China Manufacturing Sector Logs Unexpected Contraction

01 Août 2024 - 3:27AM

RTTF2

China's manufacturing sector fell into the contraction zone in

July on renewed decline in new work and weak output growth, survey

data from S&P Global showed on Thursday.

The Caixin manufacturing Purchasing Managers' Index fell to 49.8

in July from 51.8 in June. The reading was expected to drop

moderately to 51.5.

The score suggested that conditions in the manufacturing sector

deteriorated for the first time in nine months.

The official PMI survey, released earlier this week, showed that

China's manufacturing sector continued to shrink in July. The

factory PMI slid to 49.4 in July from 49.5 a month ago. At the same

time, the non-manufacturing index fell to 50.2, but remained above

the neutral 50.0 mark.

Manufacturing output expansion was the softest in the nine-month

sequence during July. As a result, new orders fell for the first

time in a year. Subdued demand conditions and reductions in client

budgets led to the decrease in new work. Nonetheless, export orders

continued to grow, albeit at slower pace.

Manufacturers' purchasing activity decreased for the first time

since October 2023. This led to a renewed depletion of stocks of

purchases.

On the other hand, stocks of finished goods increased again,

partially driven by delays in outbound shipments. Average lead

times for the delivery of inputs lengthened for the second straight

month.

Employment dropped fractionally in July. Some firms added

headcounts to cope with rising workloads, while some opted to cut

staffing levels, anticipating lower production needs.

Regarding prices, the survey showed that selling prices

decreased for the first time since May. Prices were reduced to

support sales amid increased competition. Input cost inflation

eased to the lowest in the current four-month sequence.

Finally, confidence among manufacturers remained positive in

July. Despite the fall in new work, firms were positive that

business development efforts and the launch of new products can

help drive sales in the year ahead.

Caixin Insight Group Senior Economist Wang Zhe said the 4.7

percent economic growth in the second quarter makes the annual

growth target of around 5 percent challenging. The economist said

policy efforts should focus on stabilizing growth, improving

employment, safeguarding people's livelihoods, intensifying policy

stimulus, ensuring effective implementation of previous policies,

and unleashing market vitality.

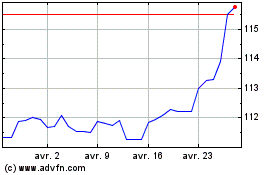

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Juil 2024 à Août 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Août 2023 à Août 2024