XRP Under The Microscope: Will It Break $2.9? Key Support Levels And Future Targets

04 Décembre 2024 - 3:00PM

NEWSBTC

XRP, the third-largest cryptocurrency by market capitalization, has

recently outperformed the top ten cryptocurrencies, including

Bitcoin (BTC) and Ethereum (ETH). This significant momentum comes

as investor sentiment grows in anticipation of clearer regulatory

frameworks in the United States, especially following Donald

Trump’s election. In addition, Securities and Exchange

Commission (SEC) Chairman Gary Gensler recently announced his

departure effective January 20, which many believe could pave the

way for increased adoption and institutional investment in XRP.

This could be achieved through the XRP exchange-traded fund (ETF)

market, which is being pursued by asset managers such as Canary

Capital, Bitwise, WisdomThree, and 21Shares. With the change

in leadership at the agency, the odds of approval continue to rise,

especially as the pro-crypto nominee to replace Gensler, Paul

Atkins, is shaping up to lead the new era of regulation in the

country. Key Fibonacci Resistance Ahead For XRP Over the past

thirty days, XRP has experienced a remarkable surge of 400%,

culminating in a six-year high of $2.91 reached over the past

weekend. This surge has been further supported by a

substantial increase in market capitalization, which has risen by

$120 billion in the last three weeks, bringing XRP’s total market

cap to approximately $140 billion. Related Reading: Analyst Says

Dogecoin Price At $1.3-$1.5 Is Still Possible, Here’s Why Despite

these encouraging trends, crypto analyst DarkDefender has

emphasized the importance of monitoring specific price levels in

the coming days. In a recent social media post on X (formerly

Twitter), he detailed critical Fibonacci levels for XRP. The

analyst identified $2.92 as a significant Fibonacci resistance

level, noting that XRP briefly reached $2.90 before experiencing a

“normal corrective phase.” DarkDefender highlighted the

necessity of holding certain support levels, particularly $2.13 and

$1.88, if XRP cannot break through the $2.92 resistance. The

analyst expects that the token could bounce between these levels

for a “few days,” but if the token breaks above $2.92, it could

target a new mid-range level of $3.99. This would mean a new

all-time high for the token above its current record mark of $3.40,

in the scenario that the token rises 59% as expected by

DarkDefender. Trading Volume Surges Past Bitcoin And Ethereum

Adding to the positive outlook, financial analyst Jacob King

pointed out a historic milestone for XRP: during the current

uptrend, XRP’s trading volume has surpassed the combined volumes of

Bitcoin and Ethereum for the first time. Related Reading:

Cardano Next In Line After XRP? ADA Price Targets $4.88 In Epic

Breakout Over the past 24 hours, XRP’s trading volume reached an

impressive $2.19 billion, significantly higher than Bitcoin’s $1.6

billion and Ethereum’s $531 million, underscoring the heightened

interest from investors in the XRP token. At the time of writing,

the market’s third largest token trades at $2.50, recording a 7%

correction in the 24 hour time frame. Featured image from DALL-E,

chart from TradingView.com

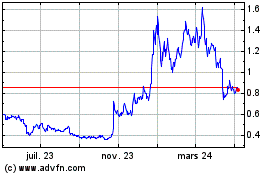

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024