Americas Gold and Silver Corporation (“the “Company”) (TSX:USA;

NYSE American: USAS) is pleased to announce that the nominees

listed in the management proxy circular dated May 11, 2023 for the

Company’s annual and special meeting of Shareholders held June 20,

2023 (the “Meeting”) were elected as directors of the Company at

the Meeting. Detailed results of the vote for the election of

directors held at the Meeting yesterday in Toronto as well as the

results for other matters voted on at the Meeting are set out

below.

Nominee

Votes For

% For

Votes Against

% Against

Darren Blasutti

83,459,219

95.40%

4,019,684

4.60%

Christine Carson

85,427,912

97.66%

2,050,991

2.34%

Alex Davidson

85,343,164

97.56%

2,135,739

2.44%

Alan Edwards

85,469,357

97.70%

2,009,547

2.30%

Bradley Kipp

85,475,355

97.71%

2,003,549

2.29%

Gordon Pridham

85,468,708

97.70%

2,010,196

2.30%

Manuel Rivera

85,467,934

97.70%

2,010,970

2.30%

Lorie Waisberg

71,501,919

81.74%

15,976,985

18.26%

In addition, the Company’s shareholders passed a resolution to

appoint PricewaterhouseCoopers LLP as auditors of the Company for

the ensuing year and authorizing the Directors to fix their

remuneration.

The results of these matters considered at the Meeting are

reported in the Report of Voting Results as filed on SEDAR

(www.sedar.com) on June 21, 2023. A total of 106,472,153 the

Company’s common shares were voted, representing 50.36% of total

shares issued and outstanding as at the record date for the

Meeting.

Additional Convertible Financing

The Company has issued an additional C$8.0 million senior

secured convertible debenture to certain subsidiaries of Delbrook

Capital Advisors Inc. (“Delbrook Capital”). Delbrook Capital are

one of the largest holders of common stock of the Company.

The Delbrook Debenture financing (the “Delbrook Debenture”) will

be issued in two tranches: (i) C$3.0M funded as of the date hereof;

and (ii) C$5.0M to be funded in the coming days subject to

conditions precedent regarding registering Mexican security and

confirmatory due diligence. The Delbrook Debenture bears interest

at a rate of 11% per annum and has a maturity date of July 1, 2024,

that can be extended by mutual consent to April 28, 2025. The

principal amount outstanding under the Delbrook Debenture is

convertible in certain instances at the holder’s option (subject to

TSX approval), into common shares of Americas Gold and Silver at a

conversion price of C$0.80 per share. The Company’s existing

debentures have a current outstanding principal amount of

C$16,300,000 and will be amended with the same terms as the

Delbrook Debenture. The Delbrook Debenture and the existing

debentures are secured by the Company’s interest in the Galena

Complex and by the shares of one of the Company’s Mexican

subsidiaries.

As part of the agreement, the Company has also agreed to issue

3.5 million share purchase warrants with an exercise price of

C$0.80 per common share and a term of three years to Delbrook

Capital.

In addition, in support of the financing, certain members of the

Company’s board and management have agreed to participate in a

private placement for common shares of the Company for an aggregate

minimum amount of C$500,000.

The proceeds are being raised to finalize construction of the

Galena Hoist and for general working capital purposes.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%-owned Galena Complex in Idaho, USA, and is

re-evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR or www.americas-gold.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas’

expectations, intentions, plans, assumptions and beliefs with

respect to, among other things, estimated and targeted production

rates and results for gold, silver and other metals, the expected

prices of gold, silver and other metals, as well as the related

costs, expenses and capital expenditures; production from the

Galena Complex, including the expected production levels and

potential additional mineral resources thereat; the expected timing

and completion of the Galena Hoist project , the expected

completion of the Delbrook Debenture financing and related private

placement The ability to maintain cash flow positive production at

the Cosalá Operations through meeting production targets and at the

Galena Complex through implementing the Galena Recapitalization

Plan, including the completion of the Galena Hoist project on its

expected schedule and budget, allowing the Company to generate

sufficient operating cash flows while facing market fluctuations in

commodity prices and inflationary pressures, are significant

judgments in the consolidated financial statements with respect to

the Company’s liquidity. Should the Company experience negative

operating cash flows in future periods, the Company may need to

raise additional funds through the issuance of equity or debt

securities. Often, but not always, forward-looking information can

be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “potential’,

“estimate”, “may”, “assume” and “will” or similar words suggesting

future outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions, or statements about future events or

performance. Forward-looking information is based on the opinions

and estimates of Americas as of the date such information is

provided and is subject to known and unknown risks, uncertainties,

and other factors that may cause the actual results, level of

activity, performance, or achievements of Americas to be materially

different from those expressed or implied by such forward-looking

information. With respect to the business of Americas , these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak including interpretations or reinterpretations of

geologic information; unfavorable exploration results; inability to

obtain permits required for future exploration, development or

production; general economic conditions and conditions affecting

the industries in which the Company operates; the uncertainty of

regulatory requirements and approvals; potential litigation;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to operate the Company’s projects; and risks associated

with the mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions, illegal blockades and other factors limiting mine

access or regular operations without interruption, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments,

risks associated with generally elevated inflation and inflationary

pressures, risks related to changing global economic conditions,

and market volatility, risks relating to geopolitical instability,

political unrest, war, and other global conflicts may result in

adverse effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas filings with the Canadian

Securities Administrators on SEDAR and with the SEC. Americas does

not undertake any obligation to update publicly or otherwise revise

any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas does not give any

assurance (1) that Americas will achieve its expectations, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230621741052/en/

Stefan Axell VP, Corporate Development & Communications

Americas Gold and Silver Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

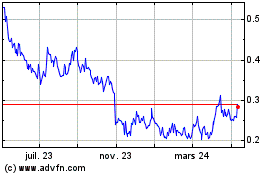

Americas Gold and Silver (AMEX:USAS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

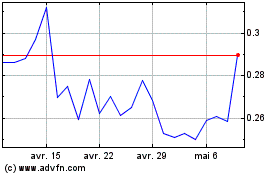

Americas Gold and Silver (AMEX:USAS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024