0000878828

false

0000878828

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT Pursuant

to

Section 13 or 15(d)

of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 4, 2023

Wireless

Telecom Group, Inc.

(Exact

name of Registrant as specified in its charter)

| New

Jersey |

|

001-11916 |

|

22-2582295 |

(State of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 25

Eastmans Road, Parsippany, New Jersey |

|

07054 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(973)

386-9696

(Registrant’s

telephone number, including area code)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Stock |

|

WTT |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory

Note

On

August 4, 2023 (the “Closing Date”), the acquisition of Wireless Telecom Group, Inc., a New Jersey corporation (“WTT”),

was completed pursuant to the terms of the previously announced Agreement and Plan of Merger, dated as of May 24, 2023 (the “Original

Merger Agreement”), as amended by the First Amendment to Agreement and Plan of Merger, dated as of June 8, 2023 (the “First

Amendment”, and together with the Original Merger Agreement, the “Merger Agreement”) with Maury Microwave, Inc., a

Delaware corporation (“Maury”), and Troy Merger Sub, Inc., a New Jersey corporation wholly-owned by Maury (“Merger

Sub”). Pursuant to the Merger Agreement, upon the terms and subject to the conditions set forth therein, Merger Sub merged with

and into WTT (the “Merger”), with WTT continuing as the surviving corporation and a wholly-owned subsidiary of Maury. As

previously announced, WTT’s shareholders approved the Merger at a special meeting of shareholders held on August 2, 2023.

The

description of the Merger Agreement and related transactions (including, without limitation, the Merger) in this Current Report on Form

8-K does not purport to be complete and is subject and qualified in its entirety by reference to the full text of the Original Merger

Agreement, which is attached as Exhibit 2.1 to WTT’s Current Report on Form 8-K filed with the Securities and Exchange Commission

(the “SEC”) on May 25, 2023 and the First Amendment, which is attached as an Exhibit to WTT’s Current Report on Form

8-K, filed with the SEC on June 12, 2023, and which are each incorporated herein by reference.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

The

description contained under the Introductory Note above is hereby incorporated by reference into this Item 2.01.

Merger

Consideration. At the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.01

per share, of WTT (the “Common Stock”), issued and outstanding immediately prior to the Effective Time (other than shares

of Common Stock that were cancelled) was automatically converted into the right to receive $2.13 per share in cash (the “Merger

Consideration”), without interest and less applicable withholding taxes. Pursuant to the terms of the Merger Agreement, payments

of Merger Consideration may not be made by the paying agent or the surviving company until file-stamped evidence of the filing of the

certificate of merger has been received from the Office of the Department of the Treasury of the State of New Jersey, which is expected

to occur in approximately seven business days.

Treatment

of Outstanding Equity Awards. At the Effective Time, each outstanding stock option award granted under WTT’s equity compensation

plans (a “WTT Stock Option Award”) that was outstanding as of the Effective Time and that had an exercise price per share

that was less than the Merger Consideration was accelerated in full, and each holder of each such WTT Stock Option Award will be paid

by the surviving corporation an amount in cash with respect to each share of Common Stock subject to such option equal to the Merger

Consideration less the applicable exercise price (as calculated pursuant to the Merger Agreement), less all applicable withholding and

other authorized deductions, and each WTT stock option award shall be cancelled and terminated as of the Effective Time.

At

the Effective Time, each outstanding restricted stock award granted under WTT’s equity compensation plans (a “WTT Restricted

Stock Award”) was accelerated in full, and was cancelled and terminated as of the Effective Time and each such WTT restricted stock

award was converted into the right to receive, with respect to each share of Common Stock subject to such WTT Restricted Stock Award

(as determined in accordance with the applicable award agreement relating thereto), the Merger Consideration, less all applicable withholding

and other authorized deductions.

