Exponential Moving Average (EMA): How To Ride Massive Trends

04 Octobre 2022 - 7:59AM

NEWSBTC

Trading the crypto market can be tough and requires more than

buying and selling crypto assets; if you aim to become a successful

investor and trader in this field, this requires skills, patience,

and psychology to stay ahead of the game. Investors and traders are

always looking for ways to stay profitable in crypto by adopting

different trading strategies, using indicators, oscillators, and

chart patterns to have an edge and remain profitable in a bullish

and bearish market. Studies have shown that the crypto market

ranges by over 70%, while the remaining percentage allows traders

to spot trending opportunities. Let us discuss the Exponential

Moving Average (EMA), one of the widely used indicators by traders

and investors to remain profitable and ride massive trends in the

crypto market. Related Reading: Litentry Breaks Out Of A Descending

Triangle, Can Bulls Hit $1.2? What Is Exponential Moving Average

(EMA) The Exponential Moving Average is a type of Moving Average

tool employed in the technical analysis of crypto assets by many

traders and investors to spot potential buying and selling areas

and identify an asset’s current trend. There are two common

Moving Averages: the Simple Moving Average (SMA) and the

Exponential Moving Average (EMA). Most traders prefer using EMA

because it filters the price actions and volatility that come with

trading in the crypto market and gives traders a more realistic

value than the SMA by placing more weight on recent price data.

Trading with EMA gives a trader more opportunities. It helps you to

identify dynamic support and resistance, enabling you as a trader

to enter and exit trades when the trend reverses against your

trade. As a trader, you do not need to start learning the formulas

and how the Exponential Moving Average was achieved, all you need

to do is make use of it on tradingview.com while analyzing your

crypto assets. How To Use EMA And Ride Massive Trends The commonly

used Exponential Moving Averages are the 50 and 200-day EMA for

long-term traders to spot trends and ride early trends based on the

high timeframes. For short-term trading, traders use 8 and 20-day

EMA to spot trends, entries, exits, and potential price

reversals. Example Of 50 And 200-Day EMA From the chart

above, the price of Bitcoin/United State Dollars (BTCUSD) trades

below the 50 and 200 EMA, indicating a downtrend price movement

with the 50 and 200-day EMA acting as resistances for the price of

Bitcoin (BTC), preventing the price from going higher. The 50 EMA

responds faster to a price change, so a break and close above the

50 and 200 EMA indicates a potential change in the trend from

bearish to bullish. Example Of 8 And 20-Day Exponential Moving

Average The 8 and 20-day Exponential Moving Average is used for

short-term trades and can be used to spot short changes in trends.

The 8-day EMA responds faster to change; as such, a crossover from

below could mean a potential change in price from a downtrend to an

uptrend. A close of prices above the 8 and 20 EMA could mean a

potential change in price from bearish to bullish. For better

confirmation, it would be ideal to trade this indicator with other

trading strategies and chart patterns like the descending triangle

from the Image above for better trading confirmation and

profitability. Related Reading: Helium (HNT) Holds Gains Amid

Market Downtrend Featured Image From Investopedia, Charts From

Tradingview

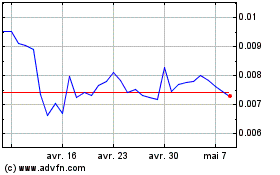

Amp (COIN:AMPUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Amp (COIN:AMPUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024

Real-Time news about Amp (Cryptomonnaies): 0 recent articles

Plus d'articles sur Amp