Amended Statement of Beneficial Ownership (sc 13d/a)

14 Février 2023 - 10:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 2)1

Servotronics, Inc.

(Name of Issuer)

Common Stock, par value $0.20 per share

(Title of Class of Securities)

817732100

(CUSIP Number)

JEFFREY E. EBERWEIN

STAR EQUITY FUND, LP

53 Forest Avenue, Suite 101

Old Greenwich, Connecticut 06870

(203) 489-9504

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

February 14, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note. Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

1 The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY FUND, LP |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

PN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY FUND GP, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR INVESTMENT MANAGEMENT, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

CONNECTICUT |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR EQUITY HOLDINGS, INC. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF, OO |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

CO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

JEFFREY E. EBERWEIN |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF, PF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

STAR VALUE, LLC |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

DELAWARE |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

135,000 |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

135,000 |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

135,000 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.38% |

| 14 | TYPE OF REPORTING PERSON

OO |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

HANNAH M. BIBLE |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

BASHARA (BO) BOYD |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

RICHARD K. COLEMAN, JR. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

JOHN W. GILDEA |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

ROBERT G. PEARSE |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

| | | | | | | | |

| 1 | NAME OF REPORTING PERSONS

G. MARK POMEROY |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*(a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS

|

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

USA |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER

- 0 - |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

- 0 - |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

-0- |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 | TYPE OF REPORTING PERSON

IN |

The following constitutes Amendment No. 2 ("Amendment No. 2") to the 13D filed by the undersigned on November 14, 2022 (the "Schedule 13D"). This Amendment No. 2 amends the Schedule 13D as specifically set forth herein.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to add the following:

On February 14, 2023, Star Equity Fund issued a press release announcing its nomination of Hannah M. Bible, Bashara C. Boyd, Richard K Coleman, Jr., John W. Gildea, Robert C. Pearse, and G. Mark Pomeroy (collectively, the “Nominees”) for election to the Issuer's board of directors (the

"Board") at the Issuer's 2023 annual meeting of stockholders (the “Annual Meeting”). Therein Star Equity Fund noted that the Nominees are experienced, capable, and fully committed to act in the best interests of all Issuer shareholders.

Star Equity Fund mentioned at the Issuer's 2022 annual meeting of shareholders that a majority of the votes casts voted WITHHOLD on the incumbents Cosgrove and Gygax, and that the executive compensation plan failed to obtain the affirmative vote of a majority of the votes cast. Star Equity Fund asserted the entrenched Board amended its bylaws to create barriers to the director nominee process as a defense mechanism to discourage dissident shareholders from seeking consideration of matters and nominations at the Annual Meeting.

Star Equity Fund noted the Board declined to meet or return phone calls regarding worthwhile ideas and suggestions on how to create value for Issuer shareholders; and Star Equity Fund is resolute in its opinion that significant change in Board composition is vital to altering corporate governance practices, improving financial results, and ultimately unlocking shareholder value at Issuer.

Star Equity Fund concluded, by stating it intends to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the Annual Meeting.

The foregoing description of the press release is qualified in its entirety by reference to the full text of the press release, which is attached hereto as Exhibit 99.6 and is incorporated herein by reference.

| | | | | |

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended to add the following:

The following items are filed as exhibits:

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2023

| | | | | | | | | | | |

| Star Equity Fund, LP |

| | |

| By: | Star Equity Fund GP, LLC

General Partner |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Equity Holdings, Inc. |

| | |

| By: | /s/ Richard K Coleman Jr. |

| | Name: | Richard K. Coleman, Jr. |

| | Title: | Chief Executive Officer |

| | | | | | | | | | | |

| Star Equity Fund GP, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Investment Management, LLC |

| |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Manager |

| | | | | | | | | | | |

| Star Value, LLC |

| | |

| By: | Star Equity Holdings, Inc. |

| | |

| By: | /s/ Jeffrey E. Eberwein |

| | Name: | Jeffrey E. Eberwein |

| | Title: | Executive Chairman |

| | | | | |

| /s/ Jeffrey E. Eberwein |

| Jeffrey E. Eberwein |

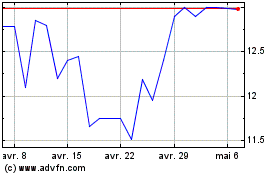

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024