Intesa Sanpaolo On Track for Pre-Great Financial Crisis Profitability -- Market Talk

08 Mai 2023 - 10:37AM

Dow Jones News

Intesa Sanpaolo saw better-than-expected interest rate tailwinds

and sturdy asset quality trends in 1Q, which enabled the Italian

bank to raise its short and mid-term profitability objectives, now

expected at levels not seen since before the great financial

crisis, AlphaValue says. The bank said that it expects 2023 net

profit at around EUR7 billion as net interest income is forecast to

exceed EUR13 billion, around EUR1 billion higher than consensus,

AlphaValue analyst David Grinsztajn says in a note. The bank's

non-performing loan ratio stood at a stable 2.4% of gross loans, a

sign that asset quality trends showed no deterioration, the analyst

says. The bank's cost of risk at the end of the quarter came to a

"particularly benign" 17 basis points, he says.

(pierre.bertrand@wsj.com)

(END) Dow Jones Newswires

May 08, 2023 04:22 ET (08:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

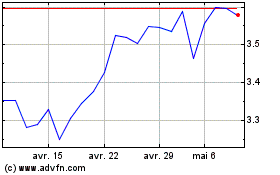

Intesa Sanpaolo (BIT:ISP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Intesa Sanpaolo (BIT:ISP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024