Users Flee FTX? Exchange Sees 47% Drop In On-Chain Balance

07 Novembre 2022 - 3:23PM

NEWSBTC

The crypto industry is witnessing a new war between exchange giants

FTX, led by Sam Bankman-Fried, and Binance-led Changpeng “CZ” Zhao.

Over the past week, rumors emerged about the former exchange

becoming insolvent and holding an illiquid balance sheet.

Related Reading: Tron Transaction Volume Balloons To 5.3 Million In

Q3, But There’s Still Doubts Ahead The Binance CEO seems to be

fulling speculations. During the weekend, CZ expressed concerns

about “recent revelations” around FTX. In 2021, Binance invested

FTX and received around $2 billion in BUSD, and the Bankman-Fried

supported token FTT. Now, Binance will sell its FTT tokens

and liquidate any participation and equity in its competitor. The

decision was controversial as CZ constantly speaks about different

actors working together to grow the crypto industry. This time is

different for the executive, via Twitter CZ wrote: Regarding any

speculation as to whether this is a move against a competitor, it

is not. Our industry is in it’s nascency and every time a project

publicly fails it hurts every user and every platform (…). Running

The FTX Bank Despite CZ’s statement, the decision is considered

part of a “Bank Run,” when many customers withdraw their money from

a financial institution leading to insolvency, against the

Bankman-Fried led FTX. So far, the strategy is working. Data

from Dune Analytics indicates that the 24 hours NetFlow for FTX is

negative. In other words, people withdraw their tokens more than

they deposit them. The platform has seen a negative $26 million in

Netflow. As seen in the chart below, stablecoin USDC

dominated the Netflow. This metric trended to the downside with the

rumors of insolvency. On higher timeframes, the Bank Run worsens

with FTX recording -$86 million weekly Netflows and -$230 million

in 30 days. In the meantime, Binance began its attack on FTT. The

token has been following the general sentiment in the market, but

now it’s experiencing further selling pressure. In this

context, when Binance takes the short side of the trade in a crypto

bear market, who will bet against them taking the long side? FTT

seems poised for further losses in the coming months. We will

try to do so in a way that minimizes market impact. Due to market

conditions and limited liquidity, we expect this will take a few

months to complete. 2/4 — CZ 🔶 Binance (@cz_binance) November 6,

2022 Sam Bankman-Fried Clears The Air Via Twitter, Sam

Bankman-Fried addressed recent events claiming that a competitor is

trying to attack them with “false rumors.” In that sense, the

executive assured his followers that FTX is “fine” and solvent.

Bankman-Fried wrote: FTX has enough to cover all client holdings.

We don’t invest client assets (even in treasuries). We have been

processing all withdrawals, and will continue to be. It’s heavily

regulated, even when that slows us down. We have GAAP audits, with

> $1b excess cash. We have a long history of safeguarding client

assets, and that remains true today. Related Reading: Solana

Plunges 12% – Is FTX Selling Its SOL To Defend FTT? Bankman-Fried

called on CZ to work on a compromise and try to “work together for

the ecosystem.” Binance is yet to reply, but CZ seems adamant in

his position.

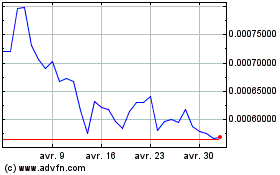

OMI Token (COIN:OMIUSD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

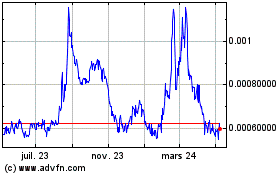

OMI Token (COIN:OMIUSD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024

Real-Time news about OMI Token (Cryptomonnaies): 0 recent articles

Plus d'articles sur ECOMI