Regulatory News:

Verallia (Paris:VRLA):

HIGHLIGHTS

- Revenue down to €836 million in Q1 2024, or -20.5%

compared to Q1 2023 (-12.7% at constant scope and exchange

rates)1

- Adjusted EBITDA2 at €204 million (24.4% margin) from

€307 million in Q1 2023 (29.2% margin)

- Strong net debt ratio maintained at 1.5x last 12-month

adjusted EBITDA, compared to 1.3x at March 31, 2023 and 1.2x at

December 31, 2023

- Awaiting regulatory approval for the acquisition of

Vidrala's Italian glass business for an enterprise value of €230

million

- Start-up of the 100% electric furnace in Cognac, a world

premiere that will reduce CO2 emissions by 60%

- Confirming guidance of an adjusted EBITDA of around €1

billion in 2024

"Verallia started the year in line with expectations, with lower

activity and prices compared to Q1 2023 which set a high basis of

comparison. As expected, we are seeing encouraging signs of

recovery from the Q4 2023 low. The continued commitment of our

teams and the impact of the Performance Action Plan have enabled us

to post a sequentially improving performance in the current market

context. We confirm our guidance of an adjusted EBITDA of around €1

billion in 2024, with performance gradually improving over the

course of the year. We are also pursuing our targeted external

growth policy with the signing at the end of February of an

agreement to acquire Vidrala's glass activities in Italy,"

commented Patrice Lucas, Chief Executive Officer of Verallia.

Revenue

In millions of euros

Q1 2024

Q1 2023

Revenue

836.4

1,051.6

Reported growth

-20.5%

+40.2%

Organic growth

-12.7%

(-20.7% excl. Argentina)

+34.7%

(+31.3% excl. Argentina)

Revenue for the first quarter of 2024 amounted to €836

million, down -20.5% on a reported basis compared to the first

quarter of 2023.

Foreign exchange impact was -8.2%, or -€85.8 million. It

is almost entirely linked to the sharp depreciation of the

Argentinian peso over the period.

The scope effect, related to the acquisition of cullet

processing centers in Iberia in Q4 2023, contributed €4 million,

or +0.4%.

At constant scope and exchange rates, revenue was down

-12.7% (-20.7% excluding Argentina). As expected, sales volumes

were down sharply compared to Q1 2023, but up slightly from the Q4

2023 low point. This start of recovery, which should intensify in

the second quarter, is in line with the outlook presented in the

2023 annual results.

Selling prices are also down across Europe compared to the peak

reached in H1 2023. Only Argentina recorded a sharp increase linked

to local inflation. Product mix was also slightly negative in the

first quarter.

By geographical area:

- In Southern and Western Europe,

volumes were down compared to the first quarter of 2023, but have

month after month returned to a positive trend compared to the end

of last year.

- In Northern and Eastern Europe,

the decline in volumes was particularly pronounced in Germany and

the United Kingdom, especially in beer and spirits.

- In Latin America, volumes were

down in the quarter despite the sharp rebound in demand in Chile

after a difficult 2023. Business was stable in Argentina, where

price increases offset the impact of foreign exchange. Volumes were

down in Brazil (wine and grape juice in particular).

Adjusted EBITDA

In millions of euros

Q1 2024

Q1 2023

Adjusted EBITDA

203.9

307.4

Adjusted EBITDA margin

24.4%

29.2%

Adjusted EBITDA was €204m in the first quarter of

2024.

As anticipated, the impact of activity was significant at -€91

million, taking into account the decline in volumes sold and the

lower stocking effect compared to Q1 2023 when the Group was fully

utilizing its capacities to replenish its inventories. Inflation

spread3 was negative and also weighed on EBITDA for the quarter to

the tune of -€9 million despite a positive spread of +€24 million

in Argentina.

Also the Performance Action Plan (PAP) once again delivered

excellent results, generating a net reduction in cash production

costs of 2.8% or €18 million over the quarter.

Finally, the unfavorable impact of foreign exchange rates

amounted to -€26 million. It is mainly due to the depreciation of

the Argentinian peso and offsets in absolute terms the positive

impact of price increases and spread in local currency.

Adjusted EBITDA margin decreased to 24.4% compared to

29.2% in Q1 2023.

