months of declaring commercial production we became debt free, after repaying $50.0 million in debt in the first half of 2023 (“H1, 2023”). This was in addition to strategically allocating a total of $37.2 million in capital throughout the year to share buybacks, exploration, and increasing our bullion holdings. We ended 2023 with peer1 leading treasury assets of $105.2 million, and while we expect the pace of our cash build to slow in 2024 due to the commencement of tax payments and contractor related charges, we remain uniquely positioned to continue to allocate capital strategically. Our new underground mining contractor began mobilization in February 2024, a key de-risking event, and we are excited that this process is underway while also having our outgoing contractor on site to allow for a smooth transition and continued ramp-up of the underground operations at Las Chispas.”

Q4, 2023

•Recovered 14,100 ounces (“oz”) of gold (“Au”) and 1.34 million oz of silver (“Ag”), or 2.47 million oz of silver equivalent (“AgEq”2).

•Sold 16,100 oz of Au and 1.28 million oz of Ag, or 2.56 million oz of AgEq.

•Cash costs of $7.45 per oz AgEq sold and Corporate AISC of $14.36 per oz AgEq sold, which was within the H2, 2023 guidance range of $13.75 to $15.50 per oz AgEq sold, but higher than Q3, 2023, primarily due to an increase in capital spend and payments to our outgoing mining contractor.

•Average realized price of $1,979/oz Au and $23.09/oz Ag.

•Revenue of $61.3 million and cost of sales of $24.4 million, resulting in mine operating earnings of $36.9 million, which represents a 60% operating margin.

•Net earnings of $35.9 million or basic earnings of $0.25 per share.

•Free cash flow of $24.1 million or $0.16 per share.

•Ended the quarter with treasury assets totaling $105.2 million ($86.0 million cash and $19.2 million in bullion), a $23.4 million or 29% increase from the prior quarter.

1 Based on company filing for the period ended September 30, 2023 of silver peer companies, including Aya Gold & Silver Inc., Coeur Mining, Inc., Endeavour Silver Corp., First Majestic Silver Corp., Fresnillo plc., Fortuna Silver Mines Inc., Hecla Mining Company, MAG Silver Corp., and Silvercorp Metals Inc.

2 Silver equivalent (“AgEq”) ratio used in this news release of 79.51:1 based on the updated technical report for Las Chispas titled “Las Chispas Operation Technical Report” dated September 5, 2023 with an effective date of July 19, 2023 (the “2023 Technical Report”).

Year ended December 31, 2023

•Recovered 59,700 oz of Au and 5.65 million oz of Ag, or 10.40 million oz of AgEq.

•Sold 58,200 oz of Au and 5.62 million oz of Ag, or 10.25 million oz of AgEq, exceeding 2023 sales guidance of 9.8 to 10.2 million oz of AgEq.

•Cash costs of $7.73 per oz AgEq sold was within the guidance range of $7.50 to $8.50 per oz AgEq sold.

•AISC of $12.58 per oz AgEq sold beat the low end of the 2023 guidance range of $12.75 to $13.75 per oz AgEq sold.

•Average realized price of $1,946/oz Au and $23.48/oz Ag.

•Revenue of $245.1 million and cost of sales of $96.8 million, resulting in mine operating income of $148.3 million, which represents a 61% operating margin.

•Net earnings of $116.7 million or basic earnings of $0.79 per share.

•Free cash flow of $121.1 million or $0.82 per share.

•Financial position remained strong with no debt and treasury assets totaling $105.2 million ($86.0 million cash and $19.2 million in bullion), a $54.4 million or 107% increase from the prior year.

•Fully repaid the $50.0 million Term Facility.

•Repurchased $7.1 million of the Company's shares under SilverCrest's Normal Course Issuer Bid ("NCIB"), representing 20% of the allowable 7.4 million common share purchase limit.

