Yen Drops Amid Smaller Fed Rate Hike Bets

15 Mars 2023 - 6:35AM

RTTF2

The Japanese yen was lower against its major counterparts in the

Asian session on Wednesday amid safe-haven status, as a slowdown in

U.S. consumer inflation supported the case for another

quarter-point rate hike by the Federal Reserve next week.

Overnight data showed that U.S. consumer inflation eased to 0.4

percent in February from 0.5 percent in January.

The odds of a 25 basis-point hike by the Fed have risen

following the data.

Economic data out of China confirmed that the recovery was well

on track.

Chinese retail sales rebounded in the first two months of 2023

and fixed investment grew at a much faster-than-expected clip,

while factory activity expanded slightly slower than expected and

the jobless rate increased, according to data by the National

Bureau of Statistics.

Additionally, China's central bank added liquidity to the

banking system via operations of medium-term lending facility.

In economic news, members of the Bank of Japan's Monetary Policy

Board said that the country's economy is still being hampered by

high commodity prices, but overall still shows signs of steady

improvement, minutes from the central bank's January 17-18 meeting

revealed.

At the meeting, the BoJ kept its interest rates unchanged at

-0.1 percent and modified some of its lending programs. The bank

will also continue to purchase a necessary amount of JGBs without

setting an upper limit so that 10-year JGB yields will remain at

around zero percent.

The yen weakened to 5-day lows of 135.06 against the greenback

and 147.54 against the franc, from its prior highs of 134.03 and

146.70, respectively. The yen may find support around 138.00

against the greenback and 149.00 against the franc.

The yen dropped to 5-day lows of 144.94 against the euro and

90.19 against the aussie, after rising to 144.00 and 89.60,

respectively in early deals. If the currency drops further, 147.00

and 92.00 are possibly seen as its next support levels against the

euro and the aussie, respectively.

The yen edged down to 98.59 against the loonie and 83.98 against

the kiwi, retreating from its early highs of 98.03 and 83.58,

respectively. Next key support for the currency is likely seen

around 100.00 against the loonie and 86.00 against the kiwi.

The yen was down against the pound, at 164.03. On the downside,

166.00 is possibly seen as its next support level.

Looking ahead, Eurozone industrial production for January is due

in the European session.

At 8:15 am ET, Canada housing starts for February will be

published.

UK Chancellor of the Exchequer Jeremy Hunt is set to deliver the

Spring Budget 2023 at 8.30 am ET.

U.S. retail sales and PPI for February, as well as business

inventories data for January and NAHB housing market index for

March will be released in the New York session.

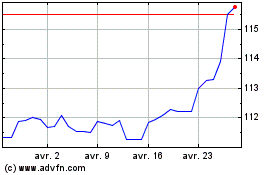

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024