A VERY STRONG BALANCE SHEET

At the end of March 2024, Verallia's net debt stood at €1,496

million, leading to a debt ratio of 1.5x last 12-month

adjusted EBITDA, compared with 1.3x at March 31, 2023 and 1.2x

at December 31, 2023.

In March 2024, Verallia exercised the option to extend the €1.1

billion syndicated credit facility closed in April 2023 by 1 year,

bringing the maturities to 2028 for the Term Loan and 2029 for the

revolving credit facility.

The Group had liquidity4 of €725 million as of March 31,

2024.

Its long-term credit rating was confirmed by Moody's (Baa3 –

outlook stable) on 26 March 2024.

SIGNING OF AN AGREEMENT FOR THE ACQUISITION OF THE ITALIAN

GLASS ACTIVITIES OF VIDRALA

On February 28, 2024, Verallia entered into an agreement to

acquire Vidrala's glass business in Italy, which generated revenue

of €131 million and EBITDA of €33 million in 2023. With this

acquisition, Verallia would expand its capabilities in the Italian

market, where the Group would operate 7 production sites.

Transaction amounts to €230 million in enterprise value and will be

financed through external debt.

The completion of the transaction is subject to the approval of

the Italian Competition Authorities under the Italian Merger

Control Law and the Italian Government under the Foreign Investment

Regulations, as well as the customary conditions precedent.

The Group aims to complete the acquisition between the second

and third quarters of 2024.

START OF THE COGNAC 100% ELECTRIC FURNACE, A WORLD

PREMIERE

Verallia started up the 100% electric furnace in Cognac in March

2024. This furnace, with a capacity of 180 tons per day, is a world

premiere in the glass packaging industry.

It will produce flint glass bottles for Cognac consumers. The

first deliveries are expected by the end of Q2 2024.

Thanks to a 60% reduction in CO2 emissions, this furnace will

contribute to the industrial decarbonization of Verallia France.

With this investment, Verallia takes on a leading role within the

sector, with a view to decarbonizing the industry.

2024 OUTLOOK

After 2023 saw a sharp weakening in demand in Europe under the

combined effect of a drop in end consumption and destocking,

Verallia confirms its forecast of a gradual recovery in activity in

2024. The first quarter was in line with our expectations, with

volumes gradually improving compared to end-2023 levels.

In this context, Verallia confirms its objective of achieving an

adjusted EBITDA of around €1 billion in 2024, with such EBITDA down

year-on-year in the first half (high 2023 comparison base) but up

year-on-year in the second half (rebound in volumes).

This objective will be achieved thanks to the expected growth in

activity combined with another annual reduction in cash production

costs (PAP) of 2%.

Verallia is also set to continue its developments in the areas

of new eco-designed products, cullet processing and decarbonation,

which lie at the heart of its CSR roadmap.

An analysts’ conference call will be held at 9.00am (CET)

on Thursday 25 April 2024 via an audio webcast service (live and

replay) and the earnings presentation will be available on

www.verallia.com.

FINANCIAL CALENDAR

- 26 April 2024: Annual General Shareholders' Meeting.

- 3 July 2024: start of the quiet period.

- 24 July 2024: 2024 half-year results - Press release after

market close and conference call/presentation the following day at

9:00 a.m. CET.

- 1 October 2024: start of the quiet period.

- 22 October 2024: 9M 2024 results - Press release after market

close and conference call/presentation the following day at 9:00

a.m. CET.

About Verallia

At Verallia, our purpose is to re-imagine glass for a

sustainable future. We want to redefine how glass is produced,

reused and recycled, to make it the world’s most sustainable

packaging material. We are joining forces with our customers,

suppliers and other partners across the value chain to develop new,

beneficial and sustainable solutions for all.

With around 11,000 employees and 34 glass production facilities

in 12 countries, we are the European leader and the world's

third-largest producer of glass packaging for beverages and food

products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses worldwide.

Verallia produced more than 16 billion glass bottles and jars in

2023 and recorded revenue of €3.9 billion. Verallia is listed on

compartment A of the regulated market of Euronext Paris (Ticker:

VRLA – ISIN: FR0013447729) and trades on the following indices: CAC

SBT 1.5°, STOXX600, SBF 120, CAC Mid 60, CAC Mid & Small and

CAC All-Tradable.