2024 Outlook

The Las Chispas underground operation will continue its ramp-up through 2024 with mining rates expected to remain at or around Q4, 2023 levels in H1, 2024, as the new mining contractor mobilizes. Mining rates will increase in H2, 2024 with a targeted exit rate of 1,050 tonnes per day (“tpd”). The mine plan was created with a measured ramp-up, which when combined with balanced usage of surface stockpiles, reduces execution risk. The new mining contractor, a subsidiary of Dumas Contracting Ltd. (“Dumas”), arrived at site in early February 2024 to begin mobilization, which is expected to continue through Q3, 2024. Guidance for 2024 incorporates assumptions related to the transition of contractors and ramp-up of Dumas, including some one time costs.

In 2024, the processing plant will operate at an average of 1,200 tpd, except in Q1, 2024, due to planned maintenance downtime in February 2024. This work is now complete and is not expected to impact production in the quarter due to the flexibility afforded by the stockpile for ore blending. Silver equivalent sales are expected to be relatively consistent quarterly throughout 2024.

The Company announced its full year 2024 guidance on February 20, 2024 which highlighted stable production at low costs, despite continued industry cost pressures.

| | | | | | | | |

| Guidance Metric | Unit | 2024 |

| AgEq Ounces Sold | millions | 9.8 to 10.2 |

Cash Costs(1) | $/oz AgEq sold | 9.50 to 10.00 |

Corporate AISC(1) | $/oz AgEq sold | 15.00 to 15.90 |

Sustaining Capital(1) | $ millions | 40.0 to 44.0 |

| Exploration | $ millions | 12.0 to 14.0 |

Notes: 1.Cash Costs, AISC, and sustaining capital are non-GAAP measures. Please refer to the Non-GAAP Financial Measures section of this news release for further information on this measure. 2.General assumptions: a.Metal prices estimated at $1,850/oz Au and $22.80/oz Ag. b.Annual average exchange rate from all costs based on Mexican peso to US dollar of 17:1. |

Estimated 2024 Corporate AISC of $15.00 to $15.90/oz AgEq sold is inline with the 2024 AISC estimate based on the 2023 Technical Report of $15.08/oz AgEq (inclusive of 2024 mine level AISC of $13.48/oz AgEq sold and an estimate of $1.60/oz AgEq sold of corporate level costs). AISC in H1, 2024 is expected to be higher than Q4, 2023 as a result of Dumas mobilization and demobilization of the outgoing contractor, and is expected to reduce in H2, 2024.

In Q1, 2024 SilverCrest expects to make payments totaling approximately $30.0 million for 2023 taxes and duties. 2024 taxes are estimated to total $28.0 to $33.0 million and will be paid in quarterly installments. Special mining duties are paid in the first quarter following the end of each fiscal year in accordance with the mandated annual schedule.

In 2024, cash flows are also expected to be impacted by mobilization and demobilization costs, including a $7.5 million advance that was made in Q1, 2024 to support equipment purchases as part of the mobilization of Dumas. The equipment advance will result in estimated savings of $1.5 million over the life of the five year contract. This advance to Dumas will be credited towards mining services for SilverCrest over 24 months starting in Q3, 2024. A total of $4.5 million in mobilization charges will be paid over the mobilization period with the expense recognized over the life of the five year contract and reflected in AISC during this time.

Fourth Quarter and Annual Operating Performance

The following operating performance refers to free cash flow, cash costs, AISC, treasury assets and net cash which are described in more detail in the “Non-GAAP Financial Measures" section of this news release.

