THESE CAPITAL INCREASES WILL RESULT IN A

MASSIVE DILUTION OF THE EXISTING SHAREHOLDERS AND COULD LEAD TO A

SIGNIFICANT DECREASE IN THE STOCK MARKET PRICE, THE VALUE OF THE

SHARE AFTER THESE TRANSACTIONS POSSIBLY BEING LESS THAN

€0.02

Regulatory News:

The accelerated safeguard plan of ORPEA SA (the

“Company”) (Paris:ORP), adopted by the Nanterre Specialised

Commercial Court on 24 July 2023 (the “Accelerated Safeguard

Plan”), provides for the implementation of three capital

increases, namely (i) a capital increase with maintenance of the

preferential subscription right, backstopped by the unsecured

creditors of the Company subscribing, if applicable, by way of

set-off against their claims, in an amount (including the issue

premium) of 3,884,212,344.65 euros, by issue of 64,629,157,149 new

shares at an issue price of 0.0601 euro per new share (the

“Equitization Capital Increase”), (ii) a capital increase

with cancellation of the preferential subscription right in favor

of named persons, for the benefit of Caisse des Dépôts et

Consignations, Mutuelle Assurance Instituteurs de France (MAIF),

CNP Assurances and MACSF Epargne Retraite (or companies affiliated

with them), with a priority period granted to the Existing

Shareholders (as defined below) of the Company, allowing them to

subscribe by preference to the shares issued, in an amount

(including the issue premium) of 1,160,080,551.59 euros, by issue

of 65,173,064,696 new shares at an issue price of 0.0178 euro per

new share (the “Groupement Capital Increase”) and (iii) a

capital increase with maintenance of the shareholders' preferential

subscription right in an amount (including the issue premium) of

390,019,672.62 euros, by issuing 29,324,787,415 new shares at an

issue price of 0.0133 euro per new share, to which the members of

the Groupement have committed to subscribe in the amount of

approximately 196 million euros, the balance, i.e. 194 million

euros, being guaranteed by five institutions holding a significant

portion of the Company's unsecured debt (the “Rights Issue”

and together with the Equitization Capital Increase and the

Groupement Capital Increase, the “Capital increases”).

It is reminded that the Existing Shareholders of the Company

will be granted preferential subscription rights enabling them to

subscribe (on an irreducible basis only) to the Equitization

Capital Increase and will benefit from a priority period enabling

them to subscribe by preference (on an irreducible basis only) to

the Groupement Capital Increase; this priority right is

non-negotiable and non-assignable.

Only the Existing Shareholders of the Company shareholders whose

securities are registered in an account on the reference date for

the granting of preferential subscription rights in the context of

the Equitization Capital Increase (the “Existing

Shareholders”) (currently anticipated around 15 November 2023

according to the indicative timetable envisaged) (the “Reference

Date”) will benefit from preferential subscription rights

enabling them to participate in the Equitization Capital Increase

and the priority period enabling them to participate in the

Groupement Capital Increase1. Any cash received by the Company in

respect of the subscriptions (including by the Existing

Shareholders) to new shares as part of the Equitization Capital

Increase on exercise of their preferential subscription rights will

be allocated to the repayment of the Company’s unsecured debt, at

par and pro rata.

It is reminded that the Existing Shareholders will benefit from

the priority period in the context of the Groupement Capital

Increase on the basis of the number of shares held by them on the

Reference Date, adding to it, where applicable and provided that

all the shares they hold on the Reference Date are held in pure

registered form (see box below), the shares that they may have

subscribed in the context of the Equitization Capital Increase upon

exercise on an irreducible basis of the preferential subscription

rights detached from the shares they held on the Reference Date

(excluding any new shares subscribed on exercise of additional

preferential subscription rights acquired by the Existing

Shareholders).

Thus, for each Existing Shareholder, the number of shares to

which it will be entitled to subscribe under the priority period in

the context of the Groupement Capital Increase will be equal to the

ratio of its eligible shares (as determined in accordance with the

preceding paragraph) on the total number of shares comprising the

Company's capital upon completion of the Equitization Capital

increase, applied to the number of shares issued as part of the

Groupement Capital increase.

