Bonduelle - First Half Year 2022-2023 Revenue: Growth in activity

fuelled by price increases / Adaptation of industrial set up for

ready-to-use fresh segment in the United States

BONDUELLE

A French SCA (Partnership Limited by Shares) with

a capital of 57 102 699,50 EurosHead Office: La Woestyne 59173

Renescure, FranceRegistered under number: 447 250 044

(Dunkerque Commercial and Companies Register)

First Half Year 2022-2023

Revenue(July 1 - December 31, 2022)

Growth in activity fuelled by price

increases Adaptation of industrial set up for

ready-to-use fresh segment in the United States

- Acceleration of group

revenue growth in the 2nd quarter

driven by the canned and frozen activities

- Significant favorable

currency impact

- Merger of the industrial

activities of the Florence and Swedesboro

sites (New Jersey - USA)

In accordance with

IFRS 5, the 2021-2022 income statement items relating to the North

American canned and frozen activities, which were sold on June 30,

2022, of which the group now holds 35%, have been restated and

combined under "net profit from discontinued operations". Revenue

reported in the 2021-2022 consolidated income statement therefore

excludes these "discontinued operations", according to the IFRS

standards.

The Bonduelle Group's revenue for the 1st half

of financial year 2022-2023 amounted to € 1,243.4 million, compared

with € 1,094.6 million for the 1st half of the previous financial

year which represents a growth of +13.6% at current exchange rates

and +6.1% on a like for like basis* with favorable currency

variations boosting sales growth by +7.5%. The growth of the 2nd

quarter revenue shows an acceleration compared to the 1st quarter

at +16.0% at current exchange rates and +7.6% on a like for like

basis*.

Activity by Geographic

Region

|

Total Consolidated Revenue(in €

millions) |

1st HY

2022-2023 |

1st

HY2021-2022 |

Variation Reported figures |

Variation Like for like

basis* |

2nd

Quarter2022-2023 |

2nd

Quarter2021-2022 |

Variation Reported figures |

Variation Like for like

basis* |

|

Europe Zone |

739.1 |

663.8 |

11.4% |

12.3% |

390.5 |

343.3 |

13.7% |

14.8% |

|

Non-Europe Zone |

504.2 |

430.8 |

17.0% |

-3.4% |

281.6 |

236.3 |

19.2% |

-2.9% |

|

Total |

1,243.4 |

1,094.6 |

13.6% |

6.1% |

672.1 |

579.6 |

16.0% |

7.6% |

Activity by Operating

Segments

|

Total Consolidated Revenue(in €

millions) |

1st HY

2022-2023 |

1st

HY2021-2022 |

Variation Reported figures |

Variation Like for like

basis* |

2nd

Quarter2022-2023 |

2nd

Quarter2021-2022 |

Variation Reported figures |

Variation Like for like

basis* |

|

Canned |

597.1 |

490.0 |

21.9% |

14.1% |

357.0 |

284.9 |

25.3% |

15.9% |

|

Frozen |

138.5 |

118.2 |

17.2% |

16.6% |

76.9 |

64.6 |

19.0% |

18.2% |

|

Fresh processed |

507.7 |

486.4 |

4.4% |

-4.4% |

238.2 |

230.0 |

3.5% |

-5.6% |

|

Total |

1,243.4 |

1,094.6 |

13.6% |

6.1% |

672.1 |

579.6 |

16.0% |

7,6% |

Europe Zone

The Europe Zone representing 59.4% of the business activity over

the period, posted an overall growth of +11.4% at current exchange

rates and +12.3% on a like for like basis* over the 1st half of the

year, with all technologies showing growth over the period. The

variations for the 2nd quarter were respectively +13.7% and +14.8%,

accelerating compared to the 1st quarter. The policy of price

increase intended to partially compensate for inflations in

production costs continues, particularly in canned and frozen

activities. A limited decline in volumes over the period was noted.

This is explained by the quotas applied to certain products

following a deficit harvest.The frozen activity showed positive

volume growth both in food service, which is continuing its

post-covid recovery, and in retail (success of recent innovations

launched, in particular under the Cassegrain brand).The

ready-to-use fresh segment (salad bags and processed), where cost

increases, and therefore price increases, are more limited, showed

growth in value and a stability in volumes. Supply difficulties and

less dynamic markets in salads were offset over the period by a

particularly dynamic summer season in processed segment.

Non-Europe

Zone The Non-Europe Zone revenue representing

40.6% of the business activity in the 1st half year, posted +17.0%

at current exchange rates and -3.4% on a like for like basis*.