| | | | | | | | | | | | | | | | | |

| OPERATIONAL | Unit | Q4, 2023 | Q4, 2022 | 2023 | 2022 |

| Ore mined | tonnes | 78,600 | 64,700 | 300,900 | 201,000 |

Ore milled(a) | tonnes | 104,500 | 104,400 | 431,400 | 187,600 |

| Average daily mill throughput | tpd | 1,136 | 1,135 | 1,182 | 877 |

| Underground development | km | 3.6 | 2.3 | 13.2 | 8.1 |

| | | | | |

| Gold | | | | | |

| Average grade | gpt | 4.28 | 3.67 | 4.39 | 3.05 |

| Recovery | % | 98.3 | % | 96.9 | % | 98.1 | % | 96.5 | % |

| Recovered | oz | 14,100 | 11,940 | 59,700 | 17,770 |

| Sold | oz | 16,100 | 11,400 | 58,200 | 11,400 |

| | | | | |

| Silver | | | | | |

| Average grade | gpt | 410 | 382 | 423 | 312 |

| Recovery | % | 97.7 | % | 93.3 | % | 96.5 | % | 92.5 | % |

| Recovered | million oz | 1.34 | 1.20 | 5.65 | 1.74 |

| Sold | million oz | 1.28 | 0.98 | 5.62 | 1.12 |

| | | | | |

Silver equivalent(b) | | | | | |

| Average grade | gpt | 750 | 674 | 771 | 555 |

| Recovery | % | 98.0 | % | 94.7 | % | 97.2 | % | 94.2 | % |

| Recovered | million oz | 2.47 | 2.15 | 10.40 | 3.16 |

| Sold | million oz | 2.56 | 1.89 | 10.25 | 2.03 |

(a)Ore milled includes material from stockpiles and ore mined. (b)Q4, 2022 and 2022 AgEq figures were originally presented using a Ag:Au ratio of 86.9:1 but have been recast for consistency with the ratio of 79.51:1 being applied to current year figures based on the 2023 Technical Report. |

| | | | | | | | | | | | | | | | | |

| FINANCIAL | Unit | Q4, 2023 | Q4, 2022 | 2023 | 2022 |

| Revenue | $ millions | $ | 61.3 | | $ | 40.8 | | $ | 245.1 | | $ | 43.5 | |

| Cost of sales | $ millions | $ | (24.4) | | $ | (14.3) | | $ | (96.8) | | $ | (15.1) | |

| Mine operating income | $ millions | $ | 36.9 | | $ | 26.5 | | $ | 148.3 | | $ | 28.4 | |

| Earnings for the period | $ millions | $ | 35.9 | | $ | 5.2 | | $ | 116.7 | | $ | 31.3 | |

| Earnings per share (basic) | $/share | $ | 0.25 | | $ | 0.03 | | $ | 0.79 | | $ | 0.21 | |

| Free cash flow | $ millions | $ | 24.1 | | N/A* | $ | 121.1 | | N/A* |

| Cash costs | $/oz AgEq | $ | 7.45 | | N/A* | $ | 7.73 | | N/A* |

| AISC | $/oz AgEq | $ | 14.36 | | N/A* | $ | 12.58 | | N/A* |

| Units | | | As at

Dec 31, 2023 | As at

Dec 31, 2022 |

| Cash and cash equivalents | $ millions | | | $ | 86.0 | | $ | 50.8 | |

| Bullion | $ millions | | | $ | 19.2 | | $ | — | |

| Treasury assets | $ millions | | | $ | 105.2 | | $ | 50.8 | |

| Credit Facility Debt | $ millions | | | $ | — | | $ | 49.6 | |

| Net cash | $ millions | | | $ | 86.0 | | $ | 1.2 | |

*This information was not available for 2022. |

Underground

Mining rates in Q4, 2023 averaged 855 tpd, a 6% decrease from Q3, 2023, but in line with the ramp-up estimate of 800 to 900 tpd. Rates decreased over the previous quarter as a result of a focus on dilution management. During 2023, mining rates averaged 824 tpd.

In Q4, 2023, the Company completed 3.6 km of horizontal and vertical underground development. In 2023, the Company completed an additional 13.2 km of horizontal and vertical underground development, compared to 8.0 km in 2022.

Processing Plant

Average daily mill throughput was 1,136 tpd in Q4, 2023 and 1,182 tpd in 2023. Q4, 2023 throughput declined slightly from Q3, 2023 throughput of 1,245 tpd as the processing plant experienced some unplanned downtime.

Average processed gold and silver grades of 4.28 gpt Au and 410 gpt Ag, or 750 gpt AgEq, in Q4, 2023 were in line with Q3, 2023 (2% and 1% declines respectively). In 2023, gold and silver processed grades averaged 4.39 gpt Au and 423 gpt Ag, or 771 gpt AgEq.

