Ayvens publishes the Purchase Price Allocation of LeasePlan

10 Janvier 2024 - 7:30AM

Ayvens publishes the Purchase Price Allocation of LeasePlan

Ayvens progressed further in the integration of

LeasePlan, which is proceeding according to plan.

The allocation of LeasePlan’s purchase price to

acquired assets and assumed liabilities as at the date of

acquisition closing (22 May 2023)1 led Ayvens to revise upwards the

value of LeasePlan’s net assets by

c. EUR 230 million, as a result of the assessment of

LeasePlan’s assets and liabilities at fair value2:

- Lease assets: c. EUR +380 million;

- Customer relationship: c. EUR +150 million3;

- Software: c. EUR -200 million;

- Other assets and liabilities: c. EUR -100 million.

Subject to any final Purchase Price

Allocation and/or acquisition price adjustment within one year from

closing4, the goodwill recognized on the acquisition is reduced by

c. EUR 220 million to

c. EUR 1,390 million. This has a positive impact on

the CET1 capital of c. EUR 220 million, in line with

previous indications.

Without pre-empting any potential impact from

the accounting closure of its full year 2023 financial results,

Ayvens expects its Q4 and full year 2023 results, whose release is

planned for 8 February 2024, to be negatively impacted by:

- Purchase Price Allocation: c. EUR -45 to -65 million

(pre-tax)5, primarily due to higher rental fleet depreciation as a

result of the lease assets’ upwards valuation, whose impact is

partially offset by lower software amortization and the recognition

of LeasePlan’s actual Used Car Sales results6;

- Accounting Marked-to-Market of derivatives: c. EUR -150 million

impact on Leasing contract margin in Q4 2023, as a result of the

recent decline in interest rates. While the stock of MtM of the

hedging derivatives portfolio was reduced to c. EUR +65 million as

at 31 December 2023 (from EUR +216 million as at 30 September

2023), potential changes in interest and foreign exchange rates

could lead to some volatility on revenues over the coming

quarters.

|

|

|

About Ayvens |

|

Ayvens is the leading global sustainable mobility player committed

to making life flow better. We’ve been improving mobility for

decades, providing full-service leasing, flexible subscription

services, fleet management and multi-mobility solutions to large

international corporates, SMEs, professionals and private

individuals. |

|

With 15,700 employees across 43 countries, 3.4 million vehicles and

the world’s largest multi-brand EV fleet, we’re leveraging

our unique position to lead the way to net zero and

spearhead the digital transformation of the mobility sector. (The

company is listed on Compartment A of Euronext Paris (ISIN:

FR0013258662; Ticker: ALD). Societe Generale Group is Ayvens

majority shareholder.Find out more at ayvens.com |

|

|

|

Press Contact |

| Stephanie

JonvilleChief Communications OfficerTel: +33 (0)6 46 14 81

90stephanie.jonville@ayvens.com |

|

|

|

|

|

1 Subject to the finalization of audit

procedures by the Statutory Auditors

2 In accordance with IFRS 3 “Business

combinations”

3 Customer relationship of c. EUR 280 million

before cancellation of pre-existing customer relationship at

LeasePlan

4 In accordance with IFRS 3 “Business

combinations”

5 Estimated impact based on Ayvens’ forecast of

LeasePlan’s Used Car Sales result in Q4 2023

6 Pending the finalization of the Purchase Price

Allocation, no UCS result was assumed in Q2 and Q3 2023

- 2024 01 10 PR PPA_Ayvens_FV

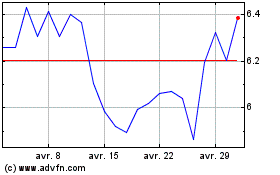

ALD (EU:ALD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ALD (EU:ALD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024