Lido Finance Cements DeFi Lead, Expands To Optimism: Is LDO Undervalued?

17 Octobre 2024 - 5:00AM

NEWSBTC

Lido Finance, the largest DeFi platform by assets under management,

is expanding. The liquidity staking platform said it now supports

the deployment of its stETH value-accruing token on Optimism, a

layer-2 solution for Ethereum. Expansion to Optimism: What It Means

In a blog post, Lido Finance said the decision will allow its users

to benefit from daily staking rewards. At the same time, the

platform said, those who choose to deploy their stETH on Optimism

will have a seamless bridging experience while concurrently

unlocking other multichain opportunities. Related Reading: Polkadot

(DOT) Gearing Up For ‘Massive Breakout’, Will It Skyrocket To $20?

The deployment means Lido Finance is expanding in line with its

multichain strategy. By offering stETH and wstETH on multiple

layer-2 platforms on Ethereum, including on Arbitrum, the liquidity

staking solution gives users a more flexible way to stake their

ETH. Moreover, because Ethereum layer-2 solutions are designed to

be scaled, all transactions, Lido Finance said, will be cheap. Lido

Finance is among several liquidity-staking platforms that allow

users to stake their ETH and earn a yield. This is possible because

Ethereum successfully migrated from a proof-of-work consensus to a

staking system in 2022 after the Merge. Once developers powered off

the proof-of-work system, the network was migrated to the Beacon

chain. In this new chain, validators secured and processed all

transactions. With validators in the equation, those who sought to

operate full nodes and compete for a part of the 3 ETH block reward

and fees had to lock in 32 ETH. This threshold was out of reach for

most users. Accordingly, the platform allows users to stake ETH

without having the 32 ETH required to run a full node. Related

Reading: Dogecoin Sees Sharp Decline: Over 106,000 Wallets Abandon

The Memecoin Lido Finance Manages Over $25 Billion, LDO Down 72% In

9 Months As of October 16, DeFiLlama data shows that Lido Finance

had a total value locked (TVL) of over $25 billion. Over the last

year alone, the protocol has generated over $845 million in the

last year and more than $1.8 billion since launching. Although the

protocol helps secure the Ethereum mainnet, ETH holders of several

layer-2s, including Arbitrum, Base, Linea, and Scroll, can stake

directly from these off-chain solutions. Despite Lido Finance

growing its ecosystem, LDO prices are struggling for momentum. Even

after gains of October 14, the token is yet to break above

September highs and reverse losses of the last nine months. After

peaking in March, LDO is down 72%. Feature image from iStock, chart

from TradingView

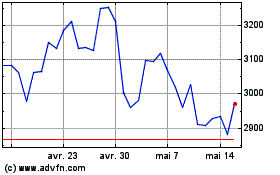

stETH (COIN:STETHUSD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

stETH (COIN:STETHUSD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025