Costs

During the quarter, cash costs averaged $7.45 per oz AgEq sold. This is higher than Q3, 2023 cash costs of $6.53 per oz AgEq sold, but within H2, 2023 cash cost guidance range of $7.00 to $8.50 per oz AgEq sold. Cash costs increased due to higher payments to our outgoing mining contractor. In 2023 cash costs averaged $7.73 per oz AgEq sold which was within the 2023 cash cost guidance range of $7.50 to $8.50 per oz AgEq sold.

AISC averaged $14.36 per oz AgEq sold in Q4, 2023, higher than $12.23 per oz AgEq sold in Q3, 2023 as expected, but within the H2, 2023 guidance range of $13.75 to $15.50 per oz AgEq sold. AISC increased due to higher capital spend and payments to our outgoing mining contractor. AISC in 2023 was $12.58 per oz AgEq sold which beat the low end of the 2023 guidance range of $12.75 to $13.75 per oz AgEq sold.

Sustaining Capital Expenditures

Sustaining capital expenditures totalled $12.0 million in Q4, 2023 and $37.1 million for 2023, which is consistent with the $39.1 million estimated in the 2023 Technical Report. Sustaining capital in 2023 was largely related to underground development and underground infrastructure.

Exploration Update

During 2023, the Company completed exploration work at Las Chispas, which is capitalized as growth capital.

During Q4, 2023, 17,947 metres of drilling was completed at Las Chispas, with 42% of the metres focused on infill drilling of Inferred Resources (see 2023 Technical Report) for conversion to Indicated Resources and possible conversion to Reserves. The balance of the drilling was focused on new vein targets. In Q4, 2023, the Company

spent $5.0 million on exploration at Las Chispas. This drilling program will continue in 2024 with a budget of up to $14 million targeting conversion in H1, 2024 and targeting inferred growth in H2, 2024.

During 2023, 50,233 metres of drilling was completed and $11.4 million was spent on exploration at Las Chispas.

Selected Fourth Quarter Financial Results

Fourth Quarter and Annual Consolidated Income Statements

(unaudited, in thousands of USD)

| | | | | | | | | | | | | | |

| Three months ended December 31, | Year ended

December 31, |

| 2023 | 2022 | 2023 | 2022 |

| Revenue | $ | 61,320 | | $ | 40,791 | | $ | 245,130 | | $ | 43,510 | |

| Cost of sales | | | | |

| Production costs | (17,555) | | (13,006) | | (74,108) | | (13,758) | |

| Depreciation | (6,328) | | (1,073) | | (21,348) | | (1,116) | |

| Royalties | (490) | | (216) | | (1,368) | | (216) | |

| (24,373) | | (14,295) | | (96,824) | | (15,090) | |

| Mine operating earnings | 36,947 | | 26,496 | | 148,306 | | 28,420 | |

| General and administrative expenses | (6,534) | | (4,365) | | (15,756) | | (9,746) | |

| Exploration and project expenses | (99) | | (775) | | (726) | | (5,444) | |

| Foreign exchange gains (losses) | 630 | | (4,493) | | (7,247) | | 27,913 | |

| | | | |

| | | | |

| Earnings from operations | 30,944 | | 16,863 | | 124,577 | | 41,143 | |

| Interest income | 1,448 | | 886 | | 4,035 | | 2,811 | |

| Interest and finance expense | (334) | | (6,397) | | (2,713) | | (6,589) | |

| Other expense | 507 | | — | | (2,653) | | — | |

| Earnings before income taxes | 32,565 | | 11,352 | | 123,246 | | 37,365 | |

| Income tax expense | 3,352 | | $ | (6,121) | | (6,526) | | $ | (6,064) | |

| Net earnings | 35,917 | | 5,231 | | 116,720 | | 31,301 | |

| | | | |

| Other comprehensive income | | | | |

| Currency translation adjustment | — | | 5,399 | | 10,255 | | (27,987) | |

| Total comprehensive earnings | $ | 35,917 | | $ | 10,630 | | $ | 126,975 | | $ | 3,314 | |

