U.S. Dollar Weakens Ahead Of Inflation Data

28 Mars 2024 - 2:43PM

RTTF2

The U.S. dollar was lower against its major counterparts in the

New York session on Thursday, as traders awaited key U.S. inflation

data and Fed Chair Jerome Powell's remarks on Friday.

The release of the Fed's favored inflation indicator along with

comments from Powell are expected to provide additional clues on

the Fed's rate trajectory.

Economists expect the annual rate of consumer price growth to

inch up to 2.5 percent in February from 2.4 percent in January,

while the annual rate of core consumer price growth is expected to

come in unchanged at 2.8 percent.

With U.S. markets closed on Friday for the Good Friday holiday,

traders will have to wait until next Monday to react to the

report.

The currency strengthened in the previous session following

hawkish comments from Fed Governor Christopher Waller.

In a speech at the Economic Club of New York, Waller said that

there is no rush to cut the policy rate, suggesting a wait-and-see

approach to policy shift.

With the focus on tomorrow's inflation data, traders largely

shrugged off a slew of strong economic data.

The Labor Department released a report report showing first-time

claims for U.S. unemployment benefits unexpectedly edged slightly

lower in the week ended March 23rd.

The report said initial jobless claims dipped to 210,000, a

decrease of 2,000 from the previous week's revised level of

212,000.

Economists had expected jobless claims to rise to 215,000 from

the 210,000 originally reported for the previous week.

A separate report released by the Commerce Department showed the

U.S. economy unexpectedly grew by more than previously estimated in

the fourth quarter of 2023.

Revised data showed real gross domestic product surged by 3.4

percent in the fourth quarter compared to the previously reported

3.2 percent jump. Economists had expected the pace of GDP growth to

be unrevised.

The National Association of Realtors also released a report

showing a notable rebound by pending home sales in the month of

February.

NAR said its pending home sales index shot up by 1.6 percent to

75.6 in February after plunging by 4.7 percent to a revised reading

of 74.4 in January.

Economists had expected pending home sales to jump by 1.5

percent compared to the 4.9 percent nosedive originally reported

for the previous month.

Separately, the University of Michigan released revised data

showing an unexpected improvement in U.S. consumer sentiment in the

month of March.

The report said the consumer sentiment index for March was

upwardly revised to 79.4 from the preliminary reading of 76.5.

Economists had expected the reading to be unrevised.

With the unexpected upward revision, the consumer sentiment

index for March is now above the final February reading of

76.9.

The greenback eased to 151.14 against the yen, 1.0818 against

the euro and 0.5984 against the kiwi, from an early high of 151.54,

multi-week high of 1.0775 and more than a 4-month high of 0.5956,

respectively. The greenback is seen finding support around 144.00

against the yen, 1.11 against the euro and 0.62 against the

kiwi.

The greenback dropped to 2-day lows of 0.9005 against the franc

and 1.2654 against the pound, from an early high of 0.9064 and a

6-day high of 1.2585, respectively. The currency may locate support

around 0.87 against the franc and 1.31 against the pound.

The greenback weakened to a 6-day low of 1.3531 against the

loonie, from an early 3-day high of 1.3613. If the currency falls

further, it is likely to test support around the 1.33 region.

The greenback retreated to 0.6525 against the aussie, from an

early more than 3-week high of 0.6485. This may be compared to a

previous 2-day low of 0.6540. The greenback is likely to face

support around the 0.68 level.

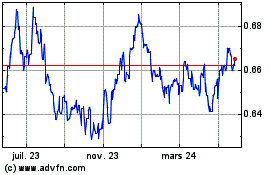

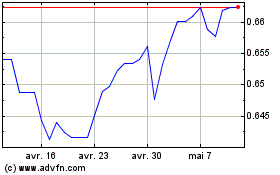

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024