Disclaimer

Certain information included in this press release consists not

of historical facts but of forward-looking statements. These

forward-looking statements are based on current beliefs,

expectations and assumptions, including, without limitation,

assumptions regarding Verallia’s present and future business

strategies and the economic environment in which Verallia operates.

They involve known and unknown risks, uncertainties and other

factors, which may cause actual performance and results to be

materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include

those discussed and identified in Chapter 4 ‘Risk Factors” of the

Universal Registration Document approved by the AMF and available

on both the Company’s website (www.verallia.com) and that of the

AMF (www.amf-france.org). These forward-looking information and

statements are no guarantee of future performance.

This press release includes only summary information and does

not purport to be comprehensive.

Protection of personal data

You may unsubscribe from the distribution list of our press

releases at any time by sending your request to the following email

address: investors@verallia.com. Press releases will still be

available via the website

https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

Group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise any of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to the CNIL (Commission nationale de

l'informatique et des libertés — France’s regulatory body).

APPENDICES – Key figures

In millions of euros

Q1 2024

Q1 2023

Revenue

836.4

1,051.6

Reported growth

-20.5%

+40.2%

Organic growth

-12.7%

+34.7%

Organic growth excluding Argentina

-20.7%

+31.3%

Adjusted EBITDA

203.9

307.4

Group margin

24.4%

29.2%

Net debt at end of period

1,496.3

1,304.4

Last 12-month adjusted EBITDA

1,004.4

990.3

Net debt/last 12-month adjusted EBITDA

1.5x

1.3x

Change in revenue by type in millions of euros over the first

quarter

In millions of euros

Revenue Q1 2023

1,051.6

Volumes

-125.7

Price / Mix

-7.7

Foreign exchange impact

-85.8

Scope effect

+4.0

Revenue Q1 2024

836.4

Change in adjusted EBITDA by type in millions of euros over the

first quarter

In millions of euros

Adjusted EBITDA Q1 2023

307.4

Activity contribution

-91.0

Price-mix/Cost spread

-8.8

Net productivity

+17.5

Foreign exchange impact

-26.2

Other

+4.8

Adjusted EBITDA Q1 2024

203.9

Reconciliation of operating profit (loss) to adjusted EBITDA

In millions of euros

Q1 2024

Q1 2023

Operating profit/(loss)

119.0

224.7

Depreciation and amortisation 5

82.3

79.0

Restructuring costs

0.5

0.5

Company acquisition costs and earn-out

0.6

0.1

IAS 29 Hyperinflation (Argentina)6

(0.9)

0.3

Management share ownership plan and

associated costs

1.6

2.8

Other

0.7

-

Adjusted EBITDA

203.9

307.4

IAS 29: hyperinflation in Argentina

The Group has applied IAS 29 in Argentina since 2018. The

adoption of this standard requires the restatement of non-monetary

assets and liabilities and of the statement of income to reflect

changes in purchasing power in the local currency. These

restatements may lead to a gain or loss on the net monetary

position included in financial income and expense.

Financial items for the Argentinian subsidiary are converted

into euros using the closing exchange rate for the relevant

period.

In Q1 2024, the net impact on revenue was €2.6 million.

The hyperinflation impact has been excluded from consolidated

adjusted EBITDA as shown in the table “Reconciliation of operating

profit (loss) to adjusted EBITDA".

Financial structure

In millions of euros

Nominal or max. drawable

amount

Nominal rate

Final maturity

31 March 2024

Sustainability-Linked bond - May

20217

500

1.625%

May 2028

505.3

Sustainability-Linked bond -

November 20217

500

1.875%

Nov. 2031

497.1

Term loan B – TLB7

550

Euribor +1.25%

Apr. 2028

549.8

Revolving credit facility - RCF

550

Euribor +0.75%

Apr. 2029 + 1 year extension

-

Negotiable commercial papers (Neu CP)7

500

254.9

Other borrowings 8

121.4

Total borrowings

1,928.5

Cash and cash equivalents

(432.3)

Net debt

1,496.3

GLOSSARY

Activity: corresponds to the sum of the change in volumes

plus or minus the change in inventories.

Organic growth: corresponds to revenue growth at constant

scope and exchange rates. Revenue growth at constant exchange rates

is calculated by applying the same exchange rates to the financial

indicators presented for the two periods being compared (by

applying the exchange rates of the previous period to the financial

indicators for the current period).