| | | | |

| Net earnings attributable to common shareholders | | | | |

| Basic earnings per share | $ | 0.25 | | $ | 0.03 | | $ | 0.79 | | $ | 0.21 | |

| Diluted earnings per share | $ | 0.24 | | $ | 0.04 | | $ | 0.79 | | $ | 0.21 | |

| Weighted average shares outstanding (in 000’s) Basic | 146,334 | | 146,646 | | 146,882 | | 146,164 | |

| Weighted average shares outstanding (in 000’s) Diluted | 146,972 | | 152,403 | | 147,539 | | 152,190 | |

Revenue

During Q4, 2023, the Company sold a total of 16,100 oz Au and 1.28 million oz Ag at average realized prices of $1,979/oz Au and $23.09/oz Ag, generating revenue of $61.3 million. During Q4, 2022, the Company sold a total of 11,400 oz Au and 1.0 million oz Ag at average realized prices of $1,730/oz Au and $21.51/oz Ag, generating revenue of $40.8 million. The increased quantities sold resulted from the Company having three months of commercial production in Q4, 2023 compared to two months in Q4, 2022.

During 2023, the Company sold a total of 58,200 oz Au and 5.62 million oz Ag at average realized prices of $1,946/oz Au and $23.48/oz Ag, generating revenue of $245.1 million. During 2022, the Company sold a total of 11,400 oz Au and 1.12 million oz Ag at average realized prices of $1,730/oz Au and $21.24/oz Ag, generating revenue of $43.5 million. The increased quantities sold resulted from the Company having a full year of commercial production in 2023 compared to two months in 2022.

Income

Q4, 2023 net earnings of $35.9 million, or $0.25 per share, was $30.7 million higher than Q4, 2022 net earnings of $5.2 million, or $0.03 per share, primarily from higher mine operating earnings resulting from higher realized metal prices and increased sales quantities and lower interest, taxes and foreign exchange losses.

During 2023, the Company generated net earnings of $116.7 million, or $0.79 per share, $85.4 million higher than 2022 net earnings of $31.3 million, or $0.21 per share. The increase in net earnings resulted from the Company having a full year of commercial production in 2023 compared to two months in 2022.

Fourth Quarter and Annual Consolidated Statements of Cash Flows

(unaudited, in thousands of USD)

| | | | | | | | | | | | | | |

| Three months ended December 31, | Year ended

December 31, |

| 2023 | 2022 | 2023 | 2022 |

| Operating activities | | | | |

| Net earnings for the year | $ | 35,917 | | $ | 5,231 | | $ | 116,720 | | $ | 31,301 | |

| Income tax (recovery) expense | (3,352) | | 6,121 | | 6,526 | | 6,064 | |

| Depreciation | 5,957 | | 1,894 | | 21,348 | | 1,937 | |

| Share-based compensation expense | 2,333 | | 1,391 | | 4,190 | | 2,398 | |

| Unrealized foreign exchange losses | 842 | | 3,579 | | 7,942 | | (21,868) | |

Interest income | (1,448) | | (886) | | (4,035) | | (2,811) | |

| Interest expense | (4,010) | | 6,374 | | 1,461 | | 6,566 | |

| Interest paid | 190 | | (1,619) | | (1,461) | | (7,568) | |

| Interest received | 1,251 | | 974 | | 4,035 | | 2,715 | |

| Income taxes paid | 10 | | — | | (977) | | — | |

| Other operating activities | (242) | | — | | (242) | | — | |

| Net change in non-cash working capital items | (1,352) | | (3,630) | | 2,754 | | (28,644) | |

| $ | 36,096 | | $ | 19,429 | | $ | 158,261 | | $ | (9,910) | |

| Investing activities | | | | |

| Payments for mineral properties, plant and equipment | (17,327) | | (16,409) | | (51,257) | | (68,489) | |

