Boomers Interested In Bitcoin, Market Won’t Allow BlackRock To Buy BTC Below $60k

04 Décembre 2023 - 11:00PM

NEWSBTC

As institutional interest in Bitcoin grows, Fidelity and

BlackRock’s proposed spot Bitcoin Exchange-Traded Fund (ETF) faces

an unexpected hurdle: the crypto market’s unwillingness to let go

of the coin at bargain prices. Bitcoin To $60,000 In

Progress? According to Mike Alfred, who claims to be a value

investor and a board director, the market will “unlikely” allow

BlackRock to purchase BTC below $60,000. Taking to X on December 4,

Alfred said BlackRock and other Wall Street players keen on issuing

spot Bitcoin ETFs would have to “buy for Boomer’s 401k plans for at

least $60,000.” This preview stems from the rapidly growing

demand among institutional investors, as seen by the number of Wall

Street players willing to issue complex derivatives tailored for,

among other investors, “baby boomers,” most of whom are

“approaching retirement.” With their substantial retirement

savings, baby boomers increasingly recognize BTC’s potential as a

hedge against inflation and a store of value. Related Reading: ADA

In The Spotlight: Heavyweight Investors Pile Into Cardano, What’s

Next? Following Federal Reserve intervention during the COVID-19

pandemic, inflation rose to multi-year levels in 2021. To preserve

purchasing power, the central bank began hiking interest rates.

Although inflation has fallen and the economy stabilized, it

remains higher than the target of 2%. The Fed continues to track

this metric and may further intervene by raising rates to lower

inflation. This might impact Bitcoin prices, as seen in the past

months. Nonetheless, the potential influx of boomer money into

Bitcoin via a Securities and Exchange Commission (SEC) and

Commodity Futures Trading Commission (CFTC) approved derivatives

product is a big boost for the coin. Though the SEC has yet to

authorize multiple spot Bitcoin ETFs, the crypto and Bitcoin market

expects the strict regulator to greenlight the first product in the

next few weeks. BlackRock And Company To Buy BTC At A Premium

Accordingly, ahead of this milestone development for the Bitcoin

and crypto market, Alfred thinks BlackRock, Fidelity, and other

players won’t secure Bitcoin at spot rates. Instead, the market

anticipates that BlackRock, one of the world’s largest digital

asset managers, will make their “bi-weekly purchases at prices

above $60,000.” Related Reading: Bitcoin Cycle Analysis And Macro

Factors Reveal When Price Will Reach $125,000 The coin is trading

at April 2022 levels, ripping above $40,000 over the weekend as

bulls step up. Looking at the BTC candlestick arrangement on the

daily chart, the first clear resistance is around $48,000.

The coin trades within a bullish breakout formation following gains

above $32,000. As buyers step up and investors anticipate the SEC

approving the first batch of spot Bitcoin ETFs, the coin will

likely continue increasing toward all-time highs of around $70,000.

Feature image from Canva, chart from TradingView

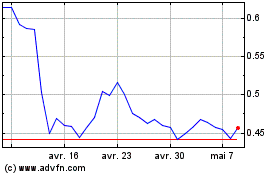

Cardano (COIN:ADAUSD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cardano (COIN:ADAUSD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024