Ethereum Holds Multi-Year Bullish Structure – Time For A Comeback?

19 Février 2025 - 12:00PM

NEWSBTC

Ethereum has been closing between $2,650 and $2,750 for the past

week, creating uncertainty in the short term. The price action

remains indecisive as bulls struggle to reclaim the $2,800 level, a

key supply zone that could determine Ethereum’s next move. While

the long-term outlook remains uncertain, Ethereum is trading at

crucial demand levels, facing continuous selling pressure that has

kept price action muted. Related Reading: Bitcoin STH Realized

Profit Reveals Strong Support Level – Time For A Breakout?

Investors are trying to stay calm amid volatility, but fear is

spreading as Ethereum shows signs of weakness compared to Bitcoin.

Some analysts worry that if ETH fails to hold above $2,600, a

deeper correction could follow. However, others remain optimistic,

suggesting that ETH could be forming a long-term bullish structure.

Crypto analyst Jelle shared a technical analysis on X revealing

that ETH still trades inside a multi-year ascending triangle, a

formation that has historically signaled strong potential for a

breakout. If ETH can hold above the current levels and push past

the $2,800 mark, it could trigger a recovery toward the key $3,000

resistance. For now, all eyes are on Ethereum’s next move, as the

coming days could be decisive in shaping its short-term trajectory.

Ethereum Testing Crucial Liquidity Levels Ethereum is currently

trading between key liquidity levels of short-term demand and

supply, with price action trapped in a tight range. Over the past

week, ETH has closed between $2,650 and $2,750, creating

uncertainty about its short-term direction. Investors remain

divided, with some expecting a further correction and extended

consolidation phase, while others anticipate a recovery rally soon.

The market is waiting for a breakout or breakdown confirmation to

determine the next trend. Related Reading: Altseason At Risk?

Expert Believes Ethereum Must Hold $2,600 To Sustain Momentum

Ethereum is attempting to push above the $2,700 mark and hold it as

support, which would be the first sign of bullish momentum.

However, for a confirmed recovery phase, ETH must reclaim the

$2,800 and $3,000 levels. These key resistance zones have acted as

strong supply areas in the past and will likely dictate Ethereum’s

next major move. If ETH fails to reclaim these levels, a deeper

correction into lower demand around the $2,500 mark could take

place. Jelle’s analysis on X reveals that ETH is still trading

inside a massive ascending triangle, a multi-year bullish pattern.

He noted that fakeouts have occurred on both the upside and

downside, taking out liquidity in both directions. With downside

liquidity now taken, Jelle expects a comeback soon, suggesting ETH

could soon attempt to reclaim lost ground. If Ethereum manages to

break above the $2,800 mark and sustain its momentum, a move toward

the $3,000 level would be the next target. However, if selling

pressure continues to dominate the market, ETH could remain in a

consolidation phase or even experience further downside. The next

few days will be crucial in determining whether ETH can regain

bullish momentum or if a deeper correction is ahead. Price Action

Lacks Short-Term Direction Ethereum is trading at $2,720 after days

of sideways movement below the $2,800 mark, struggling to gain

momentum for a breakout. Bulls need to step up and push the price

above this level as soon as possible to shift sentiment and reclaim

control of price action. The $2,800 mark has acted as a strong

supply zone, and breaking above it would open the door for a move

toward the $3,000 level. On the downside, defending the $2,700 and

even the $2,600 level is crucial for maintaining bullish momentum.

If ETH holds these levels for an extended period, it would signal

strong demand and support the possibility of a recovery rally. A

sustained move above $2,700 would encourage buyers to step in,

increasing the chances of ETH retesting higher resistance zones.

Related Reading: Are Meme Coins Hurting Solana? Rising Selling

Pressure Sparks Investor Concerns However, failure to hold above

$2,700 could expose Ethereum to further selling pressure. If ETH

drops below the $2,600 level, a deeper correction into lower demand

areas around $2,500 could follow. The next few days will be

decisive in determining whether Ethereum can establish a solid base

for a bullish reversal or if bears will continue to dominate price

action. Featured image from Dall-E, chart from TradingView

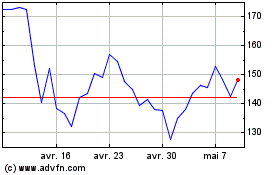

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025