| | | | |

| | | | |

| Purchase of bullion | (6,655) | | — | | (18,674) | | — | |

| | | | |

| Proceeds from derivatives | 264 | | — | | 264 | | — | |

| | | | |

| $ | (23,718) | | $ | (16,409) | | $ | (69,667) | | $ | (68,489) | |

| Financing activities | | | | |

| Common share proceeds | 2,878 | | 1,084 | | 3,131 | | 2,467 | |

| Common share repurchases | (6) | | — | | (7,145) | | — | |

| | | | |

| | | | |

| Proceeds from debt | — | | 49,583 | | — | | 49,583 | |

| Repayment of debt | — | | (92,860) | | (50,000) | | (92,860) | |

| | | | |

| | | | |

| Payments of equipment leases | (30) | | (39) | | (112) | | (159) | |

| | | | |

| $ | 2,842 | | $ | (42,232) | | $ | (54,126) | | $ | (40,969) | |

| Effects of exchange rate changes on cash and cash equivalents | 765 | | 1,396 | | 735 | | (6,386) | |

| Increase (decrease) in cash and cash equivalents | 15,985 | | (37,816) | | 35,203 | | (125,754) | |

| Cash and cash equivalents at the beginning of the period | 69,979 | | 88,577 | | 50,761 | | 176,515 | |

| Cash and cash equivalents at the end of the period | $ | 85,964 | | $ | 50,761 | | $ | 85,964 | | $ | 50,761 | |

Cash Flow

In Q4, 2023, the cash flow generated from operating activities was $36.1 million, an increase of $16.7 million compared to Q4, 2022, primarily driven by elevated mine operating earnings. Total cash flow generated from operating activities in 2023 was $158.3 million, a $168.2 million increase from the $9.9 million operating cash outflows in 2022. This notable improvement resulted from increased mine operating earnings and a reduction in cash utilized for working capital.

Q4, 2023 free cash flow was $24.1 million (or $0.16 per share) and 2023 free cash flow was $121.1 million (or $0.82 per share).

Financial Position

As at December 31, 2023, the Company had treasury assets of $105.2 million ($86.0 million cash and $19.2 million in bullion), a $54.4 million or 107% increase from the prior year. The Company remains debt free with access to an undrawn revolving facility of $70.0 million.

ESG

In 2023, SilverCrest published its inaugural full ESG report following the success of the Task Force for Climate-Related Disclosures ("TCFD") and Water Stewardship Report disclosures in 2022, collectively available on our website at www.silvercrestmetals.com. This further formalizes the Company’s commitment to diligent management of ESG issues within its own operations and the local community.

SilverCrest continues to execute on its commitment to invest in initiatives that support water stewardship in communities local to Las Chispas. In 2023, SilverCrest allocated $0.4 million from its committed five year $1.5 million water stewardship initiatives within the community. This investment facilitated approximately 900 metres of sewer system repairs, more than 500 metres of aqueduct enhancements in the Arizpe region of Sonora, and the establishment of electrified pumps for wells. In addition SilverCrest continued to assist local community members with the process to secure water concessions. These projects helped protect the main sources of income for the local population while also creating a second planting season in the local area.

The Company’s ESG practices and community engagement earned recognition in Mexico with the 2023 Empresas Socialmente Responsables (Socially Responsible Companies) distinction from the Mexican Centre for Philanthropy (CEMEFI). In addition, the Company has received recognition from the Confederation of Chambers of Commerce of Mexico (CONCAMIN) in the areas of ESG compliance and Outstanding Social Responsibility and Sustainability Practices.

Fourth Quarter 2023 Conference Call

A conference call to discuss the Company’s Q4, 2023 operational and financial results will be held Monday, March 11, 2024 at 7:00 a.m. PT / 10:00 a.m. ET. To participate in the conference call, please dial the numbers below.