In addition, it is recalled that the issue price of the new

shares in the context of the Equitization Capital Increase (0.0601

euro per share) is significantly higher than the issue price of the

shares to be issued in the context of the Groupement Capital

increase and in the context of the Rights Issue (0.0178 euro and

0.0133 euro per share respectively).

Consequences of capital increases for

Existing Shareholders – illustration based on a numerical

example

The implementation of the aforementioned capital increases will

result in a massive dilution for the Existing Shareholders and may

also lead to a very sharp decrease in the share price, which should

be close to the issue price of the Capital Increases. The Existing

Shareholders who wish to maintain their current level of equity

participation by exercising all their rights attached to the

Capital Increases would thus have to invest significant amounts in

the subscription of the new shares issued, and may suffer a very

significant loss in market value of the shares.

A simulation of the impact of the planned operations is

presented below for illustrative purposes only. This simulation is

based on assumptions and items beyond the Company's control (in

particular, changes in the Company's share price).

Illustrative example - Investments to be made by an Existing

Shareholder holding 75 Shares on the Reference Date and wishing to

maintain its current shareholding percentage post-Capital

Increases; loss of corresponding value estimated on the basis of a

post-Capital increase share price which would be the subscription

price of the Groupement Capital increase (€0.0178).

Equitization Capital Increase

The Existing Shareholder holding 75 shares of the Company on the

Reference Date, if it wishes not to be diluted by the Equitization

Capital Increase, should subscribe to the Equitization Capital

Increase by exercising all of its preferential subscription rights

on an irreducible basis up to 74 925 new shares2 , corresponding to

a total subscription price of EUR 4,503, compared to a

holding of 75 shares currently valued at approximately EUR

113, based on the closing price of the ORPEA share on 10

October 2023.

On this basis, and assuming that the share price after Capital

Increases would align with the subscription price of the Groupement

Capital increase (for illustrative purposes), the value of the

shares held by the Existing Shareholder would amount to 1,335

euros, with an investment thus corresponding for him to a latent

loss of market value of the shares of 3,169 euros (-70% of

the amount invested).

Groupement Capital Increase

The Existing Shareholder having subscribed for all of its rights

to the Equitization Capital Increase, if it wishes not to be

subsequently diluted as a result of the Groupement Capital

increase, should exercise its right of priority and subscribe on an

irreducible basis to the Groupement Capital Increase up to all its

rights. The number of shares retained for the priority right would

be equal to: 75 shares (i.e. the number of shares held on the

Reference Date) + 74,925 shares (i.e. the number of new shares

subscribed as part of the Equitization Capital increase, provided

that the Existing Shareholder holds its shares in the pure

registered form on the Reference Date, see box below) = 75,000

shares. The Existing Shareholder could therefore place an

irreducible priority subscription order for 75,555 new shares3

issued as part of the Groupement Capital increase, for a total

subscription price of €1,345.

Thus, in order to maintain its percentage of participation

unchanged following the Equitization Capital Increase and the

Groupement Capital Increase, the Existing Shareholder holding 75

shares should subscribe to 150,480 new shares and invest a total

of 5,848 euros.

On this basis, and assuming that the share price after the

Capital Increases would align with the subscription price of the

Groupement Capital increase (for illustrative purposes), the value

of the shares held by the Existing Shareholder would amount to

2,683 euros, corresponding for it to a latent loss of market value

of the new shares of 3,169 euros (-54% of the cumulative

amount invested).

Rights Issue

The Existing Shareholder having subscribed to the full amount of

its rights to the Equitization Capital Increase and to the

Groupement Capital Increase, if it wishes not to be subsequently

diluted as a result of the Rights Issue, should exercise all of its

preferential subscription rights on an irreducible basis up to

33,992 new shares4 issued as part of the Rights Issue, i.e. a total

subscription price of 452 euros.

Thus, in order to maintain its percentage of participation

unchanged following the three Capital Increases, the Existing

Shareholder holding 75 shares before the launch of the Equitization

Capital Increase would have to invest a total of 6,300

euros.

