Intermediate declaration by the

Board of Directors

Regulatory News:

Highlights Q1 2022:

› Revenue was USD 178.7 million, within the guidance of USD

175-185 million, up 15% year-on-year (YoY) and up 4%

quarter-on-quarter (QoQ)

› Continued strong demand with bookings at USD 239.3 million

resulting in a book-to-bill ratio of 1.34

› EBITDA margin of 23.0%, at the upper end of the 19-23%

guidance

› EBITDA was USD 41.0 million, up 15% YoY and up 21% QoQ

› EBIT was USD 22.2 million, up 31% YoY and up 57% QoQ

Outlook:

› Q2 2022 revenue is expected to be in the range of USD 180-190

million with an EBITDA margin in the range of 20-24%. This guidance

is based on an average exchange rate of 1.10 USD/Euro.

› Management reiterates its full-year guidance with revenues in

the range of USD 750-815 million and an EBITDA margin in the range

of 21-25%.

› Based on accelerated market development, X-FAB adjusts the

long-term guidance and expects to reach USD 1 billion in annual

revenues two years earlier than the originally planned 2026

indicated at the X-FAB Investor Day in May 2021. The corresponding

EBITDA margin guidance has been raised to >30% (previously

>27%).

Revenue breakdown per quarter:

in millions of USD

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q1 y-o-y growth

Automotive

61.6

40.8

65.4

83.5

82.8

81.5

83.8

89.7

7%

Industrial

23.9

23.9

27.3

32.4

35.2

38.3

39.7

41.4

28%

Medical

7.3

7.7

12.0

8.7

10.4

14.3

14.5

13.7

59%

Subtotal core business

92.7

72.3

104.7

124.6

128.4

134.1

138.0

144.9

16%

78.1%

75.2%

77.1%

80.1%

79.8%

79.3%

80.1%

81.1%

CCC1

25.9

23.7

30.9

30.6

32.4

34.7

34.0

32.5

6%

Others

0.2

0.1

0.3

0.3

0.1

0.3

0.3

1.2

Total revenues

118.8

96.1

135.9

155.4

161.0

169.1

172.3

178.7

15%

- Consumer, Communications & Computer

in millions of USD

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q1 y-o-y growth

CMOS

103.4

81.1

115.0

134.9

137.5

141.8

144.2

148.6

10%

MEMS

10.4

9.8

14.6

14.4

16.2

17.4

17.5

17.9

24%

Silicon carbide

5.0

5.2

6.3

6.1

7.2

9.9

10.6

12.1

99%

Total revenues

118.8

96.1

135.9

155.4

161.0

169.1

172.3

178.7

15%

Business development

In the first quarter of 2022, business continued to develop

strongly. X-FAB recorded quarterly revenues of USD 178.7 million,

within the guided USD 175-185 million, up 15% year-on-year and 4%

quarter-on-quarter. Although slightly down compared to the previous

quarter, first quarter bookings remained at an exceptionally high

level at USD 239.3 million, up 13% year-on-year.

X-FAB is uniquely positioned as it focuses on specialty

technologies tailored to serve the automotive, industrial, and

medical markets. First quarter revenues in those core markets

amounted to USD 144.9 million, up 16% year-on-year and 5%

quarter-on-quarter. Together they accounted for 81% of the Group’s

total revenues.

First quarter highlights include record prototyping revenues in

automotive as well as all-time high volume production revenues in

Industrial and Medical. Overall, Medical recorded the strongest

revenue growth, up 59% year-on-year, while Automotive and

Industrial rose 7% and 28% year-on-year respectively.

First quarter CCC (Consumer, Communication & Computer)

revenues came in at USD 32.5 million, up 6% year-on-year.

The pipeline for new projects is solid reflecting continued

strong prototyping revenues in the first quarter, which amounted to

USD 24.6 million, up 30% growth year-on-year.

The accelerating transition to green energy and mobility is

driving the demand for X-FAB’s silicon carbide (SiC) technology and

other supporting applications, spurring growth in Industrial and

Automotive. First quarter SiC revenues almost doubled compared to

the same quarter last year and reached USD 12.1 million.