Date & Time: Monday March 11, 2024 at 7:00 a.m. PT / 10:00 a.m. ET

Telephone: Toronto: +1-416-764-8624

North America Toll Free: 1-888-259-6580

Conference ID: 58528537

Webcast: https://silvercrestmetals.com/investors/presentations/

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals producer headquartered in Vancouver, BC. The Company’s principal focus is its Las Chispas Operation in Sonora, Mexico. SilverCrest has an ongoing initiative to increase its asset base by expanding current resources and reserves, acquiring, discovering, and developing high value precious metals projects and ultimately operating multiple silver-gold mines in the Americas. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

| | | | | |

For Further Information: SilverCrest Metals Inc. |

Contact: Telephone: Fax: Toll Free: Email: Website: | Lindsay Bahadir, Manager Investor Relations and Corporate Communications +1 (604) 694-1730 +1 (604) 357-1313 1-866-691-1730 (Canada & USA) info@silvercrestmetals.com www.silvercrestmetals.com |

570 Granville Street, Suite 501 Vancouver, British Columbia V6C 3P1 |

Non-GAAP Financial Measures

Management believes that the following non-GAAP financial measures will enable certain investors to better evaluate the Company's performance, liquidity, and ability to generate cash flow. These measures do not have any standardized definition under IFRS, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate these measures differently.

Average realized gold and silver price

Average realized gold and silver price per ounce is calculated by dividing the Company’s gross revenue from gold or silver sales for the relevant period by the gold or silver ounces sold, respectively. The Company believes the measure is useful in understanding the metal prices realized by the Company throughout the period. The following table reconciles revenue and metal sold during the period with average realized prices:

| | | | | | | | | | | | | | |

| | Q4, 2023 | 2023 | 2022 |

| Revenues from financial statements | | $ | 61,320 | | $ | 245,130 | | $ | 43,510 | |

| Ag sales | | (29,452) | | (131,867) | | (23,784) | |

| Au sales | A | 31,868 | 113,263 | 19,726 |

| Au oz sold during the period | B | 16,100 | 58,200 | 11,400 |

| Average realized Au price per oz sold | A/B | $ | 1,979 | | $ | 1,946 | | $ | 1,730 | |

| | | | |

| Revenues from financial statements | | $ | 61,320 | | $ | 245,130 | | $ | 43,510 | |

| Au sales | | (31,868) | | (113,263) | | (19,726) | |

| Ag sales | A | 29,452 | 131,867 | 23,784 |

| Ag oz sold during the period | B | 1,275,300 | 5,616,300 | 1,105,700 |

| Averaged realized Ag price per oz sold | A/B | $ | 23.09 | | $ | 23.48 | | $ | 21.51 | |

Capital expenditures

Capital expenditures are classified into sustaining capital expenditures or non-sustaining capital expenditures depending on the nature of the expenditure. Sustaining capital expenditures are those required to support current production levels. Non-sustaining capital expenditures represent the capital spending at new projects and major, discrete projects at existing operations intended to increase production or extend mine life. Management believes this to be a useful indicator of the purpose of capital expenditures and this distinction is an input into the calculation of AISC.

The following table reconciles payments for mineral properties, plant and equipment, and equipment leases to sustaining and non-sustaining capital expenditures:

| | | | | | | | |

| Q4, 2023 | 2023 |

| Payments for mineral properties, plant and equipment | $ | 17,327 | | $ | 51,257 | |

| Payments for equipment leases | 30 | | 112 | |

| Total capital expenditures | 17,357 | | 51,368 | |

| Less: Non-sustaining capital expenditures | (5,332) | | (14,224) | |

| Sustaining capital expenditures | $ | 12,025 | | $ | 37,144 | |

Free cash flow

Free cash flow, a non-GAAP financial metric, subtracts sustaining capital expenditures from net cash provided by operating activities, serving as a valuable indicator of our capacity to generate cash from operations post-sustaining capital investments. The following table reconciles this non-GAAP financial measure to the most directly comparable IFRS measure.