On this basis, and assuming that the share price after Capital

Increases would align with the subscription price of the Groupement

Capital increase (for illustrative purposes), the value of the

securities held by the Existing Shareholder would amount to 3,289

euros, corresponding for him to a latent loss of market value of

3,016 euros (-48% of the cumulative amount invested).

IMPORTANT

The attention of the Existing Shareholders currently holding

their shares in bearer form (au porteur) or in the administered

registered form (forme nominative administrée) is drawn to the need

to request that their shares be converted into pure registered form

(nominatif pur) by the Reference Date at the latest (i.e. around 15

November 2023 according to the indicative timetable envisaged) if

they wish that the new shares that they would subscribe for on an

irreducible basis (à titre irréductible) in the context of the

Equitization Capital Increase be taken into account when

exercising, where applicable, the right of priority that would be

open to them in the context of the Groupement Capital

Increase.

In the absence of a pure registered form, the new shares

subscribed by the Existing Shareholders upon the exercise of their

preferential subscription rights in the context of the Equitization

Capital Increase will not be taken into account for the purpose of

calculating their priority right.

It is specified that shareholders who have not converted

their shares in the pure registered form may nevertheless subscribe

to the Equitization Capital Increase and to the Groupement Capital

Increase. However, only the shares registered in the Existing

Shareholder’s securities account on the Reference Date will be

taken into account in this case, without taking into account the

new shares subscribed (if any) in the context of the Equitization

Capital Increase.

Shareholders wishing to have their shares converted into the

pure registered form are invited to apply to Société Générale

Securities Services, via the online platform accessible at the

following link:

https://forms.kroll.com/orbeon/fr/is/socgen-kyc/new?form-version=1

Shareholders are reminded that converting their shares to

pure registered form may result in processing delays, depending in

particular on the practices of their account holder.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 21 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, MSCI Small Cap Europe and CAC Mid 60

indices.

Disclaimer

This document does not constitute and shall not be considered as

constituting an offer to the public or a purchase offer or aimed at

soliciting public interest in view of a transaction by way of a

public offer.

Prospectuses relating to the capital increases will be submitted

by the Company to the approval of the Autorité des marchés

financiers before the effective launch of each capital

increase.

_________________________ 1This priority period will therefore

not benefit (i) unsecured creditors who may become shareholders of

the Company following the Equitization Capital Increase nor (ii) to

new shares subscribed to by the Existing Shareholders who also

qualify as unsecured creditors, as a result of the conversion of

their debt in the context of the Equitization Capital Increase.

2The Existing Shareholder will be granted a preferential

subscription right per share held, a preferential subscription

right giving the right to subscribe to 999 new shares as part of

the Equitization Capital Increase. 3The Existing Shareholder may

subscribe to the Groupement Capital Increase (65,173,064,696 shares

to issue) up to the share of its eligible shares in the capital of

the Company post Equitization Capital Increase, being specified

that if the exercise of the right of priority results in a number

of shares other than a whole number, then the number of shares to

which this Existing Shareholder can subscribe will be rounded down

to the lower integer. On this basis, in the example, the Existing

Shareholder will therefore be able to subscribe to

(75,000/64,693,851,000) x 65,173,064,696 = 75,555 new shares under

his priority right. 4The Existing Shareholder will be granted a

preferential subscription right per share held, with 31

preferential subscription rights giving the right to subscribe to 7

new shares as part of the Rights Issue.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231011564103/en/

Investor Relations

ORPEA Benoit Lesieur Investor Relations Director

b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations

NewCap Dusan Oresansky Tel: 01 44 71 94 94

ORPEA@newcap.eu

Press Relations

ORPEA Isabelle Herrier-Naufle Press Relations Director

Tel: 07 70 29 53 74 i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 - 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

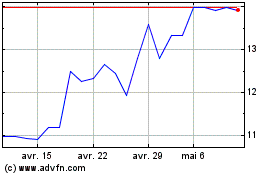

Orpea (EU:ORP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Orpea (EU:ORP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024