Adjusted EBITDA: this is a non-IFRS financial measure. It

is an indicator for monitoring the underlying performance of

businesses adjusted for certain expenses and/or income which are

non-recurring or liable to distort the Company’s performance.

Adjusted EBITDA is calculated on the basis of operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and subsidiary contingencies,

site closure costs, and other items.

Capex: short for “capital expenditure”, this corresponds

to purchases of property, plant and equipment and intangible assets

necessary to maintain the value of an asset and/or adapt to market

demand and to environmental, health and safety requirements, or to

increase the Group’s capacity. The acquisition of securities is

excluded from this category.

Recurring capex: recurring capex corresponds to purchases

of property, plant and equipment and intangible assets necessary to

maintain the value of an asset and/or adapt to market demand and to

environmental, health and safety requirements. It mainly includes

furnace renovations and maintenance of IS machines.

Strategic capex: strategic capex corresponds to purchases

of strategic assets that significantly enhance the Group’s capacity

or its scope (for example, the acquisition of plants or similar

facilities, greenfield or brownfield investments), including the

building of additional new furnaces. Since 2021 it has also

included investments associated with implementing the plan to

reduce CO2 emissions.

Cash conversion: refers to the ratio between cash flow

and adjusted EBITDA. Cash flow refers to adjusted EBITDA less

capex.

Free cash flow: defined as operating cash flow - other

operating impacts - interest paid & other financing costs -

taxes paid.

The Southern and Western Europe segment comprises

production sites located in France, Spain, Portugal and Italy. It

is also designated by its acronym “SWE”.

The Northern and Eastern Europe segment comprises

production sites located in Germany, the United Kingdom, Russia,

Ukraine and Poland. It is also designated by its acronym “NEE”.

The Latin America segment comprises production sites

located in Brazil, Argentina and Chile and, since January 1, 2023,

Verallia’s operations in the USA.

Liquidity: calculated as available cash + undrawn

revolving credit facilities – outstanding negotiable commercial

paper (Neu CP).

Amortisation of intangible assets acquired through business

combinations: corresponds to the amortisation of customer

relationships recognised upon acquisition.

1 Revenue growth at constant scope and exchange rates. Revenue

growth at constant exchange rates is calculated by applying the

same exchange rates to the financial indicators presented for the

two periods being compared (by applying the exchange rates of the

previous period to the financial indicators for the current

period). Growth in revenue at constant scope and exchange rates

excluding Argentina was -20.7% in the first quarter of 2024

compared to the first quarter of 2023. 2 Adjusted EBITDA is

calculated based on operating profit adjusted for depreciation,

amortisation and impairment, restructuring costs, acquisition and

M&A costs, hyperinflationary effects, management share

ownership plans, disposal-related effects and subsidiary

contingencies, site closure costs, and other items. 3 The spread

corresponds to the difference between (i) the increase in selling

prices and the mix applied by the Group after passing any increase

in production costs onto these selling prices and (ii) the increase

in production costs. The spread is positive when the increase in

selling prices applied by the Group is greater than the increase in

its production costs. The increase in production costs is recorded

by the Group at constant production volumes, before industrial

variance and taking into consideration the impact of the

Performance Action Plan (PAP). 4 Calculated as available cash +

undrawn revolving credit facilities – outstanding commercial paper

(Neu CP) 5 Includes depreciation and amortization of intangible

assets and property, plant and equipment, amortization of

intangible assets acquired through business combinations, and

impairment of property, plant and equipment. 6 The Group has

applied IAS 29 (Hyperinflation) since 2018. 7 Including accrued

interest. 8 o/w IFRS16 leasing (74.9 M€)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424335933/en/

Verallia press Annabel Fuder & Stéphanie Piere

verallia@wellcom.fr | +33 (0)1 46 34 60 60

Verallia investor relations David Placet |

david.placet@verallia.com Michele Degani |

michele.degani@verallia.com

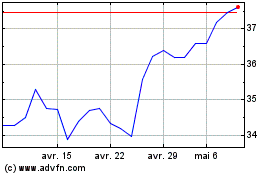

VERALLIA (EU:VRLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

VERALLIA (EU:VRLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025