X-FAB’s medical business continues to grow in line with the

increasing importance of digital healthcare covering point-of-care

diagnostics, personalized medicine or telemedicine. As in previous

quarters, lab-on-a-chip applications continued to be the main

growth driver for Medical. They require the combination of CMOS and

MEMS technologies, which X-FAB offers jointly, making it a clear

differentiator and a key advantage for customers in developing

highly complex lab-on-a-chip devices.

First quarter MEMS revenues, which X-FAB generates across all

its end markets, amounted to USD 17.9 million, up 24% year-on-year.

Lab-on-a-chip applications as well as contactless temperature

sensors were the main growth drivers.

In the first quarter, as order intake remained exceptionally

strong, capacity allocation had to be continued while every effort

was made to supply customers with the quantities required to avoid

supply chain disruptions. At the same time, the ramp-up of X-FAB

technologies at X-FAB France progressed well and contributed

positively to first quarter revenue growth. The share of the French

site’s revenues based on X-FAB technologies reached 42% in the

first quarter. While demand for X-FAB’s RF SOI technology weakened,

X-FAB France’s automotive revenues, in particular in the highly

demanded 180nm automotive technology, went up significantly,

representing the main share of the overall automotive growth in the

first quarter.

Prototyping and production revenue per quarter and end

market:

in millions

of USD

Revenue

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q1 y-o-y growth

Automotive

Prototyping

3.2

3.0

3.5

3.6

5.0

57%

Production

80.4

79.8

78.0

80.2

84.8

5%

Industrial

Prototyping

9.0

10.3

12.9

11.5

11.0

22%

Production

23.3

24.9

25.4

28.2

30.4

30%

Medical

Prototyping

2.2

2.9

4.1

4.0

3.1

38%

Production

6.4

7.5

10.2

10.6

10.7

66%

CCC

Prototyping

4.3

4.1

4.8

4.5

4.3

2%

Production

26.3

28.3

29.9

29.5

28.2

7%

Operations update

In the first quarter, X-FAB’s factories continued to run at high

load. With continued high demand, increasing productivity and

removing production bottlenecks at all sites remained key

priorities and a major operational focus throughout the quarter.

Multiple new tools ordered in 2021 were delivered this quarter with

installation and qualification activities ongoing. Each new tool

becoming operational will contribute positively to productivity

gains.

Labor markets remained tight in all regions and strong focus has

been placed on recruiting and employer marketing activities to

ensure there are sufficient staff available to handle the high

workload in the fabs. The German sites also suffered from an

increased absence rate as a result of Covid-19 quarantines.

In light of the current volatility of global supply chains and

even more so to support the Group’s future growth, X-FAB is closely

monitoring the supply situation, taking appropriate measures to

mitigate any supply risks. This includes the qualification of

second and third source suppliers as well as geographical

diversification. To date, X-FAB has not been impacted by supply

bottlenecks.

Demand for X-FAB’s SiC technologies further accelerated with

bookings in the first quarter reaching USD 21.4 million, up 149%

year-on-year and 26% quarter-on-quarter. Major initiatives include

the expansion of capacity for SiC processing as well as SiC

epitaxy, while X-FAB also made progress in streamlining the

onboarding process for new customers. The development of standard

SiC process blocks is helping to speed up technology releases and

reduces time-to-market. Customer interest remains high and the

pipeline for new projects remains strong.

Capital expenditures increased significantly to USD 48.8 million

during the first quarter, reflecting equipment orders from 2021

which were delivered during Q1 2022. Full-year capital expenditures

are expected to come in at approx. USD 200 million. X-FAB is

expanding its capacities across all sites in response to

accelerated demand as well as expected long-term growth.

Financial update

First quarter EBITDA was USD 41.0 million with an EBITDA margin

of 23.0%, at the upper end of the guided 19-23%. Top line growth

contributed positively to profitability as did the substantial

increase of unfinished and finished goods inventory, which amounted

to USD 12.4 million in the first quarter. On the other hand, cost

inflation as well as rising depreciations resulting from the

Group’s capacity expansion projects put pressure on margins. In

order to compensate for this effect, X-FAB is in the process of

increasing pricing accordingly.

Cash and cash equivalents at the end of the first quarter

amounted to USD 259.3 million, a decrease of 11% compared to the

previous quarter end. In the fourth quarter 2021, X-FAB had drawn

funds in the amount of USD 77.8 million from its revolving credit

line. These were used in the first quarter to cover capex payments

for new equipment deliveries.