Variations for the 2nd quarter were respectively +19.2% and

-2.9%.In an uncertain geopolitical context, the Eurasia zone posted

higher revenue (canned and frozen), linked to price increases, with

volumes in this area slightly down on the previous year.In North

America, the ready-to-use fresh segment declined over the period,

impacted on the one hand by the loss of contracts in the 2nd half

of financial year 2021-2022, by a salad segment that was itself in

decline, and on the other hand by an agronomic crisis affecting

salad yields in the Salinas region, generating a significant

shortage of products and a rise in purchase prices. In this

context, the Bonduelle Group decided to adapt its manufacturing set

up on the East Coast of the United States to the expected level of

activity and refocused on profitable business segments (see

below).

Other significant

information

Adaptation of the

American industrial set upIn order to improve its

competitiveness in the ready-to-use fresh produce market in the

United States and to refocus its activity on its valued segments,

the Bonduelle Group is adapting the industrial structure of its

activity on the East Coast of the United States.Thus, the

manufacturing activities in Florence (New Jersey) will be merged in

the coming months with the Swedesboro site, also in New Jersey.

This operation aims to optimize the production of all products for

customers nationally, while achieving gains in efficiency and

coverage of fixed costs.The current Florence site will be converted

into a warehouse for the East Coast, maintaining these jobs on the

site and all current Florence production workers will be offered a

position in Swedesboro. The financial impact of this reorganization

will be recorded in the 2022-2023 fiscal year under non-recurring

items, which will be specified when the half-year results are

presented.

Outlook

In a particularly uncertain environment, the

achievement of the group’s objectives in terms of business growth

and profitability for financial year 2022-2023, which will be

specified during the half year presentation, will remain dependent

both on the dynamics of consumption which are difficult to predict

and on price increases, once again essential to compensate changes

in certain components of the cost price, in particular agricultural

materials.

* at constant currency exchange rate and scope

of consolidation basis. The revenues in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows:

- For businesses acquired (or gain of

control) during the current period, revenue generated since the

acquisition date is excluded from the organic growth

calculation;

- For businesses acquired (or gain of

control) during the prior fiscal year, revenue generated during the

current period up until the first anniversary date of the

acquisition is excluded;

- For businesses divested (or loss of

control) during the prior fiscal year, revenue generated in the

comparative period of the prior fiscal year until the divestment

date is excluded. In the specific case of the loss of control of

the long life activities in North America, the IFRS 5 standard

having been applied to the historical data, the revenue is already

restated in the historical elements;

- For businesses divested (or loss of

control) during the current fiscal year, revenue generated in the

period commencing 12 months before the divestment date up to the

end of the comparative period of the prior fiscal year is

excluded.

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com.

Next financial events:

- 2022-2023 1st Half Year

Results: March 3,

2023 (prior to stock exchange trading session)- 2022-2023 3rd

Quarter FY

Revenue: May 4, 2023

(after stock exchange trading session)

About

the Bonduelle Group

We want to inspire the

transition toward a plant-based diet, to contribute to people’s

well-being and planet health. We are a French family business with

11,900 employees and we have been innovating with our farming

partners since 1853. Our products are cultivated on 73,000 acres

and marketed in 100 countries, with a revenue of € 2,203 million

(data as of June 30, 2022).

Our 4 strong brands

are: BONDUELLE, READY PAC FOODS, CASSEGRAIN and GLOBUS

Bonduelle is listed on

Euronext compartment BEuronext indices: CAC MID & SMALL - CAC

FOOD PRODUCERS - CAC ALL SHARESBonduelle is part of the Gaïa

non-financial performance index and employee shareholder index

(I.A.S.)Code ISIN: FR0000063935 - Code Reuters : BOND.PA - Code

Bloomberg : BON FP

Find out about the

group’s current events and news on Twitter @Bonduelle_Group, and

its financial news on @BonduelleCFO

This document is a free translation into English

and has no other value than an informative one. Should there be any

difference between the French and the English version, only the

French-language version shall be deemed authentic and considered as

expressing the exact information published by Bonduelle.

- Bonduelle - First Half Year 2022-2023 Revenue

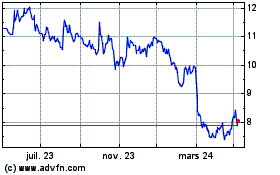

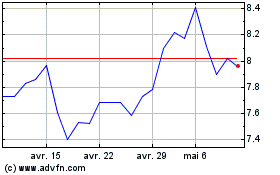

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024