At

the Effective Time, each outstanding restricted stock unit award granted under WTT’s equity compensation plans (a “WTT Restricted

Stock Unit Award”) was accelerated in full, and each such WTT Restricted Stock Unit Award was cancelled and terminated as of the

Effective Time and each holder of each such WTT restricted stock unit award will be paid by the surviving corporation an amount in cash

(without interest) equal to the product obtained by multiplying the aggregate number of restricted stock units underlying such WTT Restricted

Stock Unit Award as of the Effective Time, by the Merger Consideration.

| Item

3.01 |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The

descriptions contained under the Introductory Note and Item 2.01 are incorporated by reference into this Item 3.01.

In

connection with the consummation of the Merger, on the Closing Date, WTT notified the NYSE American (the “Exchange”) that

the Merger had closed and requested that the Exchange (1) suspend trading of the Common Stock, (2) remove the Common Stock from listing

on the Exchange prior to the open of trading on August 4, 2023, and (3) file with the SEC a notification of delisting of the Common Stock

under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, the Common Stock

will no longer be listed on the Exchange.

WTT

intends to file with the SEC certifications on Form 15 under the Exchange Act requesting the deregistration of the Common Stock under

Section 12(g) of the Exchange Act and the suspension of WTT’s reporting obligations under Sections 13 and 15(d) of the Exchange

Act.

| Item

3.03 |

Material

Modification to Rights of Security Holders. |

The

descriptions contained under the Introductory Note, Item 2.01, Item 3.01 and Item 5.01 are incorporated by reference into this Item 3.03.

In

connection with the Merger and at the Effective Time, holders of Common Stock immediately prior to such time ceased to have any rights

as stockholders in WTT (other than their right to receive the Merger Consideration pursuant to the Merger Agreement).

| Item

5.01 |

Change

in Control of Registrant. |

The

descriptions contained under the Introductory Note, Item 2.01, Item 3.01, Item 3.03 and Item 5.02 of this Current Report on Form 8-K

are incorporated by reference into this Item 5.01.

As

a result of the consummation of the Merger, a change in control of WTT occurred. Pursuant to the Merger Agreement, at the Effective Time,

Merger Sub was merged with and into WTT, with WTT continuing as the surviving corporation and becoming a wholly-owned subsidiary of Maury.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

The

descriptions contained under the Introductory Note and Item 2.01 of this Current Report on Form 8-K are incorporated by reference into

this Item 5.02.

In

connection with the Merger, each of C. Scott Gibson, Alan L. Bazaar, Jennifer Fritzsche, Michael Millegan, Allan D. L. Weinstein and

Timothy Whelan ceased to be members of the board of directors of WTT (the “Board”), and any committee thereof, effective

as of the Effective Time. In addition, at the Effective Time, Timothy Whelan ceased to be an executive officer of WTT.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

| Exhibit

No. |

|

Description

of Exhibit |

| 2.1(a)* |

|

Agreement and Plan of Merger, dated as of May 24, 2023, by and among Wireless Telecom Group, Inc., a New Jersey corporation, Maury Microwave, Inc., a Delaware corporation and Troy Merger Sub, Inc., a New Jersey corporation (incorporated by reference to Exhibit 2.1 to WTT’s Current Report on Form 8-K, filed with the SEC on May 25, 2023). |

| 2.1(b) |

|

First Amendment to Agreement and Plan of Merger, dated as of June 8, 2023 (incorporated by reference to Exhibit 10.1 to WTT’s Current Report on Form 8-K, filed with the SEC on June 12, 2023. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

| * |

Schedules

and similar attachments to the Merger Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S K. WTT hereby undertakes

to furnish supplementally copies of any of the omitted schedules and similar attachments upon request by the SEC. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

August 4, 2023 |

WIRELESS

TELECOM GROUP, INC. |

| |

|

|

| |

By: |

/s/

Michael Kandell |

| |

Name: |

Michael

Kandell |

| |

Title: |

Chief

Financial Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

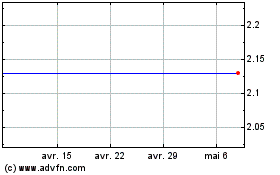

Wireless Telecom (AMEX:WTT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

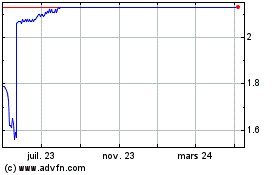

Wireless Telecom (AMEX:WTT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024