Euro-denominated sales share came in at 40% during the first

quarter, in line with the level of costs incurred in Euro. The

actual US-Dollar/Euro exchange rate for the first quarter of 2022

was 1.12 leading to an EBITDA margin of 23.0%. At a constant

exchange rate of 1.21, as experienced in the first quarter 2021,

the EBITDA margin would have been 22.8%. This demonstrates that the

achieved natural hedging of the business has made X-FAB’s

profitability development robust against exchange rate

fluctuations.

Management comments

Rudi De Winter, CEO of X-FAB Group, said: “In the first quarter

we saw a continuation of strong market trends and exceptionally

high bookings reflecting how well X-FAB is strategically

positioned. With our automotive, industrial, and medical

businesses, we are serving the strongest growing end markets, and

our technology portfolio enables much needed innovative solutions,

especially for the accelerating transition towards green energy and

cleaner transportation. Despite the manifold challenges arising

from geopolitical conflicts and tight supply chains, I am very

excited about X-FAB’s growth prospects and see us well on track for

sustainable success, which is also why we have adjusted X-FAB’s

long-term guidance upwards.”

X-FAB Quarterly Conference Call

X-FAB’s first quarter results will be discussed in a live

conference call on Thursday, April 28, 2022, at 6.30 p.m. CEST. The

conference call will be in English. Please register in advance of

the conference using the following link:

http://emea.directeventreg.com/registration/8344839.

Upon registering, you will be provided with participant dial-in

numbers, Direct Event passcode and a unique registrant ID. In the

10 minutes prior to the call, you will need to use the conference

access information provided in the email received at the point of

registering.

The conference call will be available for replay from April 28,

2022, 11.30 p.m. CEST until May 5, 2022, 11.30 p.m. CEST. The

replay number will be +44 (0) 3333009785, conference ID

8344839.

The second quarter 2022 results will be communicated on July 28,

2022.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 to 0.13 µm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs approx. 4,000 people worldwide. For more information,

please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness, or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended 31 Mar 2022

unaudited

Quarter

ended 31 Mar 2021

unaudited

Quarter

ended 31 Dec 2021

unaudited

Year

ended 31 Dec 2021

audited

Revenue

178,664

155,420

172,279

657,751

Revenues in USD in %

59

67

59

63

Revenues in EUR in %

40

33

41

37

Cost of sales

-135,422

-120,419

-138,351

-507,773

Gross Profit

43,241

35,001

33,928

149,978

Gross Profit margin in %

24.2

22.5

19.7

22.8

Research and development expenses

-10,759

-8,482

-9,383

-34,308

Selling expenses

-2,149

-2,119

-1,922

-8,017

General and administrative expenses

-8,732

-8,150

-8,651

-32,771

Rental income and expenses from investment

properties

292

627

181

1,898

Other income and other expenses

331

155

38

412

Operating profit

22,223

17,032

14,192

77,192

Finance income

7,092

4,283

3,196

16,115

Finance costs

-8,490

-7,167

-4,143

-20,441

Net financial result

-1,398

-2,884

-947

-4,326

Profit before tax

20,825

14,148

13,245

72,866

Income tax

-1,450

-1,374

9,083

10,774

Profit for the period

19,375

12,775

22,327

83,640

Operating profit (EBIT)