| | | | | | | | | | | |

| | Q4, 2023 | 2023 |

| Net cash provided by operating activities | | $ | 36,096 | | $ | 158,261 | |

| Less: sustaining capital expenditures | | (12,025) | | (37,145) | |

| Free cash flow | | $ | 24,071 | | $ | 121,116 | |

| Free cash flow per share (basic) | | $ | 0.16 | | $ | 0.82 | |

| Weighted average shares outstanding (basic) | | 146,334 | 146,882 |

Treasury assets

SilverCrest calculates treasury assets as cash and cash equivalents plus bullion as reported in the consolidated statements of financial position. Management believes that treasury assets provide a useful measure of the Company's most liquid assets that can be used to settle short-term obligations or provide liquidity. Treasury assets are calculated as follows:

| | | | | | | | |

| 2023 | 2022 |

| Cash and cash equivalents | $ | 85,964 | | $ | 50,761 | |

| Bullion | 19,191 | | — | |

| Treasury assets | $ | 105,155 | | $ | 50,761 | |

Cash costs

Cash costs are a non-GAAP financial metric which includes production costs, royalties and minesite general and administrative costs. Management uses this measure to monitor the performance of its mining operation and ability to generate positive cash flow on a site basis.

AISC

All-in sustaining costs, a non-GAAP financial measure, starts with cash costs and includes all other general and administrative costs, reclamation accretion expense and sustaining capital expenditures. Management uses this measure to monitor the performance of its mining operation and ability to generate positive cash flow on an overall company basis.

Cash costs and AISC are calculated as follows:

| | | | | | | | |

| Q4, 2023 | 2023 |

| Production costs | $ | 17,555 | | $ | 74,108 | |

| Royalties | 490 | 1,368 |

| General and administrative expenses, minesite | 999 | 3,703 |

| Total cash costs | 19,044 | 79,179 |

| General and administrative expenses, other | 5,500 | 12,053 |

| Reclamation accretion expense | 139 | 493 |

| Sustaining capital expenditures | 12,025 | | 37,145 | |

| Total AISC | $ | 36,708 | | $ | 128,870 | |

| Silver equivalent ounces sold (koz) | 2,555 | 10,244 |

| Cash costs (per AgEq sold) | $ | 7.45 | | $ | 7.73 | |

| AISC (per AgEq sold) | $ | 14.36 | | $ | 12.58 | |

Net cash

SilverCrest calculates net cash by deducting debt from cash and cash equivalents as reported in the consolidated statements of financial position. The Company believes that in addition to conventional measures prepared in accordance with IFRS, net cash is useful to evaluate the Company’s and liquidity and capital resources.

| | | | | | | | |

| 2023 | 2022 |

| Cash and cash equivalents | $ | 85,964 | | $ | 50,761 | |

| Debt | — | | (49,591) | |

| Net cash | $ | 85,964 | | $ | 1,170 | |

Forward-Looking Statements

This news release contains “forward-looking statements” and “forward-looking information” (collectively “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation. These include, without limitation, statements with respect to: the Company’s 2024 guidance and outlook; the amount of future production of gold and silver over any period; the strategic plans and expectations for the Company’s operation and exploration program; working capital requirements; expected recoveries; expected cash costs and outflows, Au and Ag prices and currency exchange rates. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: present and future business strategies; continued commercial operations at the Las Chispas Operation; the environment in which the Company will operate in the future, including the price of gold and silver; estimates of capital and operating costs; production estimates; estimates of mineral resources, mineral reserves and metallurgical recoveries and mining operational risk; the reliability of mineral resource and mineral reserve estimates; mining and development costs; the conditions in general economic and financial markets; availability of skilled labour; timing and amount of expenditures related to exploration programs; and effects of regulation by governmental agencies and changes in Mexican mining legislation. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; fluctuations in gold and silver prices and currency exchange rates; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Qualified Persons Statement

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier, CPG, P.Eng, CEO for SilverCrest, who has reviewed and approved its contents.

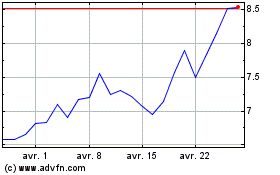

SilverCrest Metals (AMEX:SILV)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

SilverCrest Metals (AMEX:SILV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024