22,223

17,032

14,192

77,192

Depreciation

18,808

18,551

19,748

76,093

EBITDA

41,031

35,583

33,940

153,286

EBITDA margin in %

23.0

22.9

19.7

23.3

Earnings per share at the end of

period

0.15

0.10

0.17

0.64

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.12305

1.20617

1.14382

1.18331

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Quarter ended

31 Mar 2022

unaudited

Quarter ended

31 Mar 2021 unaudited

Year ended

31 Dec 2021

audited

ASSETS

Non-current assets

Property, plant, and equipment

368,674

328,469

340,670

Investment properties

8,158

8,411

8,310

Intangible assets

5,018

4,522

4,034

Other non-current assets

18

58

28

Deferred tax assets

45,528

30,359

45,645

Total non-current assets

427,397

371,819

398,687

Current assets

Inventories

195,362

156,180

181,014

Trade and other receivables

74,999

66,121

73,689

Other assets

48,654

43,361

43,354

Cash and cash equivalents

259,271

195,810

290,187

Total current assets

578,286

461,471

588,244

TOTAL ASSETS

1,005,683

833,290

986,931

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

-16,780

-107,858

-36,154

Cumulative translation adjustment

-607

-622

-559

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

763,297

672,204

743,971

Non-controlling interests

355

344

365

Total equity

763,652

672,548

744,335

Non-current liabilities

Non-current loans and borrowings

36,877

40,842

39,917

Other non-current liabilities and

provisions

5,685

4,179

5,686

Total non-current liabilities

42,562

45,021

45,602

Current liabilities

Trade payables

37,132

27,501

41,364

Current loans and borrowings

93,030

24,890

87,114

Other current liabilities and

provisions

69,308

63,331

68,515

Total current liabilities

199,470

115,721

196,993

TOTAL EQUITY AND LIABILITIES

1,005,683

833,290

986,931

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended 31 Mar 2022

unaudited

Quarter

ended 31 Mar 2021

unaudited

Quarter

ended 31 Dec 2021

unaudited

Year

ended 31 Dec 2021

audited

Income before taxes

20,825

14,148

13,245

72,866

Reconciliation of net income to cash

flow arising from operating activities:

20,944

21,592

18,518

70,319

Depreciation and amortization, before

effect of grants and subsidies

18,808

18,551

19,748

76,093

Recognized investment grants and subsidies

netted with depreciation and amortization

-874

-841

-991

-3,530

Interest income and expenses (net)

183

-122

203

-176

Loss/(gain) on the sale of plant,

property, and equipment (net)

-158

-112

37

-275

Other non-cash transactions (net)

2,985

4,116

-480

-1,793

Changes in working capital:

-32,183

-20,195

-14,079

-31,573

Decrease/(increase) of trade

receivables

-8,637

-11,293

1,027

-9,769

Decrease/(increase) of other receivables

& prepaid expenses

-5,799

-5,499

-3,222

-4,034

Decrease/(increase) of inventories

-14,349

-2,469

-8,454

-27,302

(Decrease)/increase of trade payables

-2,014

526

301

5,146

(Decrease)/increase of other

liabilities

-1,384

-1,460

-3,731

4,386

Income taxes (paid)/received

-107

-1,733

-134

-2,101

Cash Flow from operating

activities

9,479

13,812

17,549

109,511

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-48,847

-9,702

-21,122

-66,972

Payments for loan investments to related

parties

-114

-91

-626

-827

Proceeds from loan investments related

parties

98

80

45

211

Proceeds from sale of property, plant, and

equipment

164

117

220

669

Interest received

237

471

380

1,769

Cash Flow used in investing

activities

-48,462

-9,125

-21,104

-65,149

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended 31 Mar 2022

unaudited

Quarter

ended 31 Mar 2021

unaudited

Quarter

ended 31 Dec 2021

unaudited

Year

ended 31 Dec 2021

audited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

7,261

0

77,796

82,585

Repayment of loans and borrowings

-2,803

-7,619

-7,807

-28,218

Receipts of sale & leaseback

arrangements

7,723

0

0

0

Payments of lease installments

-1,759

-1,174

-1,057

-5,094

Receipt of government grants and

subsidies

0

0

535

535

Interest paid

-139

-348

-558

-1,569

Distribution to non-controlling

interests

-11

-12

0

-12

Cash Flow from (used in) financing

activities

10,271

-9,153

68,908

48,228

Effect of changes in foreign currency

exchange rates on cash

-2,205

-5,591

-1,180

-8,269

Increase/(decrease) of cash and cash

equivalents

-28,712

-4,466

65,354

92,589

Cash and cash equivalents at the beginning

of the period

290,187

205,867

226,013

205,867

Cash and cash equivalents at the end

of

the period

259,271

195,810

290,187

290,187

###

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220427005980/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

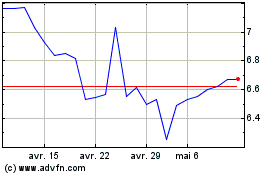

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024